U ve DOT: Motosiklet Kasklarında Farklı Güvenlik Standartları Nelerdir?

Giriş: U ve DOT Yatırımlarının Karşılaştırılması

Kripto para piyasasında Union (U) ile Polkadot (DOT) arasındaki karşılaştırma, yatırımcıların gündeminden hiç düşmeyen bir başlıktır. Bu iki varlık, piyasa değeri sıralaması, kullanım alanları ve fiyat performansları açısından belirgin farklar gösterirken, kripto varlık ekosisteminde de birbirinden farklı konumlara sahiptir.

Union (U): Sıfır bilgi (ZK) tabanlı birlikte çalışabilirlik katmanı blokzinciri olarak piyasaya sunulduğundan bu yana, lider teknolojisiyle piyasanın güvenini kazanmıştır.

Polkadot (DOT): 2020 yılında faaliyete geçen Polkadot, farklı blokzincirler arasında birlikte çalışabilirlik sağlayan çoklu zincir ağı olarak öne çıkmıştır.

Bu makalede, Union ve Polkadot'un yatırım değerleri; tarihsel fiyat hareketleri, arz mekanizmaları, kurumsal benimseme, teknik ekosistemler ve gelecek öngörüleri üzerinden kapsamlı biçimde analiz edilerek, yatırımcıların en çok merak ettiği kritik soruya yanıt aranıyor:

"Şu anda hangisi daha cazip bir yatırım fırsatı sunuyor?"

