2025 UTK Fiyat Tahmini: Dijital ödeme ekosisteminin gelişimiyle birlikte UTRUST Token'ın büyüme potansiyelini ve piyasa trendlerini analiz etmek

Giriş: UTK’nin Piyasadaki Konumu ve Yatırım Potansiyeli

xMoney (UTK), çevrim içi işlemlerde tüketici koruması sunan bir kripto para olarak, 2017’de piyasaya çıktığından beri aracı ve arabulucu platform kimliğiyle öne çıkıyor. 2025 itibarıyla xMoney’nin piyasa değeri 19.623.605 $’a ulaşırken, yaklaşık 704.112.145 adet dolaşımdaki tokenı bulunuyor ve fiyatı 0,02787 $ civarında seyrediyor. “Kripto dünyasının PayPal’ı” olarak adlandırılan bu varlık, çevrim içi ödeme ve e-ticaret sektörlerinde giderek daha önemli bir rol üstleniyor.

Bu makale; xMoney’nin 2025-2030 dönemindeki fiyat hareketlerini, geçmiş verileri, arz-talep dinamiklerini, ekosistem gelişimini ve makroekonomik faktörleri bir arada değerlendirerek, profesyonel fiyat öngörüleri ve yatırımcılara yönelik stratejik öneriler sunacaktır.

I. UTK Fiyat Geçmişi ve Güncel Piyasa Durumu

UTK Fiyat Geçmişinin Evrimi

- 2018: UTK, 9 Ocak’ta 1,18 $ ile en yüksek seviyesine ulaşarak ilk yıllarında önemli bir dönüm noktası yaşadı.

- 2020: Mart ayındaki kripto piyasası çöküşüyle UTK, 13 Mart’ta 0,00540831 $ ile en düşük seviyesini gördü ve genel piyasa düşüşünü yansıttı.

- 2025: UTK, mevcut fiyatı olan 0,02787 $ ile toparlanma göstererek piyasa dalgalanmalarına karşı direnç sergiliyor.

UTK Güncel Piyasa Görünümü

5 Ekim 2025 itibarıyla UTK, 0,02787 $ seviyesinden işlem görüyor ve piyasa değeri 19.623.605 $. 24 saatlik işlem hacmi 16.381,94 $ ile orta düzeyde bir aktiviteye işaret ediyor. UTK, son 24 saatte %1,38 düşüş yaşadı ve bu kısa vadede negatif bir eğilime işaret ediyor. Ancak 7 günlük performansı %14,13 artışla orta vadede yükseliş potansiyeli gösteriyor. 704.112.145 UTK’lik dolaşım, toplam arzın %70,41’ini temsil ederek piyasada önemli bir token miktarının aktif olduğunu gösteriyor.

Güncel UTK piyasa fiyatı için tıklayın

UTK Piyasa Duyarlılığı Göstergesi

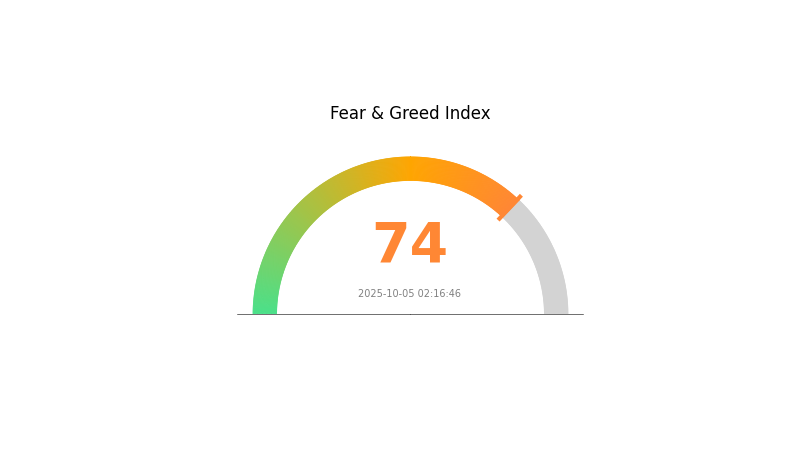

05 Ekim 2025 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında şu anda yüksek bir iyimserlik hakim ve Korku ve Açgözlülük Endeksi 74’e ulaşarak güçlü açgözlülük sinyali veriyor. Yatırımcılar hem UTK’ye hem de genel kripto piyasasına yükseliş beklentisiyle yaklaşmakta. Ancak aşırı açgözlülük, çoğu kez piyasa düzeltmesinin öncüsü olabiliyor. Yatırımcıların kâr alımı veya risk yönetim stratejileri uygulaması önerilir. Olası trend dönüşleri için kritik direnç seviyeleri ve piyasa göstergeleri takip edilmelidir.

UTK Varlık Dağılımı

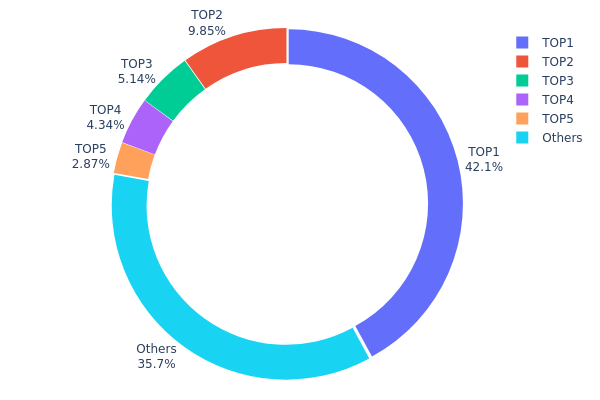

UTK adres varlık dağılımı verileri, tokenların büyük kısmının az sayıda üst adreste yoğunlaştığını gösteriyor. En büyük sahip, toplam arzın %42,06’sını elinde bulunduruyor; ilk 5 adres ise UTK’nin %64,23’ünü kontrol ediyor. Bu yüksek yoğunlaşma, UTK ekosisteminde olası piyasa manipülasyonu ve merkeziyet sorunlarını gündeme getiriyor.

Yoğun varlık dağılımı, fiyat oynaklığını ve piyasa istikrarsızlığını artırabilir. Toplam arzın %40’ından fazlasını elinde tutan en büyük adres, fiyat hareketlerinde büyük etkiye sahip. Bu yoğunlaşma, projenin merkeziyetsizliğini zayıflatıyor ve az sayıda aktöre aşırı oy gücü ve ekonomik hakimiyet veriyor.

%35,77’lik “Diğerleri” dağılımı daha geniş bir token yayılımı olduğunu gösterse de mevcut yapı, piyasa dayanıklılığı ve manipülasyon risklerinin azaltılması için daha dengeli bir dağılım gerektiriyor. Bu yoğunlaşma, adil yönetim ve eşit katılım arayan yatırımcılar için caydırıcı olabilir.

Güncel UTK Varlık Dağılımı için tıklayın

| En Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xc3c1...636138 | 210.328,41K | 42,06% |

| 2 | 0xf977...41acec | 49.225,55K | 9,84% |

| 3 | 0x5a52...70efcb | 25.700,00K | 5,14% |

| 4 | 0x2f7f...a3d2f7 | 21.681,49K | 4,33% |

| 5 | 0x0529...c553b7 | 14.340,11K | 2,86% |

| - | Diğerleri | 178.724,43K | 35,77% |

II. UTK’nin Gelecek Fiyatını Etkileyecek Temel Unsurlar

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Son dönemde birçok e-ticaret platformu, ödeme altyapısı olarak UTK’yi entegre ederek varlığın gerçek dünyadaki kullanım alanını genişletti.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: UTK, ekonomik belirsizlik dönemlerinde potansiyel bir enflasyon koruma aracı olarak değerlendirilebilir.

Teknoloji ve Ekosistem Gelişimi

- Platform Güncellemeleri: Sürekli teknolojik yenilikler, yeni finansal araçların eklenmesi ve güvenlik ile kullanıcı deneyiminin artırılması UTK fiyatını olumlu etkileyebilir.

- Ekosistem Uygulamaları: UTK platformunda DeFi hizmetlerinin yaygınlaşması, token talebini artırabilir.

III. 2025-2030 UTK Fiyat Öngörüleri

2025 Beklentisi

- Temkinli tahmin: 0,01756 $ - 0,02788 $

- Tarafsız tahmin: 0,02788 $ - 0,02927 $

- İyimser tahmin: 0,02927 $ - 0,03572 $ (olumlu piyasa duyarlılığı ve proje gelişmeleri ile)

2027-2028 Beklentisi

- Piyasa fazı: Artan benimsenmeyle büyüme potansiyeli

- Fiyat aralığı:

- 2027: 0,01865 $ - 0,04662 $

- 2028: 0,02481 $ - 0,05868 $

- Başlıca tetikleyiciler: Teknolojik ilerleme, ortaklıklar ve piyasa genişlemesi

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,04903 $ - 0,05516 $ (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 0,06129 $ - 0,0684 $ (güçlü piyasa performansı ve proje başarısı ile)

- Dönüştürücü senaryo: 0,07000 $ - 0,08000 $ (çığır açıcı yenilik ve yaygın kabul ile)

- 31 Aralık 2030: UTK 0,0684 $ (olumlu piyasa koşulları ile potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,02927 | 0,02788 | 0,01756 | 0 |

| 2026 | 0,03572 | 0,02858 | 0,02315 | 2 |

| 2027 | 0,04662 | 0,03215 | 0,01865 | 15 |

| 2028 | 0,05868 | 0,03938 | 0,02481 | 41 |

| 2029 | 0,06129 | 0,04903 | 0,04511 | 75 |

| 2030 | 0,0684 | 0,05516 | 0,03806 | 97 |

IV. UTK Profesyonel Yatırım Stratejileri ve Risk Yönetimi

UTK Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli ve risk toleransı yüksek yatırımcılar

- İşlem önerileri:

- Piyasa gerilemelerinde UTK biriktirin

- Fiyat hedefleri belirleyip portföyü düzenli aralıklarla gözden geçirin

- UTK’leri donanım cüzdanlarında güvenli şekilde saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve potansiyel giriş/çıkış noktalarını belirlemek için kullanılır

- RSI: Aşırı alım/aşırı satım bölgelerini tespit etmek için izlenir

- Dalgalı alım-satım için önemli noktalar:

- UTK’nin genel kripto piyasası ile korelasyonunu izleyin

- Olası riskleri sınırlamak için kesin stop-loss emirleri uygulayın

UTK Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-8’i

- Profesyonel yatırımcılar: Kripto portföyünün %10-15’i

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: UTK’yi diğer kripto varlıklar ve geleneksel yatırımlar ile dengeleyin

- Stop-loss emirleri: Olası kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdanı alternatifi: Resmi UTK cüzdanı (varsa)

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifreler ve düzenli yazılım güncellemesi kullanın

V. UTK için Potansiyel Riskler ve Zorluklar

UTK Piyasa Riskleri

- Oynaklık: Kripto piyasası dalgalanmaları önemli fiyat hareketlerine yol açabilir

- Rekabet: Yeni ödeme çözümleri UTK’nin piyasa konumunu zorlayabilir

- Likidite: Sınırlı işlem hacmi alım/satım işlemlerinin etkinliğini azaltabilir

UTK Düzenleyici Riskler

- Düzenleyici belirsizlikler: Kripto para mevzuatındaki değişimler UTK’nin benimsenmesini etkileyebilir

- Sınır ötesi uyumluluk: Uluslararası mevzuattaki farklılıklar küresel kullanımı sınırlayabilir

- AML/KYC gereklilikleri: Sıkılaştırılan düzenlemeler operasyonel maliyetleri yükseltebilir

