XRP News Today

Latest crypto news and price forecasts for XRP: Gate News brings together the latest updates, market analysis, and in-depth insights.

Вот цена XRP, где Ripple может закончить с оценкой в $7 триллионов

Роб Каммингем из шоу KUWL недавно поделился тем, как Ripple однажды может достичь оценки в $7 триллионов долларов, исходя из своих запасов XRP.

Особенно он основывал свой анализ на будущем, где XRP торгуется по цене $250, а правительство США предоставляет полную регуляторную ясность с помощью закона Clarity Act, а

XRP-3.78%

TheCryptoBasic·58м назад

XRP сегодняшние новости: Сокращение привлечения средств через ETF в сочетании с «ястребиным» снижением ставок Федеральной резервной системы, рубеж в 2 доллара становится линией жизни

В напряжённой борьбе между макро- и микроэкономическими факторами за прошедшую неделю ценовое движение XRP застряло в состоянии равновесия. С одной стороны, Федеральная резервная система, как и ожидалось, снизила ставку на 25 базисных пунктов, что временно подняло XRP до 2.1097 долларов; с другой стороны, однодневный чистый приток спотового ETF для XRP сократился с 3804 миллионов долларов до 873 миллионов долларов, что свидетельствует о все более осторожных настроениях институциональных инвесторов. Более важно то, что опубликованная Федеральной резервной системой "точечная диаграмма" намекает на значительное замедление будущего снижения ставок, что вносит охлаждение в рискованные активы. Несмотря на то, что технический анализ показывает, что XRP всё ещё находится ниже ключевых средних линий 50-дневной и 200-дневной скользящих средних, сильный общий спрос на ETF и потенциальные регуляторные преимущества по-прежнему сохраняют надежды на среднесрочный рост до цели в 2.35–2.50 долларов.

MarketWhisper·1ч назад

Вот сценарии цены XRP, смоделированные на основе достижения Ethereum $62,000

Ведущая модель ИИ предположила, сколько будет стоить один XRP, если Ethereum достигнет смелой цели в $62 000, как предсказал Том Ли.

Более широкий рынок криптовалют очень взаимосвязан, что делает зависимость большинства криптовалют от двух крупнейших активов по рыночной капитализации.

TheCryptoBasic·1ч назад

XRP пытается удержаться на уровне 2 долларов на фоне ослабления после решения по ставке ФРС

XRP показывает признаки слабости, в настоящее время торгуется около $2.02 на фоне настроения избегания рисков на рынке криптовалют. Несмотря на недавние притоки ETF, спрос со стороны розничных инвесторов остается низким, что мешает восстановлению XRP. Ключевые технические уровни указывают на продолжение медвежьего давления, если не произойдет существенного ценового движения.

XRP-3.78%

TapChiBitcoin·1ч назад

XRP сталкивается с новой волной давления на фоне роста спроса на ETF и внутридневной волатильности

XRP формирует сужающийся диапазон между $2.02 и $2.07, поскольку покупатели сохраняют защитный контроль.

Покупки ETF на сумму $861.3М увеличивают интерес к долгосрочной структуре предложения XRP.

Повторяющиеся макроформирования удерживают трейдеров в фокусе возможного пробоя сжатия.

