2025 OMG Fiyat Tahmini: Gelişen Kripto Ekosisteminde Token'ın Piyasa Trendleri ve Gelecek Potansiyelinin Değerlendirilmesi

Giriş: OMG’nin Piyasadaki Konumu ve Yatırım Potansiyeli

OmiseGo (OMG), Ethereum altyapısına sahip bir halka açık finans teknolojisi olarak, 2013’ten bu yana blokzincir ekosisteminde önemli bir aktör konumundadır. 2025 yılı itibarıyla OMG’nin piyasa değeri 21.515.046 dolara, dolaşımdaki arzı yaklaşık 140.245.398 tokene ulaşmış, fiyatı ise 0,15341 dolar seviyesinde sabitlenmiştir. “Blokzincir dünyasının Alipay’i” olarak anılan bu varlık, merkeziyetsiz ödeme çözümleri ve finansal hizmetler sunma noktasında giderek daha büyük bir rol üstlenmektedir.

Bu makalede, OMG’nin 2025-2030 yıllarındaki fiyat hareketleri; geçmiş fiyat trendleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında profesyonel tahmin ve yatırım stratejileriyle kapsamlı biçimde ele alınacaktır.

I. OMG Fiyat Geçmişi ve Güncel Piyasa Durumu

OMG Fiyatının Tarihsel Gelişimi

- 2017: ICO’nun başlamasıyla fiyat 0,24 dolardan 20 doların üzerine çıktı

- 2018: Boğa piyasası zirvesinde, 13 Ocak’ta tüm zamanların en yüksek seviyesi olan 25,62 dolara ulaştı

- 2022-2025: Uzun süren ayı piyasasıyla fiyat 5 dolardan bugünkü 0,15 dolar seviyesine geriledi

OMG Güncel Piyasa Görünümü

5 Ekim 2025 tarihinde OMG 0,15341 dolardan işlem görüyor; bu, tüm zamanların en yüksek seviyesine kıyasla %99,4’lük bir değer kaybına işaret ediyor. Token’ın piyasa değeri 21.515.046 dolar olup, küresel kripto para sıralamasında 1.059’uncu sırada yer alıyor. Son 24 saatte OMG’nin değeri %2,66 azaldı, işlem hacmi ise 79.448 dolar olarak gerçekleşti. Mevcut fiyat, 26 Eylül 2025’te kaydedilen tüm zamanların en düşük seviyesi olan 0,146866 doların yalnızca %4,5 üzerine çıkabilmiş durumda. Yıl başından bu yana performans %39,78 kayıp göstererek token üzerinde süregelen ayı baskısını ortaya koyuyor.

Güncel OMG piyasa fiyatını görmek için tıklayın

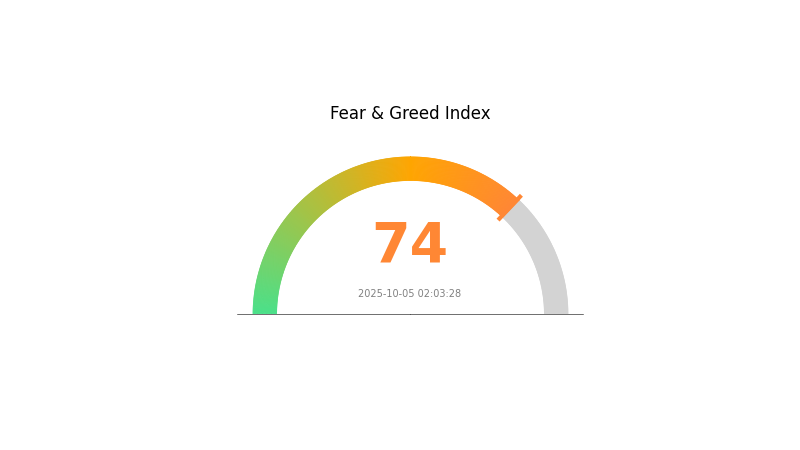

OMG Piyasa Duyarlılığı Endeksi

2025-10-05 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında Korku ve Açgözlülük Endeksi’nin 74 puana ulaşmasıyla beraber heyecan zirveye taşındı. Bu güçlü açgözlülük ortamı, yatırımcıların hızlı kazanç beklentisini artırıyor. Ancak deneyimli yatırımcılar aşırı açgözlülüğün varlıkların şişmesine ve volatilitenin yükselmesine yol açabileceğini bilir. FOMO etkisiyle hareket etmekten kaçınmak ve temkinli kalmak önemlidir. Portföyünüzü çeşitlendirin, zarar durdur emirleriyle riskinizi yönetin. Her daim kendi araştırmanızı yapın ve Gate.com’da kontrollü işlem gerçekleştirin.

OMG Varlık Dağılımı

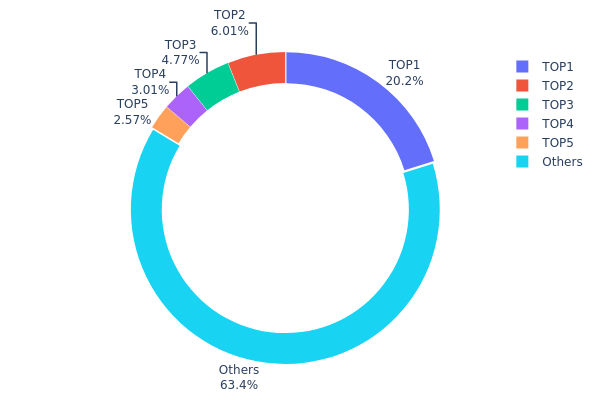

Adres bazlı varlık dağılımı verileri, OMG tokenlerinin cüzdan adresleri arasındaki yoğunlaşmayı gösteriyor. En büyük adres, tüm OMG tokenlerinin %20,21’ini elinde bulundururken, izleyen dört adresin her biri %2,56 ile %6 arasında token tutarak toplamda arzın %16,32’sini oluşturuyor.

Bu dağılım, ilk 5 adresin toplamda %36,53 OMG tokeni kontrol ettiği orta düzeyde bir yoğunlaşmaya işaret ediyor. Yoğunlaşma dikkat çekici olsa da aşırı merkezileşme anlamına gelmiyor; tokenlerin %63,47’si diğer adreslere dağılmış durumda. Ancak en büyük adresin yüksek varlığı, fiyat ve piyasa dinamiklerinde etkili olabilir.

Mevcut yapı, büyük yatırımcılarla geniş bir küçük yatırımcı kitlesi arasında bir denge olduğunu gösteriyor. Bu, piyasada tek bir varlığın (en büyük adres hariç) baskın olmadığı, dolayısıyla istikrarı destekleyebileceği anlamına geliyor. Fakat en büyük adreslerdeki hareketler, OMG’nin fiyatı ve likiditesi üzerinde belirleyici olabilir.

Güncel OMG Varlık Dağılımı için tıklayın

| Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x76ec...78fbd3 | 28.347,41K | 20,21% |

| 2 | 0xc368...816880 | 8.427,78K | 6,00% |

| 3 | 0x3727...866be8 | 6.684,72K | 4,76% |

| 4 | 0x0b2f...052eb9 | 4.214,86K | 3,00% |

| 5 | 0xf89d...5eaa40 | 3.600,88K | 2,56% |

| - | Diğerleri | 88.969,75K | 63,47% |

II. OMG’nin Gelecek Fiyatını Etkileyen Temel Unsurlar

Piyasa Dinamikleri

- Piyasa Dalgalanması: Kripto para olan OMG’nin fiyatı; piyasa duyarlılığı, regülasyonlar ve küresel ekonomik gelişmelerden yoğun şekilde etkilenir.

- Tarihsel Eğilimler: Fiyat dalgalanmaları belirgin olup, genel kripto piyasası trendleriyle uyumludur.

- Güncel Etki: Yatırımcılar, OMG’nin volatil yapısını yatırım kararlarında göz önünde bulundurmalıdır.

Makroekonomik Ortam

- Düzenleyici Politikalar: Sanal varlıklara ilişkin mevzuat, OMG’nin performansı ve geleceği üzerinde doğrudan etkiye sahiptir.

- Küresel Ekonomik Koşullar: Genel ekonomik gidişat, olası durgunluk veya büyüme gibi faktörler OMG’nin fiyatını etkileyebilir.

- Jeopolitik Unsurlar: Uluslararası ilişkiler ve ticaret gerilimleri, OMG gibi kripto paralara yönelik yatırımcı duyarlılığını etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: OMG ağında DApp ve ekosistem projelerinin geliştirilmesi, benimsenmeyi ve fiyatı olumlu etkileyebilir.

- Teknik Güncellemeler: OMG ağında yapılacak önemli yükseltmeler, piyasa performansında etkili olabilir.

III. 2025-2030 OMG Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,12258 - 0,14000 dolar

- Tarafsız tahmin: 0,14000 - 0,17000 dolar

- İyimser tahmin: 0,17000 - 0,20226 dolar (olumlu piyasa ve artan benimseme halinde)

2027-2028 Görünümü

- Piyasa fazı: Artan volatilite ile büyüme beklentisi

- Fiyat aralığı:

- 2027: 0,17164 - 0,27964 dolar

- 2028: 0,22444 - 0,31185 dolar

- Temel katalizörler: Teknik gelişmeler, DeFi sektöründe yaygın kullanım

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,27405 - 0,28501 dolar (istikrarlı büyüme varsayımıyla)

- İyimser senaryo: 0,28501 - 0,29641 dolar (güçlü boğa piyasası halinde)

- Dönüştürücü senaryo: 0,29641 - 0,32000 dolar (inovasyon ve yaygın benimseme durumunda)

- 2030-12-31: OMG 0,28501 dolar (istikrarlı büyüme potansiyeli)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0,20226 | 0,15323 | 0,12258 | 0 |

| 2026 | 0,20796 | 0,17775 | 0,14575 | 16 |

| 2027 | 0,27964 | 0,19286 | 0,17164 | 26 |

| 2028 | 0,31185 | 0,23625 | 0,22444 | 54 |

| 2029 | 0,29597 | 0,27405 | 0,2576 | 79 |

| 2030 | 0,29641 | 0,28501 | 0,23086 | 86 |

IV. OMG için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

OMG Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profil: Uzun vadeli ve yüksek risk toleransına sahip yatırımcılar

- Operasyonel öneriler:

- Piyasa düşüşlerinde OMG biriktirin

- Kısmi kar almak için fiyat hedefleri belirleyin

- Tokenleri güvenli donanım cüzdanında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve giriş/çıkış noktalarını belirlemek için kullanılır

- RSI: Aşırı alım ve aşırı satım seviyelerini takip edin

- Kısa vadeli al-sat için önemli noktalar:

- OMG’nin genel kripto piyasasıyla korelasyonunu izleyin

- Zarar durdur emirleriyle riski yönetin

OMG Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Kriterleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Agresif yatırımcı: Kripto portföyünün %5-8’i

- Profesyonel yatırımcı: Kripto portföyünün %10-15’i

(2) Riskten Koruma Çözümleri

- Çeşitlendirme: Yatırımı farklı kripto paralara yaymak

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için kullanılır

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulamayı aktif edin, güçlü şifreler kullanın

V. OMG için Potansiyel Riskler ve Zorluklar

OMG Piyasa Riskleri

- Yüksek volatilite: Kripto piyasalarında sık görülen sert fiyat dalgalanmaları

- Likidite riski: Büyük işlemlerin fiyat üzerinde olumsuz etkisi olabilmesi

- Korelasyon riski: OMG, genel piyasa duyarlılığından etkilenebilir

OMG Düzenleyici Riskler

- Belirsiz regülasyon ortamı: OMG üzerinde sıkı mevzuat olasılığı

- Sınır ötesi işlem kısıtları: Uluslararası transferlerde olası engeller

- Vergi etkisi: Değişen vergi mevzuatı OMG yatırımlarına yansıyabilir

OMG Teknik Riskler

- Akıllı kontrat açıkları: Kodda istismar olasılığı

- Ölçeklenebilirlik sorunları: Yoğun talepte ağ tıkanıklığı yaşanabilir

- Rekabet baskısı: Yeni ve daha gelişmiş blokzincir çözümleriyle rekabet

VI. Sonuç ve Eylem Önerileri

OMG Yatırım Değerinin Değerlendirilmesi

OMG, merkeziyetsiz finans alanında fırsatlar sunmakla birlikte, yoğun rekabet ve regülasyon belirsizliğiyle karşı karşıya. Uzun vadeli değer potansiyeli spekülatif, kısa vadeli volatilite ise hem fırsat hem de risk barındırıyor.

OMG Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kripto portföyünüzde küçük ve çeşitlendirilmiş OMG pozisyonlarını değerlendirin ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle ortalama maliyetle alım stratejisi kullanın ✅ Kurumsal yatırımcılar: Detaylı analiz yaparak OMG’yi çeşitlendirilmiş portföy kapsamında ele alın

OMG İşlem Yöntemleri

- Spot alım-satım: Gate.com spot piyasasında OMG alıp satın

- Staking: Uygunsa OMG staking programlarına katılım

- DeFi entegrasyonu: OMG token kullanan merkeziyetsiz finans uygulamalarını araştırın

Kripto para yatırımları çok yüksek risk taşır; bu makale yatırım tavsiyesi niteliği taşımamaktadır. Yatırımcılar, kendi risk profillerine göre temkinli hareket etmeli, gerekirse profesyonel danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

Sıkça Sorulan Sorular

2030’da OMG için fiyat tahmini nedir?

Tarihsel analizlere göre, 2030’da OMG fiyatının yaklaşık 48,61 dolara ulaşması beklenmektedir.

OMG’nin hedef fiyatı nedir?

Güncel tahminlere göre OMG için hedef fiyat 1,75 dolar olup, mevcut fiyatına göre ortalama %38,89 artış potansiyeli sunmaktadır.

OMG coin yükselecek mi?

Mevcut trendler doğrultusunda, OMG coin’in değer kazanması bekleniyor. Analistler, 2023 yılında 5,25 dolara ulaşabileceğini ve önümüzdeki yıllarda önceki zirvesini aşabileceğini öngörmektedir.

OMG Network uzun vadede iyi bir yatırım mı?

Evet, OMG Network uzun vadeli büyüme için potansiyel sunuyor. Ölçeklenebilirlik çözümleri ve merkeziyetsiz finans odaklı yaklaşımı, gelişen kripto piyasasında yaygınlaşma ve değer kazanımı açısından avantaj sağlıyor.

2025 EUL Fiyat Tahmini: DeFi Ekosisteminde Euler Finance Token’a Yönelik Piyasa Analizi ve Gelecek Trendleri

2025 EDGE Fiyat Tahmini: Büyüme Potansiyeli Analizi ve Gelecekteki Değeri Etkileyen Piyasa Faktörleri

2025 BENQI Fiyat Tahmini: DeFi Protokolü İçin Piyasa Trendleri ve Gelecek Değerleme Analizi

2025 ASTER Fiyat Tahmini: Yükselen Kripto Para Birimi İçin Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 MORPHO Fiyat Tahmini: DeFi Tokenı için Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 TOKEN Fiyat Tahmini: Piyasa Eğilimleri ve Yaklaşan Boğa Sezonunda Büyüme Potansiyelinin İncelenmesi

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi