2025 XTTA Price Prediction: Analyzing Market Trends and Key Factors That Could Drive Significant Growth

Introduction: XTTA's Market Position and Investment Value

TrendX (XTTA) as an AI and DePIN-powered profit strategy arsenal, has been processing over 20TB of on-chain and off-chain data since its inception in 2022. As of 2025, TrendX's market capitalization has reached $18,914,761, with a circulating supply of approximately 39,539,197 tokens, and a price hovering around $0.47838. This asset, known as the "change is opportunity" platform, is playing an increasingly crucial role in providing one-click trading and investment solutions.

This article will comprehensively analyze TrendX's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. XTTA Price History Review and Current Market Status

XTTA Historical Price Evolution

- 2025: Project launch, price started at $0.07

- 2025: Reached all-time high of $0.52934 on October 2nd

- 2025: Current price stabilized around $0.47838 as of October 5th

XTTA Current Market Situation

XTTA is currently trading at $0.47838, with a 24-hour trading volume of $946,236.62. The token has experienced a slight decrease of 0.13% in the past 24 hours. However, it has shown significant growth over longer periods, with a 8.95% increase in the past 7 days and a remarkable 37.99% surge over the last 30 days. The current market cap stands at $18,914,761.27, ranking XTTA at 1128th position in the cryptocurrency market. With a circulating supply of 39,539,197.44 XTTA out of a total supply of 400,000,000, the token has a circulating ratio of 9.88%. The fully diluted market cap is $191,352,000.

Click to view the current XTTA market price

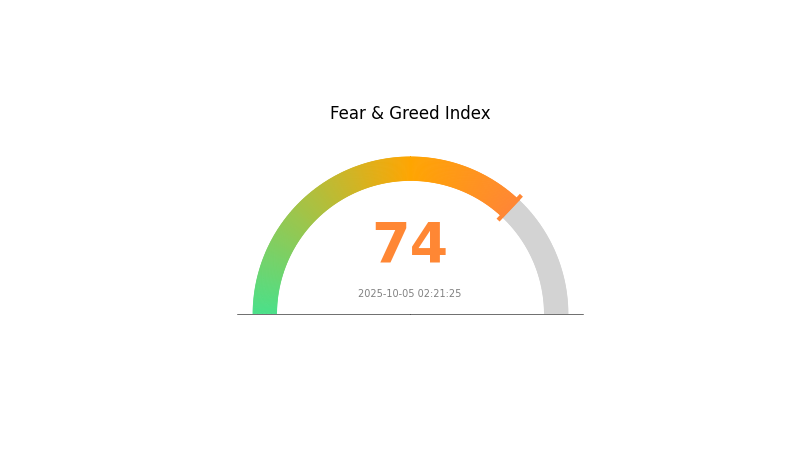

XTTA Market Sentiment Index

2025-10-05 Fear and Greed Index: 74 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently exhibiting strong signs of greed, with the Fear and Greed Index reaching 74. This indicates a high level of optimism among investors, potentially driven by recent price surges or positive market developments. However, such elevated levels of greed often suggest that the market might be overvalued, and a correction could be on the horizon. Traders should exercise caution and consider taking profits or implementing risk management strategies. As always, it's crucial to conduct thorough research and avoid making impulsive decisions based solely on market sentiment.

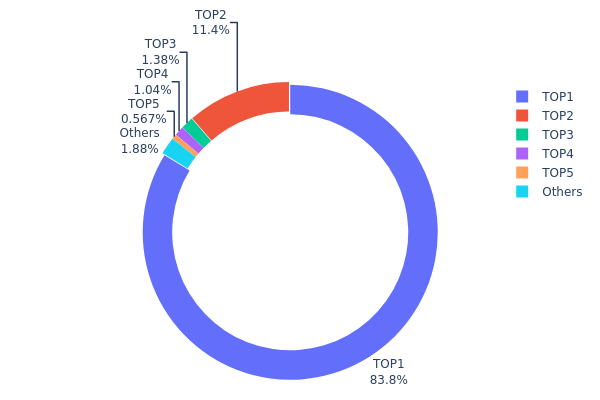

XTTA Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of XTTA tokens within the network. Analysis of this data reveals a highly centralized distribution pattern, with the top address holding an overwhelming 83.75% of the total supply. This level of concentration raises significant concerns about market manipulation and price volatility risks.

The second largest holder, a burn address, accounts for 11.39% of the supply, effectively removing these tokens from circulation. The remaining top holders control relatively small percentages, with the third, fourth, and fifth largest addresses holding 1.37%, 1.03%, and 0.56% respectively. This distribution structure indicates a low level of decentralization, as over 95% of the total supply is concentrated in just two addresses.