XRP провёл последний торговый день

XRP-3.78%

CryptoFrontNews·2ч назад

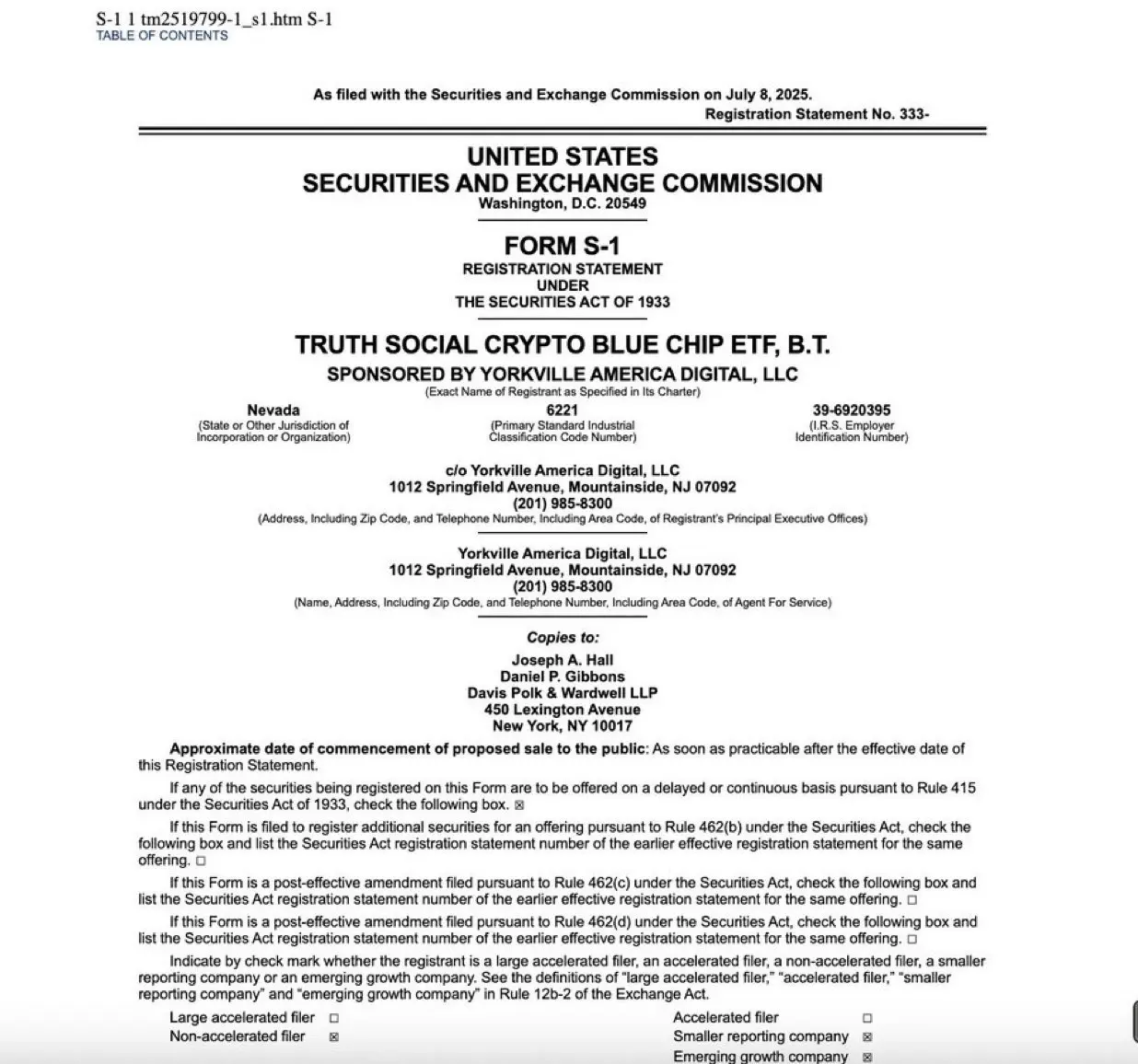

XRP включен в индексный фонд Трампа! Ripple подает заявку на получение лицензии Национального трастового банка США

XRP已被纳入与川普相关的潜在「加密蓝筹股 ETF」,并在 Hashdex 纳斯达克加密指数中占 6.4% 权重。追踪基金余额的分析师估计,目前可能有超过 5 亿枚 XRP 代币已持有在指数基金中。同时,Ripple 正在申请美国国家信托银行牌照,若获批将可直接通过美国银行系统提供加密货币托管和结算服务。

XRP-3.78%

MarketWhisper·3ч назад

XRP Сегодняшние новости: снижение ставки Федеральной резервной системы подняло цену до 2.1 долларов, замедление ETF впервые показывает нулевой приток

Федеральная резервная система объявила о снижении ставки на 25 базисных пунктов до 3.50% — 3.75%, цена XRP временно выросла до 2.1097 долларов, но диаграмма точечных ставок показывает, что в 2026 году будет лишь одно снижение ставки, что более жестко, чем прогнозы в сентябре, из-за чего XRP вернулось к росту. 12 декабря США чистый приток XRP ETF в спотовом рынке резко упал до 8.73 миллиона долларов, впервые ETF Franklin XRP показал нулевой приток.

XRP-3.78%

MarketWhisper·3ч назад

Gate Daily (12月11日): После снижения ставки Джеромом Пауэллом «две фразы» зажгли бычий настрой рынка; Япония переводит криптовалюту в рамки закона о ценных бумагах

Биткойн (BTC) однажды вырос и скорректировался, 11 декабря временно составляет около 91 220 долларов США. Федеральная резервная система объявила о снижении базовой ставки на 25 базисных пунктов, председатель Джером Пауэлл заявил, что «повышение ставки не является базовым ожиданием никого», а с 12 декабря в течение 30 дней покупка государственных облигаций на сумму 400 миллиардов долларов США зажгла бычий настрой. Япония готовится перевести регулирование криптоактивов из платежной системы страны в рамки, специально разработанные для инвестиционного и секьюритизированного рынка.

MarketWhisper·5ч назад

Технический анализ 11 декабря: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, BCH, LINK, HYPE

Bitcoin снизился с пика в $94.589 во вторник, но быки все еще пытаются удержать цену выше важного уровня в $92.000. Инвесторы сейчас следят за реакцией рынка после

TapChiBitcoin·5ч назад

Рипл (XRP) Рост откладывается, так как он все еще снижается на 4,6%. Эксперты считают, что GeeFi (GEE) — следующий $1 проект

Пока рынок криптовалют празднует последние достижения Ripple, GeeFi прокладывает свой собственный путь с предпродажей, которая набирает заметную популярность. Начальный этап финансирования проекта стал ярким проявлением доверия инвесторов, распродавшись менее чем за две недели и собрав $500 000

XRP-3.78%

CaptainAltcoin·5ч назад

XRP, DOGE, SOL прогноз на конец года: Perplexity AI раскрывает список с 4-кратным ростом

С наступающим одним из самых худших месяцев на рынке Криптовалюты, Perplexity AI сделал ошеломляющие прогнозы по XRP, DOGE, SOL на конец 2025 года: XRP вырастет с текущего уровня 2.07 долларов до 2-4 раз, целевая цена 4-8 долларов. Прогноз по SOL — движение к 400 долларов, DOGE ожидается сильное восстановление, целевая цена 0.25-0.35 долларов.

MarketWhisper·5ч назад

Аналитик заявляет, что XRP нуждается в поддержке на уровне $1.94 для прорыва к уровню $2.50

График показывает, что уровень $1.94 выступает в качестве зоны поддержки, которая должна оставаться устойчивой, чтобы XRP мог начать движение к области $2.50 в предстоящих сессиях.

XRP сформировал длительный спад, который сейчас встречается с структурой, где покупатели нуждаются в силе около 1.94, чтобы сохранить паттерн отскока и обеспечить подъем с нижней границы.

A

XRP-3.78%

CryptoNewsLand·8ч назад

Рост (XRP) на 1.2% разочаровывает, но почему эксперты видят потенциал в 100x у этой новой альткойна?

