2025 AMPL Price Prediction: Analyzing Growth Potential and Market Dynamics in the Algorithmic Stablecoin Ecosystem

Introduction: AMPL's Market Position and Investment Value

Ampleforth (AMPL) as a decentralized protocol for smart commodity currency, has made significant strides since its inception in 2019. As of 2025, Ampleforth's market capitalization has reached $21,619,856, with a circulating supply of approximately 17,867,650 tokens, and a price hovering around $1.21. This asset, known as an "elastic supply cryptocurrency," is playing an increasingly crucial role in creating a stable, non-correlated digital asset.

This article will comprehensively analyze Ampleforth's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. AMPL Price History Review and Current Market Status

AMPL Historical Price Evolution

- 2019: AMPL launched, price fluctuated around $1 target

- 2020: Reached all-time high of $4.07 on July 13, 2020

- 2021-2024: Experienced market cycles, price ranged between $1-$2

AMPL Current Market Situation

As of October 5, 2025, AMPL is trading at $1.21, with a 24-hour trading volume of $15,345.24. The token has seen a slight decrease of 0.93% in the past 24 hours. AMPL's market cap currently stands at $21,619,856, ranking it 1057th in the cryptocurrency market. The circulating supply is 17,867,650 AMPL, with a total supply of 19,198,973 AMPL and a maximum supply of 236,026,027 AMPL. Over the past week, AMPL has experienced a 1.11% decrease, while the 30-day and 1-year changes show declines of 5.96% and 5.2% respectively.

Click to view the current AMPL market price

AMPL Market Sentiment Indicator

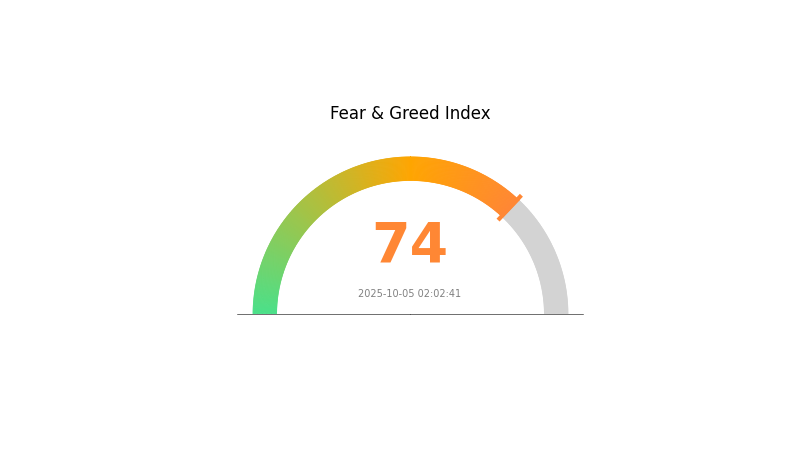

2025-10-05 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of high optimism, with the Fear and Greed Index registering at 74, indicating "Greed." This suggests that investors are becoming increasingly confident and potentially overexcited about market prospects. While such sentiment can drive prices higher in the short term, it's essential to remain cautious. Experienced traders often view extreme greed as a potential signal for market correction. As always, it's crucial to conduct thorough research and manage risk appropriately when making investment decisions.

AMPL Holdings Distribution

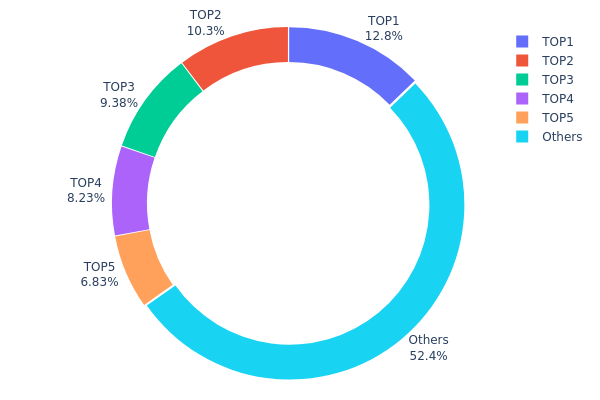

The address holdings distribution data reveals significant concentration in AMPL token ownership. The top five addresses collectively hold 47.52% of the total supply, with the largest holder controlling 12.76%. This concentration level suggests a relatively centralized distribution, which could have implications for market dynamics.

Such a concentrated distribution may pose risks to market stability. Large holders have the potential to significantly impact price movements through substantial buy or sell orders. This concentration could also make the token more susceptible to price manipulation or sudden volatility if major holders decide to liquidate their positions.

However, it's worth noting that 52.48% of the supply is distributed among other addresses, indicating some level of decentralization. This broader distribution may help mitigate some of the risks associated with high concentration, but the overall structure still leans towards a centralized model. Investors should be aware of this distribution pattern when considering AMPL's market dynamics and potential price movements.

Click to view the current AMPL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xedb1...3b49ef | 2734.21K | 12.76% |

| 2 | 0x1e28...cb24a2 | 2214.85K | 10.34% |

| 3 | 0x2235...1539a9 | 2008.48K | 9.37% |

| 4 | 0x7b32...8965f9 | 1762.35K | 8.22% |

| 5 | 0xa65c...ee11e0 | 1462.84K | 6.83% |

| - | Others | 11231.72K | 52.48% |

II. Key Factors Influencing AMPL's Future Price

Supply Mechanism

- Rebase Mechanism: AMPL employs a rebase mechanism that adjusts the token supply based on price fluctuations. When the price is above the target range, supply increases; when below, it decreases.

- Historical Pattern: Supply changes have historically amplified price volatility, creating a double-profit situation during expansions and potentially accelerating declines during contractions.

- Current Impact: The rebase mechanism continues to be a significant factor in AMPL's price movements, potentially magnifying both upward and downward price trends.

Macroeconomic Environment

- Monetary Policy Impact: As AMPL is designed to maintain purchasing power relative to the US dollar, any depreciation in the dollar is expected to lead to an increase in AMPL's price.

- Inflation Hedging Properties: AMPL aims to maintain its purchasing power over time, potentially making it an attractive option during inflationary periods.

Technical Development and Ecosystem Building

- Elastic Vault: A core product that attracted over $250,000 in funding, although the AmpleSense DAO that developed it ceased operations in 2022.

- Elastic Protocol: Created after the termination of AmpleSense DAO, continuing the development of elastic finance applications.

- Ecosystem Applications: AMPL has explored integration with lending platforms, such as developing aAMPL based on Aave, which could enable new use cases for the token.

III. AMPL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.06 - $1.20

- Neutral prediction: $1.20 - $1.30

- Optimistic prediction: $1.30 - $1.36 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $1.28 - $2.04

- 2028: $1.35 - $1.89

- Key catalysts: Increased adoption and market expansion

2030 Long-term Outlook

- Base scenario: $1.80 - $2.20 (assuming steady market growth)

- Optimistic scenario: $2.20 - $2.60 (assuming strong market performance)

- Transformative scenario: $2.60 - $2.96 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: AMPL $2.96 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.36278 | 1.206 | 1.06128 | 0 |

| 2026 | 1.63118 | 1.28439 | 0.88623 | 6 |

| 2027 | 2.0409 | 1.45778 | 1.28285 | 20 |

| 2028 | 1.88929 | 1.74934 | 1.34699 | 44 |

| 2029 | 2.23775 | 1.81931 | 1.65557 | 50 |

| 2030 | 2.96166 | 2.02853 | 1.3794 | 67 |

IV. AMPL Professional Investment Strategies and Risk Management

AMPL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking exposure to algorithmic stablecoins

- Operational suggestions:

- Dollar-cost average into AMPL over time to mitigate volatility

- Hold through rebase cycles to benefit from potential supply growth

- Store tokens in non-custodial wallets for maximum security

(2) Active Trading Strategy

- Technical analysis tools:

- Rebase cycles: Monitor daily rebase schedule to anticipate supply changes

- Price-supply equilibrium: Track deviation from $1 target to gauge potential rebounds

- Key points for swing trading:

- Buy when price is below $1 and supply is contracting

- Sell when price is above $1 and supply is expanding

AMPL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance AMPL with other stablecoins and crypto assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for AMPL

AMPL Market Risks

- High volatility: Price and supply can fluctuate dramatically during rebase cycles

- Liquidity risk: Trading volume may be low, impacting ability to enter/exit positions

- Correlation risk: May not always maintain low correlation with Bitcoin as intended

AMPL Regulatory Risks

- Uncertain classification: Regulators may view AMPL differently than traditional cryptocurrencies

- Potential restrictions: Future regulations could limit trading or use of algorithmic stablecoins

- Tax implications: Rebase mechanisms may create complex tax reporting requirements

AMPL Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying protocol

- Oracle dependency: Relies on external price feeds which could be manipulated

- Network congestion: High gas fees on Ethereum may impact rebase efficiency

VI. Conclusion and Action Recommendations

AMPL Investment Value Assessment

AMPL offers a unique value proposition as an elastic supply cryptocurrency aiming for price stability. While it presents potential for gains through supply growth, it carries significant risks due to its complex mechanics and market volatility.

AMPL Investment Recommendations

✅ Beginners: Limited exposure (1-2% of portfolio) for learning and observation ✅ Experienced investors: Consider tactical allocations based on market cycles ✅ Institutional investors: Explore as part of a diversified crypto strategy, with close monitoring

AMPL Trading Participation Methods

- Spot trading: Available on Gate.com for direct AMPL/USDT trading

- DeFi liquidity provision: Participate in AMPL liquidity pools for potential yield

- Algorithmic trading: Develop strategies around rebase cycles for advanced traders

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is AMPL a good stock to buy?

AMPL may be a good buy for risk-tolerant investors. Its current downtrend could offer a potential entry point, but careful analysis is advised.

What is the amp price prediction for 2025?

The price of Amp is predicted to reach $0.003208 by November 2, 2025, indicating a slight decline in value.

What is the price prediction for AMPL stock?

Based on current market analysis, AMPL stock is predicted to reach an average price of $33.52 in 2025, with a potential high of $41.52 and a low of $25.53.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction at $120,286, followed by Chainlink at $62.60.

Share

Content