2025 ALCX Fiyat Tahmini: Alchemix Token’ın Geleceğine İlişkin Görünüm ve Piyasa Analizi

Giriş: ALCX'in Piyasa Konumu ve Yatırım Değeri

Alchemix (ALCX), sentetik varlık tokenları alanında öncü DeFi protokollerinden biri olarak, 2021'deki lansmanından bu yana önemli gelişmeler kaydetti. 2025 itibarıyla Alchemix'in piyasa değeri 21.714.623 ABD dolarına ulaştı; yaklaşık 2.481.104 dolaşımdaki tokenı bulunuyor ve fiyatı 8,752 ABD doları civarında seyrediyor. "Gelecek gelir tokenleştiricisi" olarak da bilinen bu varlık, merkeziyetsiz finans ve getiri optimizasyonu alanında giderek daha kilit bir rol üstleniyor.

Bu makalede, Alchemix'in 2025-2030 dönemindeki fiyat hareketleri; tarihsel eğilimler, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik faktörlerle birlikte kapsamlı şekilde ele alınacak. Yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. ALCX Fiyat Geçmişi ve Güncel Piyasa Durumu

ALCX Tarihsel Fiyat Gelişimi

- 2021: ALCX, 21 Mart'ta 2.066,2 ABD doları ile tüm zamanların en yüksek seviyesine ulaştı; proje için önemli bir dönüm noktası oldu.

- 2023: Kripto para piyasası genel olarak değer kaybederken, ALCX fiyatı da düşüş gösterdi.

- 2025: ALCX, 23 Haziran'da 6,57 ABD doları ile tüm zamanların en düşük seviyesine gerileyerek zorlu bir dönem yaşadı.

ALCX Güncel Piyasa Durumu

5 Ekim 2025 tarihinde ALCX, 8,752 ABD doları seviyesinden işlem görüyor ve en düşük seviyesinden hafif bir toparlanma gösteriyor. Token, son 24 saatte %1,36 oranında değer kaybetti; işlem hacmi ise 21.391.338,152 ABD doları. ALCX'in piyasa değeri 21.714.623,62 ABD doları olup, kripto para piyasasında 1.055'inci sırada yer alıyor. Son bir haftada %5,45'lik artış kaydedilmiş olsa da, bir yıl öncesine göre fiyatı hâlâ %34,61 daha düşük. Mevcut fiyat, tüm zamanların en yüksek seviyesinden önemli ölçüde uzak ve ALCX için zorlu bir piyasa ortamını gösteriyor.

Güncel ALCX piyasa fiyatını görmek için tıklayın

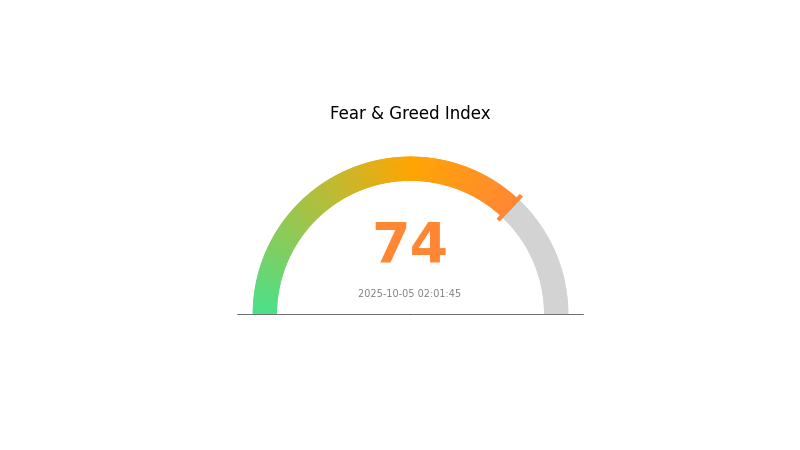

ALCX Piyasa Duyarlılık Göstergesi

2025-10-05 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında aşırı iyimserlik hâkim; Korku ve Açgözlülük Endeksi 74 seviyesinde ve açgözlülük durumunu gösteriyor. Bu, yatırımcıların aşırı güvenli hareket ettiğini ve varlık fiyatlarının şişmesine yol açabileceğini işaret ediyor. Kısa vadede boğa piyasası getirisi mümkün olsa da, yatırımcıların temkinli yaklaşması gerekir. Geçmiş veriler, aşırı açgözlülüğün genellikle piyasa düzeltmelerinden önce yaşandığını gösteriyor. Portföyünü çeşitlendirmek ve ani piyasa değişimlerinde pozisyon koruması için zarar durdur emirleri oluşturmak, dikkatli yatırımcılar için önerilir.

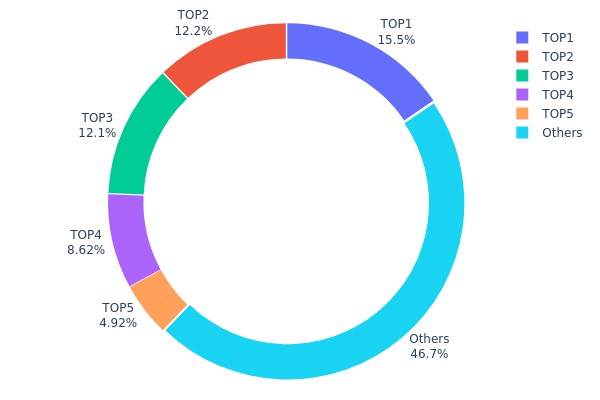

ALCX Varlık Dağılımı

ALCX adres varlık dağılımı verileri, sahipliğin yoğunlaştığı bir yapı gösteriyor. İlk 5 adres, toplam ALCX arzının %53,3'ünü elinde bulundururken, kalan %46,7 diğer adreslere yayılmış durumda. En büyük sahip, dolaşımdan çıkarılan tokenları tutan bir yakım adresi (0x0000...00dead) olup, arzın %15,48'ini barındırıyor.

Bu yoğunlaşma, olası piyasa manipülasyonu ve fiyat oynaklığı riskini artırıyor. Arzın %12'sinden fazlasına sahip üç adresin büyük miktarda satış ya da koordineli hareketleri, ALCX’in piyasa dinamiklerinde belirleyici olabilir. Merkezileşme seviyesi aynı zamanda projenin yönetişim ve karar süreçlerinde etkili olabilir.

Öte yandan, yüksek orandaki yakım adresi (%15,48) dolaşımdaki miktarı kalıcı olarak azalttığı için kıtlığı artırıcı olumlu bir unsur olarak değerlendirilebilir. Dağılım yapısı, büyük sahiplerin hareketlerinin ve etkilerinin dikkatle izlenmesini gerektiriyor.

Güncel ALCX Varlık Dağılımı için tıklayın

| En İyi | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 478,61K | 15,48% |

| 2 | 0xba12...6bf2c8 | 376,01K | 12,16% |

| 3 | 0xf977...41acec | 374,97K | 12,13% |

| 4 | 0xab8e...d7deca | 266,36K | 8,62% |

| 5 | 0xc3f2...ef91a8 | 152,00K | 4,91% |

| - | Diğerleri | 1.441,99K | 46,7% |

II. ALCX'in Gelecek Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Algoritmik Arz: ALCX, fiyat istikrarı için algoritmik bir arz mekanizması uygular.

- Tarihsel Eğilim: Geçmiş arz değişiklikleri ile fiyat hareketleri arasında belirgin bir ilişki gözlenmiştir.

- Mevcut Etki: Güncel arz ayarlamalarının fiyat istikrarına doğrudan etki etmesi bekleniyor.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Büyük kurumlar ALCX'e giderek daha fazla ilgi göstermektedir.