Пока криптосообщество отмечает последние достижения Ripple&39;s, другой проект тихо создает одну из самых впечатляющих историй успеха года. GeeFi проводит предпродажу с неукротимой силой, за первую фазу было продано менее чем за две недели, чтобы собрать $500,000

XRP-3.78%

CryptoDaily·11ч назад

Феномен Solana: криптовалютное соперничество, основанное на классической символике XRP

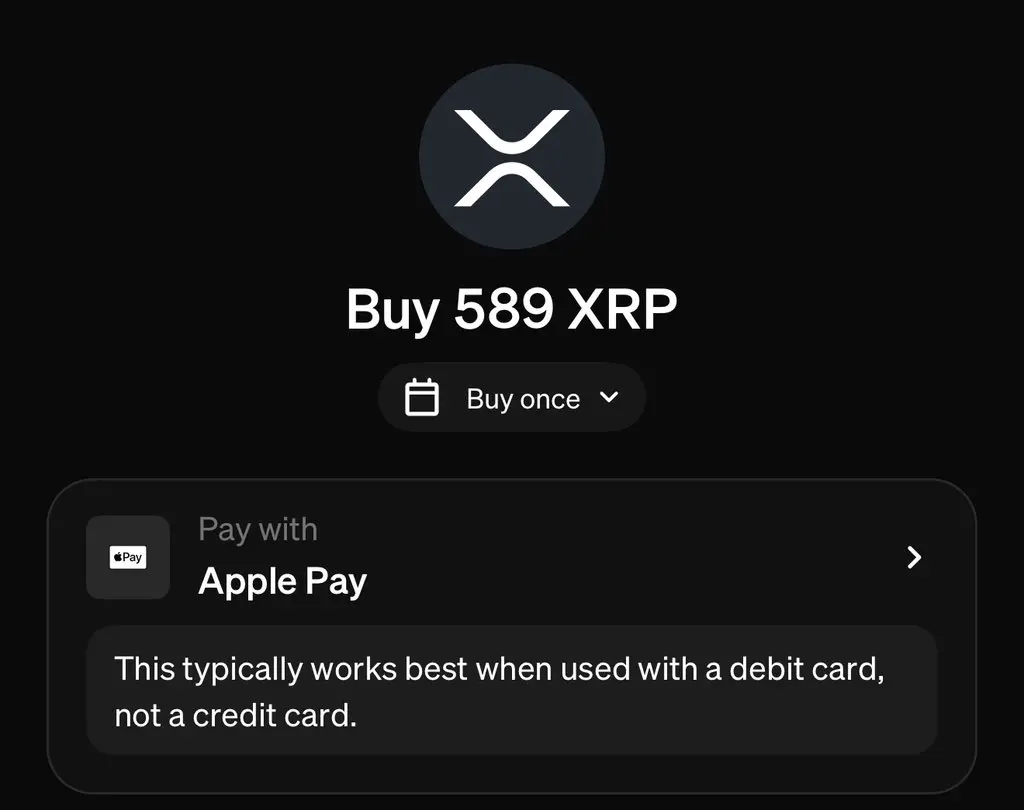

Solana спровоцировала сообщество XRP символическими постами в X, включая изменённые изображения иллюстрации "Castle" и отсылки к внутренней шутке "XRP до 589", вызвав обвинения в культурном присвоении на фоне продолжающегося соперничества.

Cryptoknowmics·11ч назад

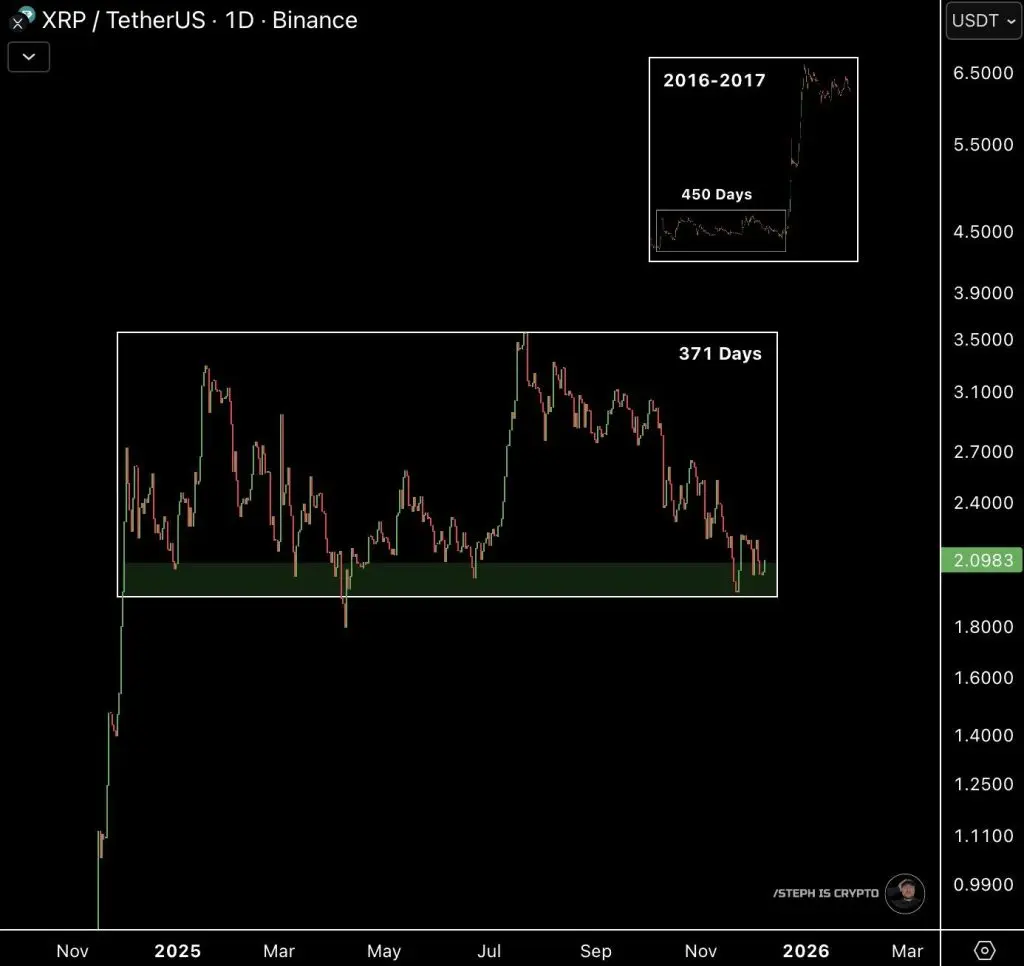

XRP держит поддержку на уровне $2.05, в то время как цена торгуется на уровне $2.08 внутри долгосрочного канала

XRP торгуется по цене $2.08, увеличившись на 0.9%, при этом оставаясь выше уровня поддержки $2.05 в рамках своего долгосрочного канала.

На графике отображается более 13 месяцев накопления выше $2.00, без месячного закрытия ниже желтой зоны поддержки.

Сопротивление находится на уровне $2.17, в то время как XRP показывает рост на 1.6% по отношению к BTC, сохраняя п

CryptoNewsLand·12ч назад

Продаст или сожжёт Ripple 17 миллиардов XRP из эскроу в связи с принятием закона о прозрачности, налагающего ограничение на удержание в 20%?

Законодатели в Сенате США продолжают работу над Законом о ясности, но один раздел законопроекта может вынудить Ripple сократить свои крупные запасы XRP в эскроу.

По мере продвижения законопроекта сообщество XRP продолжает строить предположения о том, как Ripple планирует ответить, если регуляторы потребуют от компании to

XRP-3.78%

TheCryptoBasic·15ч назад

Куда движется XRP, когда цена сталкивается с возможным сопротивлением на уровне $2.10

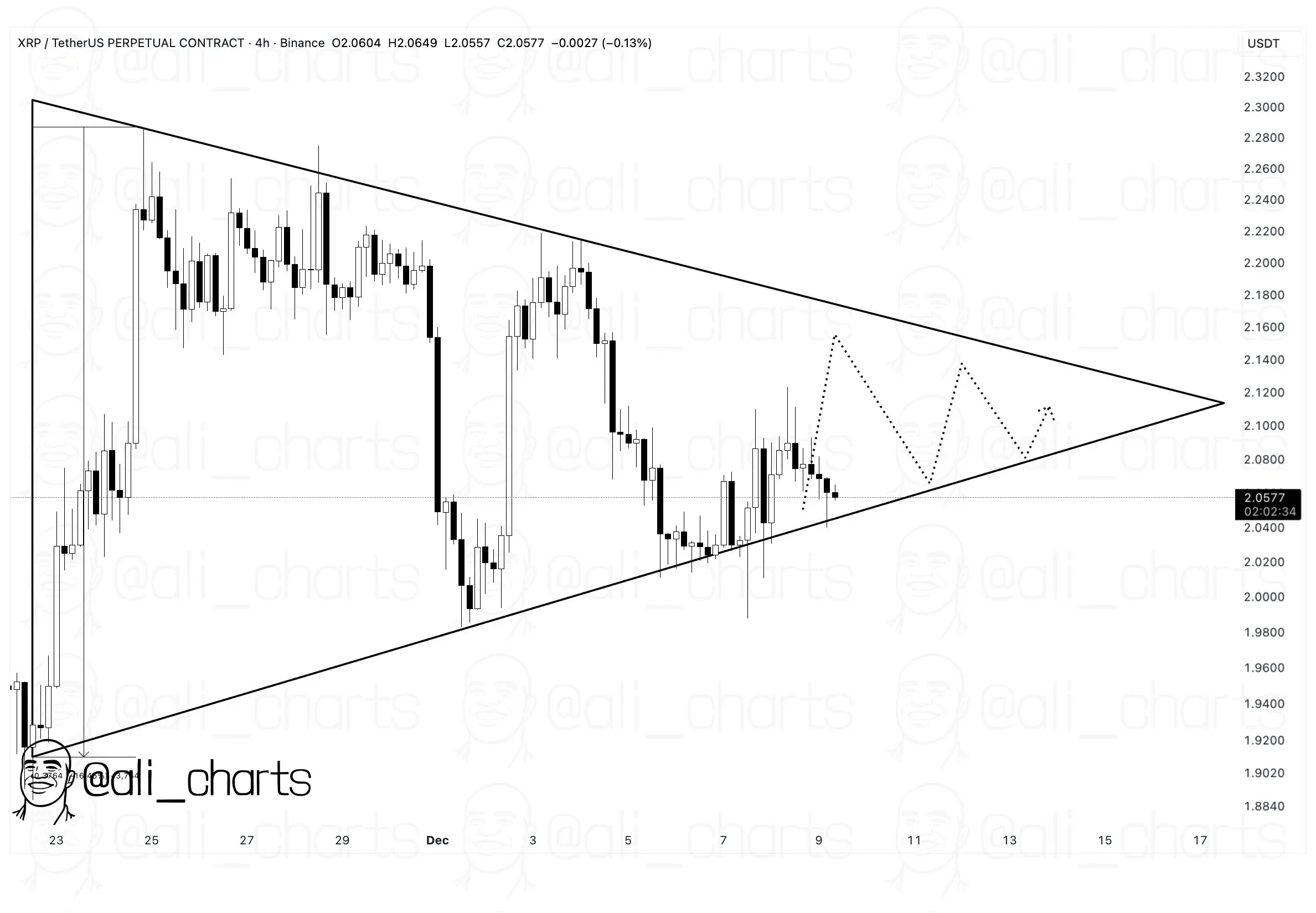

XRP сталкивается с потенциальным сопротивлением около Облака Ичимоку, так как он консолидируется внутри симметричного треугольника, готовясь к возможному пробою.

В настоящее время XRP торгуется по цене $2.07, что отражает увеличение на 0.8% за последние 24 часа. Криптовалюта демонстрировала некоторую волатильность в пределах 24-часового диапазона,

XRP-3.78%

TheCryptoBasic·15ч назад

День полного роста: ETF-Биткойн, Эфир, Солана, XRP растут с сильными притоками

Фонды, торгуемые на бирже (ETFs) по биткойну и эфиру (, продемонстрировали мощный откат во вторник, зафиксировав совокупный приток в $330 миллионов. Solana и XRP также присоединились к росту, обеспечив полностью зеленый день на американских крипто-ETF.

Фонды, торгуемые на бирже (ETFs) по биткойну и эфиру, выросли по мере полного перехода рынков в зеленую зону

Крипто ETF

Coinpedia·15ч назад

Цена XRP до $1 000? Модель прогнозирования говорит «да», но сроки шокируют

Ripple (XRP) входит в каждый рыночный цикл с амбициозными ожиданиями относительно своей цены, особенно со стороны аналитиков. Страница TheCryptoBasic в X выделила модель прогнозирования сообщества, которая утверждает, что XRP в конечном итоге может достигнуть $1,000. Само число может привлечь читателей, хотя настоящий поворот сюжета заключается в том, насколько далеко в

XRP-3.78%

CaptainAltcoin·16ч назад

Аналитики подтверждают, что альткойн XRP находится в бычьем тренде, трейдеры с нетерпением ждут следующей цели поддержки Reclama...

XRP демонстрирует бычью динамику, торгуясь примерно вокруг $2.08, при этом аналитики Optimistic о его потенциале достичь новых рекордных максимумов. Основные уровни сопротивления включают $2.22 и $2.30, что является ключевыми для будущего роста цены.

CryptoNewsLand·17ч назад

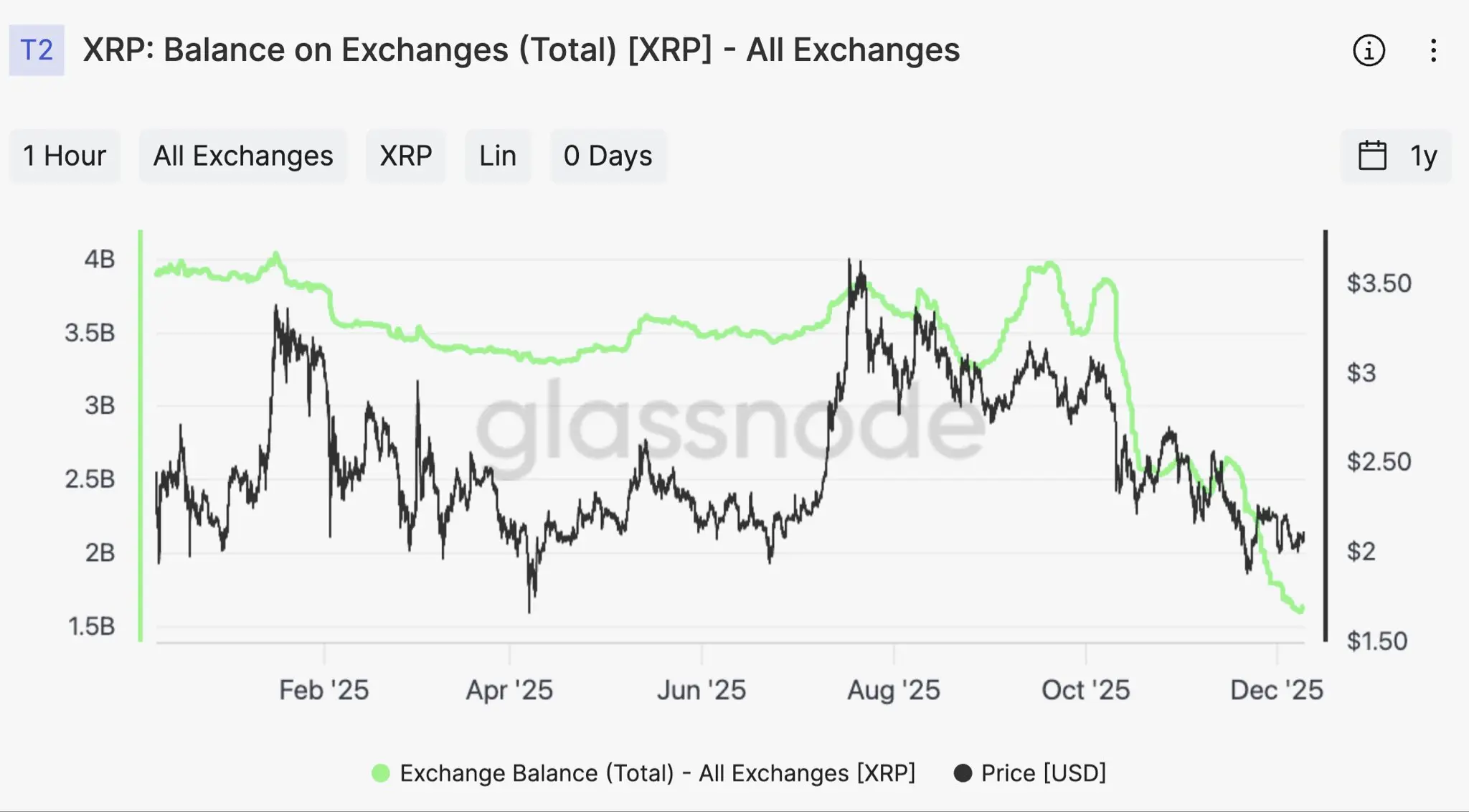

Резервы обмена XRP сократились на $1.32 млрд, поскольку цена опустилась ниже ключевых скользящих средних

Резервы XRP на биржах снизились с 7,03 миллиардов долларов до 5,70 миллиардов долларов за месяц, что составляет снижение на 18,8%, что влияет на ликвидность и стабильность цены, поскольку XRP торгуется около $2,08, ниже ключевых скользящих средних.

XRP-3.78%

Cryptonews·18ч назад

MoonPay представляет новую розыгрыш XRP

MoonPay запустила рекламную кампанию в поддержку XRP, получившую значительный отклик в социальных сетях. Платформа продемонстрировала конвертацию Bitcoin в XRP и выделила число «589», ссылку на прогноз цены сообщества, одновременно уточнив свое право поддерживать любые активы, несмотря на критику.

