توقع سعر A2Z لعام 2025: تحليل متكامل للتوقعات واتجاهات السوق للمستثمرين

المقدمة: مكانة A2Z السوقية وقيمتها الاستثمارية

تُعد Arena-Z (A2Z) منصة مركزية لألعاب Web3، حيث تجمع اللاعبين والمبدعين والمجتمعات من خلال منظومة مكافآت موحدة وقابلة للتشغيل البيني منذ انطلاقها. بحلول عام 2025، بلغ رأس مال A2Z السوقي 36,209,981 دولارًا أمريكيًا، مع معروض متداول يقارب 6,113,452,962 رمزًا، وسعر يتراوح حول 0.005923 دولار. ويُعرف هذا الأصل باسم "موصل ألعاب Web3"، ويلعب دورًا متزايد الأهمية في صناعة الألعاب والبلوك تشين.

يستعرض هذا المقال بشكل شامل اتجاهات أسعار A2Z بين 2025 و2030، من خلال دمج الأنماط التاريخية، والعرض والطلب، وتطور النظام البيئي، والظروف الاقتصادية الكلية، لتقديم توقعات سعرية احترافية واستراتيجيات استثمار عملية للمستثمرين.

I. مراجعة تاريخ سعر A2Z والوضع الحالي للسوق

تطور سعر A2Z التاريخي

- 2025: انطلاق المشروع، بلغ السعر أعلى مستوى تاريخي عند 0.01132395 دولار في 8 أغسطس

- 2025: تصحيح السوق، هبط السعر إلى أدنى مستوى تاريخي عند 0.00462476 دولار في 1 أغسطس

- 2025: تعافٍ حديث، السعر الحالي 0.005923 دولار حتى 2 أكتوبر

الوضع الحالي لسوق A2Z

في 2 أكتوبر 2025، يتم تداول A2Z بسعر 0.005923 دولار، مع حجم تداول خلال 24 ساعة بلغ 418,109.86 دولار. ارتفع الرمز بنسبة 16.25% خلال آخر 24 ساعة، مما يشير إلى زخم صعودي قوي في المدى القصير. وبالنظر لفترات أطول، حقق A2Z مكاسب بنسبة 5.05% خلال الأسبوع الماضي، بينما انخفض بنسبة 5.39% خلال الشهر الماضي. ويبلغ رأس المال السوقي للرمز 36,209,981.89 دولارًا، ويحتل المرتبة 831 بين العملات الرقمية.

السعر الحالي أقل بنسبة 47.71% من أعلى مستوى تاريخي عند 0.01132395 دولار في 8 أغسطس 2025، لكنه أعلى بنسبة 28.07% من أدنى نقطة له عند 0.00462476 دولار في 1 أغسطس 2025. هذا يدل على أن A2Z تعافى من أدنى مستوياته، لكنه لا يزال يملك هامش نمو كبير للعودة إلى ذروته السابقة.

مع معروض متداول يبلغ 6,113,452,962 رمزًا من أصل 10,000,000,000، تبلغ نسبة التداول 61.13%. هذا المعروض المرتفع نسبيًا قد يؤثر على ديناميات السعر نظرًا لتوفر كمية كبيرة للتداول.

انقر للاطلاع على سعر A2Z الحالي في السوق

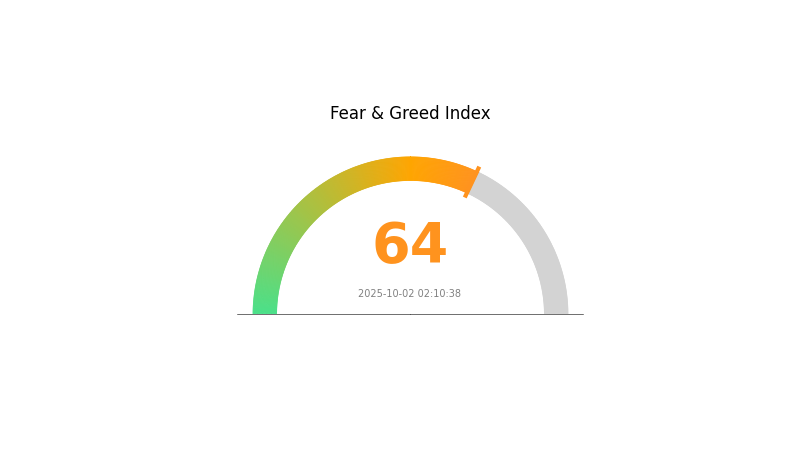

مؤشر معنويات سوق A2Z

2025-10-02 مؤشر الخوف والطمع: 64 (طمع)

