2025 UPrice Tahminleri: Dünya Genelinde Kentsel Gayrimenkul Piyasası Trendlerine Dair Kapsamlı Analiz ve Öngörü

Giriş: U'nun Piyasa Konumu ve Yatırım Değeri

Union (U), zk birlikte çalışabilirlik alanının öncü L1 blokzinciri olarak, kuruluşundan bu yana protokoller ve varlık ihraççıları için mutabakat ve likidite katmanı rolünü üstlenmiştir. 2025 yılı itibarıyla Union'ın piyasa değeri 19.992.662,9 $’a ulaşırken, dolaşımdaki arzı yaklaşık 1.919.050.000 token ve fiyatı 0,010418 $ seviyesinde seyretmektedir. “Zincirler arası gelecek sağlayıcısı” olarak tanımlanan bu varlık, blokzincir birlikte çalışabilirliği alanında gittikçe daha stratejik bir konuma sahip olmaktadır.

Bu makalede, Union’ın 2025-2030 dönemindeki fiyat hareketleri; tarihsel desenler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik unsurlar bütününde detaylı şekilde ele alınacak, yatırımcılara profesyonel fiyat tahminleri ile uygulamaya dönük yatırım stratejileri sunulacaktır.

I. U Fiyat Geçmişi ve Mevcut Piyasa Durumu

U Tarihsel Fiyat Gelişimi

- 2025: U, 4 Eylül’de 0,03651 $ ile tüm zamanların en yüksek değerine ulaştı

- 2025: U, aynı tarihte 0,0082 $ ile en düşük seviyesini gördü

U Mevcut Piyasa Durumu

5 Ekim 2025 itibarıyla U, 0,010418 $ seviyesinde işlem görmektedir. Token, son dönemlerde aşağı yönlü hareket sergilemiştir:

- Son 24 saatte U %3,11 oranında geriledi

- Son 7 günde %0,79 değer kaybetti

- Son 30 günde U, %10,19’luk bir düşüş yaşadı

- Yıl başından bu yana performansı %38,95’lik kayda değer bir azalma göstermektedir

U'nun mevcut piyasa değeri 19.992.662,9 $ olup, genel kripto para piyasasında 1.103. sıradadır. 24 saatlik işlem hacmi ise 1.213.260,957202 $’dır ve bu rakam orta seviyede piyasa faaliyetine işaret etmektedir.

U'nun dolaşımdaki arzı 1.919.050.000 token olup, toplam arzın %19,19’unu oluşturmaktadır (toplam arz: 10.000.000.000 token). Tam seyreltilmiş piyasa değeri ise 104.180.000 $ seviyesindedir.

Genel kripto para piyasasında hissiyat şu anda “Açgözlülük” bölgesinde olup, VIX göstergesi 74 seviyesindedir.

Mevcut U piyasa fiyatını görüntülemek için tıklayın

U Piyasa Hissiyatı Göstergesi

05 Ekim 2025 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Mevcut Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda açgözlülük hakim; Korku ve Açgözlülük Endeksi 74 seviyesini gösteriyor. Bu, yatırımcıların aşırı iyimserliğe yöneldiğini ve aşırı alım koşullarına yaklaşılabileceğini gösteriyor. Hissiyat yükseliş yönünde olsa da, yalnızca piyasa coşkusuna kapılarak ani kararlar almak risklidir. Deneyimli yatırımcılar, bir miktar kâr realizasyonu veya pozisyonlarını koruma altına almayı düşünebilirler. Her koşulda, kapsamlı araştırma ve risk yönetimi bu piyasalarda temel gerekliliktir.

U Varlık Dağılımı

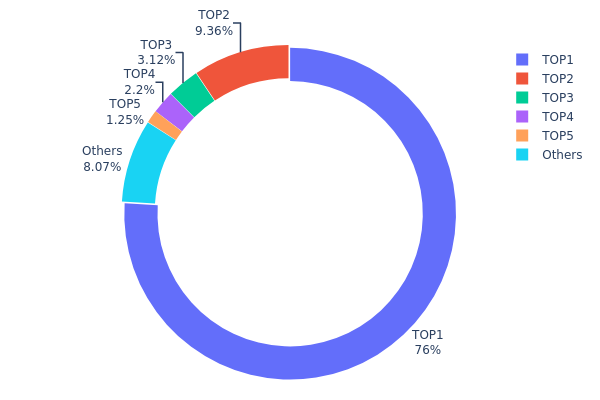

Adres bazında varlık dağılımı, U’da aşırı yoğunlaşmış sahiplik yapısını ortaya koymaktadır. En büyük adres, toplam arzın %76’sını elinde tutarken, sonraki dört adres toplamda %15,89’luk paya sahiptir. Bu denli yoğunlaşma, merkezileşme ve olası piyasa manipülasyonu risklerini gündeme taşımaktadır.

