Previsão de preço do RAY para 2025: examinando os fatores de crescimento e o potencial de mercado do token RAY nos anos seguintes

Introdução: Posição de Mercado e Valor de Investimento do RAY

Raydium (RAY), como automated market maker (AMM) e provedor de liquidez na blockchain Solana, conquistou avanços notáveis desde seu lançamento em 2021. Até 2025, Raydium alcançou capitalização de mercado de US$ 871.681.169, com uma oferta circulante de aproximadamente 268.127.090 tokens e preço na faixa de US$ 3.251. Reconhecido como o “Solana DEX Pioneer”, o ativo ocupa papel central no setor de finanças descentralizadas (DeFi) e na oferta de liquidez dentro do ecossistema da Solana.

Este artigo traz uma análise detalhada das tendências do preço do Raydium entre 2025 e 2030, combinando padrões históricos, dinâmica de oferta e demanda, evolução do ecossistema e fatores macroeconômicos para apresentar previsões profissionais de preço e estratégias práticas de investimento.

I. Histórico de Preços do RAY e Situação Atual do Mercado

Evolução Histórica do Preço do RAY

- 2021: O RAY registrou máxima histórica de US$ 16.83 em 13 de setembro, consolidando sua relevância no setor.

- 2022: O bear market cripto impactou o RAY, levando o preço à mínima de US$ 0.134391 em 30 de dezembro.

- 2023-2025: O RAY superou a retração, demonstrando recuperação e crescimento, com preço atual de US$ 3.251 em 16 de setembro de 2025.

Situação Atual do Mercado – RAY

Em 16 de setembro de 2025, RAY é negociado a US$ 3.251, com capitalização de mercado de US$ 871.681.169. O token apresentou queda de 4,91% nas últimas 24 horas, refletindo volatilidade de curto prazo. No entanto, o desempenho anual supera 122,36% de valorização. A oferta circulante soma 268.127.089 RAY, equivalente a 48,31% do total de 555.000.000. O volume negociado nas últimas 24 horas foi de US$ 1.473.198, apontando atividade de mercado moderada.

Clique para ver o preço atual de mercado do RAY

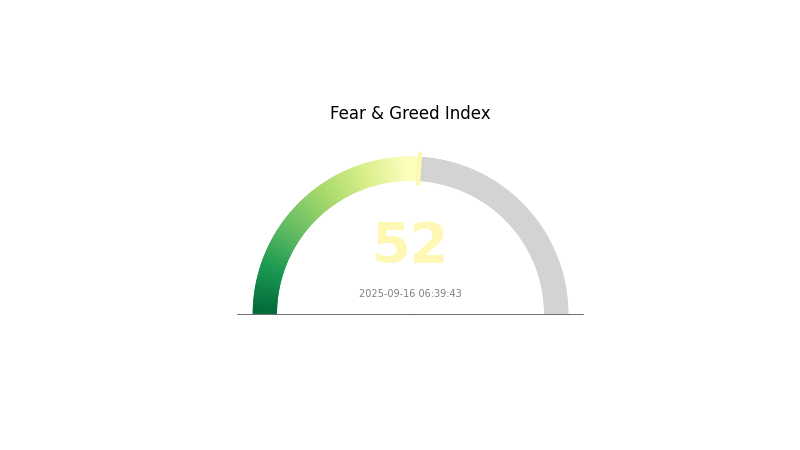

Indicador de Sentimento de Mercado – RAY

16/09/2025 Fear and Greed Index: 52 (Neutro)

Clique para ver o Fear & Greed Index em tempo real

O Fear and Greed Index está em 52, refletindo um sentimento equilibrado no mercado cripto. Esse equilíbrio gera boas oportunidades estratégicas. Recomenda-se atenção constante, já que as condições podem se alterar rapidamente. Recomenda-se pesquisa aprofundada e adoção de práticas rigorosas de gestão de risco antes de investir neste cenário neutro.

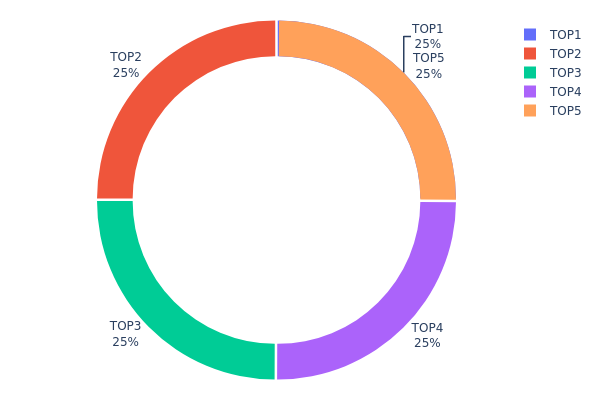

Distribuição das Posses de RAY

Os dados de distribuição de endereços do RAY indicam forte concentração de propriedade. Os cinco maiores endereços detêm cada um 138.590,93K tokens RAY, correspondendo individualmente a 24,97% da oferta circulante. Juntos, esses cinco endereços concentram 124,85% dos tokens RAY. Esse cenário anômalo demanda apuração detalhada.

Essa alta concentração preocupa quanto à descentralização e estabilidade de mercado. A maior parte dos tokens sob poucas mãos eleva o risco de manipulação e volatilidade. Grandes detentores influenciam diretamente o preço e a dinâmica geral do ativo.

A porcentagem negativa (-24,85%) atribuída a “Outros” sugere possível erro nos dados ou tokenomics complexa. Esse padrão pode impactar a liquidez, governança e saúde do ecossistema. Pode desestimular pequenos investidores e comprometer a sustentabilidade do projeto.

Clique para ver a distribuição de posse atual do RAY

| Top | Endereço | Quantidade Detida | Posse (%) |

|---|---|---|---|

| 1 | 8pFhUq...tVQc6G | 138.590,93K | 24,97% |

| 2 | 8pFhUq...tVQc6G | 138.590,93K | 24,97% |

| 3 | 8pFhUq...tVQc6G | 138.590,93K | 24,97% |

| 4 | 8pFhUq...tVQc6G | 138.590,93K | 24,97% |

| 5 | 8pFhUq...tVQc6G | 138.590,93K | 24,97% |

| - | Outros | -137.956.481,03 | -24,85% |

2. Fatores-Chave que Influenciam o Preço Futuro do RAY

Mecanismo de Oferta

- Tokenomics: O RAY possui oferta máxima de 555.000.000 tokens, e uma oferta circulante de 268.127.089,855586 até 16/09/2025.

- Impacto Atual: Oferta limitada e circulação ativa podem favorecer estabilidade e potencial valorização conforme aumenta a demanda.

Dinâmica Institucional e “Whale”

- Adoção Corporativa: A integração do Raydium ao ecossistema Solana chamou atenção de empresas em busca de soluções DeFi ágeis e econômicas.

Ambiente Macroeconômico

- Proteção contra Inflação: Como ativo DeFi, o RAY pode atuar como hedge frente à inflação em períodos de instabilidade econômica.

Desenvolvimento Tecnológico e Expansão de Ecossistema

- Expansão da rede Solana: O fortalecimento da blockchain Solana tem impacto direto na performance do RAY, visto que o Raydium é peça-chave desse ambiente.

- Liquidity as a Service (LaaS): A implementação da LaaS potencializa crescimento de usuários, consolidando o Raydium no setor DeFi.

- Aplicações no ecossistema: O Raydium é elemento central do ecossistema DeFi Solana, oferecendo DEX descentralizada e soluções de liquidez.

III. Projeção de Preço do RAY para 2025-2030

Perspectivas para 2025

- Projeção cautelosa: US$ 2.52 – US$ 3.00

- Projeção neutra: US$ 3.00 – US$ 3.50

- Projeção otimista: US$ 3.50 – US$ 3.75 (dependendo de cenário favorável)

Perspectivas para 2027–2028

- Fase de mercado: Possível ciclo de crescimento com alta volatilidade

- Previsão de faixa de preço:

- 2027: US$ 2.10 – US$ 5.56

- 2028: US$ 3.54 – US$ 6.85

- Catalisadores principais: Evolução de projetos, sentimento de mercado e adoção cripto generalizada

Projeção de Longo Prazo 2029–2030

- Cenário base: US$ 4.08 – US$ 5.87 (crescimento regular do mercado)

- Cenário otimista: US$ 5.87 – US$ 6.69 (com expansão acelerada do ecossistema)

- Cenário transformador: US$ 6.69 – US$ 7.50 (com avanços tecnológicos disruptivos)

- 31/12/2030: RAY US$ 5.87 (faixa provável de estabilização no longo prazo)

| Ano | Preço Máximo Previsto | Preço Médio Previsto | Preço Mínimo Previsto | Variação (%) |

|---|---|---|---|---|

| 2025 | 3.75214 | 3.2346 | 2.52299 | 0 |

| 2026 | 4.01737 | 3.49337 | 2.51522 | 7 |

| 2027 | 5.55795 | 3.75537 | 2.10301 | 15 |

| 2028 | 6.84529 | 4.65666 | 3.53906 | 43 |

| 2029 | 5.98101 | 5.75097 | 4.08319 | 76 |

| 2030 | 6.68723 | 5.86599 | 3.87156 | 80 |

IV. Estratégias Profissionais de Investimento e Gestão de Riscos em RAY

Metodologia de Investimento em RAY

(1) Estratégia de Holding de Longo Prazo

- Perfil ideal: Investidores com visão de longo prazo e alta tolerância ao risco

- Recomendações de operação:

- Acumular RAY em períodos de queda

- Acompanhar atualizações da Solana e avanços do protocolo Raydium

- Utilizar carteira não custodial para armazenar tokens

(2) Estratégia de Trading Ativo

- Ferramentas técnicas recomendadas:

- Médias móveis: Identificação de tendências e possíveis pontos de reversão

- Índice de Força Relativa (RSI): Análise de sobrecompra/sobrevenda do ativo

- Pontos de atenção no swing trade:

- Definir stop-loss para limitar prejuízos

- Realizar venda com lucro em faixas preestabelecidas

Estrutura de Gestão de Riscos RAY

(1) Princípios de Alocação de Ativos

- Investidores conservadores: 1–3% do portfólio cripto

- Investidores agressivos: 5–10% do portfólio cripto

- Investidores profissionais: até 15% do portfólio cripto

(2) Soluções de Proteção contra Riscos

- Diversificação: Distribuição em diferentes protocolos DeFi

- Staking: Participação em staking de RAY visando renda passiva

(3) Soluções de Armazenamento Seguro

- Carteira hot (hot wallet) recomendada: Gate Web3 Wallet

- Opção de cold storage: Carteira hardware para armazenamento prolongado

- Práticas de segurança: Ativar autenticação em dois fatores e backup seguro das chaves privadas

V. Riscos e Desafios Potenciais para RAY

Riscos de Mercado RAY

- Volatilidade: Oscilações de preço elevadas são comuns no mercado cripto

- Concorrência: Expansão da competição no ecossistema DeFi Solana

- Sentimento de mercado: Sensibilidade às tendências gerais do setor cripto

Riscos Regulatórios RAY

- Incertezas regulatórias: Mudanças e novos requisitos para o segmento DeFi mundial

- Necessidade de compliance: Exigência potencial de KYC/AML adicional

- Restrições internacionais: Variações legais conforme jurisdição

Riscos Técnicos RAY

- Vulnerabilidades de smart contract: Risco de exploits ou bugs

- Escalabilidade: Dependência da performance da rede Solana

- Interoperabilidade: Limites na integração com outras cadeias

VI. Conclusão e Recomendações

Avaliação do Valor de Investimento do RAY

Raydium (RAY) se destaca como protagonista do DeFi Solana com bom potencial de longo prazo, mas enfrenta riscos de curto prazo relacionados à volatilidade e à regulação.

Recomendações de Investimento em RAY

✅ Iniciantes: Comece com investimentos pequenos e foque no aprendizado sobre DeFi.

✅ Investidores experientes: Combine estratégias de hold e trading para balancear riscos.

✅ Institucionais: Realize análise detalhada e considere RAY em portfólio DeFi diversificado.

Como Participar do Trading de RAY

- Trading spot: Compra e venda de RAY na Gate.com

- Yield farming: Participação nos pools de liquidez Raydium

- Staking: Stake de RAY para recompensas e participação na governança

Investir em criptomoedas envolve riscos elevados. Este artigo não constitui recomendação de investimento. Decida sempre com cautela de acordo com seu perfil de risco e consulte profissionais financeiros. Nunca invista mais do que pode perder.

FAQ

RAY é um bom investimento?

Sim, RAY mostra potencial sólido de crescimento. Projeções indicam tendência de alta nos próximos anos, respaldadas pelo cenário de mercado atual.

Qual o futuro do Ray Coin?

O futuro do Ray Coin é promissor. Estimativas sugerem que pode alcançar US$ 32.10 em 2030 e até US$ 54.59 em 2035. Indicadores técnicos apontam sentimento positivo no curto prazo, com perspectiva de valorização.

Raydium é compra ou venda?

Raydium é atualmente uma compra cautelosa. As análises técnicas mostram sinais positivos, especialmente nas médias móveis de curto prazo, indicando potencial de alta próxima.

Raydium é um bom projeto?

Sim, Raydium é referência no DeFi da Solana. O projeto oferece trading eficiente, yield farming atrativo, baixas taxas e liquidez robusta. Seu modelo híbrido permanece relevante em 2025.

Previsão de preço do RAY para 2025: este protocolo Layer-1 atingirá novos patamares no cenário em constante evolução do DeFi?

Previsão de preço do KMNO para 2025: tendências do mercado, fatores-chave e perspectivas de investimento

Previsão de Preço do JUP para 2025: Análise do Potencial da Jupiter no Mercado Cripto em Transformação

Previsão de Preço do JTO para 2025: O Token Jito Network Vai Alcançar Novos Patamares no Ecossistema DeFi?

Previsão de preço do RAY em 2025: análise das tendências do mercado e dos fatores potenciais de crescimento

HLN vs SOL: Um Duelo de Titãs no Universo das Criptomoedas

Inovações em Blockchain: Entendendo os Fundamentos da Layer 0 e Sua Relevância na Rede

Guia para Efetuar Swaps na Rede Optimism

Explorando Projetos Inovadores de NFT em 2024

Como descobrir e utilizar um endereço ERC20: guia para iniciantes

Como Elaborar um White Paper de Criptomoeda Eficaz: Guia Completo