Еженедельный обзор криптовалют от Gate Ventures (29 сентября 2025 г.)

TL;DR

- Срок шатдауна в правительстве США истекает, это способно повлиять на ВВП страны и задержать публикацию ключевых экономических данных.

- На этой неделе выйдут ISM Manufacturing и Service PMI, данные по заказам в промышленности и занятости.

- Крипторынок на неделе скорректировался: BTC ушёл вниз на 2,7%, ETH — на 6,9% из-за сильных оттоков из ETF.

- Альткоины в целом просели на ~4%, что сняло оптимизм по поводу «сезона альткоинов», но такие проекты, как MNT (+14,9%), выделились на фоне рынка.

- Layer 1 Plasma ($XPL), ориентированный на стейблкоины, стартовал уверенно — с ~$0,72 до $1,69, поддержанный эирдропами сообщества и листингами на крупных биржах (Binance, Upbit).

- Cloudflare запускает NET Dollar как новый платёжный инструмент для AI-ориентированной «агентной сети».

- CleanSpark открыла кредитную линию на $100 млн, обеспеченную Bitcoin, от Coinbase Prime для расширения майнинга.

- GSR подала заявку на ETF для Digital Asset Treasury Companies на фоне волны финансирования DAT более $20 млрд.

Макрообзор

Срок шатдауна в правительстве США истекает, это способно повлиять на ВВП страны и задержать публикацию ключевых экономических данных.

Возможный шатдаун в США может наступить в ближайшие дни: администрация Трампа и республиканцы продолжают спор по продолжению финансирования до 1 октября. Потенциальный шатдаун может сказаться на ВВП страны двумя способами: через снижение доходов и расходов федеральных служащих и остановку государственных закупок товаров и услуг. Согласно данным Комитета по ответственному федеральному бюджету, во время шатдауна 2018–2019 гг. были отправлены в отпуск около 380 000 сотрудников (18% федеральных служащих, не относящихся к почте, в 2018 г.). Неделя шатдауна снижает квартальный ВВП примерно на 0,1%, но большую часть потерь можно компенсировать в следующих кварталах. По оценке CBO, пятинедельный шатдаун в 2018 г. сократил годовой квартальный рост ВВП на 0,6%.

Шатдаун способен задержать публикацию экономических данных, что усложнит работу ФРС по анализу ситуации в реальном времени. Сотрудники, собирающие и обрабатывающие данные для BLS, BEA и Census, могут быть признаны «неважными», из-за чего публикация payrolls за сентябрь, CPI за сентябрь и ВВП за III квартал может быть перенесена; детали пока неизвестны. Если публикация этих данных задержится, на октябрьском заседании FOMC ФРС останется без ключевых цифр по занятости, инфляции и ВВП. Тем не менее, поскольку влияние DOGE проявится к 30 сентября, а шатдаун может оказать более выраженное негативное воздействие на экономику США, решение о снижении ставки на октябрьском заседании ФРС остаётся вероятным.

На этой неделе выйдут ISM Manufacturing и Service PMI, данные по заказам в промышленности и занятости. Пакет данных по занятости, включая non-farm payrolls,

уровень безработицы и среднюю почасовую зарплату, даст ориентиры по дальнейшему снижению ставок. Хотя глава ФРС Пауэлл усилил тезис, что путь к снижению ставок не гарантирован, рынок ожидает два понижения в этом году — в октябре и декабре. Новые признаки ослабления рынка труда усилят «голубиные» настроения. (1, 2)

DXY

Доллар США на неделе укрепился — сильные экономические показатели поддержали курс, в то время как евро и швейцарский франк снизились против доллара. (3)

Доходность 10-летних казначейских облигаций США

Доходность 10-летних облигаций США осталась стабильной после релиза данных по PCE, совпавших с прогнозом, однако годовой показатель всё ещё выше целевой инфляции ФРС (2%). (4)

Золото

Золото выросло в цене на прошлой неделе: ежемесячный PCE оказался в рамках ожиданий, данные по ВВП США показали больший рост, чем предполагалось, а Трамп объявил новый раунд тарифов на импорт лекарств, грузовиков и мебели. (5)

Обзор крипторынка

1. Основные активы

Цена BTC

Цена ETH

ETH/BTC Ratio

Американские Bitcoin ETF показали чистый отток в $902 млн за неделю, при этом цена BTC снизилась на 2,66%. Ethereum ETF также продемонстрировали чистый отток $795 млн, а цена ETH снизилась на 6,86%. Соотношение ETH/BTC осталось почти на уровне прошлой недели — 0,0368. (6)

2. Общая капитализация рынка

Общая капитализация крипторынка

Общая капитализация крипторынка без BTC и ETH

Общая капитализация рынка без топ-10 активов

Широкий крипторынок за неделю потерял 3,6%, вне BTC и ETH падение составило 4%. Альткоин-сегмент за вычетом топ-10 просел на 3,94%, под давлением слабой динамики ETH, фактически нивелировав «сезон альткоинов».

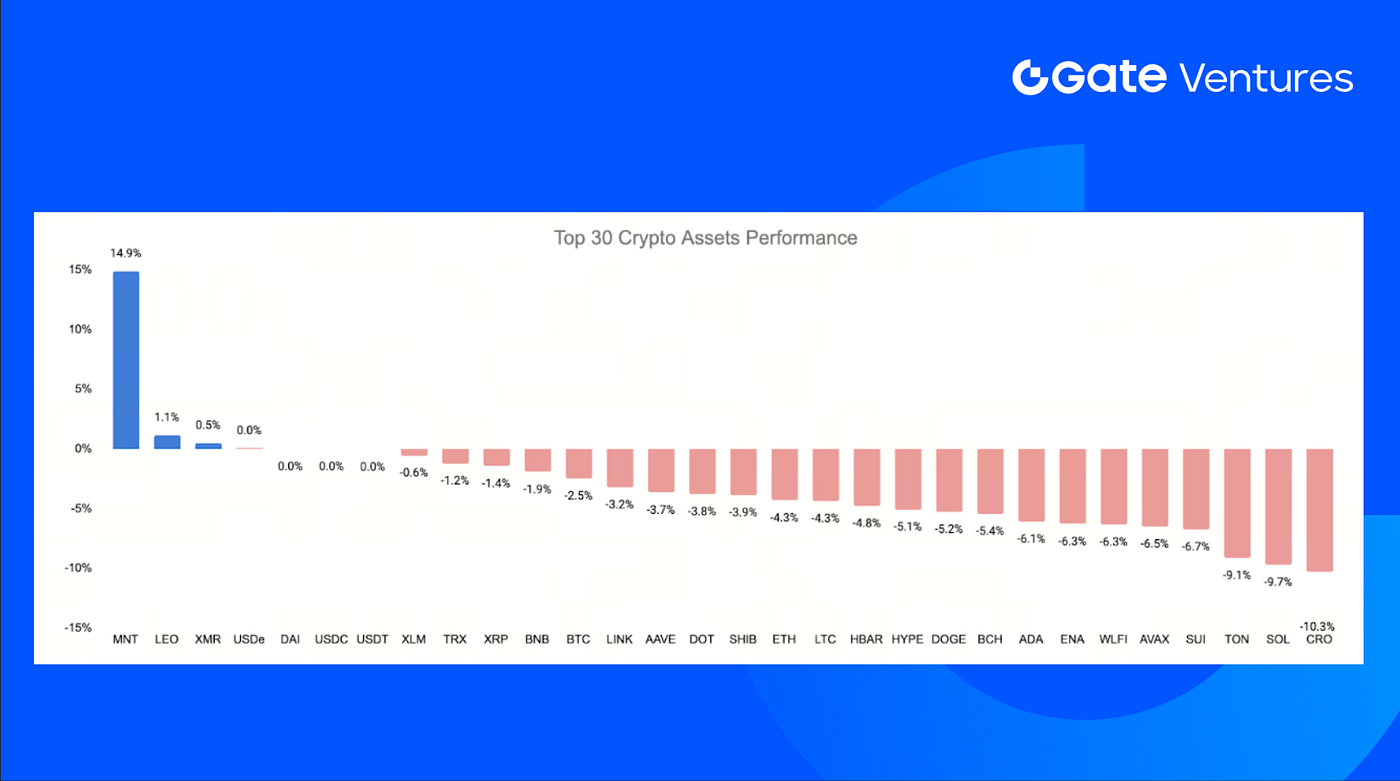

3. Динамика топ-30 криптоактивов

Источник: Coinmarketcap и Gate Ventures, на 29 сентября 2025 г.

В целом рынок двигался вниз, но некоторые токены — MNT, LEO, XMR — показали лучшую динамику, при этом MNT вырос на 14,9%.

