Gate Ventures Research Insights: ReFi Revolution, Ushering in a New Era of Consumer Applications

Introduction

Web3, powered by blockchain technology, has established an economic and cultural paradigm markedly different from the off-chain world. While this shift unlocks vast potential, it also poses compatibility challenges with Web2—mass adoption is hindered because Web2 users own fundamentally different types of assets and infrastructure. If Web2 users’ existing assets could be put on-chain, not only would it energize the on-chain economy, but it would also enable individuals to extract greater economic value. Moreover, it would broaden the spectrum of off-chain asset categories available to blockchain applications, accelerating the evolution and diversification of the on-chain ecosystem.

WiFi Master Key provides a compelling case study. Launched in 2012 during China’s transition from 3G to 4G—an era marked by steep mobile data costs—WiFi Master Key solved the dual problem of scarce public networks and expensive private connections by enabling large-scale WiFi sharing. Its core business model allowed users to share their home WiFi, building a robust shared WiFi ecosystem. At its peak, WiFi Master Key boasted 900 million users and 370 million monthly active users. However, as data costs dropped and telecom carriers rolled out affordable home WiFi and unlimited mobile plans, public WiFi infrastructure steadily improved. The product’s reliance on sharing WiFi access through password retrieval led to increased data costs and network congestion, eventually alienating users and causing a loss of market dominance.

This example underscores how WiFi Master Key leveraged extensive existing WiFi infrastructure to create a near-free, reusable shared network and scale to nearly one billion users. Web2 users naturally possess large-scale assets, but inherent incompatibility with Web3 asset models prevents these resources from realizing their full utility.

We also see an opportunity: much of Web2’s existing infrastructure can be further unlocked by Web3’s global liquidity, open economies, verifiable consensus, and DeFi mechanisms. We refer to this approach as ReFi—Repurpose Finance.

ReFi fundamentally differs from today’s DePIN initiatives. DePIN typically requires hardware purchases, but such hardware can be difficult to scale. True market penetration demands building localized sales networks and supply chains. For products that fulfill essential needs, profit alone is insufficient—product competitiveness must directly address user demands. Many teams lack the capital and capability to build a complete ecosystem and instead rely on KOLs or major sales agents to promote mining gear, often reducing the business model to little more than a Ponzi scheme.

By contrast, ReFi repurposes the existing global asset base without requiring new hardware production or sales, dramatically lowering barriers to entry.

We’ll highlight several cases showing the significant potential benefits of bringing Web2 assets on-chain, sparking entrepreneurial ideas and directly onboarding existing Web2 resources. This model bypasses DePIN’s hardware-centric commercial approach, unlocking success for innovators by integrating real Web2 assets into the blockchain economy.

Case Studies

WiFi

Integrating Tokenomics with WiFi demonstrates substantial promise: if existing WiFi infrastructure were openly accessible to third parties, users could earn income through WiFi rental or sharing, with token-based incentives driving participation.

This model targets users seeking free, high-speed outdoor WiFi for extended periods. Households providing WiFi have little incentive to offer free access as data costs plunge, especially given slower speeds and higher latency. Tokenomics changes this dynamic by rewarding users for reopening network resources, facilitating value exchange and shared profit.

In 2023, the global Wi-Fi market reached $14.5 billion and is projected to hit $39.4 billion by 2028, posting a CAGR of 22.2%. Mobile data market revenue is forecast at $600 billion in 2024, with 4.30% annual growth expected through 2029, when the market will reach $800 billion. These numbers show that WiFi sharing models enabled by Tokenomics are poised to capture significant market share in this fast-growing sector.

Bandwidth

Grass is a standout ReFi project. It enables users to contribute unused internet bandwidth and receive rewards. Today, large companies utilize residential proxy networks—routing requests through millions of users’ local bandwidth to simulate real user traffic, which helps evade single-node DDOS attacks. Residential proxies find widespread use in web scraping, data analytics, market research, social media management, and ticketing.

