2025 CTA Fiyat Tahmini: Chicago Transit Authority Ücretlerinde Gelecek Trendler ve Büyüme Potansiyelinin Analizi

Giriş: CTA'nın Piyasa Konumu ve Yatırım Değeri

Cross The Ages (CTA), dijital alım-satım kartlarının non-fungible token (NFT) olarak sunulduğu ücretsiz oynanabilen bir oyun olarak kurulduğundan bu yana kayda değer ilerleme gösterdi. 2025 yılı itibarıyla CTA'nın piyasa değeri 20.415.000 $'a ulaştı; yaklaşık 500.000.000 token dolaşımda ve fiyatı yaklaşık 0,04083 $ seviyesinde. "Oyun ekosistem tokenı" olarak anılan bu varlık, blokzincir tabanlı oyun ve NFT alanlarında giderek daha önemli bir rol üstleniyor.

Bu makale, 2025-2030 yılları arasında CTA'nın fiyat hareketlerini kapsamlı biçimde inceleyecek; geçmiş fiyat trendleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler kapsamında profesyonel fiyat tahminleri ve yatırımcılar için pratik stratejiler sunacaktır.

I. CTA Fiyat Geçmişi ve Mevcut Piyasa Durumu

CTA Fiyat Geçmişinin Seyri

- 2024: CTA, 17 Mayıs'ta 0,462 $ ile tüm zamanların en yüksek seviyesine ulaşarak proje için kritik bir kilometre taşı kaydetti.

- 2025: Piyasa geriledi ve CTA, 3 Şubat'ta 0,01307 $ ile tüm zamanların en düşük fiyatına indi.

- 2025: Son aylarda toparlanma işaretleri gözlendi ve 5 Ekim tarihi itibarıyla fiyat 0,04083 $'a yükseldi.

CTA Güncel Piyasa Durumu

5 Ekim 2025 itibarıyla CTA, 0,04083 $ seviyesinden işlem görüyor ve son 24 saatte %0,24 düşüş kaydetti. Token, uzun vadede pozitif bir ivme sergilerken, 7 günde %2,51 ve 30 günde %14,08 artış yaşadı. Ancak CTA, bir yıl öncesine göre halen %62,41 daha düşük seviyede. Güncel piyasa değeri 20.415.000 $ ve dolaşımdaki arz 500.000.000 CTA tokenı. 24 saatlik işlem hacmi 7.027,09 $ ile orta düzeyde piyasa hareketliliğine işaret ediyor. Son yükselişe rağmen CTA hâlâ tüm zamanların zirvesinin oldukça altında; bu da piyasa koşulları olumlu kalırsa ileriye dönük toparlanma potansiyeline işaret ediyor.

Güncel CTA piyasa fiyatını görmek için tıklayın

CTA Piyasa Duyarlılık Endeksi

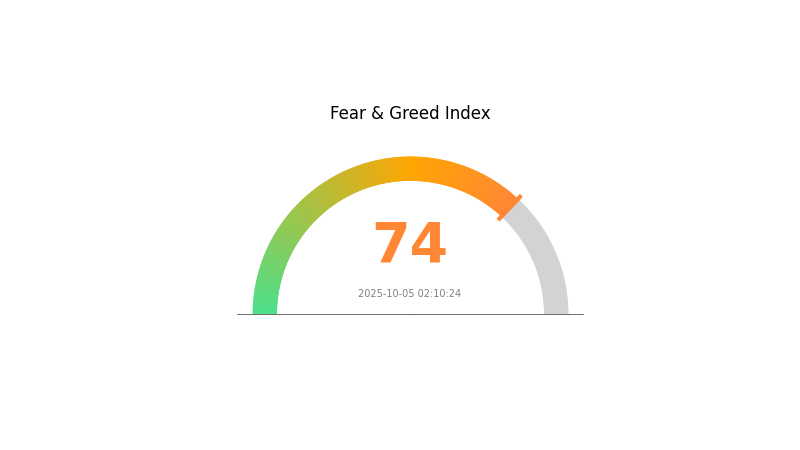

2025-10-05 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksi'ni görmek için tıklayın

Kripto piyasasında şu an açgözlülük hakim; Korku ve Açgözlülük Endeksi 74 seviyesinde. Bu yüksek açgözlülük, yatırımcıların aşırı iyimserleşerek aşırı alım pozisyonlarına yol açabileceğini gösteriyor. Duyarlılık olumlu olsa da, yatırımcıların dikkatli kalması ve olası düzeltmeleri göz önünde bulundurması önemlidir. Her zaman olduğu gibi, çeşitlendirme ve risk yönetimi bu piyasa koşullarında anahtar rol oynar. Trendleri izleyin ve olası dalgalanmalara karşı hazırlıklı olun.

CTA Varlık Dağılımı

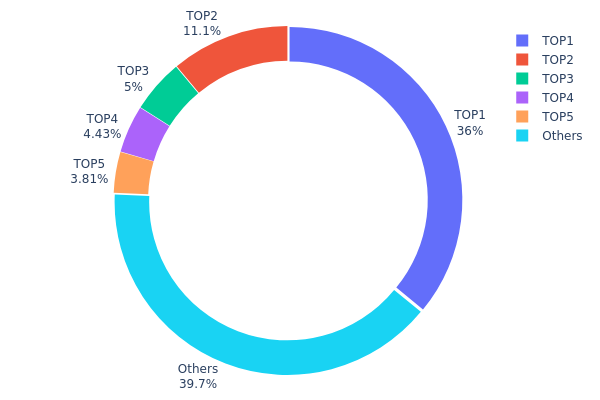

Adres varlık dağılımı verileri, CTA tokenlarının farklı adresler arasında nasıl yoğunlaştığına dair önemli bilgiler sunar. Analiz, tokenların birkaç üst adresin elinde yoğunlaştığını gösteriyor. En üstteki adres CTA tokenlarının %35,95'ini tutarken, ilk 5 adres toplam arzın %60,23'ünü kontrol ediyor.

Tokenların az sayıda adreste yoğunlaşması, piyasa merkezileşmesi ve olası fiyat manipülasyonu riskini gündeme getiriyor. Toplam arzın üçte birinden fazlasını tutan bir üst adres, tokenın piyasa dinamiğinde belirleyici etkide. Bu yoğunlaşma, fiyatlarda dalgalanma ve büyük satış ya da birikim olaylarına karşı hassasiyet doğurabilir.

Bununla birlikte, tokenların %39,77'si diğer adreslerde dağılmış durumda; bu da belirli bir merkeziyetsizlik seviyesine işaret ediyor. Bu dağılım, büyük sahiplerin piyasada ciddi söz sahibi olduğunu, ancak daha geniş katılıma hâlâ imkân bulunduğunu ortaya koyuyor. Mevcut dağılım, kısmen merkezileşmiş bir ekosistem gösteriyor ve bu durum tokenın uzun vadeli istikrarı ve benimsenme potansiyelini etkileyebilir.

Güncel CTA Varlık Dağılımı'nı görmek için tıklayın

| Üst Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x6522...837e90 | 179.779,21K | 35,95% |

| 2 | 0xfb9c...d2717b | 55.311,32K | 11,06% |

| 3 | 0xac5c...33a87d | 24.999,97K | 4,99% |

| 4 | 0xc882...84f071 | 22.139,33K | 4,42% |

| 5 | 0xcda9...a68adc | 19.074,00K | 3,81% |

| - | Diğerleri | 198.696,16K | 39,77% |

II. Gelecek CTA Fiyatlarını Etkileyecek Temel Faktörler

Arz Mekanizması

- Piyasa Dalgalanması: CTA stratejileri, piyasa hareketleri ve ivmeye dayanır. Artan dalgalanma, fiyatlar üzerindeki bu stratejilerin etkisini artırabilir.

- Tarihsel Model: Geçmişte, yüksek oynaklığın olduğu dönemlerde CTA ile ilişkili varlıklarda daha büyük fiyat hareketleri görülmüştür.

- Mevcut Etki: Devam eden piyasa belirsizliği ve oynaklık potansiyeli, CTA stratejileri için daha fazla fırsat ve daha büyük fiyat hareketleri doğurabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: 2024 itibarıyla, küresel CTA yönetimindeki varlıklar 350 milyar $'ı aştı ve bunun büyük kısmı ABD piyasasında yer alıyor.

- Kurumsal Katılım: Commodity Trading Advisors (CTA'lar), risk yönetimi ve portföy çeşitlendirmesi için büyük finans kurumları tarafından giderek daha çok tercih ediliyor.