Böyle bir dağılım, piyasa dinamiklerinde önemli dalgalanma riski oluşturabilir. Tek bir adresin arzın büyük bölümünü kontrol etmesi, bu varlığın ciddi miktarda satış veya transfer kararı alması halinde fiyatlarda sert hareketlere yol açabilir. Ayrıca, bu sahiplik yapısı U’nun merkezsizliğine dair algıyı zayıflatabilir; yatırımcı güveni ve piyasa istikrarı olumsuz etkilenebilir.

Daha küçük yatırımcıların (“Diğerleri” arasında %8,11’lik pay) varlığı piyasaya daha geniş katılım sağlasa da, genel dağılım daha fazla çeşitliliğe ihtiyaç olduğunu göstermektedir. Bu yoğunlaşma eğilimi, U’nun gelecekteki fiyat hareketleri ve piyasa sağlığı açısından piyasa katılımcıları ve analistler tarafından dikkatle izlenmelidir.

Mevcut U Varlık Dağılımı için tıklayın

| En Büyük | Adres | Sahip Miktarı | Sahiplik (%) |

|---|---|---|---|

| 1 | 0xd31e...92c638 | 7.309.139,34K | 76,00% |

| 2 | 0x5fbe...1aeb03 | 900.000,01K | 9,35% |

| 3 | 0x6fdb...f7abcf | 300.001,00K | 3,11% |

| 4 | 0xf89d...5eaa40 | 211.474,13K | 2,19% |

| 5 | 0x01c5...4c37bb | 120.001,00K | 1,24% |

| - | Diğerleri | 775.910,29K | 8,11% |

II. U’nun Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Arz ve Talep: Arz talebin üzerinde olduğunda fiyatlar düşer; talep arzı aştığında ise fiyatlar yükselir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: U’nun enflasyonist ortamlardaki performansı gelecekteki fiyatını etkileyebilir.

- Jeopolitik Faktörler: Uluslararası gelişmeler U’nun fiyatını etkileyebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Ekosistem Uygulamaları: U ile ilgili büyük DApp’ler ve projeler, fiyatı üzerinde ciddi etki yaratabilir.

III. 2025-2030 U Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,0075 $ - 0,01 $

- Tarafsız tahmin: 0,01 $ - 0,012 $

- İyimser tahmin: 0,012 $ - 0,01427 $ (ciddi piyasa toparlanması gerektirir)

2027-2028 Görünümü

- Piyasa evresi: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,01157 $ - 0,01951 $

- 2028: 0,01088 $ - 0,02456 $

- Temel katalizörler: Artan benimsenme, olumlu piyasa hissiyatı

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,01968 $ - 0,02093 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,02093 $ - 0,02512 $ (güçlü yükseliş trendleriyle)

- Dönüştürücü senaryo: 0,02512 $ üzeri (aşırı olumlu piyasa koşullarında)

- 31 Aralık 2030: U 0,02512 $ (potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,01427 | 0,01042 | 0,0075 | 0 |

| 2026 | 0,01457 | 0,01235 | 0,00691 | 18 |

| 2027 | 0,01951 | 0,01346 | 0,01157 | 29 |

| 2028 | 0,02456 | 0,01648 | 0,01088 | 58 |

| 2029 | 0,02134 | 0,02052 | 0,01211 | 96 |

| 2030 | 0,02512 | 0,02093 | 0,01968 | 100 |

IV. U için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

U Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Yüksek risk toleranslı uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde U token biriktirme

- Fiyat hedefleri belirleyip portföyü dönemsel olarak dengeleme

- Token’ları güvenli donanım cüzdanlarında saklama

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını tespit etmek için

- RSI (Göreceli Güç Endeksi): Aşırı alım veya aşırı satım bölgelerini belirlemek için

- Dalgalı alım-satım için temel noktalar:

- Fiyat hareketlerini doğrulamak için işlem hacmini izleme

- Risk yönetimi için zararı durdur emirleri kullanma

U Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’e kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Farklı kripto varlıklara yatırım yapma

- Zararı durdur emirleri: Olası kayıpları sınırlamak için uygulama

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk depolama çözümü: Uzun vadeli saklama için donanım cüzdanları kullanma