TheCryptoBasic·20ч назад

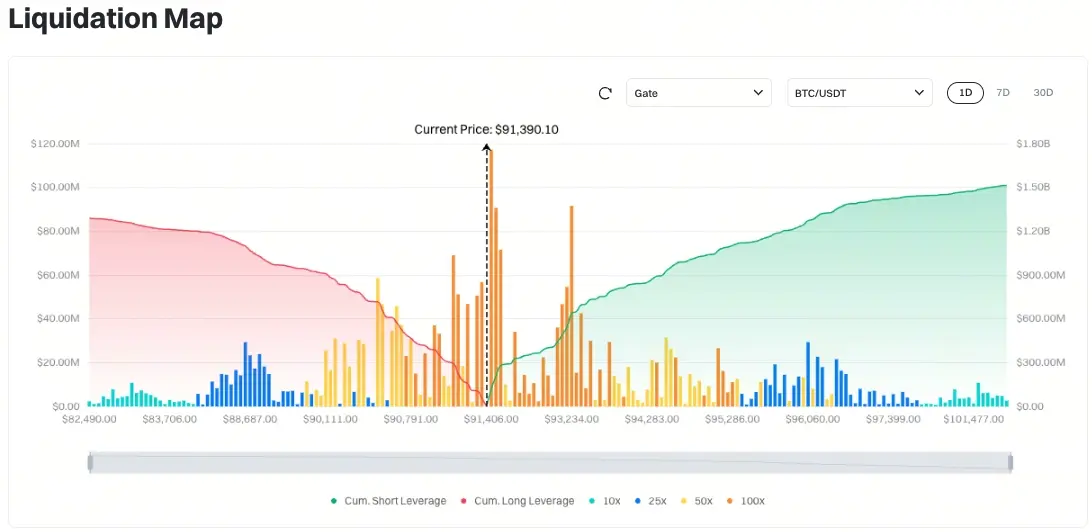

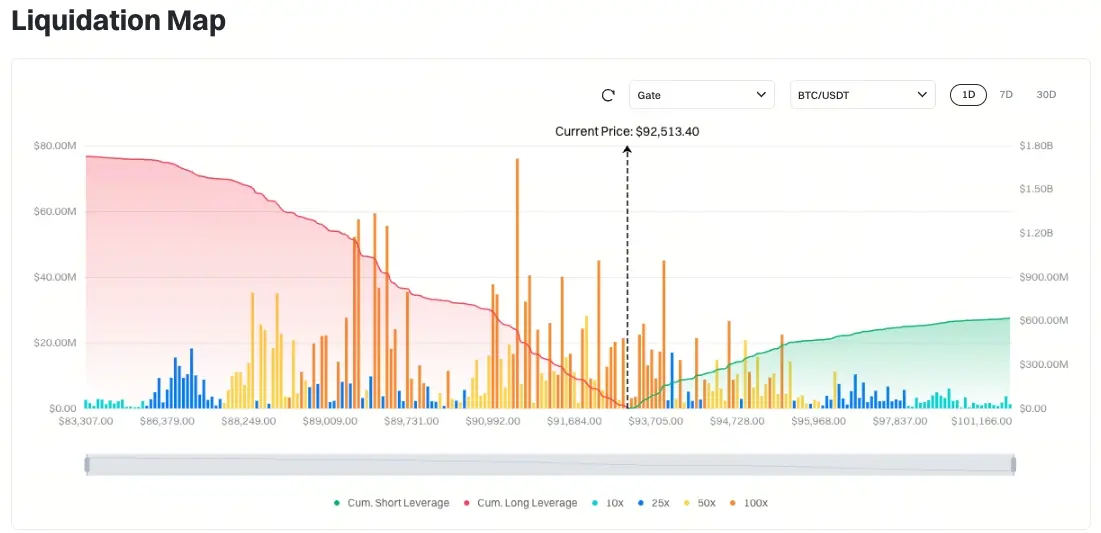

Цена XRP находится между двумя крупными кластерами ликвидности, пока трейдеры готовятся к воздействию

XRP торгуется в одном из самых узких зон давления за последние недели, при этом данные о ликвидациях показывают крупные скопления ликвидности как выше, так и ниже текущей цены. Эта ситуация создала классическую структуру сжатия; такую, где цена часто движется медленно, пока не появится карман ликвидности.

XRP-3.78%

CaptainAltcoin·20ч назад

Аналитик говорит: «Угадайте, что происходит, когда на биржах заканчивается XRP, а балансы XRP падают на 1 миллиард за 3 недели

XRP заметил резкое сокращение доступности на бирже: недавно было выведено 1 миллиард токенов, что вызвало нарратив шока предложения. Аналитики прогнозируют, что это приведёт к росту спроса и, возможно, повысит цены по мере роста институционального интереса.

TheCryptoBasic·21ч назад

MoonPay показывает покупку 589 XRP за Apple Pay — но почему именно 589 XRP?

Недавняя покупка MoonPay 589 XRP токенов вызвала значительную реакцию в криптосообществе, сосредоточившись на символическом «волшебном числе», которое указывает на амбициозные прогнозы цены и возможные партнёрства. Мероприятие совпадает с предыдущим вниманием к этому числу в экосистеме XRP, поскольку энтузиасты размышляют о его значимости для будущего признания.

TheCryptoBasic·22ч назад

Вот почему цели XRP в $7, $12 и $15 Don не выглядят безумно: аналитик

Хотя XRP испытывает медвежье давление, аналитик EGRAG Crypto недавно предположил, что более высокие долгосрочные цели выглядят разумно при рассмотрении фрактальной структуры XRP.

Особенно стоит отметить, что XRP продолжает испытывать трудности наряду с остальным рынком криптовалют, сохраняя нисходящий тренд в течение нескольких месяцев. С

XRP-3.78%

TheCryptoBasic·12-10 05:48

XRP News Today: Могут ли чистые поступления ETF на 16-м месяце компенсировать риски волатильности ФРС? Ожидается, что в краткосрочной перспективе он вырастет до $2,35

Несмотря на рыночную неопределённость, вызванную решениями Федеральной резервной системы по процентным ставкам, спотовый ETF XRP продемонстрировал выдающуюся способность привлекать золото, обеспечивая чистые притоки в течение 16 подряд торговых дней, общий размер приближается к отметке в 1 миллиард долларов, а его недавние показатели даже превзошли показатели спотовых ETF на основе биткоина. В то же время развитие законодательства, дружественного к криптовалютам, и расширение институциональной базы в совокупности обеспечивают среднесрочную поддержку цены XRP. Аналитики отмечают, что ожидается, что XRP в краткосрочной перспективе протестирует $2.35, если удержит ключевой уровень психологической поддержки на уровне $2.35, а среднесрочные цели будут ориентироваться на диапазон $2.5–$3.

MarketWhisper·12-10 03:20

XRP News Today: 16 дней с $10 миллиардами, ETF хеджируют ястребиную политику ФРС

Рынок спотовых ETF XRP демонстрирует притоки уже 16 торговых дней подряд, с суммарным чистым притоком в 9,35 миллиарда долларов, приближаясь к отметке в 10 миллиардов. Для сравнения, спотовые BTC ETF за тот же период зафиксировали чистый отток в размере 60,4 миллиона долларов, а с 14 ноября — 17,9 миллиарда долларов. Технически XRP имеет краткосрочные цели в $2.35 и среднесрочные цели $2.5–$3.

MarketWhisper·12-10 03:00

Ликвидность XRP нарастает около $2.30 на фоне реакции рынка на рост притока средств

Кластеры ликвидности XRP вблизи $2,30 указывают на основную зону ликвидации, которая может определить дальнейшее движение цены.

Притоки на биржи показывают сильное давление продаж, поскольку цена резко реагирует на рост активности предложения.

Циклы ликвидаций демонстрируют рынок с высоким уровнем кредитного плеча и повторяющимися переходами между бычьими и

XRP-3.78%

CryptoFrontNews·12-10 02:17

Китайский Kimi AI прогнозирует: XRP в следующем году вырастет до 8 долларов, DOGE и SHIB возглавят восстановление альткоинов

По прогнозу новой китайской искусственной интеллекта Kimi K2, к 2026 году XRP может достичь $5–8, а DOGE на фоне запуска Grayscale ETF и поддержки Маска установит исторический максимум в $0,70–1,30. Обновление конфиденциальности Shibarium будет готово к 2026 году, что может привести к шоку предложения SHIB.

MarketWhisper·12-10 01:30

Gate Дайджест (10 декабря): Конгресс США рассмотрит на следующей неделе "Закон о ответственных финансовых инновациях"; председатель SEC намекает на ускорение регулирования криптовалют в 2026 году

После стремительного роста биткоин (BTC) немного откатился и по состоянию на 10 декабря временно торгуется около 92 190 долларов. Ожидается, что на этой неделе будет опубликована версия закона о структуре крипторынка, подготовленная Сенатом США («Закон о ответственных финансовых инновациях»), а на следующей неделе пройдут слушания и голосование. Глава SEC США намекнул, что в начале 2026 года будет быстро продвигаться ключевая повестка по регулированию криптовалют, заявив: «Самое интересное впереди».

MarketWhisper·12-10 01:22

В США ажиотаж, а в Японии запрет! Торговля контрактами на разницу цен (ETF) на криптовалюту запрещена

Японское агентство финансовых услуг (FSA) опубликовало обновленный регуляторный FAQ, подтвердив, что предоставление контрактов на разницу (CFD), связанных с зарубежными криптовалютными ETF, "не допускается". Этот запрет вступает в силу немедленно, и такие компании, как IG Securities, прекращают предоставление продуктов CFD, отслеживающих американские биткоин-ETF. Япония заявляет, что эти продукты в соответствии с «Законом о финансовых инструментах и биржах» считаются высокорискованными криптовалютными деривативами, а поскольку в Японии спотовые криптовалютные ETF не одобрены, система защиты инвесторов остается недостаточно развитой.

MarketWhisper·12-10 00:54

XRP поглотил 716 миллионов долларов! Институциональные инвесторы тихо скупают, приток в ETF уже 16 дней подряд

На прошлой неделе на рынке криптовалют произошёл редкий феномен: инвестиционные продукты, связанные с XRP, привлекли больше средств, чем Ethereum и Solana вместе взятые. По данным CoinShares, за неделю в биржевые продукты (ETP) на базе XRP поступило 245 миллионов долларов, а согласно данным SoSo Value, ETF на XRP фиксирует положительный приток средств уже 16 дней подряд, а общий размер активов вырос до 935 миллионов долларов.

MarketWhisper·12-10 00:46

Национальным банкам США разрешили операции с криптовалютами! Хлынет ли 30 триллионов средств?

Управление контролёра денежного обращения США (OCC) выпустило разъяснительное письмо, подтверждающее, что национальные банки могут выступать в качестве безрисковых субъектов-посредников при совершении сделок с криптовалютой, не включая активы в свой баланс. В этом руководстве подтверждается, что содействие клиентам в совершении сделок с криптовалютой относится к сфере «банковской деятельности», ссылаясь на статью 24 раздела 12 Свода законов США. Банки могут выступать в роли доверенных лиц при совершении сделок с клиентами, одновременно хеджируясь с другим клиентом, что по своей структуре похоже на безрисковую деятельность по поручениям на традиционных рынках.

ETH-3.39%

MarketWhisper·12-10 00:40

Выход кита на $1,70 млн в XRP тестирует поддержку на уровне $2,02 — но сохранится ли импульс?

Кит закрыл лонг по XRP на $1,70 млн при цене $2,02, что совпало с ключевым уровнем поддержки на фоне снижения на 1,8%. Рынок сосредоточился на этой поддержке, пока XRP колебался между $2,02 и $2,09, что подчеркнуло реакцию трейдеров на структуру торговли.

XRP-3.78%

CryptoNewsLand·12-09 19:34

Аналитик XRP прокладывает путь к $2,73 после удержания поддержки на уровне $2,07

XRP демонстрирует четкий план для движения Волны 3 к $2.73 после пробоя двух сильных зон на 2.18 и 2.30.

Текущая структура графика показывает поддержку на уровне $2.07, при этом касание этой зоны рассматривается как нормальное краткосрочное движение.

Трейдеры сейчас ожидают импульсную волну, которая сформируется выше $2.18 после пробоя

XRP-3.78%

CryptoNewsLand·12-09 18:44

XRP удерживается около $2,02, поскольку 5-дневный график указывает на повторяющуюся свечную структуру

XRP торговался в узком диапазоне между поддержкой $2,02 и сопротивлением $2,09, что отражает сжатый диапазон на 5-дневном графике.

Две предыдущие свечные формации на том же уровне поддержки показали явный спрос, предоставив структуру для оценки текущей модели.

Последняя свеча формируется рядом с историческим уровнем реакции.

CryptoNewsLand·12-09 17:34

Модель прогнозирования предсказывает возможный срок достижения XRP отметки $1 000

Недавно один из аналитиков сообщества XRP представил то, что он назвал моделью прогнозирования того, как XRP может вырасти до $1 000, но есть одна загвоздка.

Сообщество XRP всегда было источником амбициозных ценовых прогнозов, и эти дерзкие мнения доминировали на сцене в последние недели на фоне бычьих настроений.

XRP-3.78%

TheCryptoBasic·12-09 15:09

Эксперт объяснил, почему цена XRP не выросла в 2025 году

Ожидания по цене XRP в 2025 году были высокими. Хотя цена XRP достигала своего исторического максимума около $3.6, в настоящее время она торгуется более чем на 40% ниже этого уровня. Цена XRP не оправдала прогнозов, которых ожидали многие.

Страница TheCryptoBasic в X поделилась инсайтами от рыночного аналитика Зака.

XRP-3.78%

CaptainAltcoin·12-09 14:34

Эксперт объясняет, почему эскроу XRP не включён в оценку Ripple $40B

Недавний раунд финансирования Ripple на $500 миллионов долларов, увеличивший её оценку до $40 миллиардов, вызвал спекуляции относительно её эскроу-хранений XRP. Эксперты отмечают, что Ripple управляет эскроу без полного права собственности, из-за чего оценка компании связана с ценой XRP, при этом часть активов не отображается в её балансе.

XRP-3.78%

TheCryptoBasic·12-09 13:23

XRP $2.00 медленно: Digitap ($TAP) — лучшая криптовалюта для покупки с помощью живой Visa-карты без KYC

После новостей о листинге XRP ETF компанией Vanguard этот альткойн резко вырос, восстановив уровень $2.00. Однако с тех пор XRP не удалось продемонстрировать дальнейший рост. В результате инвесторы задаются вопросом, какие альткойны лучше всего купить для потенциально значительной прибыли в декабре и

CaptainAltcoin·12-09 10:24

Альткойн XRP движется согласно ожиданиям аналитиков, прокладывая бычий путь и готовясь к мощному росту

Аналитики прогнозируют бычий тренд для альткоина XRP после благоприятного исхода дела с SEC. В настоящее время XRP торгуется по цене $2.05 и демонстрирует потенциал значительного роста, с целями на уровнях $2.41 и $2.65 в зависимости от поддержки рынка.

CryptoNewsLand·12-09 10:14

XRP вырос на 650% «без каких-либо законов», в то время как эксперт утверждает, что XRP может взлететь до принятия закона о ясности

Эксперт рынка Зак Ректор утверждает, что XRP не нуждается в законе Clarity Act для роста цены, указывая на прошлые скачки без поддержки со стороны регулирования. Хотя Clarity Act может стать катализатором, его принятие не является необходимым для роста XRP.

XRP-3.78%

TheCryptoBasic·12-09 08:49

Готовы ли цены на биткойн (BTC) и XRP снова к росту? Графики выглядят многообещающе

Быстрый взгляд на текущие цены BTC и XRP напоминает наблюдение за двумя спортсменами, которые замерли на одной стартовой линии. Обе диаграммы находятся на уровнях поддержки, которые ранее вызывали сильные отскоки. Может ли это быть лучшим моментом для покупки Bitcoin и XRP перед новым движением?

Ответ зависит от того, как

CaptainAltcoin·12-09 08:35

Загрузить больше

Актуальные теги

Популярные темы

БольшеКрипто-календарь

БольшеАпгрейд Хаябусы

VeChain объявила о планах по обновлению Hayabusa, запланированному на декабрь. Это обновление направлено на значительное улучшение как производительности протокола, так и токеномики, что, по словам команды, является самой полезной версией VeChain на сегодняшний день.

2025-12-27

Закаты Litewallet

Фонд Litecoin объявил, что приложение Litewallet официально прекратит свое существование 31 декабря. Приложение больше не поддерживается активно, будут исправлены только критические ошибки до этой даты. Чат поддержки также будет прекращен после этого срока. Пользователей призывают перейти на Кошелек Nexus, с инструментами миграции и пошаговым руководством, предоставленным в Litewallet.

2025-12-30

Завершение миграции OM Токенов

MANTRA Chain напомнила пользователям о необходимости мигрировать свои токены OM на основную сеть MANTRA Chain до 15 января. Миграция обеспечивает продолжение участия в экосистеме, так как $OM переходит на свою родную цепь.

2026-01-14

Изменение цены CSM

Hedera объявила, что начиная с января 2026 года, фиксированная плата в USD за сервис ConsensusSubmitMessage увеличится с $0.0001 до $0.0008.

2026-01-27

Задержка разблокировки вестинга

Router Protocol объявил о задержке на 6 месяцев в передаче токенов ROUTE. Команда отмечает стратегическое соответствие с архитектурой Open Graph (OGA) проекта и цель поддержания долгосрочного импульса как ключевые причины для отложенного разблокирования. В этот период новых разблокировок не будет.

2026-01-28