MNT укрепляет фундамент цен благодаря глубокой интеграции с экосистемой Bybit. Последний скачок вызван новостью о запуске perp DEX ApeX Protocol на базе Bybit — сотрудничество привело к шестикратному росту цены. (7)

4. Новый токен

Plasma — Layer 1 блокчейн для стейблкоинов, предназначенный для мгновенных и безкомиссионных массовых платежей (особенно USDT), с поддержкой EVM-совместимости, кастомных gas-токенов и интеграциями в платёжные и необанковские рельсы.

$XPL стартовал с ~$0,72 и быстро достиг ATH $1,69 благодаря сильному сообществу, эирдропам и листингам на крупных биржах — Upbit и Binance, что добавило ликвидности и узнаваемости.

Ключевые события криптоиндустрии

1. Cloudflare запускает NET Dollar как новый платёжный инструмент для AI-ориентированной «агентной сети».

Cloudflare анонсировала NET Dollar — стабилькоин на базе доллара США для «агентной сети», где AI-агенты проводят транзакции за пользователей. NET Dollar обеспечивает моментальные, безопасные микроплатежи для разработчиков, создателей и автономных агентов, переводя интернет от рекламы и банковских переводов к модели оплаты за использование. CEO Мэттью Принс назвал проект финансовым рельсом со скоростью интернета, поддерживающим дробные выплаты и поощряющим оригинальность. Компания также развивает стандарты совместимости: Agent Payments Protocol и x402. Запуск рассматривают как расширение применения стейблкоинов в интернет-инфраструктуре. (8),(9),(10)

2. CleanSpark открыла кредитную линию на $100 млн, обеспеченную Bitcoin, от Coinbase Prime для расширения майнинга.

CleanSpark (Nasdaq: CLSK) увеличила Bitcoin-кредитную линию на Coinbase Prime на $100 млн, получив недилютивную ликвидность для роста. Американский майнер направит средства в энергетику, масштабирование майнинга и вычисления на отдельных объектах. Руководство подчёркивает органичный рост без разводнения доли акционеров. CleanSpark в июне достигла мощности 50 EH/s и держит BTC на сумму более $1 млрд. Сделка отражает рост эффективности капитала и доступ к институциональному кредиту для ведущих майнеров. (11),(12)

3. GSR подала заявку на ETF для Digital Asset Treasury Companies на фоне волны DAT-финансирования более $20 млрд.

Маркет-мейкер GSR подал заявку в SEC на ETF GSR Digital Asset Treasury Companies с инвестированием минимум 80% средств в компании, держащие криптовалюты на корпоративных балансах. В заявке также четыре фонда по ETH, ориентированных на стейкинг и доходность. Интерес к DAT вырос: за год объём венчурного финансирования превысил $20 млрд. Предложение отражает институционализацию DAT и ускорение одобрения мульти-крипто и стейкинг-ETF. (13),(14)

Ключевые венчурные сделки

1. Bulk привлек $8 млн посевных инвестиций для вывода перпетуал-контрактов уровня CEX на Solana.

Bulk привлек $8 млн в раунде под руководством Robot Ventures и 6th Man Ventures, с участием Chapter One, WMT Ventures, Mirana Ventures, Big Brain Holding и ангелов. Проект строит слой исполнения на Solana (Bulk-agave + Bulk Tile) с задержкой менее 20 мс и более 2,5 млн ордеров в секунду, сохраняя децентрализацию за счёт FIFO, безгазовых ордеров, некастодиального хранения и деления комиссий с валидаторами. Институциональные интеграции — SDK, FIX, CCXT. Инвесторы видят в Bulk перспективный путь к производительности уровня CEX на блокчейне, позиционируя проект как институциональный шлюз для перпетуал-торговли перед запуском основной сети в 2025 г. (15),(16)

2. Divine привлекла $6,6 млн посевных инвестиций под руководством Paradigm для масштабирования неконтролируемого кредитования через Credit.

Divine привлекла $6,6 млн посевных инвестиций под руководством Paradigm при участии Nascent и ангелов для расширения протокола неконтролируемого кредитования Credit. Запущенный в декабре 2024 года Credit выдал более 175 000 займов 100 000+ заёмщикам в Аргентине, Нигерии, Колумбии и других странах, преимущественно на ежедневные расходы. Протокол использует поведенческие данные вместо залога, увеличивая лимит до $1 000 при своевременном погашении. Распространяется через World MiniApps с 15 млн+ подтверждённых пользователей, поддерживая инвесторский тезис по блокчейн-микрофинансированию и выходу на недобанковские рынки. (17),(18)

3. Bastion привлекла $14,6 млн для расширения глобальных сервисов по выпуску стейблкоинов.

Bastion привлекла $14,6 млн в раунде под руководством Coinbase Ventures с участием Sony, Samsung Next, a16z crypto и Hashed. Компания, основанная бывшим руководителем Meta и a16z crypto, создаёт white-label системы для выпуска стейблкоинов, позволяя бизнесу выпускать цифровые доллары без программирования и лицензий. Платформа включает кошельки и off-ramp-конвертацию наличных в 70+ странах, конкурируя с Paxos и Agora. Bastion становится инфраструктурным слоем для корпоративных клиентов, учитывая рост спроса на брендированные и compliant стейблкоин-решения. (19),(20)

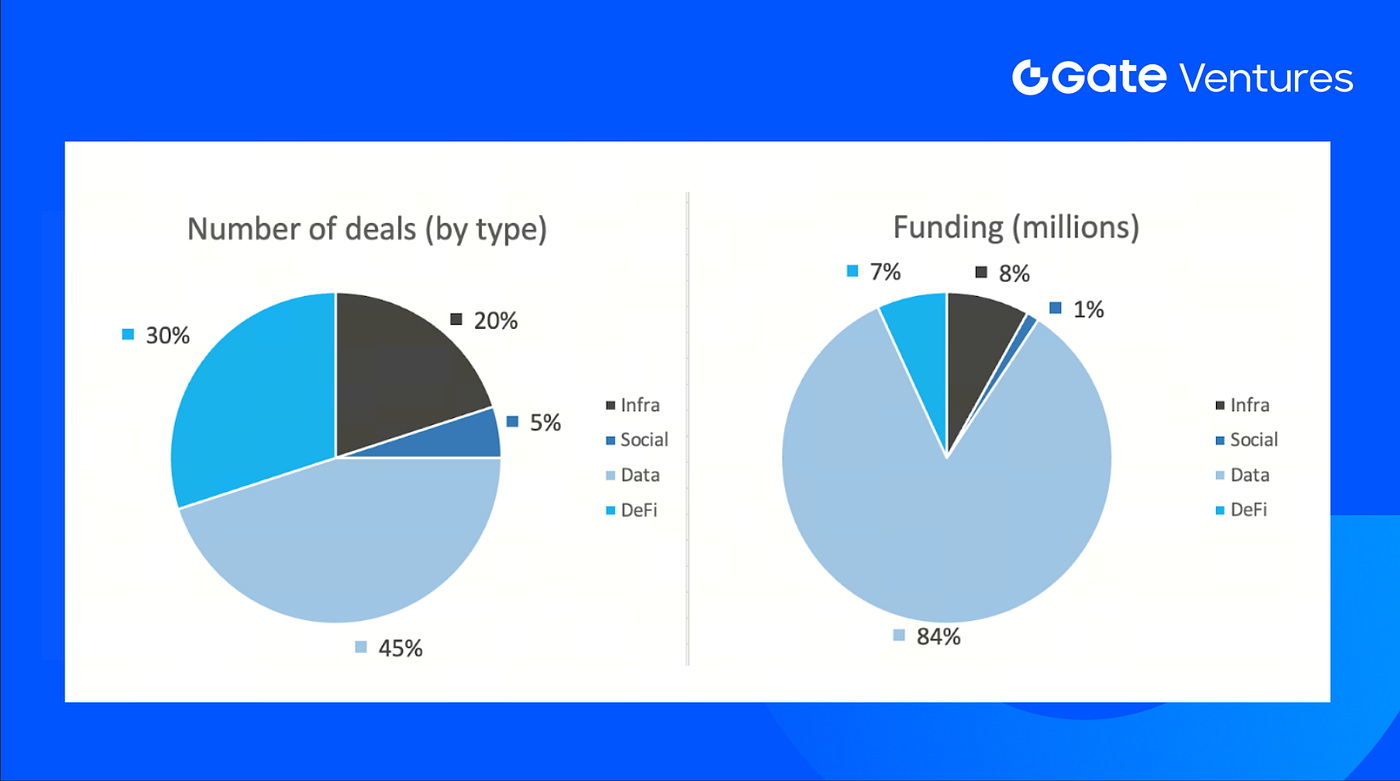

Метрики венчурного рынка

За неделю закрыто 20 сделок: Data — 9 (45%), Infra — 4 (20%), Social — 1 (5%), DeFi — 6 (30%).