Such a concentrated holding pattern could potentially lead to market instability and increased susceptibility to large price swings based on the actions of a single major holder. It also raises questions about the token's governance structure and the actual level of decentralization within the XTTA ecosystem. Investors and market participants should carefully consider these factors when evaluating the long-term stability and growth potential of XTTA.

Click to view the current XTTA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7370...c88272 | 335000.00K | 83.75% |

| 2 | 0x0000...00dead | 45571.34K | 11.39% |

| 3 | 0xc882...84f071 | 5502.58K | 1.37% |

| 4 | 0x5f52...fa071f | 4150.15K | 1.03% |

| 5 | 0x0d07...b492fe | 2268.78K | 0.56% |

| - | Others | 7507.15K | 1.9% |

II. Key Factors Affecting XTTA's Future Price

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's policies and interest rate decisions are expected to continue influencing cryptocurrency markets, including XTTA.

- Inflation Hedging Properties: In the current inflationary environment, XTTA's performance as a potential hedge against inflation will be closely watched by investors.

- Geopolitical Factors: International tensions and global economic uncertainties may impact XTTA's price as investors seek alternative assets.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development of DApps and major ecosystem projects built on or compatible with XTTA could significantly influence its adoption and value.

III. XTTA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.36 - $0.40

- Neutral prediction: $0.45 - $0.50

- Optimistic prediction: $0.65 - $0.70 (requires significant market recovery and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.59 - $0.92

- 2028: $0.59 - $0.96

- Key catalysts: Technological advancements, broader market acceptance, and potential partnerships

2030 Long-term Outlook

- Base scenario: $0.95 - $1.10 (assuming steady growth and adoption)

- Optimistic scenario: $1.20 - $1.40 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $1.50 - $1.54 (assuming breakthrough use cases and mainstream integration)

- 2030-12-31: XTTA $1.54 (potential peak price under highly favorable conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.70518 | 0.47647 | 0.36212 | 0 |

| 2026 | 0.7208 | 0.59082 | 0.42539 | 23 |

| 2027 | 0.91814 | 0.65581 | 0.59023 | 37 |

| 2028 | 0.96011 | 0.78698 | 0.59023 | 64 |

| 2029 | 1.20549 | 0.87354 | 0.55907 | 82 |

| 2030 | 1.53848 | 1.03952 | 0.72766 | 117 |

IV. Professional Investment Strategies and Risk Management for XTTA

XTTA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors seeking exposure to AI and DePIN technologies

- Operational suggestions:

- Accumulate XTTA tokens during market dips

- Set up regular dollar-cost averaging purchases

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor TrendX platform updates and user growth metrics

- Set stop-loss orders to manage downside risk

XTTA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance XTTA with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for XTTA

XTTA Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Emerging AI and DePIN projects may challenge TrendX's market position

- Liquidity: Limited trading pairs may affect price stability

XTTA Regulatory Risks

- Regulatory uncertainty: Evolving crypto regulations may impact XTTA's operations

- Compliance challenges: Potential difficulties in adhering to global financial regulations

- Tax implications: Unclear tax treatment of AI-driven crypto trading profits

XTTA Technical Risks

- Smart contract vulnerabilities: Potential security flaws in the token contract

- AI model accuracy: Risks associated with the reliability of TrendX's AI predictions

- Network congestion: BASE network issues could affect transaction speeds

VI. Conclusion and Action Recommendations

XTTA Investment Value Assessment

XTTA presents a unique opportunity in the AI-driven crypto trading space, with strong long-term potential due to its innovative approach. However, short-term volatility and regulatory uncertainties pose significant risks.

XTTA Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the TrendX platform

✅ Experienced investors: Consider allocating a portion of their crypto portfolio to XTTA

✅ Institutional investors: Conduct thorough due diligence and consider XTTA for diversification

XTTA Trading Participation Methods

- Spot trading: Buy and hold XTTA tokens on Gate.com

- DeFi staking: Participate in liquidity provision if available

- Automated trading: Utilize TrendX's AI-powered trading strategies

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What happened to XTIA stock?

XTIA completed a $16 million public offering, announced partnerships, and held FAA certification meetings for its TriFan 600 aircraft.

How volatile is XTI Aerospace stock?

XTI Aerospace stock is highly volatile, with significant price swings. Recent surges have increased its volatility, making it a speculative investment with substantial price fluctuations.

What is XTIA known for?

XTIA is known for developing the TriFan 600, an innovative aircraft with vertical takeoff and landing capabilities, combining helicopter flexibility with airplane speed and range.

What are the analyst ratings for XTIA?

Analyst ratings for XTIA vary from 'Very Bullish' to 'Very Bearish'. The current consensus is mixed, with no specific rating summary available as of 2025-10-05.

Share

Content