# Stablecoins

1.06M

User_any

#Stablecoins

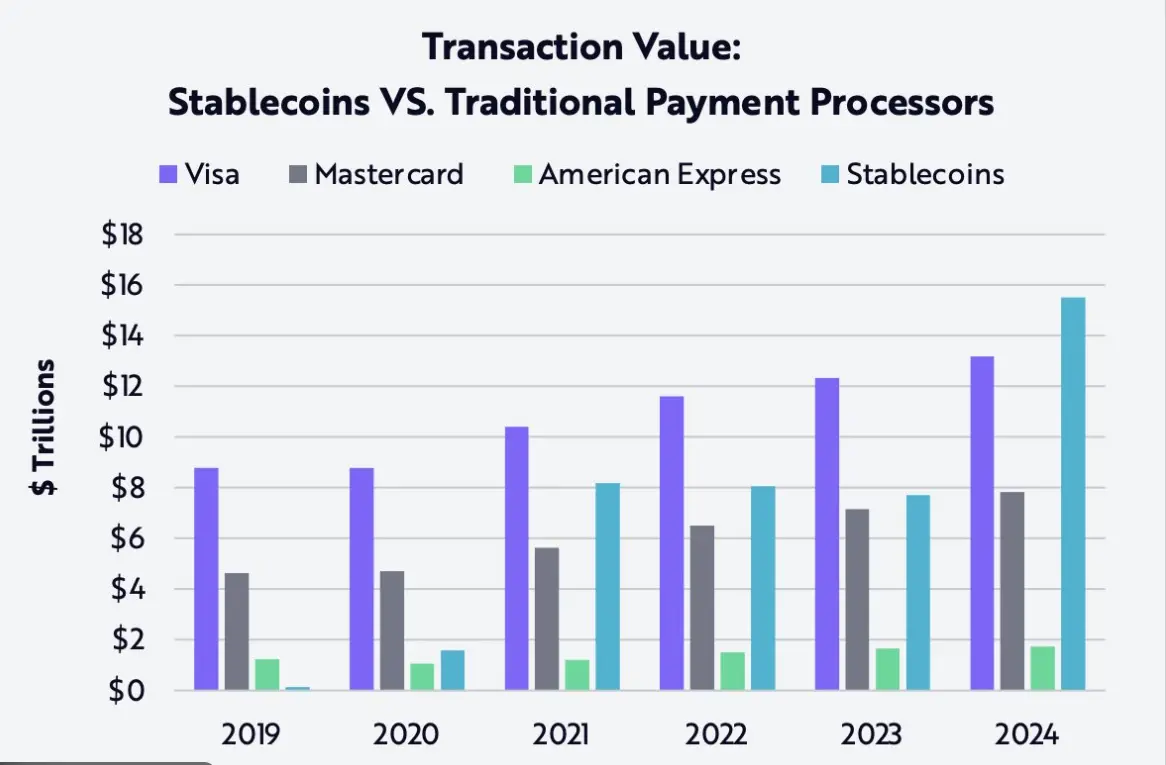

✨En 2025, la capitalización de mercado de las stablecoins creció un 49%, pasando de $205 mil millones a $310-318 mil millones. USDT destacó con aproximadamente $187 mil millones, un aumento del 36%(, y USDC con aproximadamente )mil millones, un aumento del 73%$75 . El volumen total de transacciones alcanzó los $33-35 billones; USDC lideró en adopción institucional. Se proyecta una capitalización de mercado de (billón para 2026, con un crecimiento anual compuesto del 40%). Gracias a la claridad regulatoria, las stablecoins se están convirtiendo en indispensables para las finanzas

✨En 2025, la capitalización de mercado de las stablecoins creció un 49%, pasando de $205 mil millones a $310-318 mil millones. USDT destacó con aproximadamente $187 mil millones, un aumento del 36%(, y USDC con aproximadamente )mil millones, un aumento del 73%$75 . El volumen total de transacciones alcanzó los $33-35 billones; USDC lideró en adopción institucional. Se proyecta una capitalización de mercado de (billón para 2026, con un crecimiento anual compuesto del 40%). Gracias a la claridad regulatoria, las stablecoins se están convirtiendo en indispensables para las finanzas

USDC-0,02%

- Recompensa

- 28

- 75

- Republicar

- Compartir

CryptoChampion :

:

GOGOGO 2026 👊Ver más

Duplica las recompensas, reduce el estrés. 💎

¿Por qué elegir entre un 4.4% APR "seguro" y el potencial de "lanzamiento a la luna" de nuevos proyectos? Con GUSD en Gate, obtienes ambos.

✅ 4.4% APR Fijo (La Fundación)

✅ Acceso a Launchpool (La Ventaja)

✅ Volatilidad Mínima (La Tranquilidad)

Convierte tu $GUSD en un motor de doble ganancia hoy. ⚙️

#Crypto #Stablecoins #GUSD #Earn #Gateio $GT

Ver originales¿Por qué elegir entre un 4.4% APR "seguro" y el potencial de "lanzamiento a la luna" de nuevos proyectos? Con GUSD en Gate, obtienes ambos.

✅ 4.4% APR Fijo (La Fundación)

✅ Acceso a Launchpool (La Ventaja)

✅ Volatilidad Mínima (La Tranquilidad)

Convierte tu $GUSD en un motor de doble ganancia hoy. ⚙️

#Crypto #Stablecoins #GUSD #Earn #Gateio $GT

- Recompensa

- 1

- Comentar

- Republicar

- Compartir

#TheWorldEconomicForum 🌍

Davos 2026: Dónde los Líderes Globales Moldearon el Futuro 🌐

La Cumbre del WEF 2026 abordó los grandes temas:

🌱 Cambio climático

🌍 Tensiones geopolíticas

💻 Transformación digital

Conclusión clave para las criptomonedas:

🚀 Las stablecoins reciben un impulso regulatorio

🏦 La tokenización de activos para democratizar los mercados

🇺🇸 Trump refuerza a EE. UU. como la “Capital de las Criptomonedas del Mundo”

¿Resultado?

Mayor adopción institucional

Un ecosistema cripto más seguro y accesible

Potencial de crecimiento en la capitalización de mercado en todos los ámbit

Davos 2026: Dónde los Líderes Globales Moldearon el Futuro 🌐

La Cumbre del WEF 2026 abordó los grandes temas:

🌱 Cambio climático

🌍 Tensiones geopolíticas

💻 Transformación digital

Conclusión clave para las criptomonedas:

🚀 Las stablecoins reciben un impulso regulatorio

🏦 La tokenización de activos para democratizar los mercados

🇺🇸 Trump refuerza a EE. UU. como la “Capital de las Criptomonedas del Mundo”

¿Resultado?

Mayor adopción institucional

Un ecosistema cripto más seguro y accesible

Potencial de crecimiento en la capitalización de mercado en todos los ámbit

TRUMP1,39%

- Recompensa

- 2

- Comentar

- Republicar

- Compartir

Legisladores en Estados Unidos están tratando de modificar las leyes financieras para fomentar el uso de activos digitales en los pagos.

La nueva propuesta tiene como objetivo eliminar los impuestos sobre las transacciones rutinarias pequeñas utilizando monedas estables (#Stablecoins ) con un máximo de 200 dólares, siempre que estén vinculadas al dólar, y también incluye un tratamiento flexible para los ingresos de minería (#Mining ).

#FOMCWatch #USChinaDeal

$SOL

$BTC

$ETH

Ver originalesLa nueva propuesta tiene como objetivo eliminar los impuestos sobre las transacciones rutinarias pequeñas utilizando monedas estables (#Stablecoins ) con un máximo de 200 dólares, siempre que estén vinculadas al dólar, y también incluye un tratamiento flexible para los ingresos de minería (#Mining ).

#FOMCWatch #USChinaDeal

$SOL

$BTC

$ETH

- Recompensa

- 1

- Comentar

- Republicar

- Compartir

🔮 #2026CryptoOutlook | ¿Qué sigue para el mercado de criptomonedas?

A medida que nos acercamos a 2026, el mercado de criptomonedas entra en una nueva fase — menos hype, más adopción real. El enfoque se está desplazando de la especulación a corto plazo hacia el crecimiento a largo plazo en infraestructura e instituciones.

📌 Temas clave a vigilar en 2026:

1️⃣ Bitcoin sigue siendo el núcleo

Con ETFs, flujos institucionales y dinámicas post-halving, se espera que Bitcoin siga siendo el ancla del mercado. La volatilidad continuará, pero el papel del BTC como activo macro sigue fortaleciéndose.

2️

Ver originalesA medida que nos acercamos a 2026, el mercado de criptomonedas entra en una nueva fase — menos hype, más adopción real. El enfoque se está desplazando de la especulación a corto plazo hacia el crecimiento a largo plazo en infraestructura e instituciones.

📌 Temas clave a vigilar en 2026:

1️⃣ Bitcoin sigue siendo el núcleo

Con ETFs, flujos institucionales y dinámicas post-halving, se espera que Bitcoin siga siendo el ancla del mercado. La volatilidad continuará, pero el papel del BTC como activo macro sigue fortaleciéndose.

2️

- Recompensa

- 7

- 6

- Republicar

- Compartir

repanzal :

:

GOGOGO 2026 👊Ver más

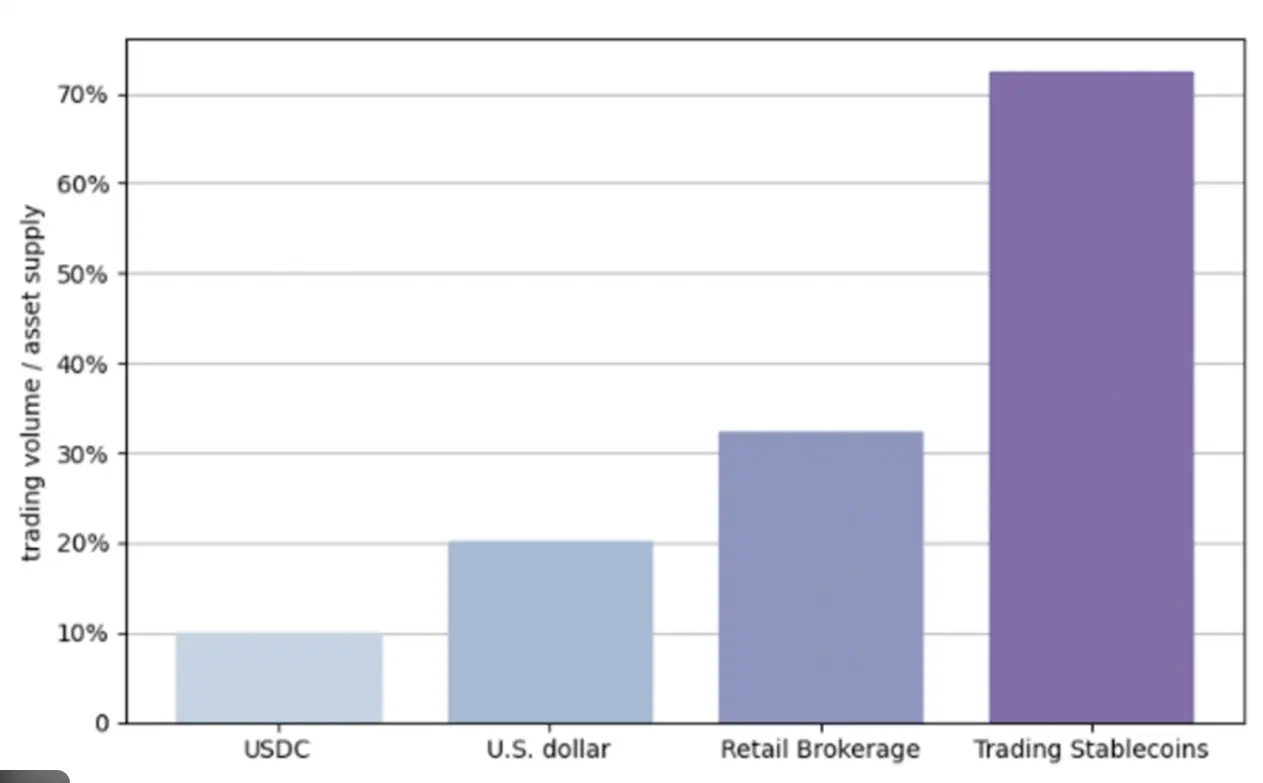

🔥 $35 TRILLONES MOVIDOS… PERO SOLO EL 1% UTILIZADO PARA PAGOS REALES?! 🔥

Según McKinsey & Artemis Analytics, las stablecoins transfirieron más de $35 trillones en la cadena el año pasado — sin embargo, solo ~$380B se utilizó para pagos en el mundo real como remesas, nóminas o proveedores.

Eso es solo el 0,02% de los pagos globales.

¿Entonces, qué significa esto realmente? 👇

🐂 CASO AL ALZA: “Esto es solo el principio”

Los alcistas argumentan que estos datos son optimistas, no pesimistas:

Las stablecoins ya dominan en liquidación y liquidez en la cadena

Se están convirtiendo en la columna ve

Ver originalesSegún McKinsey & Artemis Analytics, las stablecoins transfirieron más de $35 trillones en la cadena el año pasado — sin embargo, solo ~$380B se utilizó para pagos en el mundo real como remesas, nóminas o proveedores.

Eso es solo el 0,02% de los pagos globales.

¿Entonces, qué significa esto realmente? 👇

🐂 CASO AL ALZA: “Esto es solo el principio”

Los alcistas argumentan que estos datos son optimistas, no pesimistas:

Las stablecoins ya dominan en liquidación y liquidez en la cadena

Se están convirtiendo en la columna ve

- Recompensa

- 22

- 16

- Republicar

- Compartir

Flower89 :

:

Comprar para ganar 💎Ver más

#CLARITYFacturadoRetrasado

Lo que significa el retraso de la Ley CLARITY para las criptomonedas, DeFi y stablecoins

El retraso de la Ley de Claridad del Mercado de Activos Digitales (Ley CLARITY) ha vuelto a colocar a la industria cripto de EE. UU. en una fase de espera — destacando lo crucial que se ha vuelto la certeza regulatoria para los activos digitales, los protocolos DeFi y las stablecoins.

La Ley CLARITY fue introducida para poner fin a años de confusión definiendo cómo se clasifican las criptomonedas, qué reguladores las supervisan y cómo deben operar las stablecoins y plataformas. S

Lo que significa el retraso de la Ley CLARITY para las criptomonedas, DeFi y stablecoins

El retraso de la Ley de Claridad del Mercado de Activos Digitales (Ley CLARITY) ha vuelto a colocar a la industria cripto de EE. UU. en una fase de espera — destacando lo crucial que se ha vuelto la certeza regulatoria para los activos digitales, los protocolos DeFi y las stablecoins.

La Ley CLARITY fue introducida para poner fin a años de confusión definiendo cómo se clasifican las criptomonedas, qué reguladores las supervisan y cómo deben operar las stablecoins y plataformas. S

DEFI-1,61%

- Recompensa

- 4

- 4

- Republicar

- Compartir

Yanlin :

:

GOGOGO 2026 👊Ver más

ÚLTIMA HORA: World Liberty Financial, afiliada a Trump, presenta solicitud para una licencia bancaria federal en EE. UU.

La narrativa ha cambiado de la noche a la mañana de "adopción" a "integración". World Liberty Financial ha solicitado oficialmente a la Oficina del Contralor de la Moneda (OCC) una licencia para un banco fiduciario nacional. Esto no es solo el lanzamiento de otro proyecto cripto; es un intento directo de llevar la emisión de stablecoins bajo el mismo paraguas regulatorio federal que la banca tradicional.

Este movimiento cambia fundamentalmente el perfil de riesgo de los acti

Ver originalesLa narrativa ha cambiado de la noche a la mañana de "adopción" a "integración". World Liberty Financial ha solicitado oficialmente a la Oficina del Contralor de la Moneda (OCC) una licencia para un banco fiduciario nacional. Esto no es solo el lanzamiento de otro proyecto cripto; es un intento directo de llevar la emisión de stablecoins bajo el mismo paraguas regulatorio federal que la banca tradicional.

Este movimiento cambia fundamentalmente el perfil de riesgo de los acti

- Recompensa

- 3

- 6

- Republicar

- Compartir

Crypto_Buzz_with_Alex :

:

¡Feliz Año Nuevo! 🤑Ver más

🔮 El Futuro del Cripto: Las Grandes Tecnologías Entran en la Cadena

Estamos entrando en un nuevo capítulo en Cripto — y esta vez, no solo Ethereum o Solana están en el centro de atención.

La próxima ola está siendo liderada por gigantes corporativos. Empresas como Circle, Tether, Robinhood y Stripe no solo están participando en cripto, sino que están construyendo las infraestructuras para ello. Y va a cambiarlo todo. 👇

🚀 El Nuevo Orden de Blockchain🔹 Circle → ARK Blockchain• Tarifas en USDC• 3,000 TPS• Costos fijos y amigables para negocios

🔹 Tether → Plasma & Stable• Plasma para transfer

Ver originalesEstamos entrando en un nuevo capítulo en Cripto — y esta vez, no solo Ethereum o Solana están en el centro de atención.

La próxima ola está siendo liderada por gigantes corporativos. Empresas como Circle, Tether, Robinhood y Stripe no solo están participando en cripto, sino que están construyendo las infraestructuras para ello. Y va a cambiarlo todo. 👇

🚀 El Nuevo Orden de Blockchain🔹 Circle → ARK Blockchain• Tarifas en USDC• 3,000 TPS• Costos fijos y amigables para negocios

🔹 Tether → Plasma & Stable• Plasma para transfer

- Recompensa

- 1

- 2

- Republicar

- Compartir

LittleQueen :

:

😊😊😊Ver más

#StablecoinPaymentChainPlasmaProgress

El desarrollo de cadenas de pago basadas en Plasma para stablecoins avanza de manera constante, con el objetivo de ofrecer transacciones más rápidas, baratas y escalables para pagos cotidianos.

Esta evolución destaca el creciente enfoque en la utilidad del cripto en el mundo real más allá de la especulación.

🔗 Qué Está Avanzando

Los marcos de Plasma mejoran la escalabilidad al mover las transacciones fuera de la cadena principal, manteniendo la seguridad de la cadena principal

Las transferencias de stablecoins se vuelven casi instantáneas con tarifas más

Ver originalesEl desarrollo de cadenas de pago basadas en Plasma para stablecoins avanza de manera constante, con el objetivo de ofrecer transacciones más rápidas, baratas y escalables para pagos cotidianos.

Esta evolución destaca el creciente enfoque en la utilidad del cripto en el mundo real más allá de la especulación.

🔗 Qué Está Avanzando

Los marcos de Plasma mejoran la escalabilidad al mover las transacciones fuera de la cadena principal, manteniendo la seguridad de la cadena principal

Las transferencias de stablecoins se vuelven casi instantáneas con tarifas más

- Recompensa

- 8

- 9

- Republicar

- Compartir

QueenOfTheDay :

:

GOGOGO 2026 👊Ver más

Cargar más

Únete a 40M usuarios en nuestra comunidad en crecimiento.

⚡️ Únete a 40M usuarios en el debate sobre la fiebre cripto

💬 Interactúa con tus creadores favoritos

👍 Explora lo que te interesa

Temas de actualidad

20.12K Popularidad

98.3K Popularidad

69.99K Popularidad

20.16K Popularidad

38.99K Popularidad

33.02K Popularidad

24.09K Popularidad

97.59K Popularidad

63.9K Popularidad

33.22K Popularidad

23.49K Popularidad

17.13K Popularidad

145.98K Popularidad

33.33K Popularidad

172.92K Popularidad

Noticias

Ver másLos tres principales índices de acciones de EE. UU. cierran en alza, Apple sube cerca del 3%

1 h

El índice del dólar estadounidense cae un 0.57%, cerrando en 97.035

1 h

Datos: 743.09 monedas de BTC transferidas desde una dirección anónima, con un valor de aproximadamente 644 millones de dólares

2 h

Datos: 35.2456 millones de SKY transferidos desde una dirección anónima a Galaxy Digital, por un valor de aproximadamente 2.3165 millones de dólares

3 h

Datos: 113.94 BTC transferidos desde Cumberland DRW, y después de una transferencia intermedia, enviados a otra dirección anónima

4 h

Anclado