I. Fiyat Geçmişi Karşılaştırması ve Güncel Piyasa Görünümü

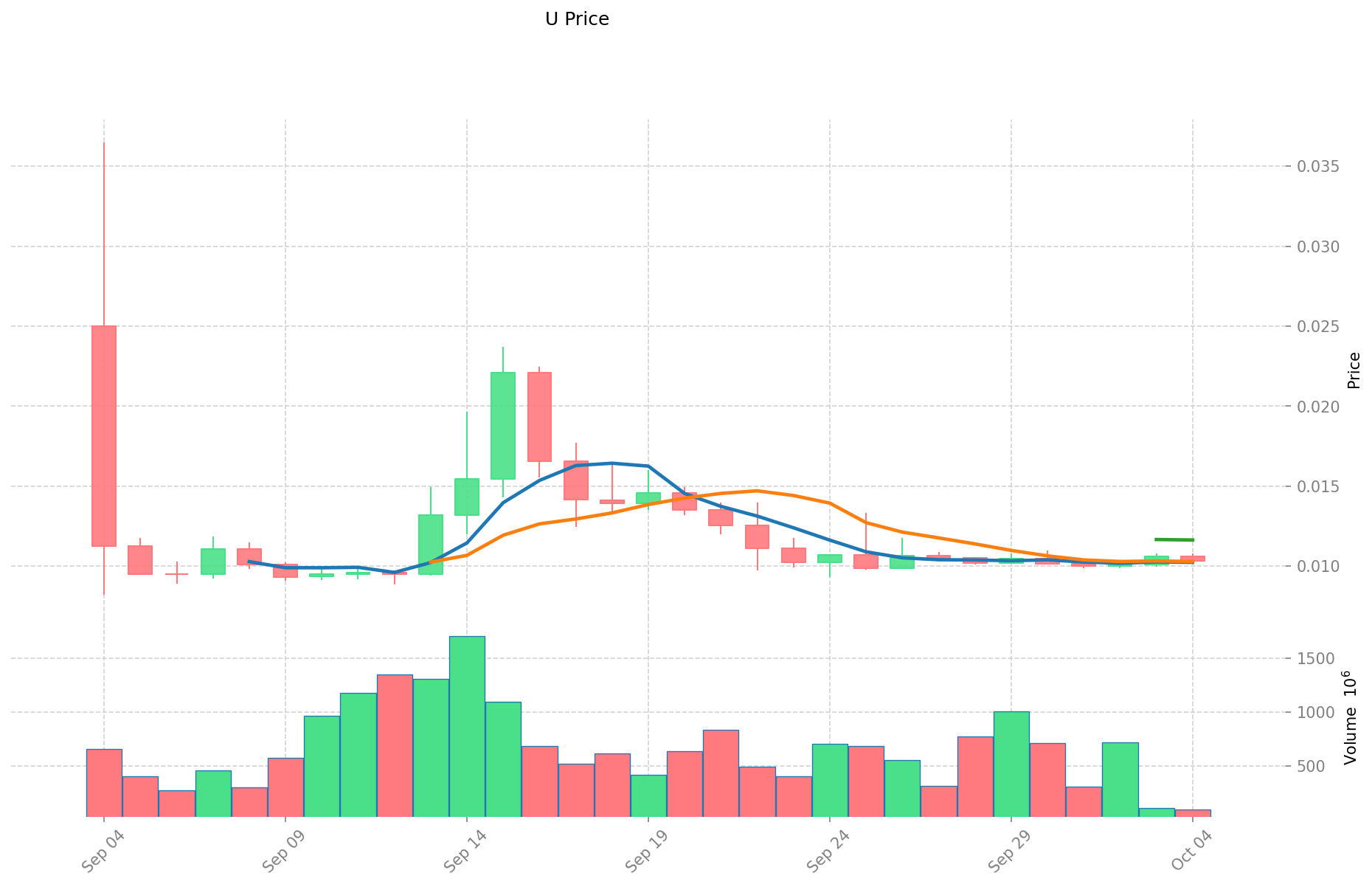

Union (U) ve Polkadot (DOT) Tarihsel Fiyat Eğilimleri

- 2025: Union (U) fiyatı $0,010361 seviyesine gerileyerek, tüm zamanların en yüksek noktası olan $0,03651'den kayda değer bir düşüş yaşadı.

- 2025: Polkadot (DOT) fiyatı ise $4,187 düzeyine indi; 2021'deki rekor seviyesi olan $54,98'e göre ciddi bir gerileme gösterdi.

- Karşılaştırma: Mevcut piyasa döngüsünde Union (U) zirveden $0,010361 seviyesine gerilerken, Polkadot (DOT) $54,98'den $4,187'ye düştü. Oransal olarak, DOT'taki düşüş daha keskin gerçekleşti.

Güncel Piyasa Durumu (05 Ekim 2025)

- Union (U) güncel fiyatı: $0,010361

- Polkadot (DOT) güncel fiyatı: $4,187

- 24 saatlik işlem hacmi: U $1.072.917,95 / DOT $2.126.558,80

- Korku ve Açgözlülük Endeksi: 71 (Açgözlülük)

Anlık fiyatlar için tıklayınız:

- U güncel fiyatı: Piyasa Fiyatı

- DOT güncel fiyatı: Piyasa Fiyatı

DOT Yatırım Değerini Etkileyen Unsurlar

Arz Mekanizması Analizi (Tokenomik)

- DOT: Polkadot DAO, arzı 21 milyar token ile sınırlandırırken, enflasyon oranını yönetişim mekanizmasıyla kontrol ediyor.

- 📌 Tarihsel eğilim: DOT'un değeri, yönetişimde oy hakkı sunmasından gelirken; sabit arz sınırı Bitcoin benzeri kıtlık etkisi yaratmaktadır.

Kurumsal Benimseme ve Piyasa Uygulamaları

- Kurumsal portföyler: DOT'un yönetişim faydası, spekülatif işlemlerin ötesinde temel bir değer kazandırır.

- Kurumsal kullanım: DOT, Polkadot ekosisteminde fayda tokeni olarak zincirler arası birlikte çalışabilirliği ve ağ güvenliğini destekler.

- Regülasyon: DOT, diğer kripto varlıklar gibi, farklı ülke düzenlemeleri kapsamında benzer yasal değerlendirmelerle karşı karşıyadır.

Teknik Gelişim ve Ekosistem Oluşumu

- DOT teknik güncellemeleri: Polkadot, parachain fonksiyonlarını genişletmeye ve zincirler arası iletişimi iyileştirmeye odaklanan sürekli bir geliştirme sürecindedir.

- Ekosistem karşılaştırması: DOT, uzmanlaşmış blokzincirlerin birbiriyle iletişim kurmasını ve ortak güvenlikten yararlanmasını sağlayan çoklu zincir mimarisini işletir.

Makroekonomik ve Piyasa Döngüleri

- Enflasyon ortamındaki performans: DOT'un yönetişimle yönetilen enflasyon oranı, ekosistem içinde esnek bir para politikası sağlar.

- Makroekonomik para politikası: DOT, diğer kripto paralar gibi genel piyasa koşulları ve risk algısından etkilenmektedir.

- Jeopolitik faktörler: DOT'un merkeziyetsiz yönetişimi ve zincirler arası kapasitesi, dijital varlık ekosisteminde ona özgün bir konum kazandırır.

III. 2025-2030 Fiyat Tahmini: U ve DOT

Kısa Vadeli Tahmin (2025)

- U: Muhafazakâr $0,00819941 - $0,010379 | İyimser $0,010379 - $0,01546471

- DOT: Muhafazakâr $3,5734 - $4,204 | İyimser $4,204 - $5,21296

Orta Vadeli Tahmin (2027)

- U, büyüme dönemine girebilir; tahmini fiyat aralığı $0,013397379264 - $0,017723616318

- DOT, boğa piyasasına girebilir; tahmini fiyat aralığı $4,685408448 - $7,405968192

- Temel etkenler: Kurumsal sermaye girişi, ETF'ler, ekosistem gelişimi

Uzun Vadeli Tahmin (2030)

- U: Temel senaryo $0,010787000028419 - $0,017122222267332 | İyimser senaryo $0,017122222267332 - $0,024142333396938

- DOT: Temel senaryo $5,924458968669696 - $9,2569671385464 | İyimser senaryo $9,2569671385464 - $13,42260235089228

Yasal Uyarı

U:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,01546471 | 0,010379 | 0,00819941 | 0 |

| 2026 | 0,0149893518 | 0,012921855 | 0,0100790469 | 24 |

| 2027 | 0,017723616318 | 0,0139556034 | 0,013397379264 | 34 |

| 2028 | 0,01789875914067 | 0,015839609859 | 0,01203810349284 | 52 |

| 2029 | 0,01737526003483 | 0,016869184499835 | 0,012483196529877 | 62 |

| 2030 | 0,024142333396938 | 0,017122222267332 | 0,010787000028419 | 65 |

DOT:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 5,21296 | 4,204 | 3,5734 | 0 |

| 2026 | 5,3676672 | 4,70848 | 4,1905472 | 12 |

| 2027 | 7,405968192 | 5,0380736 | 4,685408448 | 20 |

| 2028 | 8,64860904544 | 6,222020896 | 5,41315817952 | 48 |

| 2029 | 11,0786193063728 | 7,43531497072 | 3,7920106350672 | 77 |

| 2030 | 13,42260235089228 | 9,2569671385464 | 5,924458968669696 | 121 |

IV. Yatırım Stratejileri Karşılaştırması: U ve DOT

Uzun Vadeli ve Kısa Vadeli Yatırım Stratejileri

- U: Sıfır bilgi teknolojisi ve birlikte çalışabilirlik çözümlerine odaklanan yatırımcılar için ideal

- DOT: Çoklu zincir ekosistemi ve zincirler arası uygulamalara ilgi duyan yatırımcılar için uygun

Risk Yönetimi ve Varlık Dağılımı

- Dikkatli yatırımcılar: U %30 / DOT %70

- Riskli yatırımcılar: U %60 / DOT %40

- Koruma araçları: Stabilcoin portföyü, opsiyonlar, çoklu para portföyleri

V. Olası Risk Karşılaştırması

Piyasa Riski

- U: Piyasada yeni ve geçmişi kısa bir proje

- DOT: Daha büyük piyasa değeri, daha geniş benimseme, yüksek volatilite

Teknik Risk

- U: Ölçeklenebilirlik ve ağ istikrarı

- DOT: Parachain ihale süreçleri, zincirler arası güvenlik riskleri

Regülasyon Riski

- Küresel düzenlemeler her iki tokeni farklı etkileyebilir; DOT daha büyük ekosistemiyle daha fazla denetime maruz kalabilir

VI. Sonuç: Hangisi Daha İyi Bir Yatırım?

📌 Yatırım Değeri Özeti:

- U avantajları: Lider ZK birlikte çalışabilirlik katmanı, niş pazarda büyüme potansiyeli

- DOT avantajları: Yerleşik ekosistem, çoklu zincir mimarisi, yönetişim faydası

✅ Yatırım Tavsiyesi:

- Yeni yatırımcılar: DOT'un köklü piyasa varlığı nedeniyle portföyde daha yüksek DOT ağırlığı ile dengeli yaklaşım önerilir

- Tecrübeli yatırımcılar: Daha yüksek büyüme potansiyeli için U'yu değerlendirin, DOT'ta ise büyük pozisyonunuzu koruyun

- Kurumsal yatırımcılar: DOT'u ekosistem maruziyeti için, U'yu ise sıfır bilgi teknolojisi odaklı yatırım için değerlendirin

⚠️ Risk Uyarısı: Kripto para piyasası yüksek volatiliteye sahiptir ve bu makale yatırım tavsiyesi niteliğinde değildir. None

VII. Sıkça Sorulan Sorular

S1: Union (U) ile Polkadot (DOT) arasındaki başlıca farklar nelerdir? C: Union (U), öncü sıfır bilgi (ZK) birlikte çalışabilirlik katmanı blokzinciridir; Polkadot (DOT) ise farklı blokzincirler arasında birlikte çalışabilirliği sağlayan çoklu zincirli bir ağdır. U, ZK teknolojisine odaklanırken, DOT parachain modeli ile zincirler arası iletişim ve ortak güvenlik sunar.

S2: U ve DOT'un güncel fiyatları tüm zamanların en yüksek seviyelerine göre nasıl? C: 05 Ekim 2025 itibarıyla Union (U) $0,010361 ile, tüm zamanların zirvesi olan $0,03651'in altında; Polkadot (DOT) ise $4,187 ile, 2021'deki $54,98 rekorunun hayli gerisindedir.

S3: DOT'un yatırım değerini etkileyen ana unsurlar nelerdir? C: Başlıca unsurlar; 21 milyar maksimum arz, yönetişim faydası için kurumsal sahiplenme, zincirler arası birlikte çalışabilirlik için kurumsal benimseme, parachain teknik gelişimi ve makroekonomik koşullardaki performansıdır.

S4: U ve DOT'un uzun vadeli fiyat tahminleri nasıl karşılaştırılıyor? C: 2030 için U'nun temel senaryo fiyat aralığı $0,010787000028419 - $0,017122222267332; DOT'un ise $5,924458968669696 - $9,2569671385464. DOT'un fiyatında mevcut seviyelere göre daha yüksek oransal artış bekleniyor.

S5: U ve DOT için önerilen yatırım stratejisi nedir? C: Dikkatli yatırımcılar için önerilen dağılım %30 U, %70 DOT; riskli yatırımcılar için %60 U, %40 DOT. U, ZK teknolojisiyle ilgilenenlere; DOT ise çoklu zincir ekosistemine odaklananlara uygundur.

S6: U ve DOT yatırımlarındaki başlıca riskler neler? C: U'da; yeni bir proje olması, sınırlı piyasa geçmişi, olası ölçeklenebilirlik ve ağ istikrarı sorunları. DOT'ta; yüksek piyasa değeri, parachain ihale dinamikleri ve zincirler arası güvenlik riskleri nedeniyle yüksek volatilite. Her iki token de küresel regülasyonlarda yaşanacak değişimlerden etkilenebilir.

S7: Yeni yatırımcılar için hangi token daha uygun? C: Yeni yatırımcılar için DOT'un yerleşik piyasa varlığı ve ekosistemi nedeniyle ağırlıklı DOT içeren dengeli bir portföy önerilebilir. Ancak yatırım kararları, kişisel risk toleransına ve kapsamlı araştırmaya dayanmalıdır.

2025 MINA Fiyat Tahmini: Hafif Blockchain’in Büyüme Potansiyeli ve Piyasa Trendleri Analizi

2025 VFY Fiyat Tahmini: Virtual Finance Yield Token’ın Piyasa Eğilimleri ve Gelecek Büyüme Potansiyelinin Değerlendirilmesi

ZEC'nin Son Dönemdeki Fiyat Artışı, Zincir Üstü Metri̇kleri̇ ve Borsa Akışlarını Nasıl Etkiledi̇?

Bir Kripto Para Projesinin Temel Analizi: Dikkate Almanız Gereken 5 Temel Faktör

2025 VFY Fiyat Tahmini: Değişen kripto ekosisteminde VFY'nin piyasa trendleri ve gelecekteki değer potansiyelinin analizi

Zcash (ZEC) Temelleri Açısından Gelecekte Ne Vaat Ediyor?

Do Kwon'un Hapis Cezası, Terra ve LUNA'nın Mirası İçin Yeni Bir Bölümü İşaret Ediyor

Xenea Günlük Quiz Yanıtı 14 Aralık 2025

Kripto Terminolojisini Anlama: Yeni Başlayanlar İçin Rehber

NFT’lerde Yeni Bir Dönem: Soulbound Token’ların Temelini Kavramak

Blockchain Teknolojisinde Tendermint’in Konsensüs Mekanizmasını Anlamak