なぜEulerが現在のDeFiで最高の貸出商品なのか

この記事では、オイラーがオランダ式オークション清算およびソフト清算メカニズムを通じて、従来のDeFiレンディングプロトコルにおける清算およびMEVの問題に取り組んでいる方法について詳しく説明しており、より競争力のある手数料とより高い貸値比率(LTV)を提供しています。オイラーの革新的な機能はDeFiスペースで際立ち、借り手や貸し手にとって信頼できる選択肢となっています。なぜオイラーが現在最高のDeFiレンディング製品であるかEuler Financeは、2024年10月以来、DeFiの歴史で最も驚くべきカムバックの1つとなっています。2023年のハッキングによる一時的なプロトコルの停止など、大きな挫折に直面しながらも、Eulerチームは精力的に働き、ユーザーの信頼を取り戻すために努力してきました。

データは自己を語る。

- 総預金は10億ドルに達しました(4ヶ月で1000%増加)

- 43億ドルのローン

- SonicでのTVLが1億ドルを超えました

- 8つのチェーンに展開されました

Euler Financeの総預金、出典: DeFiLlama

預金の著しい増加は、DeFiスペースにおけるEulerの魅力の向上を証明しています。

しかし、なぜユーザーは今、貸出のためにEulerを検討すべきなのでしょうか? Eulerが他の貸出製品とどのように異なるかを理解するには、まず市場にある他の貸出製品のいくつかの問題点を探って、Eulerがこれらの問題にどのように対処しているかを見てみましょう。

クリアリングとMEVの問題

DeFiレンディングプロトコルの主な問題の1つは、清算方法です。従来の貸出市場では、中央機関(銀行など)が不良債権を清算する場合があります。しかし、分散型の世界では、このプロセスはアービトラージャーとして行動する第三者である清算者に依存しています。これらのユーザーは、担保が不十分な場合にポジションを自動的に清算するためのボットを作成します。その代わりに、彼らは担保の割引を受け取り、これらのポジションを清算する競争は激しいです。

この競争は、特にイーサリアムのようなネットワーク上で、アクションの最初のリキデータが報酬を受け取るという競争がガス手数料の増加につながります。その結果、ガス戦争がエスカレートし、ガス価格が急騰すると、一般ユーザーがブロックチェーンとのやり取りをすることが困難になるかもしれません。この現象はMEVと呼ばれ、DeFiエコシステムに直面する重大な問題です。

他のプロトコルはどのように清算を処理していますか

Aave、Compound、Curveなどの主要なDeFiプラットフォームには、清算システムがあります。借り手のポジションが担保の閾値を下回ると、清算者が割引価格で担保を差し押さえるために競争します。しかし、このプロセスはしばしば担保価格の急落をもたらし、清算問題をさらに悪化させ、ガスコストを押し上げます。

これらのプロトコルは、アービトラージャーにインセンティブを与えて清算を促進しますが、激しい清算競争はしばしば公正でない結果や一般ユーザーに高い取引コストをもたらします。

オイラーの革新的な清算方法

Euler Financeは、これらの問題に真正面から取り組むことを目的とした、根本的に異なる清算方法を採用しています。

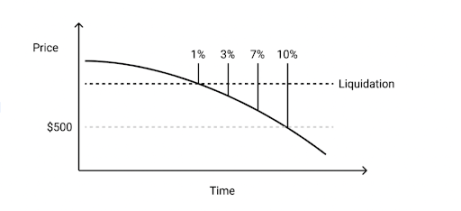

ダッチオークション決済

CompoundやAaveとは異なり、Eulerは清算プロセスで固定割引率を使用するのではなく、オランダ式オークションメカニズムを使用しています。これは、借り手のポジションの担保がますます不十分になると、清算割引が徐々に増加することを意味します。清算者は、自身のリスクとリターンの期待に基づいて最適な介入時期を選択できます。

清算割引は時間とともに増加します

このメカニズムにより、混雑や競争が減少し、MEVを抑制することで、ガス価格の安定化に寄与しています。Eulerは清算をオークションに変えることで、関係者全員にとってより有益でコントロールしやすい環境を作り出しました。

ソフト・リキデーション

Eulerのハイライトの1つは、完全な清算の恐れから借り手を守ることを目的としたソフトな清算メカニズムです。ソフトな清算メカニズムの下では、借り手の担保の価値が下がるか借金が増えた場合、一部の担保のみが清算されます。しかし、担保の価格が上昇すれば、借り手は清算された部分を回収することができます。

これにより、借入者は市場の変動から直ちに全ポジションを失うことなく、より多くの時間を回復することができます。ソフト・リキデーションにより、ユーザーは資産の管理を維持し、一時的な価格の低下に耐える能力を高め、損失を最小限に抑えることができます。

Eulerの革新的な清算メカニズムは、その基準に直接的かつ肯定的な影響を与えています:

貸出活動は活発です

Aave(0.38)やCompound(0.3)などの他のプロトコルと比較して、Eulerは最も高い借入TVL比率(0.45)を持っています。これは、Eulerに借り手が惹かれる理由として、より有利な清算条件やリスクの低い資金レバレッジの能力など、独自の特徴があるためです。

魅力的な手数料とリターン

トークン端末からの収益

ユーザーセントリックなアプローチにより、ユーザーには非常に競争力のある手数料が提供され(週最大$557,000)、預金者には利益をもたらします。流動化の負の影響を最小限に抑えることで、プロトコルは借り手と貸し手の両方がよりスムーズで効率的なプロセスを享受できるよう支援しています。

Loan-to-Value比率(LTV)

オイラーの平均貸借比率は90%と非常に高く、他のほとんどの分散型金融プラットフォームよりも高いです。これは、ソフトな清算メカニズムのおかげで、借り手により高いセキュリティとポジションの管理時の柔軟性を提供しています。借り手は、低い清算イベントでのすべての担保の失う可能性を確保しながら、より高いレバレッジを利用することができます。

結論

Eulerの革新的な機能、オランダ式オークション決済やソフトリキデーションなどは、DeFiレンディングにおける最も深刻な問題のいくつかに対処しており、MEV、高いGas手数料、従来の清算メカニズムのリスクなどが含まれます。プロトコルの強力な回復と成長、魅力的なメトリックスは、Eulerが信頼性が高いだけでなく、今日のDeFiスペースで最もユーザーフレンドリーで安全な選択肢の1つであることを示しています。有利な条件を求める借り手や安定した収益を求める貸し手、Eulerは、その分野で際立った解決策を提供できます。

ステートメント:

- この記事は[から転載されましたForesightNews], 著作権は元の著者に帰属します[Tommy.eth、Alex Liu、Foresight News],如对転載に異議がある場合は、お問い合わせくださいGate Learn チームチームは関連手続きに従ってできるだけ早く処理します。

- 免責事項:この記事で表現されている意見や見解は、著者個人のものであり、投資アドバイスを構成するものではありません。

- 他の言語版は、Gate Learnチームによって翻訳されています。Gate.com翻訳された記事をコピー、拡散、または盗用してはなりません。

関連記事

ブロックチェーンについて知っておくべきことすべて

ステーブルコインとは何ですか?

流動性ファーミングとは何ですか?

分散型台帳技術(DLT)とは何ですか?