- Kurumsal Benimseme: Bazı tanınmış şirketler ALCX entegrasyonunu değerlendirmektedir.

Makroekonomik Ortam

- Para Politikası Etkisi: Özellikle ABD Merkez Bankası'nın politikaları, ALCX'in değerinde belirleyici olabilir.

- Enflasyona Karşı Koruma: ALCX, son dönemde enflasyona karşı koruma potansiyeli göstermiştir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Protokol Güncellemeleri: Alchemix protokolünde devam eden iyileştirmeler, işlevselliği ve kullanıcı deneyimini artırıyor.

- Ekosistem Uygulamaları: Ekosistemdeki DApp ve projelerin büyümesi, ALCX'in kullanım alanını ve talebini artırıyor.

III. 2025-2030 ALCX Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 7,52 - 8,75 ABD doları

- Tarafsız tahmin: 8,75 - 10,50 ABD doları

- İyimser tahmin: 10,50 - 12,25 ABD doları (olumlu piyasa ve artan benimseme koşulu ile)

2027-2028 Görünümü

- Piyasa fazı: Yüksek volatiliteyle büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 11,01 - 13,04 ABD doları

- 2028: 10,02 - 14,52 ABD doları

- Temel katalizörler: Teknolojik yenilikler, genel piyasa eğilimleri ve proje gelişmeleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 13,68 - 14,02 ABD doları (istikrarlı piyasa ve proje gelişimi ile)

- İyimser senaryo: 14,36 - 19,07 ABD doları (güçlü piyasa ve ekosistem genişlemesi ile)

- Dönüştürücü senaryo: 19,07+ ABD doları (çok olumlu koşullar ve çığır açan yenilikler ile)

- 2030-12-31: ALCX 14,02 ABD doları (%60 artış, 2025 seviyesine göre)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 12,2542 | 8,753 | 7,52758 | 0 |

| 2026 | 14,81008 | 10,5036 | 8,92806 | 20 |

| 2027 | 13,03654 | 12,65684 | 11,01145 | 44 |

| 2028 | 14,51676 | 12,84669 | 10,02042 | 46 |

| 2029 | 14,36581 | 13,68173 | 11,62947 | 56 |

| 2030 | 19,07233 | 14,02377 | 13,32258 | 60 |

IV. ALCX Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ALCX Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Uzun vadeli bakış açısına ve yüksek risk toleransına sahip yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde ALCX biriktirin

- ALCX tokenlarını stake ederek ek kazanç elde edin

- Tokenları güvenli donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve destek/direnç noktalarını belirlemede kullanılır

- RSI: Aşırı alım/aşırı satım koşullarını tespit eder

- Dalgalı alım-satım için kritik noktalar:

- DeFi sektörü trendleri ve ALCX’in göreli performansını izleyin

- Risk yönetimi için zarar durdur emirleri koyun

ALCX Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Agresif yatırımcı: Kripto portföyünün %5-10’u

- Profesyonel yatırımcı: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı DeFi projelerine yayarak riski azaltın

- Opsiyon stratejileri: Olası fiyat düşüşlerine karşı opsiyon kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate web3 cüzdanı

- Yazılım cüzdanı: Güvenilir çoklu imzalı cüzdanlar tercih edin

- Güvenlik önlemleri: İki faktörlü doğrulama etkinleştirin, güçlü şifre kullanın

V. ALCX İçin Potansiyel Riskler ve Zorluklar

ALCX Piyasa Riskleri

- Oynaklık: DeFi tokenlarında ciddi fiyat dalgalanmaları yaşanabilir

- Rekabet: Yeni DeFi protokollerinin ortaya çıkışı ALCX’in pazar payını azaltabilir

- Likidite riski: Düşük işlem hacmi, büyük işlemlerde kaymaya neden olabilir

ALCX Düzenleyici Riskler

- Belirsiz regülasyon ortamı: DeFi protokollerine yönelik denetim artabilir

- Uyum zorlukları: Değişen regülasyonlara uyum için protokolde düzenleme gerekebilir