انقر للاطلاع على مؤشر الخوف والطمع الحالي

تشير سوق العملات الرقمية إلى حالة طمع، حيث بلغ مؤشر الخوف والطمع 64. يعكس ذلك تفاؤلًا متزايدًا بين المستثمرين، محتمل أن يكون مدفوعًا بتوجهات السوق الإيجابية أو الأخبار المحفزة. ومع ذلك، يجب توخي الحذر، إذ أن الطمع الزائد قد يؤدي إلى تضخم الأسعار وزيادة التقلبات. ينبغي للمتداولين موازنة محافظهم وعدم الانسياق وراء الخوف من فقدان الفرصة (FOMO). كما أن البحث المتعمق وإدارة المخاطر يبقيان أمرين ضروريين للتعامل مع سوق العملات الرقمية.

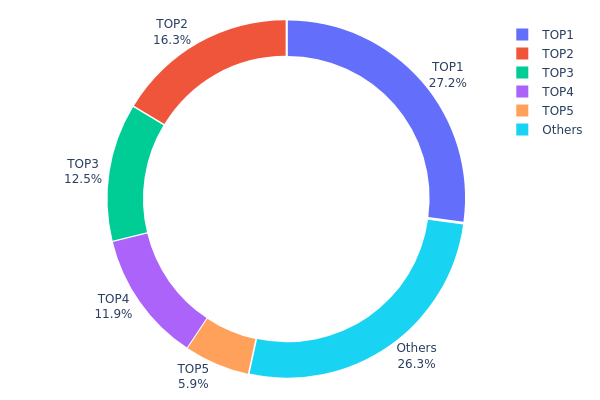

توزيع حيازات A2Z

تشير بيانات توزيع الحيازات لعناوين A2Z إلى تركّز كبير للرموز لدى عدد محدود من العناوين الكبرى. يحتفظ أكبر عنوان بنسبة 27.16% من إجمالي المعروض، بينما تسيطر أعلى خمسة عناوين مجتمعة على 73.71% من الرموز. هذا التركّز المرتفع يثير مخاوف بشأن إمكانية التلاعب بالسوق والمخاطر المركزية.

قد يؤدي هذا الهيكل إلى ارتفاع تقلبات الأسعار وزيادة القابلية لعمليات البيع الكبيرة إذا قرر الحائزون الرئيسيون التصفية. كما يعني أن عددًا قليلًا من الجهات يمتلكون تأثيرًا كبيرًا على حوكمة الرمز وديناميات السوق. مستوى التركّز هذا قد يثني بعض المستثمرين الذين يفضلون اللامركزية والتوزيع العادل.

مع ذلك، يُلاحظ أن 26.29% من الرموز تحتفظ بها عناوين خارج الخمسة الكبار، مما يدل على وجود توزيع جزئي بين الحائزين الأصغر. قد يوفر ذلك بعض الاستقرار ويساعد في التخفيف من المخاطر المرتبطة بالتركّز العالي. مراقبة تغيرات هذا التوزيع بمرور الوقت ستبقى ضرورية لتقييم صحة السوق على المدى الطويل وتقدم اللامركزية.

انقر للاطلاع على توزيع حيازات A2Z الحالي

| الأعلى | العنوان | كمية الحيازة | النسبة (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 2,485,810.73K | 27.16% |

| 2 | 0x0c7c...2503e2 | 1,495,598.36K | 16.34% |

| 3 | 0x9018...600915 | 1,140,000.00K | 12.45% |

| 4 | 0x9e64...051d71 | 1,085,714.28K | 11.86% |

| 5 | 0x90d6...328d03 | 540,132.15K | 5.90% |

| - | أخرى | 2,404,527.10K | 26.29% |

II. العوامل الرئيسية المؤثرة في سعر A2Z المستقبلي

آلية العرض

- احتياطيات البورصات: تستمر احتياطيات A2Z في البورصات المركزية بالتراجع، مما يشير إلى احتمالية تضييق العرض.

- النمط التاريخي: عادةً ما يؤدي انخفاض احتياطيات البورصات إلى ضغط تصاعدي على الأسعار.

- الأثر الحالي: يشير الانخفاض المستمر في الاحتياطيات إلى أزمة عرض محتملة قد تدعم سعر A2Z.

ديناميكيات المؤسسات والحيتان

- حيازات المؤسسات: ارتفعت حيازة أعلى 100 عنوان إلى 45% من إجمالي المعروض، مع استمرار المؤسسات والمستثمرين أصحاب الثروات الكبيرة في التجميع.

- تبني الشركات: تمتلك شركات مثل Bitmine Immersion Tech وSharpLink Gaming حيازات كبيرة من A2Z، بما يعادل 1.41% و0.66% من إجمالي المعروض على التوالي.

البيئة الاقتصادية الكلية

- تأثير السياسة النقدية: تشير تصريحات مسؤولي الاحتياطي الفيدرالي إلى احتمال تباطؤ اقتصادي نتيجة الرسوم الجمركية، ما قد يؤثر على سوق العملات الرقمية.

التطوير التقني وبناء النظام البيئي

- تكامل التمويل اللامركزي: تم بناء A2Z على منظومة التمويل اللامركزي (DeFi) وWeb 3.0، بهدف إنشاء اقتصاد رقمي مستدام من خلال نماذج اقتصادية مبتكرة وحوكمة فعّالة على الشبكة.

- تطبيقات النظام البيئي: يظهر نظام الرموز الخاص بـA2Z إمكانات نمو قوية مع تزايد الاعتراف بقيمته السوقية.

III. توقعات سعر A2Z للفترة 2025-2030

توقعات 2025

- توقع محافظ: 0.00498 – 0.00593 دولار

- توقع محايد: 0.00593 – 0.00676 دولار

- توقع متفائل: 0.00676 – 0.00759 دولار (يتطلب معنويات سوق إيجابية وتطورات للمشروع)

توقعات 2026-2028

- توقع مرحلة نمو السوق: مرحلة نمو محتملة مع تزايد الاعتماد

- نطاق السعر المتوقع:

- 2026: 0.00433 – 0.00804 دولار

- 2027: 0.00385 – 0.01014 دولار

- 2028: 0.00623 – 0.01114 دولار

- العوامل المحورية: التقدم التقني، توسع حالات الاستخدام، واتجاهات السوق العامة

توقعات طويلة الأمد 2029-2030

- سيناريو أساسي: 0.00995 – 0.01194 دولار (مع افتراض نمو وتبني مستمر)

- سيناريو متفائل: 0.01194 – 0.01393 دولار (مع تسارع التبني وظروف سوق إيجابية)

- سيناريو تحولي: 0.01326 – 0.01393 دولار (في ظل ظروف إيجابية للغاية وابتكارات رائدة)

- 2030-12-31: A2Z 0.01326 دولار (ذروة محتملة حسب التوقعات الحالية)

| السنة | أعلى سعر متوقع | متوسط السعر المتوقع | أدنى سعر متوقع | نسبة التغير |

|---|---|---|---|---|

| 2025 | 0.00759 | 0.00593 | 0.00498 | 0 |

| 2026 | 0.00804 | 0.00676 | 0.00433 | 14 |

| 2027 | 0.01014 | 0.0074 | 0.00385 | 24 |

| 2028 | 0.01114 | 0.00877 | 0.00623 | 48 |

| 2029 | 0.01393 | 0.00995 | 0.00647 | 68 |

| 2030 | 0.01326 | 0.01194 | 0.01039 | 101 |

IV. استراتيجيات الاستثمار الاحترافية وإدارة المخاطر لـA2Z

منهجية الاستثمار في A2Z

(1) استراتيجية الاحتفاظ طويل الأمد

- المستثمرون المستهدفون: المستثمرون الصبورون ذوو تحمل عالي للمخاطر

- اقتراحات التنفيذ:

- تجميع رموز A2Z أثناء هبوط السوق

- تحديد أهداف سعرية لجني أرباح جزئية

- تخزين الرموز في محفظة أجهزة آمنة

(2) استراتيجية التداول النشط

- أدوات التحليل الفني:

- المتوسطات المتحركة: متابعة الاتجاهات قصيرة وطويلة الأجل

- مؤشر القوة النسبية (RSI): تحديد حالات التشبع الشرائي والبيعي

- نقاط مهمة لتداول التأرجح:

- تحديد أوامر وقف الخسارة الصارمة

- جني الأرباح عند مستويات المقاومة المحددة مسبقًا

إطار إدارة المخاطر لـA2Z

(1) مبادئ تخصيص الأصول

- المستثمرون المحافظون: 1-3%

- المستثمرون الجريئون: 5-10%

- المستثمرون المحترفون: 10-15%

(2) حلول التحوط ضد المخاطر

- تنويع: توزيع الاستثمارات على عدة عملات رقمية

- أوامر وقف الخسارة: تنفيذ أوامر بيع تلقائية للحد من الخسائر المحتملة

(3) حلول التخزين الآمن

- توصية المحفظة الساخنة: Gate Web3 Wallet

- حل التخزين البارد: محفظة أجهزة للاحتفاظ طويل الأمد

- إجراءات الأمان: تفعيل المصادقة الثنائية واستخدام كلمات مرور قوية

V. المخاطر والتحديات المحتملة لـA2Z

مخاطر سوق A2Z

- تقلبات عالية: تغيرات كبيرة في الأسعار شائعة في سوق العملات الرقمية

- مخاطر السيولة: إمكانية صعوبة بيع كميات كبيرة دون التأثير على السعر

- المنافسة: منصات ألعاب Web3 أخرى قد تكتسب حصة من السوق

المخاطر التنظيمية لـA2Z

- أنظمة غير مؤكدة: إمكانية صدور قوانين جديدة تؤثر على منصات الألعاب الرقمية

- الآثار الضريبية: تطورات في معالجة الضرائب لمكافآت ألعاب العملات الرقمية

- قيود عبر الحدود: إمكانية وجود قيود على مشاركة المستخدمين الدوليين

المخاطر التقنية لـA2Z

- ثغرات العقود الذكية: إمكانية استغلال نقاط الضعف في كود الرمز

- مشاكل القابلية للتوسع: تحديات في التعامل مع زيادة المستخدمين

- مخاوف التشغيل البيني: صعوبات في التكامل مع شبكات بلوك تشين أخرى

VI. الخلاصة والتوصيات العملية

تقييم قيمة الاستثمار في A2Z

يمثل A2Z فرصة عالية المخاطر وعالية الإمكانيات في قطاع ألعاب Web3. يوفر نهج المنصة المبتكر لتوحيد اللاعبين والمبدعين قيمة طويلة الأمد، لكن التقلبات القصيرة الأجل وعدم اليقين التنظيمي يمثلان مخاطر كبيرة.

توصيات الاستثمار في A2Z

✅ المبتدئون: خصص نسبة صغيرة (1-3%) من محفظتك الرقمية لـA2Z ✅ المستثمرون ذوو الخبرة: فكر في تخصيص 5-10% مع إدارة نشطة للمخاطر ✅ المستثمرون المؤسساتيون: قيّم A2Z كجزء من محفظة ألعاب Web3 متنوعة

طرق المشاركة في A2Z

- تداول فوري: اشترِ رموز A2Z عبر Gate.com

- التخزين (Staking): شارك في برامج تخزين A2Z إذا توفرت

- الألعاب: تفاعل مع منصة Arena-Z لكسب المكافآت

الاستثمار في العملات الرقمية يحمل مخاطر مرتفعة للغاية، وهذا المقال لا يُعد نصيحة استثمارية. على المستثمرين اتخاذ قراراتهم بناءً على قدرتهم على تحمل المخاطر وينصح باستشارة مستشار مالي محترف. لا تستثمر أكثر مما يمكنك تحمل خسارته.

الأسئلة الشائعة

كم تبلغ قيمة عملة A2Z الرقمية؟

في أكتوبر 2025، تبلغ قيمة عملة A2Z الرقمية 0.000031 دولار لكل رمز، برأس مال سوقي 31 ألف دولار ومعروض متداول 999.93 مليون رمز.

هل AZ سهم جيد للشراء؟

نعم، تبدو AZ واعدة. رغم التوقع بانخفاض قصير الأجل، فإن ارتفاعها الأخير بنسبة 7.24% يشير إلى إمكانيات مستقبلية. آفاق النمو الطويلة ضمن قطاع web3 والعملات الرقمية تجعلها خيارًا استثماريًا جاذبًا.

كم سيكون سعر ICE في عام 2025؟

وفقًا للتحليل الحالي للسوق، من المتوقع أن يصل سعر ICE إلى حوالي 0.028 دولار بحلول 2025، ما يمثل مكسبًا محتملًا يقارب 87.8% مقارنة بقيمته الحالية.

ما هو توقع سعر Clover في عام 2030؟

استنادًا إلى الاتجاهات الحالية، يُتوقع أن تبلغ قيمة Clover Finance (CLV) حوالي 0.016772 دولار في 2030، مما يشير إلى انخفاض معتدل عن المستويات الحالية.

توقعات سعر TAKE في عام 2025: تحليل توجهات السوق وفرص النمو للأصول الرقمية

توقعات سعر ACP لعام 2025: توجهات السوق والعوامل المؤثرة على القيم المستقبلية

توقعات سعر CGX في عام 2025: تحليل اتجاهات السوق وفرص CGX المستقبلية

توقعات سعر BRWL في عام 2025: تحليل اتجاهات السوق والعوامل المحتملة لنمو رمز Brawl

ما مدى التقلب الحالي لعملة BEAT، وكيف يُقارن هذا التقلب بنطاقها خلال آخر ٥٢ أسبوعاً؟

إجابة اختبار زينيا اليومي 9 ديسمبر 2025

استكشاف سلسلة الكتل Ethereum: دليل متكامل

دليل شامل لفهم معيار الرموز BEP-2

ملخص أسبوعي لمشاريع Gate (8 ديسمبر 2025)