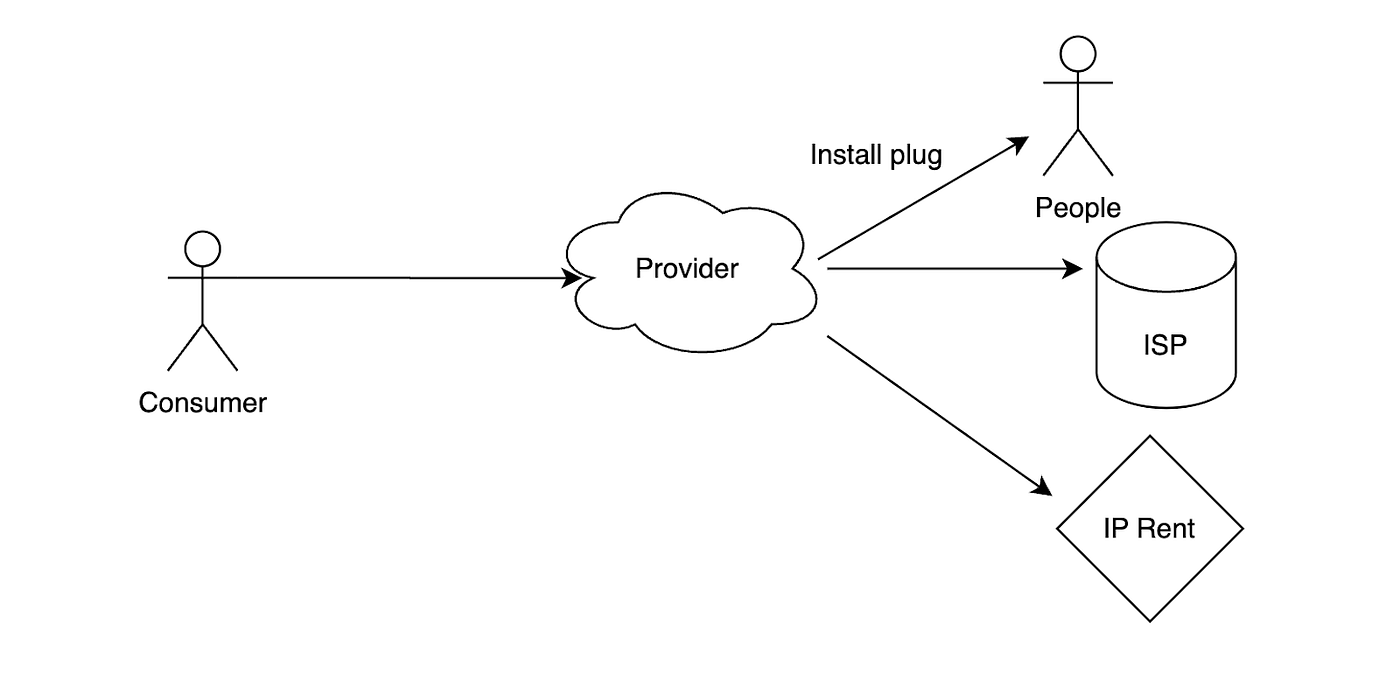

Traditionally, companies in need of residential proxies pay third-party providers, who acquire residential IPs by persuading users to install plugins, partnering with ISPs, or buying from IP lessors—without compensating the end users. Grass disrupts this model by letting individuals monetize their unused bandwidth and making the market transparent and user-centric.

For consumers, this market remains niche: global residential proxy sales stood at $620 million in 2023, projected to reach $840 million by 2030, with a CAGR of 4.6%.

Data

Web2 user data contributions offer transformative potential, especially as LLMs and AI agents wrestle with compute and high-quality dataset shortages. Scale AI exemplifies this opportunity with its tagline: “Empower AI with your data.”

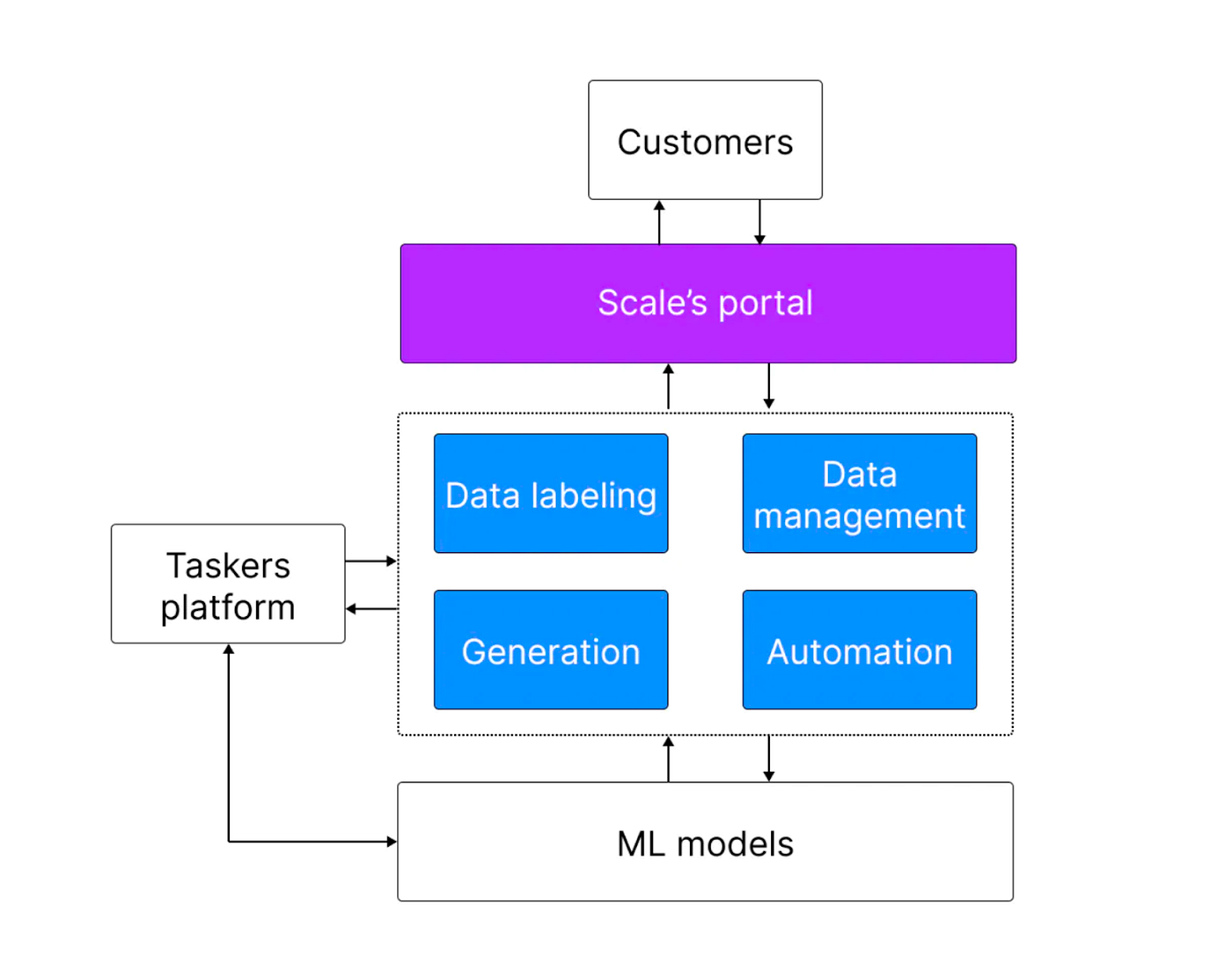

Scale AI Business Model, source: Scale AI

Scale AI’s model connects user data to a task-oriented platform, recruiting low-cost data labelers in Southeast Asia who tag uploaded data and feed it to large models, before scoring model outputs. Data—whether for LLMs or specialized models—is vital, with Scale AI often described as “selling shovels” to the gold rush. Data labelers typically earn just $1–2 per hour, enabling Scale AI to operate at massive scale and efficiency.

Web3 projects can dramatically increase these wages by introducing token incentives. Vana, backed by Paradigm, uses a Data DAO approach, but its reach is limited; low user awareness impedes token demand. A more direct model is Aggregata, which targets retailers by uploading ChatGPT conversations for secondary training, already securing investment from Binance Labs. Token-driven rewards promise to redistribute the majority of profits to providers and workers, not just the platform operator.

The data annotation market is valued at $838.2 million for 2024 and is expected to reach $10.3462 billion by 2033, with a 32.2% CAGR.

Energy

Daylight is another ReFi success, encouraging users to repurpose their surplus energy for additional revenue. The firm has received $13.2 million in funding from A16Z and Lattice Fund Lead. Daylight manages and builds edge grids, using tokenization to incentivize the installation and mobile management of devices like solar panels and water heaters, with users earning token rewards. This approach accelerates clean energy adoption and balances centralized grid load.

While it resembles DePIN, ReFi aims to upgrade existing clean energy devices—without requiring new equipment—through token incentives, simplifying improvements. Daylight’s business model is hardware sales; ReFi, by contrast, centers on leveraging and tokenizing existing widespread assets. Collaborating with manufacturers to set interface standards so legacy clean energy devices can connect on-chain and earn token rewards could unlock new business models. Innovation in this space is highly anticipated.

Global power generation equipment was valued at $110.4 billion in 2022, projected to reach $173.1 billion by 2032, with a 4.8% CAGR through 2032.

Conclusion

This analysis reveals deep-set incompatibilities between Web3 and Web2 users—especially in the asset layer. We propose a new direction: ReFi (Repurpose Finance), which leverages Web2’s vast infrastructure and user assets, using blockchain and tokenomics to migrate these resources on-chain and trigger second-wave value creation.

ReFi’s essence is tapping value from globally pervasive existing resources—home GPUs, WiFi networks, bandwidth, data, energy, and more—upgradable at scale. While the concept is established, ReFi’s key distinction from DePIN is that it doesn’t require new hardware purchases; it uses tokenomics to unlock new use cases for the existing stock market.

Practicality and efficiency matter: some repurposing avenues—like Grass’s bandwidth-for-proxy model—serve small markets with modest efficiency requirements. By contrast, bandwidth or GPU contributions for AI training demand peak performance and are tough to commercialize with today’s tech.

We hope to see wider ReFi adoption, allowing entrepreneurs to tap the latent assets of the world’s 8 billion Web2 users—integrating them into Web3 through global liquidity, distributed state storage, and tokenomics—and ushering in a new era for value and resource utilization.

Disclaimer:

This content does not constitute an offer, solicitation, or investment advice. Always seek independent professional guidance before making investment decisions. Gate.com and/or Gate Ventures may limit or prohibit services in certain jurisdictions. Please review the applicable user agreement for full details.

About Gate Ventures

Gate Ventures is Gate’s venture capital arm, specializing in investments across decentralized infrastructure, ecosystem development, and applications shaping the world in the Web3 era. Gate Ventures partners with global industry leaders to empower innovative teams and startups, pioneering new paradigms of social and financial interaction.

Website: https://ventures.gate.com/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/gate_ventures

Related Articles

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)

Gate Ventures Weekly Crypto Recap (September 22, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

How On-Chain TCGs Could Unlock the Next $2 Billion Market: Landscape Overview and Valuation Outlook