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü şifre kullanımı

V. U için Potansiyel Riskler ve Zorluklar

U Piyasa Riskleri

- Oynaklık: Kripto para piyasası yüksek volatiliteye sahiptir

- Likidite riski: Düşük işlem hacmi fiyat kaymalarına yol açabilir

- Korelasyon riski: Genel kripto piyasa trendleriyle yüksek korelasyon

U Regülasyon Riskleri

- Regülasyon belirsizliği: Yasal düzenlemelerdeki değişiklikler U’nun faaliyetlerini etkileyebilir

- Sınır ötesi uyum: Farklı ülke düzenlemelerine uyum sağlama zorlukları

- Vergilendirme sonuçları: Kripto işlemlerine ilişkin değişen vergi mevzuatı

U Teknik Riskler

- Akıllı sözleşme açıkları: Temel kodda istismar riski

- Ölçeklenebilirlik sorunları: Artan ağ aktivitesiyle ilgili potansiyel kısıtlar

- Birkaç zincirle çalışma sorunları: Zincirler arası işlemlerle ilgili riskler

VI. Sonuç ve Eylem Önerileri

U Yatırım Değeri Değerlendirmesi

U, zk birlikte çalışabilirlik alanında eşsiz bir değer sunmakta ve uzun vadeli büyüme potansiyeli taşımaktadır. Ancak kısa vadeli volatilite ve regülasyon belirsizlikleri önemli riskler oluşturmaktadır.

U Yatırım Önerileri

✅ Yeni başlayanlar: Piyasayı anlamak için küçük ve aşamalı yatırımlar yapın ✅ Deneyimli yatırımcılar: Belirlenen fiyat hedefleriyle düzenli alım stratejisi uygulayın ✅ Kurumsal yatırımcılar: Kapsamlı analizle U’yu çeşitlendirilmiş kripto portföyüne dahil etmeyi değerlendirin

U Alım-Satım Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden U token alıp tutma

- Staking: Mümkünse staking programlarına katılım

- DeFi entegrasyonu: U token ile ilgili merkeziyetsiz finans olanaklarını araştırma

Kripto para yatırımları yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar kararlarını kendi risk toleranslarına göre dikkatle vermeli, profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

U hissesi alınmalı mı satılmalı mı?

Mevcut analist değerlendirmelerine göre U hissesi orta düzeyde alım olarak görülmektedir. Karışık notlar büyüme potansiyeline işaret etse de, yatırımcıların piyasa koşulları ve risk toleranslarını dikkatle gözden geçirmesi gerekir.

2030'da Nvidia hisse fiyatı ne olacak?

Mevcut piyasa eğilimlerine göre Nvidia hissesi 2030 yılında 520,51 $ ile 943,16 $ arasında fiyatlanabilir. Ancak kesin rakamlar piyasa koşullarına bağlı olarak değişebilir.

2025 için Unity'nin görünümü nedir?

2025 için Unity’nin görünümü olumlu; fiyatın 47,58 $’a ulaşması ve mevcut seviyelere göre %25,57’lik artış göstermesi bekleniyor.

2025 için Uni kripto tahmini nedir?

Mevcut piyasa analizine göre, Uni kripto fiyatı 2025’te 19 $ olarak öngörülmektedir. Bu tahmin, Uni’nin önümüzdeki yıllarda büyüme potansiyeline işaret etmektedir.

Gate Square Spark Program 2025: Web3 Yenilikçi Yetiştirme Blockchain Girişimciliğini Desteklemek İçin

Momentum & BuildPad: Bilmeniz Gerekenler

Enso (ENSO) nedir?

Bir Kripto Projesinin Topluluğu ile Ekosistemindeki Aktiviteyi Nasıl Ölçebilirsiniz?

2025 SAAS Fiyat Tahmini: Bulut Tabanlı Yazılım Maliyetlerinin Değişen Dinamiklerinde Yol Almak

2025 yılında temel analiz, bir kripto projenin değerini nasıl değerlendirir?

Sıfır Bilgi İspatı (Zero Knowledge Proof) Teknolojisini Anlamak

Metaverse Dijital Para Birimlerini Güvenli Bir Şekilde Satın Alma Rehberi

ENS Alan Adınızı Kaydettirmenin Sağladığı Avantajlar

Yönetim Tokenlarını Anlamak: Web3 Dünyasında Merkeziyetsiz Finansın Derinliklerine Yolculuk