UTK Teknik Riskler

- Akıllı kontrat açıkları: Temel kodda potansiyel güvenlik riskleri

- Ölçeklenebilirlik sorunları: Yoğun işlem dönemlerinde ağda tıkanıklık yaşanabilir

- Birlikte çalışabilirlik sorunları: Diğer blokzincirlerle entegrasyon zorlukları

VI. Sonuç ve Eylem Önerileri

UTK Yatırım Değeri Analizi

UTK, kripto ödeme alanında potansiyel sunuyor; ancak ciddi rekabet ve mevzuat engelleriyle karşı karşıya. Uzun vadeli değer, yaygın kullanım ve teknolojik ilerlemelere bağlı; kısa vadede ise oynaklık devam ediyor.

UTK Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kademeli ve düzenli alımlarla pozisyon oluşturmayı değerlendirin ✅ Deneyimli yatırımcılar: Stratejik giriş/çıkış noktaları ve dengeli portföy yaklaşımı benimseyin ✅ Kurumsal yatırımcılar: Kapsamlı analiz yapın ve UTK’yi çeşitlendirilmiş bir kripto portföyüne dahil edin

UTK Katılım Yolları

- Spot alım-satım: Gate.com üzerinden UTK alıp satabilirsiniz

- Staking: UTK platformu staking programları sunuyorsa katılabilirsiniz

- DeFi entegrasyonu: UTK tokenları ile merkeziyetsiz finans fırsatlarını değerlendirin

Kripto para yatırımları çok yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Her yatırımcı kendi risk toleransına göre karar vermeli ve uzman bir finansal danışmana başvurmalıdır. Asla kaybetmeyi göze alacağınızdan fazla yatırım yapmayın.

SSS

2030 için UFT fiyat tahmini nedir?

Mevcut piyasa analizine göre, UFT’nin 2030’da 0,005073 $ seviyesine ulaşması ve yaklaşık %27,63 büyüme göstermesi bekleniyor.

2025’te hangi meme coin patlama yapacak?

BONK, internet kültürü ve topluluk ilgisiyle 2025’te fiyatında sıçrama potansiyeline sahip. Bu büyüme beklentisi, önceki popüler meme coinlerin trendlerine dayanıyor.

UTK kripto nedir?

UTK, finansı modernleştirmeyi ve geleneksel ödeme yöntemlerindeki sorunları çözmeyi amaçlayan bir ödeme odaklı kripto para birimidir. Utrust tarafından ihraç edilmektedir.

UTK kripto fiyatı nedir?

05 Ekim 2025 itibarıyla UTK kripto fiyatı 0,02763 $’dır ve son 24 saatte %2,84 düşüş göstermiştir.

2025 AMP Fiyat Tahmini: Kripto Para Yatırımcılarına Yönelik Stratejik Analiz ve Piyasa Görünümü

2025 REQ Fiyat Tahmini: Request Network için piyasa trendleri ve olası büyüme faktörlerinin analizi

2025 WPAY Fiyat Tahmini: Dijital ödeme token’ının gelecekteki büyüme potansiyeli ve piyasa eğilimleri üzerine analiz

P ve XLM: Gelişmekte Olan Piyasalarda Yatırım Performansına İlişkin Kapsamlı Bir Analiz

UNA ve XLM: Sınır ötesi işlemlerde kullanılan iki yenilikçi blockchain protokolünün karşılaştırılması

MOVE ve XLM: İki Yenilikçi Blockchain Programlama Dili Karşılaştırması

Meteora (MET) Yatırım Kılavuzu: Solana’nın Likidite Motoru Açıklaması ve Son Piyasa Analizi

Web3 ortamında Mnemonic Phrase’lerin Kullanımı: Güvenliğe Dair Açıklamalar

Metaverse Yatırımı ve Pazar Görünümü: MANA ve SAND Üzerine Son Analiz

DEX İşlem Likiditesini Optimize Etmeye Yönelik En Etkin Çözümler

Kurumsal Birikim Sinyali: Amerika Bitcoin 416 Daha BTC Ekledi, Toplam Varlıklar 4,783'e Yükseldi