2025 ESPrice Tahmini: Kurumsal Yazılım Çözümleri için Pazar Analizi ve Gelecek Eğilimler

Giriş: ES’in Piyasa Konumu ve Yatırım Değeri

Eclipse (ES), Ethereum’un ilk Solana Sanal Makinesi (SVM) Katman 2 (Layer 2) çözümü olarak, kuruluşundan bu yana önemli kilometre taşlarına ulaşmıştır. 2025 yılı itibarıyla Eclipse’in piyasa değeri 18.975.000 $’a ulaşmış, dolaşımdaki arz yaklaşık 150.000.000 token olup fiyatı 0,1265 $ seviyesinde bulunmaktadır. “Ethereum-Solana köprü” olarak adlandırılan bu varlık, blokzincirler arası birlikte çalışabilirlik ve ölçeklenebilirlik konusunda giderek daha önemli bir rol üstleniyor.

Bu makale, Eclipse’in 2025-2030 dönemindeki fiyat hareketlerini; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler doğrultusunda kapsamlı şekilde analiz ederek yatırımcılara profesyonel fiyat tahminleri ve uygulamaya dönük yatırım stratejileri sunmayı amaçlamaktadır.

I. ES Fiyat Geçmişi ve Mevcut Piyasa Durumu

ES Fiyatının Tarihsel Gelişim Süreci

- Temmuz 2025: ES, 0,5 $ ile tüm zamanların en yüksek seviyesine ulaşarak proje için kritik bir başarıya imza attı

- Eylül 2025: Fiyat, 0,1167 $ ile rekor düşük seviyeye gerileyerek piyasa dalgalanmasını gözler önüne serdi

- Ekim 2025: ES fiyatı 0,1265 $ civarında dengeye oturdu ve toparlanma sinyalleri verdi

ES Güncel Piyasa Durumu

5 Ekim 2025 tarihi itibarıyla ES, 0,1265 $ seviyesinden işlem görmektedir. 24 saatlik işlem hacmi 139.261,89 $’dır ve piyasa değeri 18.975.000 $ seviyesindedir. ES, son 24 saatte %1,55 oranında hafif bir gerileme yaşasa da, son bir haftada %5,68 oranında pozitif bir ivme göstermiştir. Güncel dolaşımdaki arz 150.000.000 ES token olup, bu miktar toplam arzın %15’ine (1.000.000.000 token) karşılık gelmektedir. Tam seyreltilmiş piyasa değeri ise 126.500.000 $’dır. ES, kripto para piyasasında 1.126’ncı sırada yer almakta ve %0,0028’lik bir piyasa hakimiyetine sahiptir.

ES Piyasa Duyarlılık Göstergesi

05 Ekim 2025 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasası şu anda açgözlülük aşamasında ve Korku ve Açgözlülük Endeksi 74 seviyesine ulaşmış durumda. Bu veri, yatırımcıların yüksek oranda iyimser ve kendinden emin olduğunu gösteriyor. Duyarlılıktaki bu yükseklik çoğunlukla fiyat yükselişiyle ilişkilendirilse de, temkinli kalmak gereklidir. Tarihsel olarak aşırı açgözlülük dönemleri genellikle piyasa düzeltmesinin öncüsü olmuştur. Portföy çeşitlendirmesi yapmak ve kazançları korumak için zarar durdur emirleri kullanılması önerilir. Her koşulda, kapsamlı araştırma ve risk yönetimi bu piyasa ortamında kritik önem taşır.

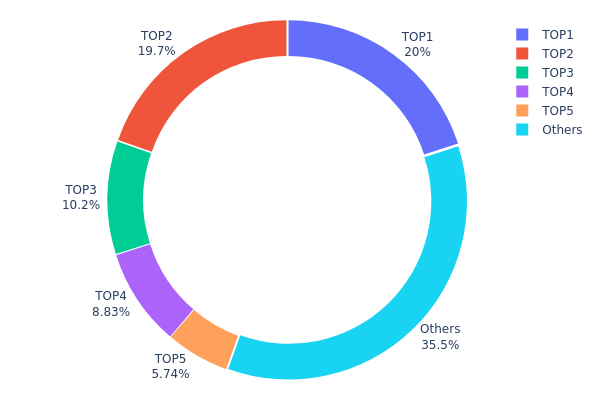

ES Varlık Dağılımı

Adres bazında varlık dağılımı verisi, ES tokenlarının farklı cüzdanlar arasında yoğunlaşma oranı hakkında önemli içgörüler sunar. Mevcut veriler, en büyük beş adresin toplam ES arzının %64,46’sını elinde bulundurduğunu ve en büyük sahibin toplam tokenların %20’sini kontrol ettiğini gösteriyor.