- Sınır ötesi kısıtlamalar: Uluslararası regülasyon farklılıkları benimsemeyi sınırlayabilir

ALCX Teknik Riskler

- Akıllı kontrat açıkları: Protokoldeki hata veya açıklar istismara yol açabilir

- Ölçeklenebilirlik sorunları: Ağ tıkanıklığı kullanıcı deneyimini etkileyebilir

- Oracle hataları: Yanlış fiyat verisi protokol işlemlerini aksatabilir

VI. Sonuç ve Eylem Önerileri

ALCX Yatırım Değeri Değerlendirmesi

ALCX, yenilikçi getiri tokenleştirme yaklaşımıyla DeFi alanında özgün bir değer sunar. Ancak yatırımcılar, kısa vadede yüksek volatilite ve düzenleyici belirsizliklerin farkında olmalı.

ALCX Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, DeFi mekanizmasını öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Stake ve alım-satım stratejilerini birleştirerek dengeli yaklaşım benimseyin ✅ Kurumsal yatırımcılar: Kapsamlı analiz yapın, ALCX’i çeşitlendirilmiş DeFi portföyüne dahil edin

ALCX Alım-Satım Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden ALCX alıp satabilirsiniz

- Getiri çiftçiliği: Likidite havuzlarına katılarak ek gelir elde edin

- Yönetişim: ALCX token oylarıyla protokol kararlarına katılın

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi niteliği taşımaz. Her yatırımcı, kendi risk toleransına göre karar vermeli ve profesyonel finans danışmanına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

Alchemix yükselecek mi?

Evet, Alchemix'in yükselmesi muhtemel. Kısa vadede 5,21 ABD dolarına ulaşabilir; uzun vadede ise 5-10 yıl içinde 46,12 ABD doları veya daha fazlası hedeflenebilir.

Alchemix neden düştü?

Alchemix, resmi alETH dağıtım komutunda yapılan bir hata nedeniyle güvenlik açığı yaşadı ve bu da ciddi finansal kayıplara neden oldu.

ALCX coin maksimum arzı nedir?

ALCX coin'in maksimum arzı 1.000.000 token ile sınırlıdır. Bu sabit limit, kıtlık ve değer artışı potansiyelini destekler.

ALCX kripto nedir?

ALCX, Alchemix'in yönetim tokenıdır; kullanıcıların gelecekteki kripto kazancına karşı borçlanabildiği bir DeFi protokolüdür. Toplam arzı yaklaşık 1,09 milyon tokendir.

SEI Staking Analizi: %60-70 Arasında Arz Kilitli ve Fiyat Etkisi

SWELL ve RUNE: Zincirler Arası Likidite Yarışında İki Önde Gelen DeFi Protokolünün Karşılaştırılması

2025 CAKE Fiyat Tahmini: Yükseliş Trendleri ve PancakeSwap'ın Token Değerini Etkileyen Ana Unsurlar

2025 CVX Fiyat Tahmini: DeFi'nin Benimsenmesi Hızlanırken Yükseliş Eğilimi Öne Çıkıyor

SPO ve SNX: Yield Farming ve Staking Alanında İki Lider DeFi Protokolünün Karşılaştırılması

AVAX Token Akışının 2025’te Piyasa Değeri Üzerindeki Etkisi Nedir?

Polygon PoS Ağı’na Varlık Aktarma Kılavuzu

Polygon Ağına Bağlanmanın Zahmetsiz Yolu Rehberi

Tap Crypto'yu Keşfetmek: Web3 İşlemlerine Yönelik Eksiksiz Başlangıç Rehberi

Ethereum Name Service (ENS) Hakkında Temel Bilgiler: Basit ve Açık Bir Rehber

Aptos Blockchain’i İncelemek: Detaylı Bir Kılavuz