Сводка венчурных сделок за неделю, источник: Cryptorank и Gate Ventures, на 29 сентября 2025 г.

Общая сумма раскрытого финансирования за неделю составила $364 млн, при этом 25% сделок (5 из 20) не раскрыли объём финансирования. Лидирует Data — $305 млн. Крупнейшие сделки: Fnality $136 млн, zerohash $104 млн.

Сводка венчурных сделок за неделю, источник: Cryptorank и Gate Ventures, на 29 сентября 2025 г.

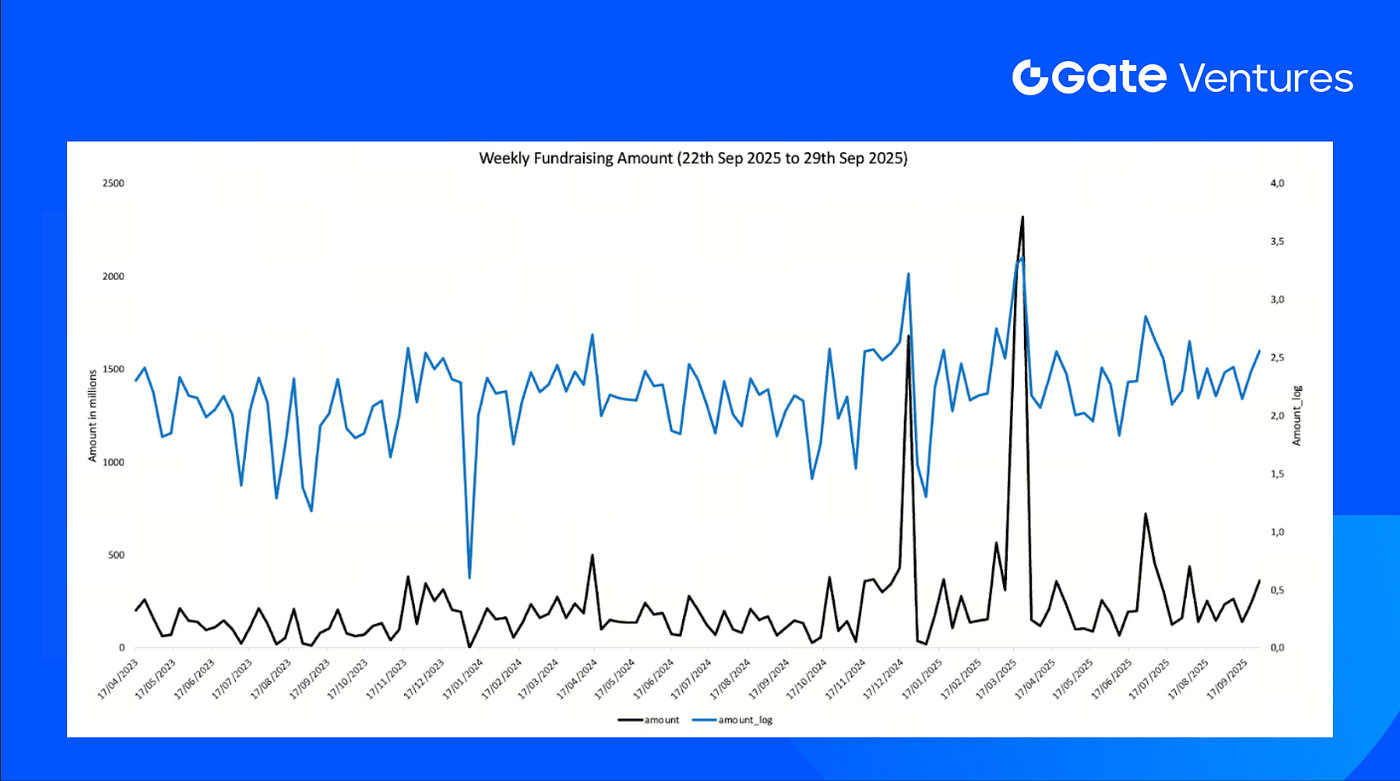

Совокупный недельный объём привлечения вырос до $364 млн за 4-ю неделю сентября 2025 года — это на 51% больше, чем неделей ранее. За аналогичный период год к году рост составил 63%.

О Gate Ventures

Gate Ventures — венчурное подразделение Gate, инвестирующее в децентрализованную инфраструктуру, middleware и приложения, формирующие облик Web 3.0. Gate Ventures поддерживает перспективные команды и стартапы по всему миру, обладающие идеями и компетенциями для переосмысления социальных и финансовых взаимодействий.

Веб-сайт | Twitter | Medium | LinkedIn

Данный материал не является предложением, ходатайством или рекомендацией. Всегда консультируйтесь с независимым специалистом перед принятием инвестиционных решений. Gate Ventures может ограничивать или запрещать использование сервисов из запрещённых юрисдикций. Подробнее — в пользовательском соглашении.

Ссылки:

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-29-september-2025.html

- The Effects of the Partial Shutdown Ending in January 2019, US Congressional Budget Office, https://www.cbo.gov/publication/54937

- TradingView on DXY Index, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- Tradingview on US 10 year bond yield, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- TradingView on Gold, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- Apex Protocol’s tweet, https://x.com/OfficialApeXdex/status/1971526416983535829

- Cloudflare introduces NET Dollar as new payment rail for AI-driven “agentic web” https://www.coindesk.com/business/2025/09/25/cloudflare-unveils-u-s-dollar-stablecoin-for-ai-powered-internet-economy

- Cloudflare introduces NET Dollar as new payment rail for AI-driven “agentic web” https://blockworks.co/news/cloudflare-unveils-net-dollar-stablecoin-for-ai-internet-economy

- Cloudflare introduces NET Dollar as new payment rail for AI-driven “agentic web”https://www.theblock.co/post/372392/the-daily-cloudflare-joins-stablecoin-race-with-net-dollar-plans-us-senate-sets-hearing-on-crypto-taxation-and-more

- CleanSpark secures $100M Bitcoin-backed credit line from Coinbase Prime to fuel mining growth, https://cointelegraph.com/news/cleanspark-second-btc-backed-credit-line-share-dilution

- CleanSpark secures $100M Bitcoin-backed credit line from Coinbase Prime to fuel mining growth, https://www.theblock.co/post/371773/cleanspark-secures-100-million-credit-financing-coinbase

- GSR files for Digital Asset Treasury Companies ETF amid $20B+ DAT funding wave, https://www.theblock.co/post/372186/gsrs-new-etf-proposal-eyes-digital-asset-treasuries-amid-growing-popularity

- GSR files for Digital Asset Treasury Companies ETF amid $20B+ DAT funding wave, https://cointelegraph.com/news/market-maker-gsr-files-5-crypto-etfs

- Bulk Raises $8M Seed Funding to Redefine Perpetuals DEX Trading, https://x.com/_bulktrade/status/1970867330210218039

- Bulk secures $8M Seed to deliver CEX-grade perps on Solana, https://ventureburn.com/bulk-raises-8m-seed-funding-to-redefine-perpetuals-dex-trading/

- Divine secures $6.6M Seed led by Paradigm to scale undercollateralized lending via Credit, https://www.axios.com/pro/fintech-deals/2025/09/25/stablecoin-lender-divine-paradigm-seed

- Divine secures $6.6M Seed led by Paradigm to scale undercollateralized lending via Credit, https://blockworks.co/news/divine-raises-6-6m-to-expand-credit-lending-protocol

- Bastion secures $14.6M funding to expand global stablecoin issuance services, https://fortune.com/crypto/2025/09/24/bastion-coinbase-sony-samsung-hashed-fundraise/

- Bastion secures $14.6M funding to expand global stablecoin issuance services, https://www.coindesk.com/business/2025/09/24/coinbase-sony-and-samsung-back-usd14-6m-round-for-stablecoin-startup-bastion

Похожие статьи

Еженедельный обзор криптовалютных событий Gate Ventures (15 сентября 2025 г.)

Еженедельный обзор криптовалют от Gate Ventures (25 августа 2025 г.)

Инвестиционная стратегия в криптовалюты на 2025 год: будущее AI, DeFi, DeSci и мемов

Еженедельный обзор крипторынка Gate Ventures (18 августа 2025 г.)

Как ончейн-игры TCG способны сформировать новый рынок объемом 2 млрд долларов: анализ текущей ситуации и прогнозы оценки