2025 SKYA Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Değerlendirilmesi

Giriş: SKYA'nın Pazar Konumu ve Yatırım Potansiyeli

Topluluk odaklı bir video oyun şirketi olan Sekuya (SKYA), kuruluşundan bu yana oyun dünyasında yenilikçi dönüşümlere imza atmaktadır. 2025 yılı itibarıyla SKYA'nın piyasa değeri 1.097.545 $ seviyesine ulaşmıştır; dolaşımdaki token miktarı yaklaşık 403.212.732,75 olup, fiyatı ise 0,002722 $ civarında seyretmektedir. "Topluluk odaklı yaklaşımı" ile öne çıkan bu varlık, anime ağırlıklı fantastik oyun evreninde giderek daha belirleyici bir rol üstleniyor.

Bu makalede, 2025-2030 dönemi için SKYA'nın fiyat hareketleri; tarihsel eğilimler, piyasa arz ve talebi, ekosistem gelişimi ile makroekonomik etkenler ışığında kapsamlı biçimde analiz edilerek yatırımcılara profesyonel fiyat öngörüleri ve uygulamaya dönük yatırım stratejileri aktarılacaktır.

I. SKYA Fiyat Geçmişi İncelemesi ve Güncel Piyasa Durumu

SKYA Tarihsel Fiyat Değişim Süreci

- 2024: İlk çıkış; 16 Aralık'ta fiyat 0,085964 $ ile tüm zamanların en yüksek seviyesine (ATH) ulaştı

- 2024: Piyasa düzeltmesi; 19 Eylül'de fiyat 0,00215 $ ile tüm zamanların en düşük seviyesine (ATL) geriledi

- 2025: Konsolidasyon dönemi; fiyat, destek ve direnç noktaları arasında dalgalanıyor

SKYA Güncel Piyasa Görünümü

29 Ekim 2025 itibarıyla SKYA, 0,002722 $ seviyesinden işlem görüyor. Son 24 saatte token %3,5 değer kaybederken, işlem hacmi 36.355,07 $ olarak gerçekleşti. SKYA'nın piyasa değeri 1.097.545,06 $ olup, küresel kripto para piyasasında 2771. sırada bulunuyor.

Fiyat farklı zaman dilimlerinde karmaşık bir grafik çiziyor. Son bir hafta içinde %2,68 artış yaşanırken, son 30 gün ve yıl bazında sırasıyla %28,51 ve %11,17 oranında önemli düşüşler yaşandı. Mevcut fiyat seviyesi, tüm zamanların zirvesinden büyük bir kayba işaret ediyor ve SKYA için zorlu bir piyasa ortamı doğuruyor.

Toplam arzı 1.000.000.000 olan SKYA'da, dolaşımdaki miktar 403.212.732,75 ile %40,32 dolaşım oranına karşılık geliyor. Tam seyreltilmiş piyasa değeri 2.722.000 $ olup, piyasa koşullarının iyileşmesi halinde büyüme potansiyeli barındırıyor.

Güncel SKYA piyasa fiyatı için tıklayın

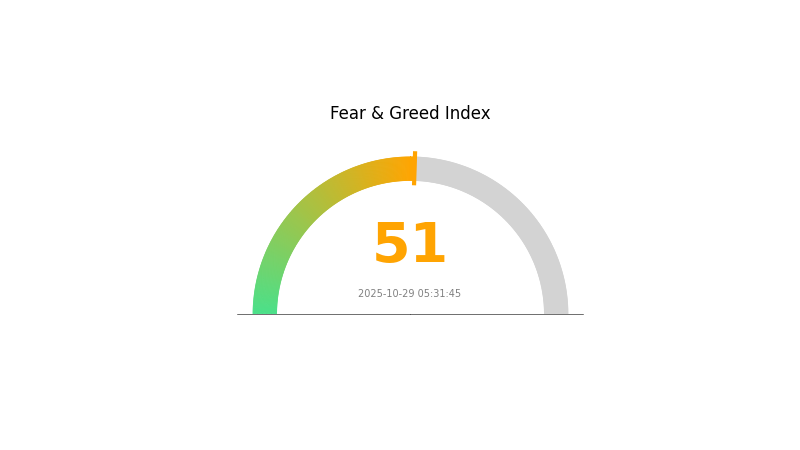

SKYA Piyasa Duyarlılık Endeksi

2025-10-29 Korku ve Açgözlülük Endeksi: 51 (Nötr)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasası şu anda nötr seviyede ve Korku & Açgözlülük Endeksi 51'e işaret ediyor. Bu dengeli görünüm, yatırımcıların ne aşırı korkulu ne de aşırı açgözlü olduğunu gösteriyor. Yatırımcılar için strateji ve portföy dağılımını yeniden gözden geçirmek için elverişli bir dönem. Piyasa istikrarlı görünse de olası hareketlere karşı dikkatli olmak ve gelişmeleri yakından takip etmek önemlidir. Her zaman detaylı araştırma yapmak ve volatil kripto piyasasında ihtiyatlı adımlar atmak tavsiye edilir.

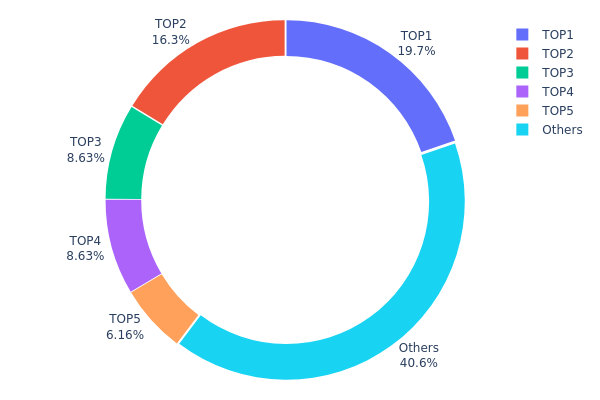

SKYA Varlık Dağılımı

SKYA adres varlık dağılımı, en büyük sahipler arasında belirgin bir yoğunlaşma gösteriyor. En büyük adres toplam arzın %19,71'ine sahipken, ilk beş adres birlikte SKYA tokenlarının %59,41'ini kontrol ediyor. Bu yüksek yoğunlaşma, piyasa dinamiklerinde merkezi bir sahiplik yapısının etkili olabileceğine işaret ediyor.

Böyle bir dağılım modeli, piyasa manipülasyonu ve fiyat oynaklığı açısından endişe yaratıyor. Tokenların yaklaşık %60'ının sadece beş adreste toplanmış olması, bu cüzdanlardan gerçekleşecek büyük işlem hareketlerinin SKYA fiyatını ciddi şekilde etkileyebileceği anlamına geliyor. Aynı zamanda, yönetişim süreçlerinde az sayıda adresin büyük oy gücüne sahip olması projenin merkeziyetsizlik hedeflerini zora sokabilir.

Tokenların %40,59'u diğer adreslere dağılmış durumda. Yine de mevcut sahiplik yapısı, merkeziyetsizlik oranının düşük olduğunu gösteriyor. Bu yoğunlaşma, piyasa istikrarı açısından risk oluşturabilir ve "balina" etkisinden endişe eden yatırımcılar açısından caydırıcı olabilir. Büyük sahiplerin kimliği ve amaçları kesin olarak bilinmese de, bu varlıklar projeye uzun vadeli bağlılık da gösterebilir.

Güncel SKYA Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0x277b...e5186c | 160.000,00K | 19,71% |

| 2 | 0x7c90...288a40 | 132.285,50K | 16,30% |

| 3 | 0x3dc9...0fa240 | 70.000,00K | 8,62% |

| 4 | 0x6486...6fd8d8 | 70.000,00K | 8,62% |

| 5 | 0x5063...77512e | 50.000,00K | 6,16% |

| - | Diğerleri | 329.139,56K | 40,59% |

II. SKYA'nın Gelecek Fiyatını Etkileyen Temel Faktörler

Teknik Gelişim ve Ekosistem Oluşumu

- Merkeziyetsiz Bulut Depolama: SKYA, merkeziyetsiz bulut depolama çözümü olarak konumlanıyor ve bu alana olan talep arttıkça fiyat üzerinde ciddi etki yaratabilir.

- Ekosistem Uygulamaları: SKYA'nın merkeziyetsiz finans ekosisteminde Dai ve USDS gibi yaygın stabilcoinler yer alıyor. Bu bileşenlerin benimsenmesi ve performansı SKYA fiyatı üzerinde belirleyici olabilir.

Makroekonomik Koşullar

- Piyasa Duyarlılığı: Kripto piyasasının genel durumu ve psikolojik etkenler (korku, açgözlülük vb.) SKYA fiyatında önemli dalgalanmalara yol açabilir.

- Jeopolitik Faktörler: Hükümet politikalarındaki belirsizlikler ve riskten kaçınma eğilimi, SKYA dahil kripto para fiyatlarını etkileyebilir.

III. 2025-2030 SKYA Fiyat Tahmini

2025 Beklentisi

- Temkinli tahmin: 0,00185 $ - 0,00273 $

- Nötr tahmin: 0,00273 $ - 0,00302 $

- İyimser tahmin: 0,00302 $ - 0,00332 $ (pozitif piyasa duyarlılığı ve proje gelişmeleriyle)

2027-2028 Beklentisi

- Piyasa evresi: Benimsenmenin arttığı büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,00214 $ - 0,00439 $

- 2028: 0,00277 $ - 0,00448 $

- Ana katalizörler: Teknolojik yenilikler, kullanım alanlarının genişlemesi ve genel kripto piyasası trendleri

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,00419 $ - 0,00465 $ (istikrarlı piyasa büyümesi ve proje gelişimiyle)

- İyimser senaryo: 0,00511 $ - 0,00618 $ (ekosistemin önemli genişlemesi ve piyasa benimsenmesiyle)

- Dönüştürücü senaryo: 0,00618 $ - 0,00700 $ (çığır açan yenilikler ve ana akım entegrasyonla)

- 2030-12-31: SKYA 0,00618 $ (potansiyel zirve, piyasa dinamiklerine bağlı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,00332 | 0,00273 | 0,00185 | 0 |

| 2026 | 0,00378 | 0,00302 | 0,00221 | 11 |

| 2027 | 0,00439 | 0,0034 | 0,00214 | 25 |

| 2028 | 0,00448 | 0,0039 | 0,00277 | 43 |

| 2029 | 0,00511 | 0,00419 | 0,0039 | 53 |

| 2030 | 0,00618 | 0,00465 | 0,00279 | 70 |

IV. SKYA Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SKYA Yatırım Stratejisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygunluk: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde SKYA token biriktirin

- En az 1-2 yıl tutarak piyasa dalgalanmalarını karşılayın

- Tokenları güvenli donanım cüzdanında saklayın

(2) Aktif Alım Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend yönünü ve olası dönüş noktalarını tespit etmek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım veya aşırı satım bölgelerini belirlemede yardımcı olur

- Swing trading için ana noktalar:

- Teknik göstergelere göre net giriş ve çıkış noktaları belirleyin

- Risk yönetimi için zarar-durdur emirleri kullanın

SKYA Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-2'si

- Agresif yatırımcılar: Kripto portföyünün %3-5'i

- Profesyonel yatırımcılar: Kripto portföyünün %5-10'u

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Varlıkları birden fazla kripto para ve farklı varlık sınıflarına dağıtın

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama çözümü: Uzun vadeli saklama için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki faktörlü doğrulama aktif edin, güçlü şifreler kullanın ve özel anahtarları asla paylaşmayın

V. SKYA için Potansiyel Riskler ve Zorluklar

SKYA Piyasa Riskleri

- Yüksek oynaklık: Fiyat ciddi dalgalanmalar gösterebilir

- Düşük likidite: Az hacim, kayma ve büyük işlemlerde zorluk yaratabilir

- Piyasa duyarlılığı: Genel kripto piyasası algısı SKYA fiyatını etkileyebilir

SKYA Düzenleyici Riskler

- Belirsiz düzenleyici çerçeve: Düzenlemelerdeki olası değişiklikler SKYA'nın faaliyetlerini etkileyebilir

- Uyum zorlukları: Değişen global regülasyonlara uyum sağlamak kolay olmayabilir

- Hukuki statü: SKYA'nın farklı ülkelerdeki yasal durumu farklılık gösterebilir

SKYA Teknik Riskler

- Akıllı sözleşme açıkları: Temel akıllı sözleşmede güvenlik zaafları oluşabilir

- Ağ tıkanıklığı: Yoğun zamanlarda yüksek işlem ücretleri ve yavaş onay süreleri

- Teknolojik eskime: Yeni teknolojiler SKYA platformunun rekabetçiliğini azaltabilir

VI. Sonuç ve Eylem Tavsiyeleri

SKYA Yatırım Değeri Değerlendirmesi

SKYA, oyun ve kripto para sektöründe yüksek riskli ve yüksek potansiyelli bir yatırım olanağı sunuyor. Yenilikçi özellikler ile topluluk merkezli gelişim vadetse de; yatırımcılar, piyasadaki volatilite ve düzenleyici belirsizliklerin farkında olmalı.

SKYA Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Portföyünüzde yalnızca küçük bir pay ayırın veya hiç dahil etmeyin, önceliğinizi eğitime verin ✅ Deneyimli yatırımcılar: Çeşitlendirilmiş portföyde küçük bir pozisyon düşünebilirler ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapmalı ve SKYA'yı spekülatif, yüksek riskli bir varlık olarak değerlendirmelidir

SKYA Alım Satıma Katılım Yöntemleri

- Spot alım satım: Gate.com üzerinden SKYA token alıp satabilirsiniz

- Staking: Varsa staking programlarına katılarak pasif gelir elde edebilirsiniz

- DeFi entegrasyonu: SKYA token ile merkeziyetsiz finans seçeneklerini keşfedebilirsiniz

Kripto para yatırımları son derece yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre karar vermeli, profesyonel finans danışmanlarına başvurmalıdır. Kaybetmeyi göze alamayacağınız tutardan fazlasını asla yatırım yapmayın.

SSS

Siacoin 1 dolara ulaşabilir mi?

Mümkün olsa da, Siacoin'in kısa vadede 1 $ seviyesine çıkması oldukça düşük ihtimal. Mevcut fiyat ve piyasa trendleri, yakın dönemde bu büyüklükte bir artışı desteklemiyor.

SLP coin 1 $'a ulaşır mı?

SLP'nin 1 $'a ulaşabilmesi için tokenların %90'ının yakılması gerekir. Bu, mevcut fiyattan 628,93 kat artış demektir. Tahminler bunun 2030'a kadar gerçekleşebileceğini belirtiyor.

Solana 2025'te 1000 $ seviyesine çıkar mı?

Mevcut piyasa trendleri ve Solana'nın büyüme potansiyeline bakılırsa, 2025'e kadar 1000 $ seviyesine ulaşması mümkün ancak kesinlik yok. Benimsenme ve teknolojik ilerlemeler gibi faktörler belirleyici olacak.

SKYA Crypto nedir?

SKYA, Sekuya ekosisteminin yerel token'ıdır ve ağ genelinde işlem, ödül ve yönetişim mekanizmalarında kullanılır.

League of Traders (LOT) iyi bir yatırım mı?: Bu kripto oyun platformunun potansiyeli ve risklerinin analizi

VICE ve ENJ: Medyanın Geleceğini Şekillendiren İki Dijital İçerik Platformunun Karşılaştırılması

GameBuild (GAME2) iyi bir yatırım mı?: Bu oyun kripto para biriminin potansiyelini ve risklerini değerlendiriyoruz

Versus-X (VSX) yatırım için uygun mu?: Bu Yeni Kripto Paranın Potansiyeli ve Riskleri Üzerine Analiz

2025 MNRY Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Immortal Rising 2 (IMT) iyi bir yatırım mı?: Bu yeni ortaya çıkan kripto varlığın potansiyelini ve risklerini analiz etmek

Tagger (TAG) iyi bir yatırım mı?: Piyasa Potansiyeli, Risk Faktörleri ve Gelecekteki Büyüme Olanaklarının Kapsamlı Analizi

Polymesh (POLYX) iyi bir yatırım mı?: Blockchain platformunun potansiyeli ve risk faktörlerine dair kapsamlı bir analiz

SoSoValue (SOSO) iyi bir yatırım mı?: Fiyat Potansiyeli, Riskler ve Piyasa Görünümüne Dair Kapsamlı Bir Analiz

GIGGLE vs QNT: Kripto Piyasasında Öne Çıkan İki Yeni Blockchain Token’ının Kapsamlı Karşılaştırması

USELESS vs XLM: Birbirine Zıt İki Kripto Para Projesinin Kapsamlı Karşılaştırması