Bu yüksek yoğunlaşma, potansiyel piyasa manipülasyonu ve fiyat dalgalanması açısından endişe yaratmaktadır. En büyük iki adres arzın yaklaşık %40’ını tutmakta olup, büyük miktarlarda token hareketi veya satışı fiyatlarda sert değişikliklere neden olabilir. Bu yapı, merkeziyetsizlik derecesinin düşük olduğunu ve az sayıda adresin ekosistem üzerinde büyük etki sahibi olduğunu gösteriyor.

Birçok kripto para biriminde belli düzeyde yoğunlaşma görülse de, ES’deki oran oldukça yüksektir. Bu yapı, piyasa istikrarı üzerinde etkili olabileceği gibi, büyük hacimli hareketlerden çekinen yatırımcılar için caydırıcı olabilir. Öte yandan, arzın %35,54’ünün diğer adresler arasında dağıtılmış olması, riskleri bir miktar dengeleyebilir ve çeşitlilik sağlayabilir.

Güncel ES Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı (K) | Varlık (%) |

|---|---|---|---|

| 1 | 0x2b7d...ef982f | 200.000,00K | 20,00% |

| 2 | 0x0bfa...b5e263 | 196.786,99K | 19,67% |

| 3 | 0x3ee1...b3dd85 | 102.337,54K | 10,23% |

| 4 | 0x4d0a...1c3fcf | 88.328,43K | 8,83% |

| 5 | 0x4597...cdab0d | 57.366,66K | 5,73% |

| - | Diğerleri | 355.180,37K | 35,54% |

II. ES’in Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Makroekonomik Ortam

-

Para Politikası Etkisi: Büyük merkez bankalarının temkinli tavırlarını sürdürmesi bekleniyor; FED ve Avrupa Merkez Bankası, faiz kararlarını enflasyon ve ekonomik göstergeler doğrultusunda şekillendiriyor.

-

Enflasyona Karşı Koruma Özelliği: ES, enflasyon dönemlerinde dayanıklılık göstererek fiyat artışına karşı koruma arayan yatırımcıların ilgisini çekebilir.

-

Jeopolitik Unsurlar: Uluslararası gerilimler ve ticaret politikaları ES fiyatı üzerinde etkili olmaya devam ediyor. Büyük ekonomiler arasındaki müzakereler ve küresel ittifaklarda olası değişiklikler piyasa algısını etkileyebilir.

Teknolojik Gelişmeler ve Ekosistem Gelişimi

-

Sektörel Benimsenme: ES ekosistemi büyüyor ve çeşitli sektörlerde entegrasyon oranı artıyor; bu talebi ve fiyatı yukarı taşıyabilir.

-

Ekosistem Uygulamaları: ES platformunda geliştirilen merkeziyetsiz uygulamalar (DApp), ağın kullanım alanını artırarak daha fazla kullanıcıya ulaşmasını sağlıyor.

III. 2025-2030 ES Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,10702 $ - 0,12590 $

- Tarafsız tahmin: 0,12590 $ - 0,14793 $

- İyimser tahmin: 0,14793 $ - 0,16997 $ (olumlu piyasa koşulları gerektirir)

2026-2027 Görünümü

- Piyasa fazı beklentisi: Kademeli büyüme ve konsolidasyon

- Fiyat aralığı tahmini:

- 2026: 0,0932 $ - 0,21302 $

- 2027: 0,14258 $ - 0,24545 $

- Temel tetikleyiciler: Benimsenmenin artması ve piyasa olgunlaşması

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,21296 $ - 0,29489 $ (istikrarlı piyasa büyümesi ile)

- İyimser senaryo: 0,29489 $ - 0,34807 $ (güçlü piyasa performansı ile)

- Dönüştürücü senaryo: 0,34807 $ - 0,404 $ (istisnai piyasa ve yaygın benimsenme ile)

- 31 Aralık 2030: ES 0,404 $ (son derece olumlu koşullarda muhtemel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,16997 | 0,1259 | 0,10702 | 0 |

| 2026 | 0,21302 | 0,14793 | 0,0932 | 16 |

| 2027 | 0,24545 | 0,18048 | 0,14258 | 42 |

| 2028 | 0,27046 | 0,21296 | 0,1512 | 68 |

| 2029 | 0,34807 | 0,24171 | 0,1837 | 91 |

| 2030 | 0,404 | 0,29489 | 0,23886 | 133 |

IV. ES Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ES Yatırım Stratejileri

(1) Uzun Vadeli Tutma Stratejisi

- Uygunluk: Sabırlı ve yüksek risk toleranslı yatırımcılar için

- Uygulama önerileri:

- Piyasa düşüşlerinde ES token biriktirin

- Minimum 2-3 yıl tutma hedefi belirleyin

- Tokenları güvenli donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası giriş/çıkış noktalarını belirleme

- RSI: Aşırı alım/satım durumlarını izleme

- Dalgalı alım-satımda dikkat edilecek noktalar:

- Açık zarar durdur ve kar al seviyeleri belirleyin

- Eclipse ekosistemindeki gelişmeleri olası fiyat tetikleyicileri için takip edin

ES Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımlarınızı farklı blokzincir projelerine yaymak

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk saklama: Uzun vadeli tutumda donanım cüzdanı kullanın

- Güvenlik önlemleri: İki aşamalı doğrulama etkinleştirin, güçlü şifreler kullanın

V. ES Potansiyel Riskleri ve Zorlukları

ES Piyasa Riskleri

- Dalgalanma: Kripto piyasalarda yüksek oynaklık görülür

- Rekabet: Diğer Katman 2 çözümleri pazar payı kazanabilir

- Likidite: Sınırlı işlem hacmi fiyat kaymasına sebep olabilir

ES Düzenleyici Riskler

- Belirsiz düzenlemeler: Yeni kripto mevzuatlarının çıkma ihtimali

- Sınır ötesi uyumluluk: Farklı ülkelerde değişen yasal statü

- Vergilendirme: Kripto işlemlerinin vergisel durumu değişmektedir

ES Teknik Riskler

- Akıllı kontrat zafiyetleri: Sömürü veya hata ihtimali

- Ölçeklenebilirlik sorunları: Yoğun talep dönemlerinde ağ tıkanıklığı

- Birlikte çalışabilirlik: Diğer blokzincirlerle uyumluluk

VI. Sonuç ve Eylem Önerileri

ES Yatırım Değeri Değerlendirmesi

Eclipse (ES), Ethereum’un ilk Solana Sanal Makinesi (SVM) Katman 2 çözümü olarak benzersiz bir değer sunar. Modüler mimarisi ve güçlü sektör desteği uzun vadeli potansiyel taşırken, kısa vadeli dalgalanma ve teknik riskler göz önünde bulundurulmalıdır.

ES Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasayı anlamak için küçük ve düzenli yatırımlarla başlayın ✅ Deneyimli yatırımcılar: Hem uzun vadeli tutum hem aktif alım-satım ile dengeli bir strateji izleyin ✅ Kurumsal yatırımcılar: Stratejik ortaklık fırsatlarını değerlendirin ve detaylı durum tespiti yapın

ES Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden ES token alıp satabilirsiniz

- Staking: Varsa staking programlarına katılabilirsiniz

- DeFi entegrasyonu: Eclipse ekosistemi içinde merkeziyetsiz finans olanaklarını keşfedin

Kripto para yatırımları yüksek risk içerir; bu makale yatırım tavsiyesi niteliği taşımamaktadır. Yatırımcıların kendi risk profillerine göre karar vermesi ve profesyonel finansal danışmanlardan destek alması önerilir. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

ES tokenı için fiyat tahmini nedir?

Mevcut piyasa algoritmalarına göre ES tokenının önümüzdeki 2 hafta içinde 59,23 $’a ulaşması bekleniyor; bu, mevcut seviyeye göre %5,26 düşüş anlamına gelir.

Hamster token fiyatları artacak mı?

Evet, hamster token fiyatlarında artış bekleniyor. Tahminlere göre fiyat 0,095000 $’a yükselecek ve 2 Kasım 2025’e kadar %3,80’lik bir artış gerçekleşecek.

XRP %100 artış gösterir mi?

XRP’nin geleceği belirsiz olsa da, bazı analistler %100’lük bir yükseliş olabileceğini öngörüyor. Piyasa koşulları ve düzenleyici adımlar fiyat hareketinde belirleyici olacak.

2030’da 1 XRP ne kadar olacak?

Mevcut projeksiyonlara göre, 2030 yılında 1 XRP’nin fiyatı 9,5 $ ile 10,8 $ arasında olabilir. Bu aralık yaygın olarak öngörülmekle birlikte, kesin fiyatlar belirsizliğini koruyor.

dYdX (DYDX) iyi bir yatırım mı?: Bu merkeziyetsiz türev borsa tokeninin potansiyelini değerlendirmek

TIMECHRONO vs LRC: Ses Prodüksiyonunda Zaman Senkronizasyonu Teknolojilerinin Karşılaştırmalı Analizi

HEI ve DYDX: Dijital Varlık Ekosisteminde İki Lider Alım-Satım Platformunun Karşılaştırılması

2025 SOON Fiyat Tahmini: Benimsenme Artışıyla Büyüme Beklentisi ve Yükseliş Görünümü

2025 MNT Fiyat Tahmini: Moğolistan Tugriki'nin gelecekteki değeri için piyasa trendleri ve uzman tahminlerinin analizi

CGN ile LRC: Bilişsel Süreçler ve Öğrenme Sonuçlarındaki Farklar

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak