2025 GHST Fiyat Tahmini: Aavegotchi'nin Token'ı, gelişen NFT oyun ekosisteminde yeni zirvelere ulaşabilir mi?

Giriş: GHST'nin Piyasa Konumu ve Yatırım Potansiyeli

Aavegotchi (GHST), DeFi entegrasyonlu bir kripto koleksiyon projesi olarak, başlangıcından bu yana kayda değer gelişmeler göstermiştir. 2025 yılı itibarıyla Aavegotchi'nin piyasa değeri 21.148.402 $ seviyesine ulaşmış, yaklaşık 51.157.239 token dolaşıma girmiş ve fiyatı 0,4134 $ civarında seyretmiştir. Genellikle “oyunlaştırılmış DeFi deneyimi” olarak tanımlanan bu varlık, merkeziyetsiz finans ile blokzincir tabanlı oyun sektörlerinin birleşim noktasında giderek daha önemli bir rol üstlenmektedir.

Bu makale, 2025-2030 yılları arasında GHST'nin fiyat hareketlerini; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörlerle birlikte bütüncül bir şekilde inceleyerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. GHST Fiyat Geçmişi ve Mevcut Piyasa Durumu

GHST Tarihsel Fiyat Seyri

- 2024: GHST, 2 Nisan tarihinde 3,63 $ ile tüm zamanların en yüksek seviyesini görerek proje için kritik bir dönüm noktası oluşturdu.

- 2025: Piyasadaki aşağı yönlü hareketle GHST, 23 Haziran'da 0,311585 $ ile en düşük seviyesine indi.

GHST Güncel Piyasa Durumu

5 Ekim 2025 tarihi itibarıyla GHST'nin fiyatı 0,4134 $; son 24 saatte %2,68 düşüş kaydetti. Piyasa değeri 21.148.402 $ olan token, kripto para piyasasında 1.067. sırada yer alıyor. Dolaşımdaki miktarı 51.157.239 token ve toplam arzın (52.747.802 GHST) %96,98'ini oluşturuyor.

Son bir haftada GHST %3,25 oranında değer kazanarak kısmi toparlanma gösterdi. Ancak uzun vadeli trend hâlen zayıf; son 30 günde %3,27, son bir yılda ise %56,07 oranında düşüş yaşandı.

Fiyatın mevcut seviyesi, tüm zamanların zirvesine kıyasla ciddi bir değer kaybına işaret etmekte ve token'ın uzun süreli düzeltme sürecinde olduğunu göstermektedir. 24 saatlik işlem hacmi ise 18.129 $ ile sınırlı bir piyasa hareketliliğine işaret ediyor.

Güncel GHST piyasa fiyatını görüntüleyin

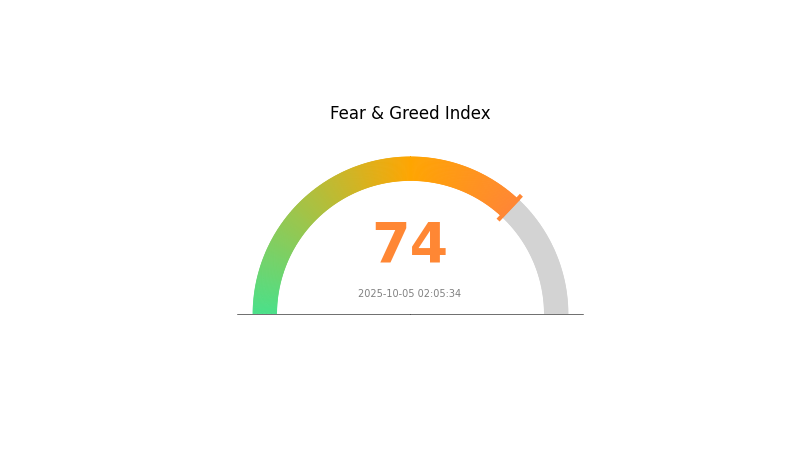

GHST Piyasa Duyarlılığı Göstergesi

2025-10-05 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksini inceleyin

Bugün kripto piyasasında açgözlülük güçlü bir şekilde hissediliyor; Korku ve Açgözlülük Endeksi 74 seviyesinde. Bu yüksek açgözlülük, yatırımcıların aşırı iyimser olduklarını ve fiyatların sürdürülemez seviyelere çıkma riski taşıdığını gösteriyor. Boğa havası ilave kazançları tetikleyebilir; fakat temkinli olmak her zamankinden daha önemli. Deneyimli yatırımcılar, aşırı açgözlülüğü genellikle zıt bir gösterge olarak görüp olası bir piyasa düzeltmesine işaret kabul eder. Hareketli bir piyasa ortamında, araştırmaların titizlikle yapılması ve risklerin dikkatli yönetilmesi gerekir.

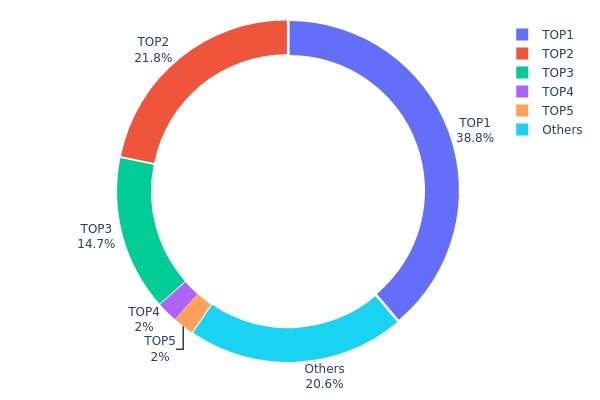

GHST Varlık Dağılımı

GHST'nin adres varlık dağılımı, sahiplik yapısında yüksek bir yoğunlaşma olduğunu göstermektedir. En büyük adres, toplam arzın %38,83'ünü elinde bulunduruyor; ikinci ve üçüncü en büyük adresler ise sırasıyla %21,82 ve %14,69 paya sahip. İlk üç adres birlikte GHST tokenlarının %75,34'ünü kontrol ederek ağ üzerindeki güç yoğunlaşmasını ortaya koyuyor.

Bu yoğunlaşma, piyasa istikrarı ve fiyat manipülasyonu risklerini gündeme getiriyor. Tokenların büyük kısmı az sayıda adreste olduğu için, bu yatırımcıların olası hareketleri GHST'nin piyasasında orantısız etkiler yaratabilir. Ayrıca, bu yoğunlaşma merkeziyetsizliğin düşük olduğunu gösterir ve GHST ekosisteminin genel dayanıklılığı ile demokratik yapısını olumsuz yönde etkileyebilir.

Bununla birlikte, GHST tokenlarının %20,68'i diğer adresler arasında dağılmış durumda ve bu, daha geniş bir katılımın da mevcut olduğunu gösterir. Fakat genel dağılım yapısı, piyasada oynaklık ve büyük pay sahiplerinin belirgin etkisine açık bir ortam sunuyor.

Güncel GHST Varlık Dağılımını inceleyin

| Üst Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x40ec...5bbbdf | 20.486,32K | 38,83% |

| 2 | 0x3154...0f2c35 | 11.514,20K | 21,82% |

| 3 | 0xf977...41acec | 7.753,38K | 14,69% |

| 4 | 0xdde7...5af429 | 1.052,38K | 1,99% |

| 5 | 0xf6ae...fc3223 | 1.052,38K | 1,99% |

| - | Diğerleri | 10.889,14K | 20,68% |

II. GHST'nin Gelecekteki Fiyatını Belirleyen Temel Faktörler

Arz Mekanizması

- Piyasa Arz ve Talebi: Piyasa arzı ile talebinin dengesi, GHST fiyatında belirleyici rol oynar.

- Tarihsel Desen: Geçmişteki arz değişikliklerinin GHST fiyat hareketlerinde etkisi görülmüştür.

- Güncel Etki: Mevcut arz dinamikleri, yakın gelecekte GHST fiyatına etki edecektir.

Kurumsal ve Whale Dinamikleri

- Whale Etkisi: “Whale” olarak bilinen büyük yatırımcılar, işlem hacimleriyle GHST fiyatını önemli ölçüde etkileyebilir.

Makroekonomik Ortam

- Ekonomik Koşullar: Küresel ekonomik durum, yatırımcıların duyarlılığını ve risk algısını şekillendirerek GHST fiyatını etkiler.

- Faiz Oranları: Büyük merkez bankalarının faiz politikası trendleri, GHST'nin yatırım cazibesini değiştirebilir.

Teknik Gelişim ve Ekosistem Genişlemesi

- Benimsenme ve Kullanım: GHST'nin ekosistemi içinde benimsenme ve kullanım alanlarının artması, token değerini yükseltebilir.

- Ekosistem Projeleri: GHST tabanlı büyük DApp ve projeler, fiyat performansına katkı sağlar.

III. 2025-2030 GHST Fiyat Tahmini

2025 Öngörüsü

- Temkinli senaryo: 0,3594 $ - 0,4131 $

- Tarafsız senaryo: 0,4131 $ - 0,5000 $

- İyimser senaryo: 0,5000 $ - 0,55769 $ (güçlü piyasa toparlanması ve Aavegotchi'nin yaygınlaşması ile)

2027-2028 Öngörüsü

- Piyasa fazı: Artan oynaklıkla potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,26112 $ - 0,68482 $

- 2028: 0,30615 $ - 0,62407 $

- Başlıca katalizörler: Aavegotchi ekosisteminin genişlemesi, genel kripto sektör eğilimleri ve olası yeni iş ortaklıkları

2030 Uzun Vadeli Öngörü

- Temel senaryo: 0,60641 $ - 0,70343 $ (Aavegotchi'nin istikrarlı büyümesi varsayımıyla)

- İyimser senaryo: 0,70343 $ - 0,80555 $ (Aavegotchi kullanım alanlarının ciddi biçimde artmasıyla)

- Dönüştürücü senaryo: 0,80555 $+ (NFT oyunlarının ana akım haline gelmesi gibi olumlu koşullarda)

- 2030-12-31: GHST 0,65492 $ (ortalama fiyat tahmini)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,55769 | 0,4131 | 0,3594 | 0 |

| 2026 | 0,49995 | 0,48539 | 0,38346 | 17 |

| 2027 | 0,68482 | 0,49267 | 0,26112 | 19 |

| 2028 | 0,62407 | 0,58874 | 0,30615 | 42 |

| 2029 | 0,70343 | 0,60641 | 0,48513 | 46 |

| 2030 | 0,80555 | 0,65492 | 0,57633 | 58 |

IV. GHST Yatırım Stratejileri ve Risk Yönetimi

GHST Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: GameFi ve DeFi alanında uzun vadeli potansiyel arayanlar

- Operasyon önerileri:

- Piyasa düşüşlerinde GHST biriktirin

- Aavegotchi ekosistem etkinliklerine katılarak ek ödüller kazanın

- Tokenları güvenli, saklayıcı olmayan cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını belirlemede kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım ve aşırı satım durumlarını takip edin

- Salınım ticareti için anahtar noktalar:

- GHST'nin genel kripto eğilimleriyle korelasyonunu izleyin

- Aavegotchi proje güncellemeleri ve topluluk etkinliklerine dikkat edin

GHST Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Birden fazla GameFi ve DeFi projesine yatırım yapın

- Zarar durdur emirleri: Kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutma için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama kullanın, güçlü şifrelerle güvenliği artırın ve yazılımları güncel tutun

