2025 NS Fiyat Tahmini: Nintendo Switch’in Gelecek Yıldaki Piyasa Trendleri ve Büyüme Tahminleri

Giriş: NS'nin Piyasadaki Konumu ve Yatırım Potansiyeli

SuiNS (NS), blokzincir ekosistemi için dijital kimlik çözümü olarak, blokzincir teknolojisiyle etkileşimi kolaylaştırmada giderek daha önemli bir rol üstleniyor. 2025 yılı itibarıyla SuiNS'in piyasa değeri 21.928.654 $'a ulaşırken, yaklaşık 155.302.085 token dolaşımda ve fiyatı 0,1412 $ seviyesinde bulunuyor. "Dijital kimlik kolaylaştırıcısı" olarak adlandırılan bu varlık, dijital kimlik yönetimi ve blokzincirler arası uyumluluk alanında kayda değer katkılar sunuyor.

Bu makalede, SuiNS'in 2025-2030 dönemindeki fiyat eğilimleri; tarihsel desenler, piyasa arz-talebi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı biçimde analiz edilecek, yatırımcılara profesyonel fiyat tahminleri ve uygulamaya yönelik yatırım stratejileri sunulacaktır.

I. NS Fiyat Geçmişi ve Mevcut Piyasa Durumu

NS Fiyatının Tarihsel Gelişim Süreci

- 2024: İlk çıkış, fiyat 0,06 $ ile 1,1936 $ aralığında dalgalandı

- 2025: Piyasa dengelendi, fiyat 0,1412 $ civarında sabitlendi

NS Güncel Piyasa Durumu

5 Ekim 2025 tarihinde NS 0,1412 $ seviyesinden işlem görüyor. Token, son 24 saatte %1,4'lük yükseliş kaydederken, işlem hacmi 198.117,20 $ oldu. NS, son 30 gün içinde %13 değer kazanarak kısa vadede olumlu bir trend sergiledi. Ancak, son bir yılda fiyat %80,027 oranında gerileyerek uzun vadede ciddi bir düşüş yaşadı.

NS'nin mevcut piyasa değeri 21.928.654,41 $ ve küresel kripto piyasasında 1.051. sırada yer alıyor. 500.000.000 toplam arzın 155.302.085,076389 NS tokeni dolaşımda; dolaşım oranı ise %31,06.

NS'nin tüm zamanların en yüksek fiyatı 14 Kasım 2024'te 1,1936 $ olarak kaydedildi, aynı gün 0,06 $ ile en düşük seviyeye de ulaşıldı; bu da lansman sürecinin oldukça oynak geçtiğini gösteriyor. Projenin tamamen seyreltilmiş değeri 70.600.000,00 $ olup, tüm tokenler dolaşıma girdiğinde büyüme potansiyelinin yüksek olduğunu gösteriyor.

NS'nin güncel piyasa fiyatını görüntüleyin

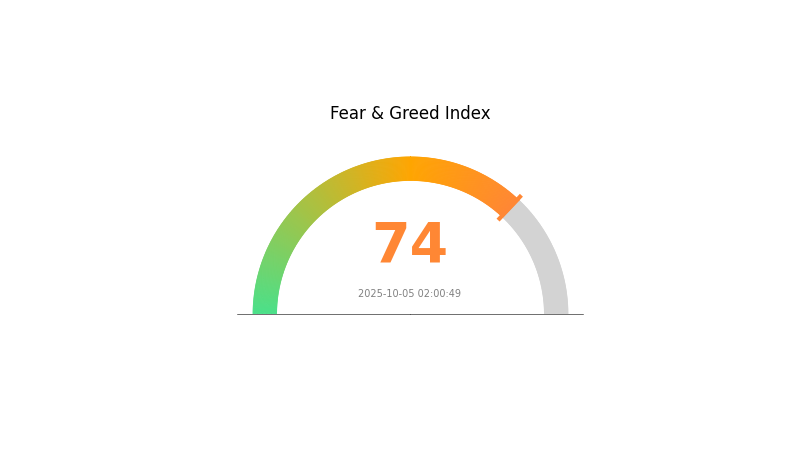

NS Piyasa Duyarlılık Endeksi

05 Ekim 2025 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Korku & Açgözlülük Endeksini görüntüleyin

Kripto piyasasında aşırı iyimserlik hâkim; Korku ve Açgözlülük Endeksi 74 seviyesinde. Bu durum yatırımcılar arasında belirgin bir "Açgözlülük" eğilimine işaret ediyor. Yükseliş dönemlerinde heyecan artsa da temkinli olmak şart. Açgözlülüğün yüksek olduğu dönemler genellikle piyasa düzeltmelerinden önce görülür. Gate.com'daki deneyimli yatırımcılar kâr almayı veya zarar-durdur emirleriyle risk yönetimini düşünmelidir. Unutmayın, duyarlılık hızla değişebilir; piyasayı yakından takip ederek bilinçli işlemler gerçekleştirin.

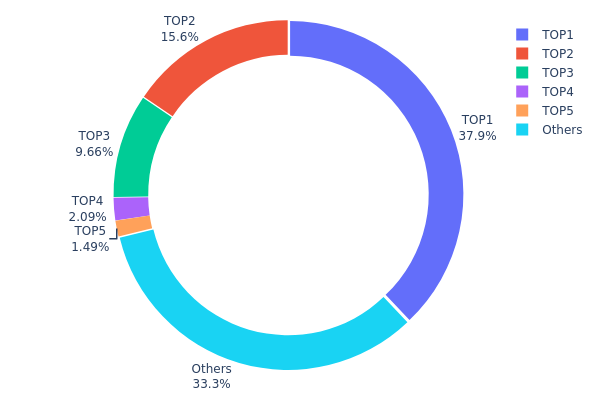

NS Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, NS tokenlerinin farklı adreslerdeki yoğunlaşmasına dair önemli bilgiler sunar. Analiz sonucu NS token varlıklarında yüksek merkezileşme görülmektedir. En büyük adres toplam tokenlerin %37,90'ını elinde tutarken, ilk beş adresin kontrolü toplam arzın %66,69'una ulaşmaktadır.

Tokenlerin büyük kısmının az sayıda adreste toplanması, piyasa manipülasyonu ve fiyat dalgalanması riskini artırıyor. Bu üst sahiplerin etkisi, ani büyük işlemlerle piyasa dinamiklerini değiştirebilir; ayrıca yönetişim ve tokenin kullanım alanı üzerinde etkili olabilirler.

Merkezileşmeye rağmen tokenlerin %33,31'i diğer adresler arasında dağılmış durumda, bu da daha geniş katılımı gösteriyor. Ancak mevcut dağılım, merkeziyetsizlik seviyesinin düşük olduğunu ortaya koyuyor; bu durum uzun vadede istikrarı ve benimsenmeyi etkileyebilir. Dağılımdaki değişimi izlemek, NS'nin zincir üstü yapısının ve piyasa olgunluğunun gelişimini değerlendirmek için kritik önem taşır.

NS Varlık Dağılımını görüntüleyin

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x2ba3...7206fe | 189.509,57K | 37,90% |

| 2 | 0x2893...2c6d07 | 77.897,74K | 15,57% |

| 3 | 0x8495...4b1342 | 48.288,72K | 9,65% |

| 4 | 0x60dd...b0984d | 10.473,63K | 2,09% |

| 5 | 0x45dc...ced046 | 7.432,68K | 1,48% |

| - | Diğerleri | 166.397,65K | 33,31% |

II. NS'nin Gelecekteki Fiyatını Belirleyen Temel Unsurlar

Makroekonomik Faktörler

-

Para Politikası Etkisi: Özellikle ABD Merkez Bankası başta olmak üzere büyük merkez bankalarının faiz politikaları NS fiyatını doğrudan etkileyecektir. Eylül ayında olası faiz indirimleri için piyasa yakından izleniyor.

-

Enflasyona Karşı Koruma: Altın ve NS, enflasyon ortamında değer koruma aracı olarak güçlü performans sergiliyor. Yatırımcılar, mevcut enflasyonist koşullarda bu varlıklara daha fazla yöneliyor.

-

Jeopolitik Unsurlar: Özellikle Orta Doğu'daki süregelen gerilimler, risk priminin artmasına ve NS gibi güvenli liman varlıklara olan talebin yükselmesine neden oluyor.

Kurumsal ve Büyük Oyuncu Davranışları

-

Kurumsal Varlıklar: Küresel merkez bankalarının 2025'te 1.000 tondan fazla altın alması bekleniyor; bu, üst üste dördüncü yıl büyük birikim anlamına geliyor. Bu eğilim, NS üzerinde uzun vadeli yükseliş beklentisi için sağlam bir zemin oluşturuyor.

-

Ulusal Politikalar: Çeşitli ülkeler, güvenli liman varlıklara talebi etkileyen politikalar uygulayarak NS fiyatını dolaylı olarak etkileyebilir.

Teknik Gelişim ve Ekosistem Güçlenmesi

- Piyasa Duyarlılığı: ABD tahvil piyasasında baskı olsa da ABD hisse senedi piyasasının durağanlığı, yatırımcıların tam anlamıyla riskten kaçışa yönelmediğini gösteriyor. Buna karşın NS'nin güvenli liman olarak cazibesi artıyor.

III. 2025-2030 Dönemi İçin NS Fiyat Tahmini

2025 Öngörüsü

- İhtiyatlı tahmin: 0,08722 $ - 0,14068 $

- Tarafsız tahmin: 0,14068 $ - 0,15123 $

- İyimser tahmin: 0,15123 $ - 0,16178 $ (olumlu piyasa ortamı ve artan benimseme ile)

2027 Orta Vadeli Öngörü

- Piyasa aşaması: Artan benimseme ile potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,10284 $ - 0,19811 $

- 2027: 0,15022 $ - 0,22009 $

- Kritik tetikleyiciler: Genel kripto piyasası eğilimleri ve NS'ye özgü gelişmeler

2030 Uzun Vadeli Öngörü

- Temel senaryo: 0,19331 $ - 0,2974 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,2974 $ - 0,33606 $ (olumlu koşullar ve yükselen NS kullanımı ile)

- Dönüştürücü senaryo: 0,33606 $ - 0,35301 $ (NS teknolojisinde önemli atılım ve yaygın benimseme ile)

- 31 Aralık 2030: NS 0,33606 $ (uzun vadeli projeksiyona göre potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,16178 | 0,14068 | 0,08722 | 0 |

| 2026 | 0,19811 | 0,15123 | 0,10284 | 7 |

| 2027 | 0,22009 | 0,17467 | 0,15022 | 23 |

| 2028 | 0,2862 | 0,19738 | 0,1283 | 39 |

| 2029 | 0,35301 | 0,24179 | 0,23454 | 71 |

| 2030 | 0,33606 | 0,2974 | 0,19331 | 110 |

IV. NS için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

NS Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı: Uzun vadeli hedefleri olan, risk toleransı yüksek kişiler

- İşlem önerileri:

- Piyasa düzeltmelerinde NS biriktirin

- Kısmi kâr için fiyat hedefleri belirleyin

- Tokenleri güvenli, kişisel cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve pozisyon belirlemede kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım-satım durumunu tespit eder

- Kısa vadeli al-sat için önemli noktalar:

- SuiNS ekosistemindeki gelişmeleri izleyin

- Zarar-durdur emirleriyle riski yönetin

NS Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Orta düzey yatırımcılar: %3-5 arası

- Aggresif yatırımcılar: %5-10 arası

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Varlıkları farklı blokzincir projelerine dağıtın

- Düzenli alım yöntemi: Küçük tutarlarla düzenli yatırım yaparak zamanlama riskini azaltın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk saklama: Donanım cüzdanı ile uzun vadeli tutum

- Güvenlik tedbirleri: İki faktörlü doğrulama ve güçlü şifre kullanımı

V. NS için Potansiyel Riskler ve Zorluklar

NS Piyasa Riskleri

- Yüksek oynaklık: NS fiyatında ciddi dalgalanmalar olabilir

- Düşük likidite: Büyük işlemlerin gerçekleştirilmesinde zorluk yaşanabilir

- Rekabet: Diğer blokzincir isimlendirme sistemleri NS'nin benimsenmesini etkileyebilir

NS Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Olumsuz düzenlemeler riski

- Sınır ötesi uyumluluk: Farklı ülkelerde değişen yasal statü

- KYC/AML gereklilikleri: NS token işlemleri ve kullanımı üzerinde etki yaratabilir

NS Teknik Riskler

- Akıllı sözleşme açıkları: İstismar veya hata olasılığı

- Ölçeklenebilirlik sorunları: Benimseme arttıkça ağ tıkanıklığı riski

- Entegrasyon sorunları: Diğer blokzincir ekosistemleriyle uyumsuzluk

VI. Sonuç ve Eylem Önerileri

NS'nin Yatırım Potansiyeli Değerlendirmesi

NS, Sui ekosistemi için dijital kimlik çözümü olarak uzun vadede değer potansiyeli taşır. Ancak yatırımcılar, kısa vadeli oynaklık ve projenin erken aşama risklerine dikkat etmelidir.

NS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla adım atın, SuiNS ekosistemini öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Uzun vadeli tutum ve stratejik alım-satımı dengeli şekilde uygulayın ✅ Kurumsal yatırımcılar: Detaylı inceleme yaparak NS'yi çeşitlendirilmiş blokzincir portföyüne dahil etmeyi değerlendirin

NS İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com'da NS token alıp satabilirsiniz

- Stake etme: Pasif gelir için staking programlarına katılın (mevcutsa)

- Ekosistem katılımı: SuiNS uygulamalarında aktif olarak yer alıp pratik deneyim kazanın

Kripto para yatırımları son derece yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre dikkatli kararlar vermeli ve profesyonel finans danışmanlarına danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

Hamster Kombat Coin 1 $'a ulaşır mı?

Hamster Kombat'ın fiyatı ciddi oranda yükselse de 1 $'a ulaşması kesin değil. Mevcut eğilimler potansiyel gösteriyor fakat piyasa oynaklığı da yüksek.

Nano Nuclear Energy'nin 2025 yılı için hisse fiyatı tahmini nedir?

Güncel piyasa analizlerine göre, Nano Nuclear Energy'nin 2025'teki hisse fiyatı 39,29 $ ile 76,69 $ aralığında tahmin edilmektedir.

Bir meme coin 1 $'a ulaşabilir mi?

Evet, bir meme coin teorik olarak 1 $'a ulaşabilir. Nadir olsa da doğru piyasa koşulları, topluluk desteği ve yaygınlaşma ile mümkündür. Ancak meme coin'ler aşırı oynak ve öngörülemezdir.

Secret Network için 2030 fiyat tahmini nedir?

Mevcut tahminlere göre Secret Network (SCRT) fiyatının 2030'da 4,17 $'a ulaşması ve %705 getiri potansiyeli sunması bekleniyor.

Web3 Alfa Kripto: 2025 için En İyi Yatırım Stratejileri

2025'te BDT'nin CAD'ye dönüşüm oranı ve Web3 ticaret seçenekleri

2025 Web3 Rezerv Fonu Mekanizması: Proje Yönetimi ve Risk Kontrolü

Gate Web3 Alfa: 2025 Yılında Yatırım Fırsatları ve Gelişim Trendlerinin Analizi

Warren Buffett'in 2025'te Web3 ve Kripto Para Üzerine Vizyonu

SRP Fiyat Anlamı: Önerilen Perakende Fiyatı Gerçekten Nedir

Avalanche Ağı’na Varlık Transferini Güvenle Yapma Rehberi

MemeFi İçgörüleri: Günlük Kazançlar ve Token Fiyatlandırmasının Temel Noktaları

Ethereum Staking Rehberi: On-Chain ETH Getiri Stratejileri ve Minimum Katılım Koşulları Karşılaştırması

Gate Vault: Kendine Ait Çok Zincirli Varlıklar İçin Yeni Bir Güvenlik Benchmark'ı Belirliyor