2025 OCTA Fiyat Tahmini: Dijital Varlık Sektöründe Piyasa Eğilimleri ve Büyüme Potansiyelinin Analizi

Giriş: OCTA'nın Piyasa Konumu ve Yatırım Potansiyeli

OctaSpace (OCTA), merkeziyetsiz hesaplama hizmetleri sunan bir platform olarak, DePIN (Merkeziyetsiz Fiziksel Altyapı Ağları) ekosisteminde başlangıcından bu yana önemli bir konuma sahiptir. 2025 yılı itibarıyla OCTA'nın piyasa değeri 21.413.066 $'ya ulaşırken, dolaşımdaki token miktarı yaklaşık 40.732.482 adettir ve fiyatı 0,5257 $ civarındadır. DePIN ekosisteminde önde gelen varlık olarak anılan OCTA, merkeziyetsiz hesaplama kaynakları ile yenilikçi çözümler sunmada giderek daha önemli bir rol üstlenmektedir.

Bu analizde, OCTA'nın 2025 ile 2030 yılları arasında fiyat hareketleri detaylı şekilde incelenecek; tarihsel gelişmeler, arz-talep dengesi, ekosistem büyümesi ve makroekonomik koşullar bir arada ele alınarak yatırımcılar için uzman fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. OCTA Fiyat Geçmişi ve Güncel Piyasa Durumu

OCTA'nın Tarihsel Fiyat Seyri

- 2024: Proje başlangıcı, fiyat 0,1745 $'dan işlem görmeye başladı

- 2024: 29 Eylül'de tüm zamanların en yüksek seviyesi olan 1,9758 $'a çıktı

- 2025: Yüksek volatiliteyle fiyat 0,5257 $'a geriledi

OCTA Güncel Piyasa Tablosu

5 Ekim 2025 tarihi itibarıyla OCTA fiyatı 0,5257 $, 24 saatlik işlem hacmi ise 65.163,43 $ seviyesindedir. Son 24 saatte %3,29 oranında değer kaybetmiştir. OCTA'nın piyasa değeri 21.413.066 $ olup, kripto para piyasasında 1.062. sıradadır.

Token son dönemde ciddi fiyat dalgalanmaları göstermiştir. Son bir yılda %68,53 değer kaybetmesine rağmen, son 7 günde %28,93 ve son 30 günde %12,57 oranında yükselerek güçlü kısa vadeli performans sergilemiştir.

OCTA'nın mevcut fiyatı, 29 Eylül 2024'te ulaşılan 1,9758 $'lık zirvenin oldukça altındadır. Ancak, 15 Eylül 2024'teki 0,1 $'lık dip seviyesinin belirgin şekilde üzerindedir.

Dolaşımdaki OCTA miktarı 40.732.482,62 token olup, toplam arzın %84,86'sını (48.000.000 token) oluşturmaktadır. Bu yüksek dolaşım oranı, token sahipleri arasında sağlıklı bir dağılıma işaret eder.

Güncel OCTA piyasa fiyatını incelemek için tıklayın

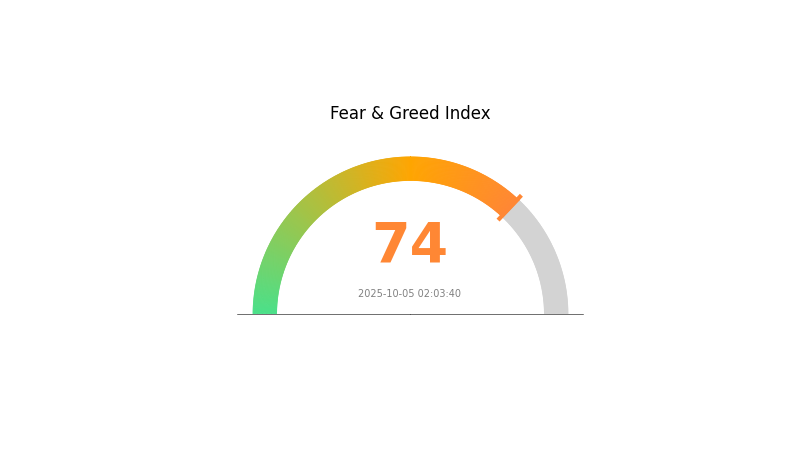

OCTA Piyasa Duyarlılığı Endeksi

2025-10-05 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksi'ni görüntülemek için tıklayın

Korku ve Açgözlülük Endeksi değeri yüksek (74). Bu, yatırımcıların iyimserliğinin arttığını ve varlıkların fazla değerlenmiş olabileceğini gösteriyor. Böyle bir coşku kısa vadede fiyatları yukarı çekse de, temkinli yaklaşmak önemlidir. Tarihsel olarak aşırı açgözlülük, genellikle piyasa düzeltmelerinden önce görülür. Yatırımcılar portföylerini çeşitlendirmeli ve kazançları korumak için zarar-durdur emirleri kullanmalıdır. Her zaman kapsamlı araştırma yapmak ve dengeli bir strateji izlemek bu koşullarda kritik önemdedir.

OCTA Varlık Dağılımı

OCTA'nın adres bazlı varlık dağılımı verileri sahiplik yapısında dikkat çekici bir desen gösteriyor. Ancak mevcut tablo boş olduğu için ayrıntılı analiz yapılamıyor. Yine de bu verilerin token'ın piyasa dinamiklerini anlamada neden önemli olduğunu vurgulayabiliriz.

Adres varlık dağılımı, tokenların blokzincir üzerindeki adresler arasında nasıl dağıldığını gösterir. Sağlıklı ve merkeziyetsiz bir ekosistemde, tokenların birçok adrese yayılmış olması beklenir; az sayıda cüzdanda yoğunlaşması ise risk oluşturabilir.

Veri olmadığı için OCTA’nın mevcut yoğunlaşma düzeyini veya olası manipülasyon riskini değerlendirmek mümkün değil. Dağılımın geniş olması piyasa istikrarı ve direnç için olumlu iken, yoğunlaşmanın fazla olduğu bir yapı fiyat oynaklığı ve ani satış riskini artırır.

Güncel OCTA Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. OCTA'nın Gelecek Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Staking Ödülleri: Staking ödüllerindeki artış beklentisi, daha fazla yatırımcıyı çekerek OCTA'nın gelecekteki değerini etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Yeni Özellik Geliştirme: OctaSpace platformunda yeni özelliklerin hayata geçirilmesi, OCTA token fiyatını yukarı çekebilir.

- Ekosistem Büyümesi: OctaSpace ekosisteminin başarısı, OCTA token fiyatında artışa yol açabilir.

Makroekonomik Faktörler

- Para Politikası Etkisi: Makroekonomik gelişmeler, OCTA gibi kripto paraların kısa vadeli piyasa hareketlerinde belirleyici olur.

- Düzenleyici Unsurlar: Düzenleyici gelişmeler, kripto piyasasının ve OCTA'nın kısa vadeli yönünü şekillendirir.

III. 2025-2030 Dönemi için OCTA Fiyat Öngörüleri

2025 Beklentisi

- Temkinli tahmin: 0,29954 $ - 0,5255 $

- Tarafsız tahmin: 0,5255 $ - 0,55178 $

- İyimser tahmin: 0,55178 $ - 0,63021 $ (olumlu piyasa duyarlılığı koşuluyla)

2027-2028 Beklentisi

- Piyasa evresi: Olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,41494 $ - 0,87079 $

- 2028: 0,6694 $ - 0,77126 $

- Temel katalizörler: Artan kullanım ve teknolojik yenilikler

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,74943 $ - 0,91056 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 1,07169 $ - 1,23836 $ (güçlü piyasa performansı ile)

- Olağanüstü piyasa koşulları senaryosu: 1,23836 $ - 1,50000 $ (olağanüstü piyasa koşulları ve yaygın benimsenme halinde)

- 2030-12-31: OCTA 1,23836 $ (olası zirve fiyatı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,55178 | 0,5255 | 0,29954 | 0 |

| 2026 | 0,63021 | 0,53864 | 0,37705 | 2 |

| 2027 | 0,87079 | 0,58442 | 0,41494 | 11 |

| 2028 | 0,77126 | 0,72761 | 0,6694 | 38 |

| 2029 | 1,07169 | 0,74943 | 0,68198 | 42 |

| 2030 | 1,23836 | 0,91056 | 0,82861 | 73 |

IV. OCTA Profesyonel Yatırım Stratejileri ve Risk Yönetimi

OCTA Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Hedef yatırımcı: Merkeziyetsiz hesaplama ekosistemine inanan uzun vadeli yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde OCTA biriktirin

- Kısa vadeli dalgalanmayı aşmak için en az 1-2 yıl boyunca tutun

- Kendi kontrolünüzde olan (non-custodial) cüzdanda tokenları muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve al/sat sinyallerini tespit etmek için kullanılır

- RSI: Aşırı alım/aşırı satım durumunu ölçmek için

- Swing trade için önemli noktalar:

- OctaSpace proje gelişmelerini ve piyasa duyarlılığını takip edin

- Zarar-durdur ve kar al seviyelerini net olarak belirleyin

OCTA Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Orta seviye yatırımcılar: Kripto portföyünün %3-5'i

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı birden fazla DePIN projesine dağıtın

- Zarar-durdur emirleri: Olası kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk cüzdan: Uzun vadeli depolama için donanım cüzdanı

- Güvenlik tedbirleri: İki faktörlü kimlik doğrulama ve güçlü şifre kullanımı

V. OCTA İçin Potansiyel Riskler ve Zorluklar

OCTA Piyasa Riskleri

- Yüksek volatilite: Kripto piyasalarında ani fiyat hareketleri sıklıkla görülür

- Rekabet: Diğer DePIN projeleri güçlü rakipler olarak öne çıkabilir

- Likidite riski: Düşük işlem hacmi fiyat istikrarını etkileyebilir

OCTA Düzenleyici Riskleri

- Belirsiz düzenleyici ortam: Kripto para mevzuatı küresel ölçekte sürekli değişmektedir

- Uyum zorlukları: Yeni düzenlemelere uyum sağlamakta yaşanabilecek sorunlar

- Jeopolitik etkiler: Hükümet politikalarındaki değişiklikler benimsenmeyi etkileyebilir

OCTA Teknik Riskler

- Akıllı sözleşme açıkları: Blokzincir kodunda suistimal riski

- Ölçeklenebilirlik sorunları: Kullanıcı sayısı arttıkça ağ tıkanıklığı yaşanabilir

- Teknolojik eskime: Hızlı yenilikler OctaSpace teknolojisinin geride kalmasına neden olabilir

VI. Sonuç ve Eylem Önerileri

OCTA Yatırım Potansiyeli Değerlendirmesi

OctaSpace (OCTA), merkeziyetsiz hesaplama sektöründe güçlü bir uzun vadeli yatırım potansiyeline sahiptir. Ancak yatırımcıların kısa vadeli volatilite ve düzenleyici risklere karşı hazırlıklı olması gerekmektedir.

OCTA Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Düzenli ve düşük miktarda yatırımlarla pozisyon oluşturun ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ve stratejik alım-satım yöntemlerini bir arada değerlendirin ✅ Kurumsal yatırımcılar: Detaylı analiz ve büyük alımlar için OTC kanallarını tercih edin

OCTA Alım-Satım Katılım Yöntemleri

- Spot işlemler: Gate.com'da OCTA alım-satımı yapın

- Staking: Ek kazançlar için varsa staking programlarına katılın

- DeFi entegrasyonu: OCTA için merkeziyetsiz finans imkanlarını değerlendirin

Kripto para yatırımları son derece yüksek risk taşır; bu metin yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlara danışmalıdır. Asla kaybedebileceğinizden fazlasını yatırmayın.

SSS

2025'te hangi meme coin yükselişe geçecek? Fiyat tahmini nedir?

BONK'ın 2025'te fiyatında artış yaşaması bekleniyor; bu öngörü internet kültürü ve topluluk ilgisine dayanıyor. Potansiyel büyüme, meme coinlerin geçmiş trendlerine bağlı olarak değerlendirilmektedir.

OCTA fiyatı nedir?

OCTA'nın güncel fiyatı 2025-10-05 itibarıyla 0,48 $; geçen hafta 0,42 $ iken %14 artış göstermiştir.

OctaSpace coin değeri nedir?

2025-10-05 tarihi itibarıyla OctaSpace coin 0,48 $ değerindedir ve piyasa değeri 18.850.000 $'dır.

2030 için XRP fiyat tahmini nedir?

XRP'nin 2030 yılında 4,67 $ ile 26,97 $ aralığında olacağı öngörülmektedir. Bu tahmin, benimsenme, düzenleyici gelişmeler ve piyasa koşullarına bağlıdır. Kurumsal kullanım ve düzenleyici onayın güçlü olması, potansiyel fiyat artışının anahtarıdır.

2025 NATIX Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 LUNC Fiyat Tahmini: Terra Luna Classic’in Çöküş Sonrası Dönemde Potansiyel Toparlanma ve Piyasa Görünümünün Analizi

2025 HTX Fiyat Tahmini: Dijital Varlık Borsası Token’ı Üzerine Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 HBAR Fiyat Tahmini: Hedera Hashgraph, Kripto Piyasasında Yeni Zirvelere Ulaşabilir mi?

2025 CFX Fiyat Tahmini: Conflux Network İçin Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 LTC Fiyat Tahmini: Litecoin’in Piyasa Trendleri ve Olası Büyüme Dinamiklerinin Analizi

Bitcoin Marjin İşlemleri: Yeni Başlayanlar İçin Rehber

Wise Monkey Token’a Dair Kapsamlı Rehber & Yeni Yatırımcılar için Geleceğe Yönelik Fiyat Analizleri

Kripto Para Ticareti İçin Yeni Başlayanlar Rehberi

Kripto Korunma Teknikleri Hakkında Yeni Başlayanlar İçin Rehber

2024 yılında incelemeniz gereken önde gelen Avalanche DApp'leri ve projeleri