2025 PROPC Price Prediction: Market Analysis and Future Projections for Property Coin in the Evolving Cryptocurrency Landscape

Introduction: PROPC's Market Position and Investment Value

Propchain (PROPC), as a blockchain-powered ecosystem transforming real estate finance, has been addressing inefficiencies in the industry since its inception in 2023. As of 2025, PROPC's market capitalization has reached $20,174,561, with a circulating supply of approximately 42,490,652 tokens, and a price hovering around $0.4748. This asset, dubbed the "Real Estate DeFi Innovator," is playing an increasingly crucial role in bridging traditional finance with the digital asset world.

This article will comprehensively analyze PROPC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide professional price predictions and practical investment strategies for investors.

I. PROPC Price History Review and Current Market Status

PROPC Historical Price Evolution

- 2024: PROPC reached its all-time high of $1.77 on December 19, marking a significant milestone for the project.

- 2025: The market experienced a downturn, with PROPC hitting its all-time low of $0.2809 on July 7.

- 2025: Current market cycle shows signs of recovery, with the price rebounding from its low point.

PROPC Current Market Situation

As of October 5, 2025, PROPC is trading at $0.4748, representing a 24-hour decrease of 7.89%. The token has shown mixed performance across different timeframes, with a significant 21.92% increase over the past week, despite a 2.73% decline in the last 30 days. The current price is still 73.17% below its all-time high, indicating potential room for growth. With a market capitalization of $20,174,561 and a circulating supply of 42,490,652 PROPC, the token ranks 1099th in the cryptocurrency market. The 24-hour trading volume stands at $41,145, suggesting moderate market activity.

Click to view the current PROPC market price

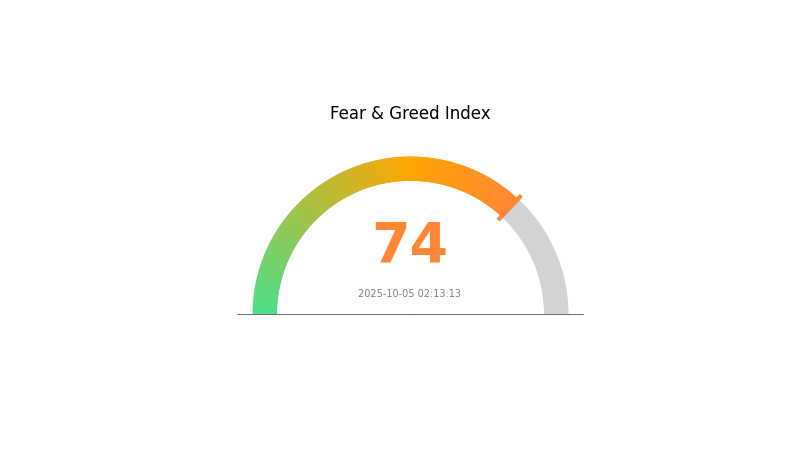

PROPC Market Sentiment Indicator

2025-10-05 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a strong bullish sentiment, with the Fear and Greed Index reaching 74, indicating "Greed." This suggests that investors are optimistic and potentially overconfident. While this can drive prices higher in the short term, it's essential to remain cautious. Historically, extreme greed has often preceded market corrections. Traders should consider taking profits or implementing risk management strategies. As always, diversification and thorough research are crucial in navigating these volatile market conditions.

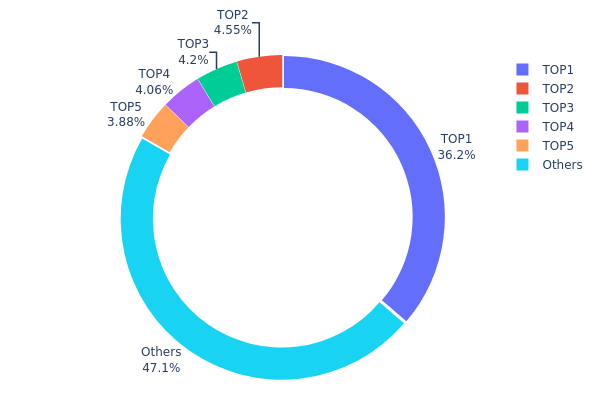

PROPC Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of PROPC tokens across different addresses. Notably, the top address, likely a burn address (0x0000...00dead), holds 36.23% of the total supply, indicating a significant portion has been removed from circulation. The next four largest holders collectively account for 16.66% of the supply, with individual holdings ranging from 3.87% to 4.54%.

This distribution pattern suggests a moderate level of concentration among top holders, excluding the burn address. While not excessively centralized, the presence of several addresses holding over 3% each could potentially influence market dynamics. The fact that 47.11% of tokens are distributed among "Others" indicates a degree of wider distribution, which may contribute to market stability and reduce the risk of price manipulation by individual large holders.

Overall, this distribution reflects a balanced ecosystem with a significant burn component and a mix of larger stakeholders and smaller holders. This structure could foster a relatively stable market environment, though vigilance regarding the actions of top holders remains prudent for assessing potential market impacts.

Click to view the current PROPC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 36236.66K | 36.23% |

| 2 | 0xb091...76afc9 | 4545.78K | 4.54% |

| 3 | 0x4b41...f16e79 | 4198.69K | 4.19% |

| 4 | 0x96de...7e81b3 | 4061.64K | 4.06% |

| 5 | 0x3cc9...aecf18 | 3876.10K | 3.87% |

| - | Others | 47081.12K | 47.11% |

II. Key Factors Affecting PROPC's Future Price

Market Sentiment

- Investor Confidence: The sentiment and confidence of investors have a direct impact on PROPC's price trajectory.

- Historical Pattern: Market trends show that investing in assets that have undergone significant corrections may yield substantial returns.

- Current Impact: Time sensitivity and limited opportunities are crucial factors that could affect future returns.

Macroeconomic Environment

- Economic Trends: Macroeconomic trends play a significant role in influencing PROPC's exchange rates against fiat currencies.

- Regulatory Impact: Government policies and regulations directly affect the market acceptance of cryptocurrencies, thereby determining their value relative to fiat currencies like the US dollar.

- Geopolitical Factors: Events outside the cryptocurrency sphere, including macroeconomic and regulatory factors, are important in determining short-term market directions.

Technical Development and Ecosystem Building

- Technological Innovation: Ongoing technological advancements contribute to price fluctuations and future prospects of PROPC.

- Market Adaptation: The ability to quickly respond to market changes is crucial for predicting future price trends and adjusting investment strategies accordingly.

III. PROPC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.29 - $0.40

- Neutral prediction: $0.40 - $0.55

- Optimistic prediction: $0.55 - $0.65 (requires favorable market conditions)

2026-2028 Outlook

- Market stage expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.38 - $0.70

- 2027: $0.51 - $0.72

- 2028: $0.60 - $0.93

- Key catalysts: Increased adoption, technological advancements, and market maturation

2029-2030 Long-term Outlook

- Base scenario: $0.80 - $0.90 (assuming steady market growth)

- Optimistic scenario: $0.90 - $1.14 (assuming strong market performance)

- Transformative scenario: $1.14+ (under extremely favorable conditions)

- 2030-12-31: PROPC $0.83 (potential year-end average)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.65384 | 0.4738 | 0.29376 | 0 |

| 2026 | 0.69914 | 0.56382 | 0.38904 | 18 |

| 2027 | 0.71989 | 0.63148 | 0.5115 | 32 |

| 2028 | 0.93244 | 0.67568 | 0.60136 | 42 |

| 2029 | 0.86035 | 0.80406 | 0.7317 | 69 |

| 2030 | 1.14012 | 0.83221 | 0.7157 | 75 |

IV. Professional Investment Strategies and Risk Management for PROPC

PROPC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a long-term outlook on real estate technology

- Operational suggestions:

- Accumulate PROPC tokens during market dips

- Stake tokens for potential rewards and to support network security

- Store tokens in secure, non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor real estate market news for potential impact on PROPC

- Set strict stop-loss and take-profit levels

PROPC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various real estate-related tokens

- Options strategies: Consider using options to protect against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for active trading

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for PROPC

PROPC Market Risks

- Volatility: High price fluctuations common in crypto markets

- Liquidity: Potential challenges in buying/selling large amounts

- Correlation: May be affected by overall crypto market sentiment

PROPC Regulatory Risks

- Uncertain regulations: Potential for new laws affecting tokenized real estate

- Cross-border complications: Varying regulatory approaches in different countries

- Compliance costs: Potential increase in operational expenses due to regulations

PROPC Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability issues: Possible network congestion during high demand

- Interoperability challenges: Integration difficulties with traditional systems

VI. Conclusion and Action Recommendations

PROPC Investment Value Assessment

PROPC offers potential long-term value in revolutionizing real estate finance, but faces short-term risks from market volatility and regulatory uncertainties.

PROPC Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Explore strategic partnerships and large-scale tokenization projects

PROPC Trading Participation Methods

- Spot trading: Buy and sell PROPC tokens on Gate.com

- Staking: Participate in potential staking programs for passive income

- DeFi integration: Explore decentralized finance protocols supporting PROPC

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is propc crypto?

PROPC is an ERC-20 token on Ethereum, ranked #771 on CoinMarketCap. It aims to enhance blockchain interoperability.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction at $120,286, followed by Chainlink at $62.60.

What will be the price of pi in 2025?

Based on current trends, Pi's price in October 2025 is expected to be around $0.256. However, for sustained growth, it needs to break above $0.299.

What is the prediction for prosper?

Prosper is predicted to reach $0.2015 by 2025 and potentially hit $9.61 by 2026, based on current market trends and projections.

Share

Content