2025 MYRO Fiyat Tahmini: Gelişen Kripto Para Ekosisteminde Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

Giriş: MYRO'nun Piyasadaki Konumu ve Yatırım Potansiyeli

Myro (MYRO), Solana kurucu ortağı Raj Gokal’ın köpeğinden ilham alınarak yaratılan bir meme token olarak kripto para sektöründe dikkat çekmektedir. 2025 yılı itibarıyla MYRO’nun piyasa değeri 20.019.629 dolar seviyesine ulaşmış, dolaşımdaki arzı yaklaşık 999.981.490 adet olup, fiyatı 0,02002 dolar civarında seyretmektedir. Solana’nın Köpek Token’ı unvanıyla bilinen MYRO, Solana blokzincirindeki meme coin ekosisteminde ve topluluk etkileşimlerinde giderek daha önemli bir rol üstlenmektedir.

Bu makale, 2025-2030 döneminde MYRO’nun fiyat eğilimlerini, geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortamla birleştirerek profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunacaktır.

I. MYRO Fiyat Geçmişi ve Güncel Piyasa Durumu

MYRO Fiyat Geçmişinin Evrimi

- 2024: Proje lansmanı, 5 Mart’ta 2,084 dolar ile tüm zamanların en yüksek fiyatına ulaştı

- 2025: Piyasa düzeltmesi, 16 Nisan’da 0,01 dolar ile en düşük seviyeye geriledi

- 2025: Kademeli toparlanma, fiyat şu anda 0,02 dolar civarında dengelendi

MYRO Güncel Piyasa Durumu

5 Ekim 2025 itibarıyla MYRO, 0,02002 dolardan işlem görmektedir ve piyasa değeri 20.019.629 dolardır. Son 24 saatte %3,28 oranında değer kaybeden MYRO, son bir haftada %4,49 artış göstermiştir. Mevcut fiyat geçtiğimiz yıla göre %73,22’lik ciddi bir gerilemeye işaret ederek kripto para piyasasının dalgalı yapısını yansıtmaktadır.

MYRO’nun son 24 saatteki işlem hacmi 448.448 dolardır, bu da orta düzeyde piyasa aktivitesine işaret etmektedir. Dolaşımdaki arzı 999.981.490 MYRO olup, toplam arzın %99,99’u piyasadadır. Bu yüksek dolaşım oranı, neredeyse tüm tokenların aktif olarak piyasada olduğu anlamına gelir ve fiyat dinamiklerini etkileyebilir.

MYRO’da mevcut piyasa hissiyatı temkinli bir iyimserliğe işaret etmektedir; kısa vadeli kazançlar, uzun vadeli kayıplarla dengelenmiştir. Yatırımcıların olası fiyat hareketleri için piyasa eğilimlerini ve proje gelişmelerini yakından izlemeleri önerilir.

Güncel MYRO piyasa fiyatını görmek için tıklayın

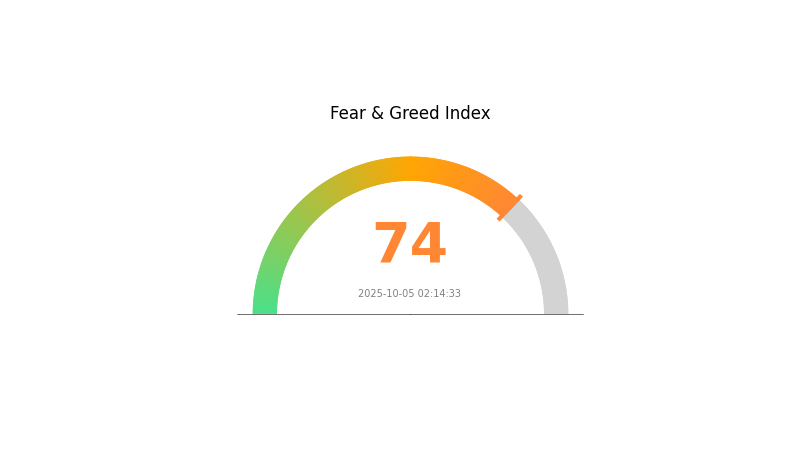

MYRO Piyasa Duyarlılığı Endeksi

05 Ekim 2025 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda açgözlülük öne çıkıyor; Korku ve Açgözlülük Endeksi 74 seviyesinde. Bu, yatırımcıların aşırı iyimser olduğunu ve varlık fiyatlarının şişebileceğini gösteriyor. Coşku yüksek olsa da, dikkatli olunmalı ve ani kararlar verilmemelidir. Tecrübeli yatırımcılar bu dönemleri genellikle kar alma veya olası düzeltmelere hazırlanma fırsatı olarak görür. Her zaman olduğu gibi, çeşitlendirme ve kapsamlı araştırma bu piyasada yol göstericidir.

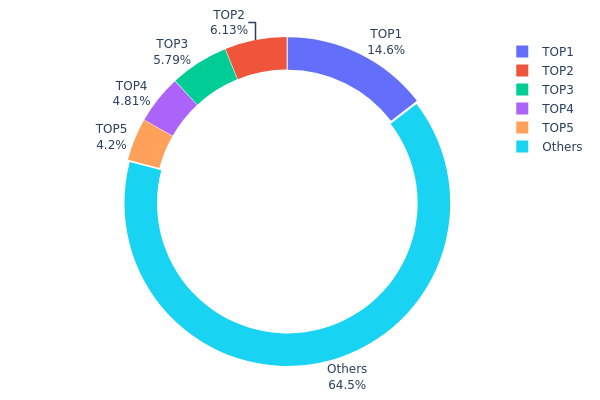

MYRO Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, MYRO tokenlarının farklı cüzdanlarda yoğunlaşmasını göstererek sahiplik yapısındaki merkeziyeti ortaya koyar. Analize göre MYRO sahipliğinde orta düzeyde bir merkezileşme söz konusudur. İlk beş adres toplam arzın %35,48’ini elinde bulundururken, en büyük adresin payı %14,57’dir. Bu yoğunlaşma dikkat çekici olsa da, aşırı merkezileşme endişesi yaratmamaktadır.

Mevcut dağılım, hiçbir yatırımcının çok büyük bir hâkimiyete sahip olmadığı dengeli bir piyasa yapısına işaret eder. Ancak, büyük sahiplerin varlığı, bu adresler yüksek hacimli işlemler yaptığında fiyat oynaklığını artırabilir. Tokenların %64,52’sinin Diğerleri arasında dağılması, piyasa istikrarını destekler ve tek bir büyük yatırımcının fiyat manipülasyonu riskini azaltır.

Genel olarak MYRO’nun varlık dağılımı, büyük paydaşlarla küçük yatırımcılar arasında sağlıklı bir dengeye sahip, kısmen merkeziyetsiz bir ekosistemi yansıtmaktadır. Bu yapı, piyasa dayanıklılığını destekler ve zincir üstü istikrarı gösterir; yine de büyük sahiplerin hareketlerinin dikkatle izlenmesi doğru olacaktır.

Güncel MYRO Varlık Dağılımı için tıklayın

| En Yüksek | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 7cAui6...Lx4xR8 | 145.759,56K | 14,57% |

| 2 | u6PJ8D...ynXq2w | 61.261,87K | 6,12% |

| 3 | HVh6wH...3ekFgt | 57.912,98K | 5,79% |

| 4 | ASTyfS...g7iaJZ | 48.133,87K | 4,81% |

| 5 | A77HEr...oZ4RiR | 41.997,28K | 4,19% |

| - | Diğerleri | 644.896,96K | 64,52% |

II. MYRO’nun Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Piyasa Duyarlılığı: Kripto para piyasasındaki genel hissiyat MYRO’nun fiyatında belirleyici rol oynar.

- Geçmiş Eğilimler: Olumlu haber akışı ve topluluk desteği geçmişte fiyat hareketini tetiklemiştir.

- Güncel Etki: Mevcut piyasa koşulları ve sınırlı topluluk fonları MYRO fiyatını baskılayabilir.

Kurumsal ve Balina Etkisi

- Kurumsal Benimseme: MYRO’nun önde gelen şirketler tarafından benimsenmesi değerini artırabilir.

- Ulusal Politikalar: Kripto piyasasında düzenleyici değişiklikler MYRO’nun gelişimini ve fiyatını etkileyebilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Enflasyonist ortamlarda MYRO’nun performansı fiyatına yansıyabilir.

- Jeopolitik Unsurlar: Uluslararası gelişmeler ve politik olaylar MYRO’nun fiyatında etkili olabilir.

Teknolojik Gelişim ve Ekosistem Büyümesi

- Topluluk Desteği: Aktif ve güçlü bir topluluk, MYRO’nun benimsenmesi ve fiyatının artışı için kritiktir.

- Ekosistem Uygulamaları: MYRO’nun DApp’lere, NFT ticaretine veya oyun varlıklarına entegrasyonu, faydasını ve değerini artırabilir.

- İş Birlikleri: Diğer projeler veya kurumlarla yapılacak ortaklıklar MYRO’nun güvenilirliğini ve potansiyelini artırarak fiyatına etki edebilir.

III. MYRO 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,01241 - 0,01500 dolar

- Tarafsız tahmin: 0,01500 - 0,02001 dolar

- İyimser tahmin: 0,02001 - 0,02641 dolar (olumlu piyasa koşulları gerektirir)

2026-2028 Görünümü

- Piyasa aşaması: Kademeli büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,01416 - 0,03342 dolar

- 2027: 0,02294 - 0,03625 dolar

- 2028: 0,01679 - 0,04649 dolar

- Başlıca katalizörler: Artan benimseme ve olası teknolojik yenilikler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,03938 - 0,04884 dolar (istikrarlı piyasa büyümesi olması durumunda)

- İyimser senaryo: 0,05829 - 0,07033 dolar (güçlü piyasa performansı varsayımıyla)

- Olağanüstü senaryo: 0,07033 doların üzerinde (son derece olumlu koşullarda)

- 31 Aralık 2030: MYRO 0,04884 dolar (potansiyel ortalama fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,02641 | 0,02001 | 0,01241 | 0 |

| 2026 | 0,03342 | 0,02321 | 0,01416 | 15 |

| 2027 | 0,03625 | 0,02832 | 0,02294 | 41 |

| 2028 | 0,04649 | 0,03228 | 0,01679 | 61 |

| 2029 | 0,05829 | 0,03938 | 0,02166 | 96 |

| 2030 | 0,07033 | 0,04884 | 0,04542 | 143 |

IV. MYRO Profesyonel Yatırım Stratejisi ve Risk Yönetimi

MYRO Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli bakış açısına ve yüksek risk toleransına sahip olanlar

- İşlem önerileri:

- Piyasa geri çekilmelerinde MYRO token biriktirin

- Kısmi kar realizasyonu için fiyat hedefleri belirleyin

- Token’ları Solana uyumlu güvenli bir cüzdanda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını belirlemek için

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım koşullarını analiz etmek için

- Dalgalı al-sat için temel noktalar:

- Solana ekosistemindeki gelişmeleri olası fiyat katalizörleri için izleyin

- Aşağı yönlü risk için zarar durdur emirleri belirleyin

MYRO Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-2’si

- Agresif yatırımcılar: Kripto portföyünün %3-5’i

- Profesyonel yatırımcılar: Kripto portföyünün %5-10’u

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: MYRO’yu diğer kripto varlık ve geleneksel yatırımlarla birlikte değerlendirin

- Zarar durdur emirleri: Olası kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Solana tokenlarını destekleyen bir donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifreler ve düzenli yazılım güncellemeleri

V. MYRO’nun Potansiyel Riskleri ve Zorlukları

MYRO Piyasa Riskleri

- Yüksek volatilite: Fiyat büyük dalgalanmalara açık

- Kısıtlı likidite: İşlem hacmi fiyat istikrarını etkileyebilir

- Meme token algısı: Uzun vadeli yatırımcı güvenini azaltabilir

MYRO Düzenleyici Riskler

- Belirsiz mevzuat: Meme token’lere yönelik denetim artabilir

- Uyum zorlukları: Yeni düzenlemelere uyumda güçlük yaşanabilir

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişen yasal statü

MYRO Teknik Riskler

- Solana ağına bağımlılık: Solana platformundaki sorunlar MYRO’yu etkileyebilir

- Akıllı sözleşme açıkları: Token sözleşmesinde istismar ya da hata riski

- Cüzdan desteği: Bazı cüzdanlarda sınırlı destek

VI. Sonuç ve Eylem Önerileri

MYRO Yatırım Potansiyeli Değerlendirmesi

MYRO, Solana ekosisteminde yüksek risk-yüksek getiri fırsatı sunar. Prestijli bir blokzincire bağlı olması avantaj sağlarken, meme token statüsü büyük dalgalanma ve belirsizlik getirir.

MYRO Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Sıkı risk yönetimiyle küçük ve deneme amaçlı pozisyonlar alın ✅ Deneyimli yatırımcılar: Giriş-çıkış noktalarını belirleyerek dengeli strateji uygulayın ✅ Kurumsal yatırımcılar: MYRO’yu çeşitlendirilmiş Solana portföyünde değerlendirin

MYRO Alım-Satım Yöntemleri

- Spot alım-satım: Gate.com ve diğer borsalarda işlem yapılabilir

- Limit emirler: İstenilen fiyat seviyesinde pozisyon almak için kullanılır

- Düzenli küçük alımlar: Ortalama maliyetle zamanlama riskini azaltır

Kripto para yatırımları yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre dikkatli karar vermeli ve profesyonel finans danışmanlarına danışmalıdır. Asla kaybetmeyi göze alamayacağınız miktarda yatırım yapmayın.

Sıkça Sorulan Sorular

MYRO ne kadar yükselebilir?

Mevcut tahminlere göre MYRO 2025’te yaklaşık 0,01 dolar seviyesine ulaşabilir. Daha yüksek rakamlar, sınırlı veri nedeniyle kesin değildir.

MYRO’nun geleceği var mı?

Evet, MYRO geleceğe dair potansiyel göstermektedir. Tahminler, 2028’de 0,023637 dolara ulaşabileceğini ve %15,76 büyüme oranı yakalayabileceğini öngörüyor. Ancak kripto piyasası oldukça dalgalı olduğu için dikkatli analiz gereklidir.

Monero 1.000 dolara ulaşabilir mi?

Mevcut piyasa eğilimleri ve uzun vadeli tahminlere göre Monero 2036’da 1.000 dolara ulaşabilir.

MYRO coin’in tüm zamanların en yüksek fiyatı nedir?

MYRO coin’in zirve fiyatı 0,44654 dolardır; belirli bir tarihte elde edilmiştir. Şu anda fiyatı bu seviyenin oldukça altındadır.

2025 POPCAT Fiyat Tahmini: Dijital Kedi Ekonomisinde Gelecek Piyasa Trendleri ve Yatırım Potansiyelinin Değerlendirilmesi

2025 BOME Fiyat Tahmini: Dalgalı Ekonomide Piyasa Trendleri ve Yatırım Fırsatlarında Yol Almak

2025 PNUT Fiyat Tahmini: Gelişen Dijital Varlık Ekosisteminde Büyüme Potansiyeli ve Piyasa Dinamiklerini Değerlendirme

XAI gork (GORK) iyi bir yatırım mı?: Açıklanabilir Yapay Zeka pazarında GORK Tokenlarının potansiyelini ve risklerini analiz etmek

dogwifhat (WIF) iyi bir yatırım mı?: Son dönemin en popüler meme coin’inin potansiyeli ve riskleri üzerine değerlendirme

2025 PUNDU Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Kripto Dolandırıcılıklarını Tespit Etmeye Yönelik Meme Rehberi: Tespit ve Önleme Araçları

Zincirler Arası Varlık Transferini Kolaylaştırın: Polygon Network için Kapsamlı Rehber

Sanal Araziye Yatırımın Kapsamlı Rehberi

En İyi DeFi Yield Farming Stratejileriyle Getirileri Maksimuma Çıkarma Rehberi

EIP 4337'yi Anlamak: Hesap Soyutlamasına Kapsamlı Bir Rehber