A Tale of Two Worlds: A Comparative Analysis of Crypto Regulations Worldwide

When Satoshi published his white paper, it was so easy to mine Bitcoin that any gamer with a decent CPU could accumulate soon-to-be millions of dollars per day.

On the family’s desktop, instead of playing The Sims, you could have built a legacy so vast that none of your descendants would have to toil, with an ROI of around 250,000x.

But most gamers were stuck to their Xbox, playing Halo 3, and just a few teenagers were leveraging the family’s PC to make more money than modern tech behemoths. Napoleon built his mythos by conquering Egypt, and later, Europe, while you just had to click on ‘’Start mining”.

In 15 years, Bitcoin became a global asset, mined thanks to large-scale operations backed by billions of dollars worth of funding, hardware and energy bills. On average, one Bitcoin consumes 900,000 kWh.

Bitcoin birthed a completely new paradigm, in stark opposition to the gate-kept financial world we grew up with. It was perhaps the first true rebellion against the elite following the failed Occupy Wall Street movement. It is noteworthy that Bitcoin was created precisely after the Obama-era Great Financial Crisis, largely fueled by complacency toward risky casino banking. The Sarbanes-Oxley Act of 2002 sought to prevent future DotCom collapses from happening; ironically, the 2008 meltdown was magnitudes worse.

Whoever Satoshi was, his invention came at the right moment, a spasmodic yet thoughtful act of resistance against the Leviathan, oh so potent and pervasive.

Prior to 1933, the US equity market was effectively an unregulated environment governed only by fragmented state-level “Blue Sky“ laws, creating massive information asymmetry and rampant wash trading.

The liquidity crisis of 1929 was the stress test that broke this model, proving that decentralised self-regulation could not contain systemic risk (rings a bell?). In response, the US government executed a hard reset via the Securities Acts of 1933 and 1934, replacing the “caveat emptor” standard (proceed at your own risk model) with a centralised enforcement body (the SEC) and mandatory disclosure protocols, thus standardising the law for all public assets to restore trust in the solvency of the system… We are seeing the exact same process at work with DeFi.

Until recently, crypto operated as a permissionless “shadow banking” asset, functionally similar to the pre-1933 era but rendered magnitudes more dangerous by a total lack of supervision. The architecture relied on code and hype as the primary governance mechanism, which failed to account for the immense risk such a feral beast posed. The cascading insolvencies of 2022 served as the ecosystem’s 1929-style stress test, showing that decentralisation does not equate infinite gains and sound money; instead, it created a risk node where several different asset classes could be engulfed. We are currently witnessing a forced change in Zeitgeist from a libertarian casino-like paradigm to a compliant asset class, where regulators are trying to effect a U-turn with crypto: if it’s legal, funds, institutions, HNWIs, and States can stack it like any other asset, and so we can tax it.

This article will attempt to unearth the genesis of crypto’s institutional rebirth, a transition currently unavoidable. Our objective is to project this trend to its logical conclusion and define precisely what the final state of the DeFi ecosystem will look like.

Laying Down Regulations

Until 2021, when DeFi entered its first true Dark Ages, its infancy was defined less by new legislation than by federal agencies stretching existing laws to fit digital assets. One thing at a time, indeed.

The first major federal action came in 2013, when FinCEN issued guidance classifying crypto “exchangers” and “administrators” as Money Services Businesses, effectively subjecting them to the Bank Secrecy Act and anti-money-laundering controls. One can recognise 2013 as the year when DeFi was first acknowledged by Wall Street, paving the way for both enforcement and oppression.

In 2014, the IRS complicated the landscape by declaring virtual currency to be “property“ rather than currency for federal tax purposes, triggering capital gains obligations on every transaction; there, Bitcoin received a legal qualification, and with it, the ability to be taxed; a far cry from its original intent!

At the state level, New York launched the controversial BitLicense in 2015, the first framework requiring disclosures for crypto businesses. Finally, the SEC ended the party with the DAO Report, confirming that many tokens were unregistered securities under the Howey Test.

By 2020, the OCC briefly opened the door for national banks to provide crypto custody services, a move later contested by the Biden administration, as it was customary for past presidents to do.

On the other side of the pond, in the Old World, the same antiquated customs held sway over crypto. Inspired by the rigid Roman Law, poles apart from the Common Law, the same spirit of anti-individual freedom prevailed, restraining what DeFI could be in a retrograde civilisation. Let us remember that America is largely protestant; this spirit of autonomy shaped America, which has always been defined by entrepreneurship, freedom and the Frontier mindset.

In Europe, Catholicism, Roman Law and the remnants of Feudalism begat quite a different culture. It is thus expected that the old Nations of France, Great Britain and Germany followed a different path. In a world where obedience is preferred over risk-taking, crypto was bound to be severely repressed.

Europe’s early era was thus defined by fragmented bureaucracy rather than a unified vision. The industry scored its first victory in 2015 when the European Court of Justice (Skatteverket v Hedqvist) exempted Bitcoin exchanges from VAT, effectively legitimising crypto as currency.

Without EU-wide laws, nations diverged until MiCA. France (PACTE Law, a terrible corpus of law) and Germany (crypto custody licenses) built strict national frameworks, while Malta and Switzerland raced to attract business with top-tier regulations.

This chaotic era ended with the 5th Anti-Money Laundering Directive in 2020, which mandated strict KYC across the bloc and annihilated anonymous trading. Recognising that 27 conflicting rulebooks were untenable, the Commission finally proposed MiCA in late 2020, signalling the end of the patchwork era and the start of a unified regulatory regime… to the dismay of everyone.

The forward-looking model of the USA

Oh chain, can you see, as Donald clears the way,

What so long was restrained now stands lawful today?

The transformation of the American regulatory apparatus is not truly systemic; it is driven mainly by talking heads. The changing of the guard in 2025 brought with it a new philosophy: mercantilism over moralism.

Trump’s launch of his infamous memecoin in December 2024 was perhaps the top, or not, but it demonstrated that the elite is willing to make crypto great again. Several crypto popes now steer the ship, forever toward greater freedom and leeway for founders, builders, and retail.

The arrival of Paul Atkins at the SEC was less a hiring and more a regime change. His predecessor, Gary Gensler, had viewed the crypto industry with sheer hatred. He became the pet peeve of our generation; the University of Oxford published a paper showing how painful Gensler’s rule was. It is believed that, because of his aggressive stance, years of progress were lost for DeFi champions, who were hindered by a regulator out of touch with the industry he is supposed to guide.

Atkins didn’t just stop the lawsuits; he effectively apologised for them. His “Project Crypto“ is a masterclass in bureaucratic pivot. The “Project“ is about creating a disclosure regime so boring, so standardised, and so thorough that it allows Wall Street to trade Solana like they trade oil. Allen & Overy summarises the plan:

Establishing a clear regulatory framework for crypto asset distributions in the United States

Ensuring freedom of choice among custodians and trading venues

Embracing market competition and facilitating “super-apps”

Supporting onchain innovation and decentralised finance

Innovation exemptions and commercial viability

Perhaps the most critical shift sits within the Treasury. Janet Yellen viewed stablecoins as a systemic risk. Scott Bessent, a man with a hedge-fund mind occupying a bureaucratic seat, sees them for what they actually are: the only net-new buyers of US debt.

Bessent understands the ugly math of the US deficit. In a world where foreign central banks are slowing their purchases of Treasuries, the insatiable appetite of stablecoin issuers for short-term T-bills is a solid upside for the new master of the Treasury. He views USDC/USDT not as a competitor to the dollar, but as its herald, extending the hegemony of the greenback into distressed countries where one would prefer holding stablecoins rather than a bleeding fiat.

Another villain who turned bullish, Jamie Dimon, who once threatened to fire any trader caught touching Bitcoin, has performed the most lucrative 180-degree turn in financial history. JPMorgan’s 2025 rollout of crypto-collateralised lending was the white flag. As per The Block:

JPMorgan Chase plans to permit institutional clients to use bitcoin and ether holdings as collateral for loans by the end of the year, as Wall Street pushes deeper into cryptocurrencies.

The program will be offered globally and will rely on a third-party custodian to safeguard the pledged assets, Bloomberg reported, citing people familiar with the matter.

When Goldman Sachs and BlackRock began eating into JPM’s custody fee revenue, the war was effectively over. The banks have won by not fighting the war.

Finally, Cynthia Lummis, the lonely crypto lady of the Senate, tolerated but ignored, has emerged as the most loyal bull of the new American collateral. Her proposal for a Strategic Bitcoin Reserve has moved from the fringes of CT theory to serious committee hearings. Her pontifications did not really affect Bitcoin’s price, but her efforts are genuine.

The legal landscape of 2025 is defined by what is settled for good and what is still dangerously in the balance. The current administration is so keen on crypto that white-shoe firms maintain real-time feeds for the latest crypto news: Latham & Watkins’ US Crypto Policy Tracker follows the latest developments from the myriad of regulatory bodies that tirelessly deploy new rules for DeFi. We are, however, still in the discovery phase.

Currently, two bodies of law dominate the US debates:

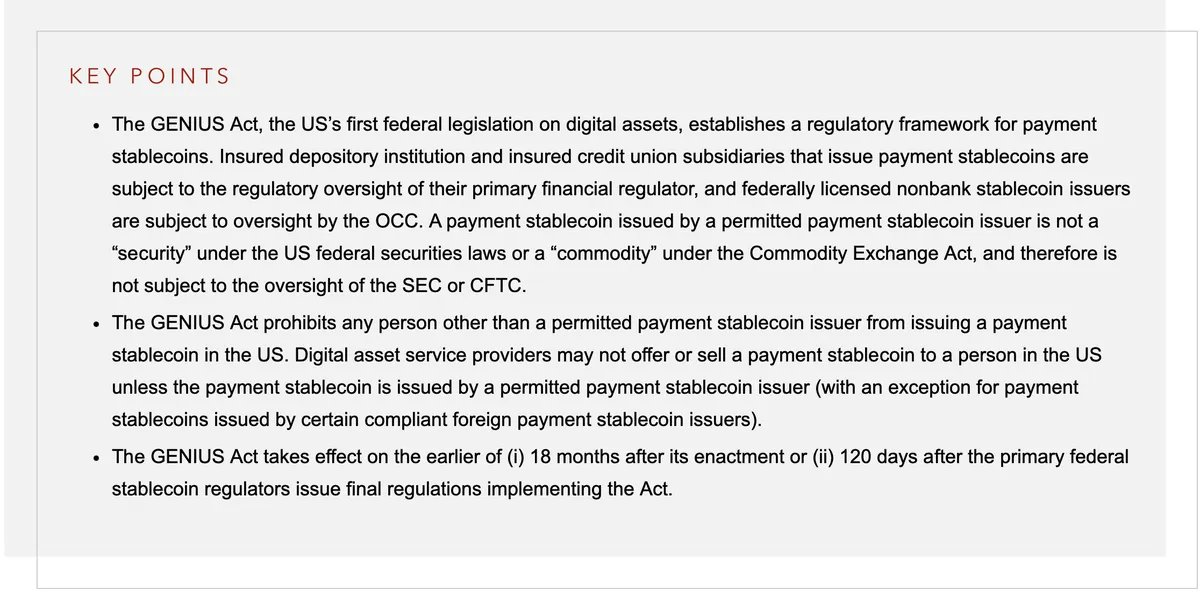

The GENIUS Act (passed July 2025); the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) was the moment Washington finally tackled stablecoins, the most critical asset after Bitcoin. By mandating strict 1:1 treasury backing, it transformed stablecoins from a systemic risk into a geopolitical tool, such as gold or oil. The Act effectively deputised private issuers like Circle and Tether, turning them into recognised purchasers of U.S. debt. Win-win.

Conversely, the CLARITY Act remains the industry’s “Waiting for Godot.” Stalled in the House Financial Services Committee, this market-structure bill aims to finally settle the skirmish between the SEC and the CFTC regarding the distinction between securities and commodities. Until this passes, exchanges exist in a comfortable but fragile limbo, operating under temporary agency guidance (which has been the case thus far - rather than the permanent ink of statutory law.

Currently, it is a point of contention between the Republicans and the Democrats, and it seems like this piece of legislation is being weaponised by each side.

Finally, the repeal of Staff Accounting Bulletin 121 was a technical accounting rule that effectively prevented banks from holding crypto by requiring them to treat custodial assets as liabilities. Its repeal was the moment the floodgates opened. It was the signal that institutional capital (even pension funds!) could finally buy crypto without fear of regulatory retaliation. In the same vein, they have meanwhile started offering life insurance denominated in Bitcoin; the future looks bright.

The Old World: an Innate Aversion to Risk

Ancient times often held servitude, customs, and laws that benefited the powerful and oppressed the common people.

Cicero

What is the point of such a sophisticated civilisation, which birthed geniuses like Plato, Hegel or Macron (jk) if the current builders are stifled by mediocre bureaucrats whose sole endeavour is to refrain others from creating?

In the same way, the Church once burnt scientists at the stake (or merely tried them), the current regional powers devise complex and sibylline laws that may only deter entrepreneurs. The chasm between a dynamic, young American spirit of defiance and a dishevelled, crippled Europe has never been so wide. While Brussels had the opportunity to deviate from its usual rigid manners, it chose to remain unbearably stiff.

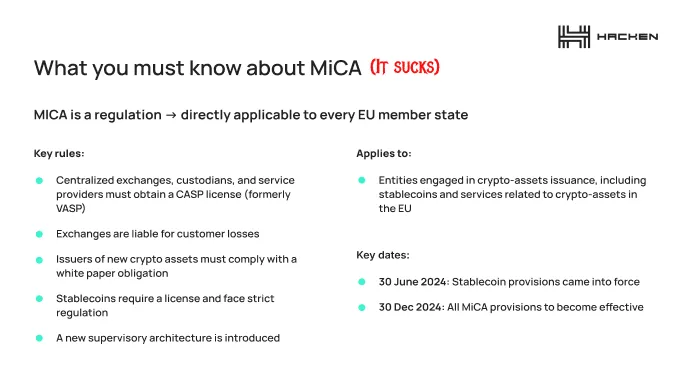

The full implementation of MiCA in late 2025 is a masterpiece of bureaucratic intent and an absolute catastrophe for innovation.

MiCA was sold to the public as a “comprehensive framework,” a phrase that in Brussels usually translates to “comprehensive torture.” It provided the industry with clarity, yes; the clarity to run away.

The fundamental flaw of MiCA is a category error: it treats founders like sovereign banks. The cost of compliance is such that crypto businesses are bound to fail.

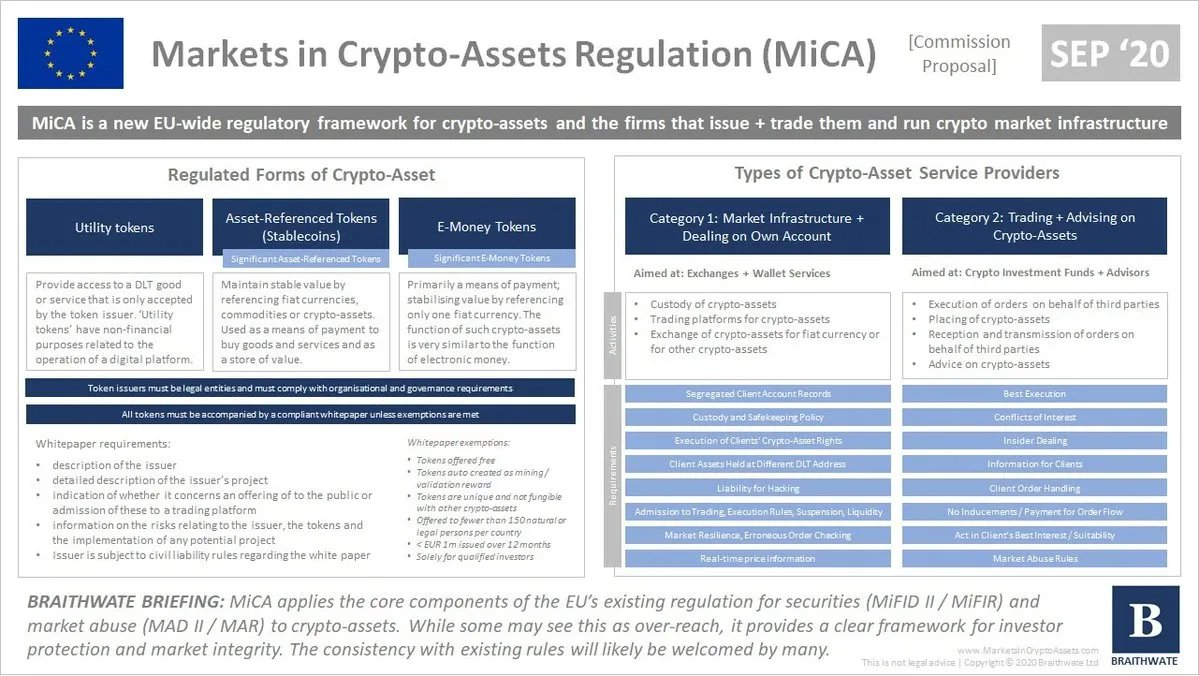

Norton Rose released a memo that objectively explains the regulation.

Structurally, it functions as an exclusionary mechanism, moving digital assets into highly regulated categories (Asset-Referenced Tokens (ARTs) and E-Money Tokens (EMTs)) while subjecting Crypto-Asset Service Providers (CASPs) to a burdensome compliance architecture mirroring MiFID II, a regulation normally reserved for finance giants.

Under Titles III and IV, the regulation imposes a strict 1:1 liquid reserve mandate on stablecoin issuers, effectively proscribing algorithmic stablecoins by rendering them legally insolvent ab initio (which could, in itself, constitute a significant systemic risk; imagine being outlawed by Brussels overnight?).

Furthermore, issuers of “significant“ tokens (the infamous sARTs/sEMTs) face enhanced supervision by the European Banking Authority, including capital requirements that render startup issuance economically unviable. It is now impossible to open a crypto outfit without an army of top-tier lawyers and the kind of capital proper to TradFi’s dealings.

For intermediaries, Title V eliminates the concept of the offshore, cloud-based exchange. CASPs must establish a registered office within a Member State, appoint resident directors subject to “fit and proper” tests, and implement segregated custody protocols. The “Whitepaper“ requirement (Article 6) transforms technical documentation into a binding prospectus, attaching strict civil liability for any material misstatements or omissions, thereby piercing the corporate veil of anonymity often cherished by the sector. One might as well open a neo-bank.

While the regulation introduces passporting rights, allowing a CASP authorised in one Member State to operate across the entire EEA without further localisation, this “harmonisation “ (a terrible word in EU law) comes at a steep price.

It creates a regulatory moat in which only hyper-capitalised institutional actors can sustain the overhead of AML/CFT integration, market abuse monitoring, and prudential reporting.

MiCA does not merely regulate the European crypto market; it effectively prevents entry without the legal and financial resources that crypto founders almost always lack.

On top of EU law, Germany’s regulator, BaFin, has become a mediocre compliance machine, efficient only at processing the paperwork of a dying sector. Meanwhile, France’s ambition to be the “Web3 Hub” (the Startup Nation…) of Europe has crashed into the wall of its own making. French startups are not coding; they are leaving. They are unable to compete with the speed of American pragmatism or Asian relentless innovation, leading to a massive brain drain toward Dubai, Thailand and Zurich.

But the true death knell is the ban on stablecoins. By effectively prohibiting non-Euro stablecoins (such as USDT) to “protect monetary sovereignty,” the EU has effectively ended the only reliable sector in DeFi. The global crypto economy runs on stables. By forcing European traders into low-liquidity “Euro-tokens” that nobody outside the Schengen zone wants to hold, Brussels has created a liquidity pit.

The ECB and the European Systemic Risk Board (ESRB) have urged Brussels to ban the “multi-issuance” model, in which global stablecoin firms treat tokens issued in the EU as interchangeable with those outside the bloc. The ESRB, chaired by ECB President Christine Lagarde, said in a report that a rush by non-EU holders to redeem EU-issued tokens could “amplify runs within the bloc.”

Meanwhile, the UK wants to limit stablecoin holdings to 20k GBP per person… while shitcoins are absolutely not regulated. The risk-averse strategies of Europe need a serious overhaul before regulators trigger a full-blown collapse.

I suppose the explanation is simple: Europe wants its citizens to remain bound to the Euro, unable to participate in the US economy and escape economic stagnation, if not, death. As per Reuters:

Stablecoins could draw valuable retail deposits away from eurozone banks, and any run on a coin could have widespread stability implications for the global financial system, the European Central Bank warned.

Nonsense!

The ideal framework: Switzerland

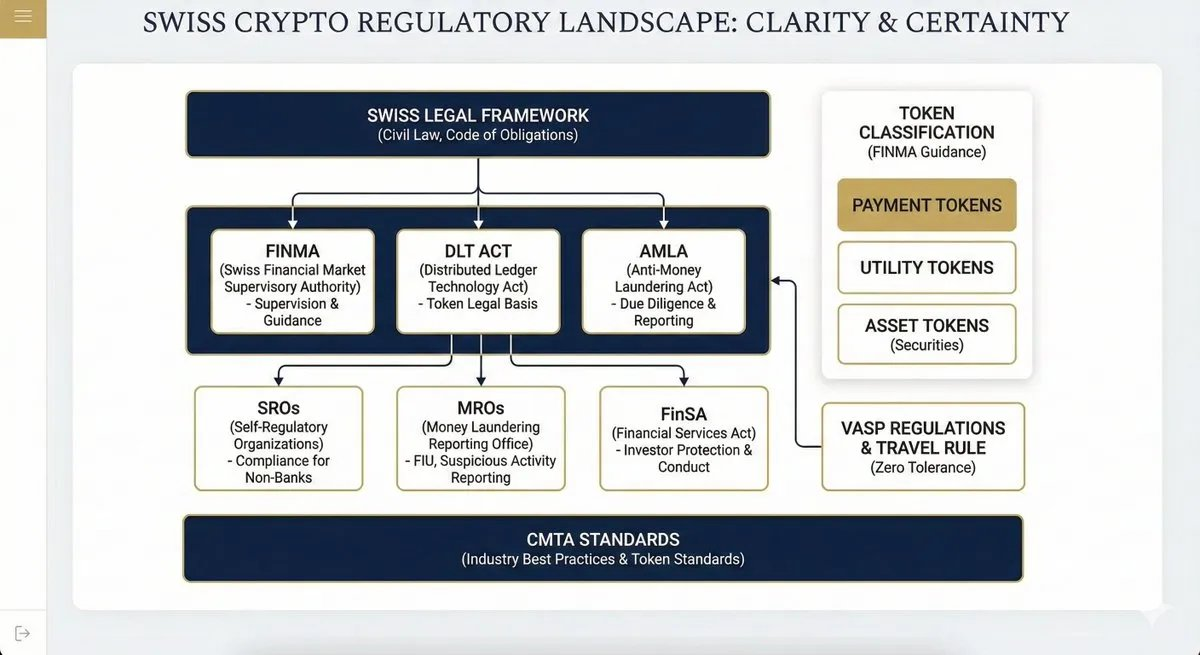

Some countries, unburdened by partisan politics, stupidity or antiquated laws, managed to escape the dichotomy of too much regulation/not enough and found a way to accommodate everyone. Switzerland is one of those marvellous countries.

The regulatory landscape is diverse, but it works, it is friendly and actual providers/users love it:

- The Financial Market Supervision Act (FINMASA), enacted in 2007, is the umbrella statute that established FINMA as the integrated, independent supervisor of the Swiss financial market (by merging banking, insurance, and AML authorities).

- The FinSA focuses on investor protection. It creates a “level playing field” for financial service providers (banks and independent asset managers) by mandating strict rules of conduct, client classification (retail, professional, institutional), and transparency (Basic Information Sheets)

- The Anti-Money Laundering Act is the primary framework for combating financial crime. It applies to all financial intermediaries (including crypto CASPs) and sets the baseline duties.

- The DLT-Law (2021) is a “blanket act” that amended 10 federal laws (including the Code of Obligations and Debt Enforcement Act) to recognise crypto assets.

- VASP Regulations, enforcing the FATF Travel Rule with zero tolerance (no de minimis threshold).

- Article 305bis SCC (Swiss Criminal Code) defines the criminal offence of Money Laundering.

- CMTA Standards Published by the Capital Markets and Technology Association, these are non-binding but widely adopted industry standards

The Regulatory Bodies consist of the Parliament (which enacts federal acts), FINMA, which regulates the sector through Ordinances and Circulars, and the SROs (Self-Regulatory Organisations, such as Relai), supervised by FINMA, which in turn supervise independent asset managers and crypto intermediaries. The MROS (Money Laundering Reporting Office) reviews SARs (Suspicious Activity Reports, just like in TradFi) and sends them to prosecutors.

Consequently, the Zug Valley is the gold standard for crypto founders, with a logical framework that not only allows them to work but also to operate under a well-defined legal umbrella, both reassuring users and the banks willing to take a little risk.

Forward, America!

The New World’s approach to crypto is not born of a desire to innovate (France has yet to send someone to the Moon), but of fiscal desperation. Having surrendered the Web2 internet to Silicon Valley since the 80s, Europe views Web3 not as an industry to build, but as a tax base to harvest, like everything else.

The repression is structural and cultural. In a context of ageing demographics and overwhelmed pension systems, the EU cannot afford a competing financial industry it does not control. We are reminded here of the feudal lords imprisoning or killing the local baron to avoid unduly rivalries. Europe has a terrible reflex to sabotage its citizens to prevent uncontrolled change. This is not something familiar to the USA, which thrives on competition, aggression and a certain Faustian will to power.

MiCA is not a framework for “growth“; it is a death sentence. It is designed to ensure that if a Euro-citizen transacts, they do so within a surveillance grid that guarantees the state its cut, in the manner of a fat monarch looking to bleed its peasants. Europe is effectively positioning itself as the world’s luxury consumer colony, an eternal museum where Americans, amazed, come to contemplate a past that is impossible to revive.

Nations like Switzerland and the UAE are operating outside of historical and structural defects. They are unencumbered by the imperial overhang of defending a global reserve currency or the bureaucratic inertia of a 27-member bloc, deemed crippled by everyone living inside. By exporting trust via the DLT Act, they attracted the foundations (Ethereum, Solana, Cardano) that hold the actual IP. The UAE followed suit; no wonder French people are invading Dubai.

We are moving toward a period of aggressive jurisdictional arbitrage.

We will see a geographical split in the crypto industry. The consumer side will live in the US and Europe, fully KYC’d, massively taxed, and integrated with traditional banks, but protocols will migrate entirely to the rational jurisdictions of Switzerland, Singapore, and the UAE.

The user base will be everywhere, but founders, VCs, protocols and devs will have to consider moving out of their native market to find a better place to build.

The fate of Europe is to become a financial museum. Europe is guaranteeing its citizens a nice, shiny body of law that is utterly useless and fatal for actual users. I wonder if the technocrats of Brussels ever bought Bitcoin or bridged some stables.

The macro asset status of crypto is inevitable, and the USA will retain its seat as the world’s financial capital. They are already offering Bitcoin-denominated life insurances, crypto collateral, crypto reserves, endless VC backing for anyone with an idea, and a feisty breeding ground for builders.

Worried closing thoughts

To conclude, the “brave new world” currently being architected by Brussels feels less like a coherent digital framework and more like an awkward, Frankenstein patchwork, a clumsy attempt to graft 20th-century banking compliance onto 21st-century decentralised protocols, designed mainly by engineers who know nothing about the European Central Bank’s tantrums.

We must aggressively advocate for a different regime, one that prioritises our reality over administrative control, lest we definitively strangle Europe’s already anaemic economy.

Crypto, unfortunately, is not the sole victim of this obsession with risk. It is merely the latest target of a well-paid, complacent bureaucratic caste haunting the sterile, post-modernist corridors of our capital cities. This is a ruling class that regulates with a heavy hand precisely because they lack real-world experience. They have never endured the throes of having to KYC one’s account, get a new passport or obtain a business license; so, despite the so-called technocratic elite at work in Brussels, crypto-native founders and users have to juggle with deeply incompetent people who produce nothing but harmful legislation.

Europe must pivot, and immediately. While the EU busies itself with stifling red tape, the United States is actively determining exactly how to “regularise” DeFi, moving toward a framework that works for everyone. Centralisation through regulations was obvious: the writing was on the wall when FTX collapsed.

The bagholders are desperate for retribution; we need a reprieve from the current wild west cycle of memecoins, bridge exploits, and regulatory chaos. We need a structure that allows real capital to enter safely (Sequoia, Bain, BlackRock, or Citi are leading the charge), while also protecting end-users from predatory capital.

Rome wasn’t built in a day, but we are now fifteen years into this experiment, and the institutional foundations have yet to emerge from the mire. The window of opportunity to build a functional crypto industry is closing rapidly; hesitation and half measures lose everything in war, and a swift, decisive, all-encompassing regulation must be implemented on both sides of the Atlantic.

If this cycle is indeed ending, it is the best time to salvage our honour and redeem all the serious investors whom bad actors have wronged for too many years.

The exhausted traders from 2017, 2021 and 2025 demand a reckoning and a final resolution to the crypto question; and above all, well-deserved ATHs for our favourite assets in the entire world.

Disclaimer:

- This article is reprinted from [castle_labs]. All copyrights belong to the original author [castle_labs]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

NFTs and Memecoins in Last vs Current Bull Markets

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market