- Ulusal Politikalar: CTA'lar ABD'de Commodity Futures Trading Commission (CFTC) tarafından düzenleniyor ve National Futures Association (NFA) tarafından izleniyor.

Makroekonomik Ortam

- Para Politikası Etkisi: Özellikle Federal Reserve'in politikaları, CTA performansı üzerinde önemli etkiye sahip. Faiz indirim döngüsüne geçiş, emtia piyasalarında oynaklığı artırabilir.

- Enflasyona Karşı Koruma Özellikleri: CTA'lar, emtia piyasalarına olan maruziyetleri sayesinde enflasyonist dönemlerde genellikle iyi performans sergiler; çünkü emtialar enflasyonla birlikte değer kazanır.

- Jeopolitik Faktörler: Uluslararası ticaret gerilimi, örneğin gümrük tarifeleri, emtia piyasalarında oynaklık yaratabilir ve CTA stratejileri için avantaj sağlayabilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Algoritmik Alım-Satım Gelişmeleri: Makine öğrenimi ve veri analizinde ilerlemeler, CTA stratejilerinin öngörü gücünü artırıyor.

- Piyasa Erişiminde Genişleme: Elektronik alım-satım platformlarının yaygınlaşması, CTA'ların piyasaya erişimini artırıyor ve daha çeşitli alım-satım fırsatları sunuyor.

- Ekosistem Uygulamaları: CTA'lar, kripto paralar ve diğer dijital varlıklar da dahil olmak üzere yeni piyasalara ve varlık gruplarına girerek finansal ekosistemlerde daha geniş etki yaratıyor.

III. 2025-2030 CTA Fiyat Tahmini

2025 Görünümü

- Tedbirli tahmin: 0,02286 $ - 0,03500 $

- Tarafsız tahmin: 0,03500 $ - 0,04500 $

- İyimser tahmin: 0,04500 $ - 0,05063 $ (olumlu piyasa duyarlılığı ve benimsenme artışı ile)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Konsolidasyon dönemi sonrası kademeli büyüme

- Fiyat aralığı tahmini:

- 2027: 0,02605 $ - 0,05452 $

- 2028: 0,04573 $ - 0,05600 $

- Temel katalizörler: Teknolojik ilerleme, daha geniş sektör ortaklıkları ve iyileşen piyasa koşulları

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,05500 $ - 0,06500 $ (istikrarlı büyüme ve benimsenme ile)

- İyimser senaryo: 0,06500 $ - 0,08023 $ (güçlü boğa piyasası ve yaygın entegrasyon ile)

- Dönüştürücü senaryo: 0,08000 $ - 0,10000 $ (büyük kurumsal benimseme gibi çok olumlu koşullarda)

- 2030-12-31: CTA 0,05772 $ (2030 için tahmini ortalama fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi |

|---|---|---|---|---|

| 2025 | 0,05063 | 0,04083 | 0,02286 | 0 |

| 2026 | 0,05076 | 0,04573 | 0,03704 | 12 |

| 2027 | 0,05452 | 0,04824 | 0,02605 | 18 |

| 2028 | 0,056 | 0,05138 | 0,04573 | 25 |

| 2029 | 0,06175 | 0,05369 | 0,02899 | 31 |

| 2030 | 0,08023 | 0,05772 | 0,04791 | 41 |

IV. CTA için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

CTA Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli yatırımcılar ve NFT meraklıları

- Operasyon önerileri:

- Piyasa düşüşlerinde CTA tokenı biriktirin

- Cross The Ages oyun ekosistemine aktif katılım sağlayın

- Tokenları saklamada, kendi saklamalı cüzdan kullanın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve destek/direnç noktalarını saptamak için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım durumlarını izleyin

- Swing trading için kritik noktalar:

- Oyun güncellemeleri ve yeni özellikleri takip edin

- Ekosistemdeki NFT satış hacmini ve fiyatlarını izleyin

CTA Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Farklı oyun tokenlarına yatırım dağıtımı

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için uygun zarar durdur seviyeleri belirleyin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama etkinleştirin, güçlü parolalar kullanın

V. CTA için Olası Riskler ve Zorluklar

CTA Piyasa Riskleri

- Oynaklık: Oyun tokenları büyük fiyat dalgalanmaları yaşayabilir

- Rekabet: Yeni blokzincir tabanlı oyun projelerinin piyasaya çıkışı

- Kullanıcı benimsenmesi: Oyuncu kitlesinin sürekli büyümesine bağımlılık

CTA Düzenleyici Riskler

- NFT düzenlemeleri: NFT sınıflandırması ve vergilendirmesinde olası değişiklikler

- Oyun mevzuatı: Farklı ülkelerde değişen yasal düzenlemeler

- Token sınıflandırması: Menkul kıymet olarak sınıflandırılma riski

CTA Teknik Riskler

- Akıllı kontrat açıkları: Token kontratında olası zafiyetler ve açıklardan yararlanma riskleri

- Ölçeklenebilirlik sorunları: Artan ağ trafiğini yönetmede yaşanabilecek zorluklar

- İşbirliği: Zincirler arası işlevsellikteki sınırlamalar

VI. Sonuç ve Eylem Önerileri

CTA Yatırım Değeri Değerlendirmesi

CTA, blokzincir tabanlı oyun alanında uzun vadeli büyüme potansiyeli sunan özgün bir fırsat yaratıyor. Ancak yatırımcıların kısa vadede yüksek oynaklık ve düzenleyici belirsizliklere karşı dikkatli olması gerekir.

CTA Yatırım Önerileri

✅ Yeni başlayanlar: Küçük tutarla yatırım yapın, oyun ekosistemini öğrenmeye öncelik verin ✅ Deneyimli yatırımcılar: Token tutma ve aktif oyun katılımını bir arada değerlendiren dengeli yaklaşım benimseyin ✅ Kurumsal yatırımcılar: Projenin gelişim yol haritası ve ekip hakkında kapsamlı inceleme gerçekleştirin

CTA Alım-Satım Katılım Yöntemleri

- Spot alım-satım: CTA tokenlarını Gate.com üzerinden alıp satın

- Staking: Uygunsa staking programlarına katılın

- Oyun içi etkinlikler: Oynayarak ve NFT ticaretiyle CTA tokenları kazanın

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına uygun şekilde dikkatli karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

2025 için Constellation kripto fiyat tahmini nedir?

Piyasa göstergelerine göre, Constellation kripto 2025 sonunda 0,071531 $ ile 0,076001 $ aralığında işlem görecektir.

CTA tokenı ne kadar değerli?

2025-10-05 itibarıyla CTA tokenı 0,27053 $ değerindedir. Bu fiyat, mevcut piyasa durumu ve kripto piyasasındaki eğilimleri yansıtmaktadır.

Hamster kombat coin 1 $'a ulaşabilir mi?

Hamster Kombat'ın fiyatı önemli ölçüde yükseldi; ancak 1 $ seviyesine ulaşması kesin değil. Mevcut trendler potansiyel gösterse de, piyasa oynaklığı yüksek. Hiçbir garanti verilemez.

2050 için Coti fiyat tahmini nedir?

Yıllık %5 büyüme oranına göre, COTI'nin 2050'de 0,1486 $ seviyesine ulaşması bekleniyor. Bu uzun vadeli tahmin, yıllar boyunca istikrarlı piyasa büyümesini varsaymaktadır.

2025 FEAR Fiyat Tahmini: Kripto Fear Index Token Piyasasındaki Dalgalanmada Yol Almak

AVNT vs ENJ: İki Umut Vadeden Blockchain Oyun Tokeninin Karşılaştırmalı Analizi

B3 ve FLOW: Ölçeklenebilirlik ve performans açısından iki yenilikçi blockchain protokolünün karşılaştırılması

2025 DOMI Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

GODL ve ENJ: İki Blockchain Oyun Token’ının Karşılaştırılması

Legends of Elysium (LOE) iyi bir yatırım mı?: Bu blokzincir tabanlı kart oyununun potansiyeli ve riskleri üzerine analiz

IOTA'yı Keşfedin: Merkeziyetsiz Defter Teknolojisine Kapsamlı Bir Rehber

2023’te Dogecoin Madenciliğine Başlama Rehberi: Yeni Başlayanlar İçin Kesin Kılavuz

DeFi likidite havuzlarında geçici kayıp nedir, nasıl oluşur?

MetaMask Bağlantı Sorunlarını Çözme: Adım Adım Sorun Giderme Kılavuzu

İkonik Bored Ape Yacht Club NFT Koleksiyonunu Yakından İncelemek