V. GHST İçin Potansiyel Riskler ve Zorluklar

GHST Piyasa Riskleri

- Oynaklık: Kripto piyasalarında yüksek fiyat dalgalanması

- Likidite: Büyük miktarda alım-satımda zorluk yaşanabilir

- Rekabet: Yeni GameFi projeleri GHST'nin pazar payını azaltabilir

GHST Düzenleyici Riskler

- Belirsiz regülasyonlar: Kripto düzenlemelerinde olası küresel değişiklikler

- Vergi etkileri: Kripto varlıklar ve oyun ödüllerinde değişen vergi mevzuatı

- AML/KYC gereklilikleri: Daha sıkı uyum tedbirleri benimsenmeyi etkileyebilir

GHST Teknik Riskler

- Akıllı kontrat açıkları: Aavegotchi ekosisteminde güvenlik zafiyetleri oluşabilir

- Ölçeklenebilirlik sorunları: Ethereum ağında tıkanıklık kullanıcı deneyimini olumsuz etkileyebilir

- Birlikte çalışabilirlik sorunları: Diğer blokzincirlerle entegrasyonda zorluklar yaşanabilir

VI. Sonuç ve Eylem Önerileri

GHST Yatırım Değeri Analizi

GHST, oyun ve finansı bir araya getiren özgün yapısıyla büyüyen GameFi ve DeFi sektörlerine erişim sunar. Ancak yüksek oynaklık ve düzenleyici belirsizlikler nedeniyle yatırımcıların dikkatli olması gerekmektedir.

GHST Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, Aavegotchi ekosistemini anlamaya odaklanın ✅ Tecrübeli yatırımcılar: GHST'yi diğer kurumsallaşmış kripto varlıklarla dengeli şekilde değerlendirin ✅ Kurumsal yatırımcılar: GHST'yi çeşitlendirilmiş GameFi ve DeFi portföyüne dahil edin

GHST Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com ve büyük borsalarda işlem yapılabilir

- Staking: GHST staking programlarına katılarak ek ödüller elde edin

- Ekosistem katılımı: Aavegotchi oyun ve yönetişim süreçlerinde yer alarak ilave avantajlar kazanın

Kripto para yatırımları yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alamayacağınız miktarda yatırım yapmayınız.

Sıkça Sorulan Sorular

GHST Coin'in maksimum arzı nedir?

GHST Coin'in maksimum arzı 52.747.802 tokendir. Bu nihai limit, Bancor kapanışı sonrası belirlenmiştir.

GHST kripto nedir?

GHST, Aavegotchi blokzincir tabanlı oyunun yönetim tokenıdır. AavegotchiDAO'da oy hakkı sağlar ve ekosistemin ekonomisi ile karar süreçlerinde merkezi rol oynar.

HOT coin 1 $ olur mu?

Mevcut tahminlere göre HOT coin'in yakın dönemde 1 $ seviyesine ulaşması beklenmemektedir. Tahminler, 2029'a kadar en fazla 25 cent civarında zirve yapabileceğine işaret ediyor. Uzun vadeli potansiyel ise halen spekülatif.

GRT için 2025 fiyat tahmini nedir?

Güncel piyasa eğilimlerine göre, The Graph (GRT) için 2025 yılında maksimum fiyat 1,77 $, minimum 1,06 $ olarak öngörülüyor.

2025 SUPER Fiyat Tahmini: Gelişen blockchain ekosisteminde SUPER Token'ın piyasa trendleri ve gelecekteki değerlemesinin analizi

2025 DEGO Fiyat Tahmini: Uzun Vadeli Büyüme Potansiyeli Açısından Temel Faktörler ve Piyasa Trendlerinin Analizi

2025 BMT Fiyat Tahmini: Gelecekteki Piyasa Trendleri ve Yatırım Potansiyeli Analizi

RON ve FLOW: Verimli Veri Serileştirme Yöntemlerinde İki Farklı Yaklaşımın Karşılaştırılması

GAFI ve AVAX: Oyun ve DeFi alanında iki lider Blockchain ekosisteminin karşılaştırmalı analizi

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi