Crypto Asset Survival Guide: What Is a Cold Wallet and Why Everyone Should Have One

What Is a Cold Wallet?

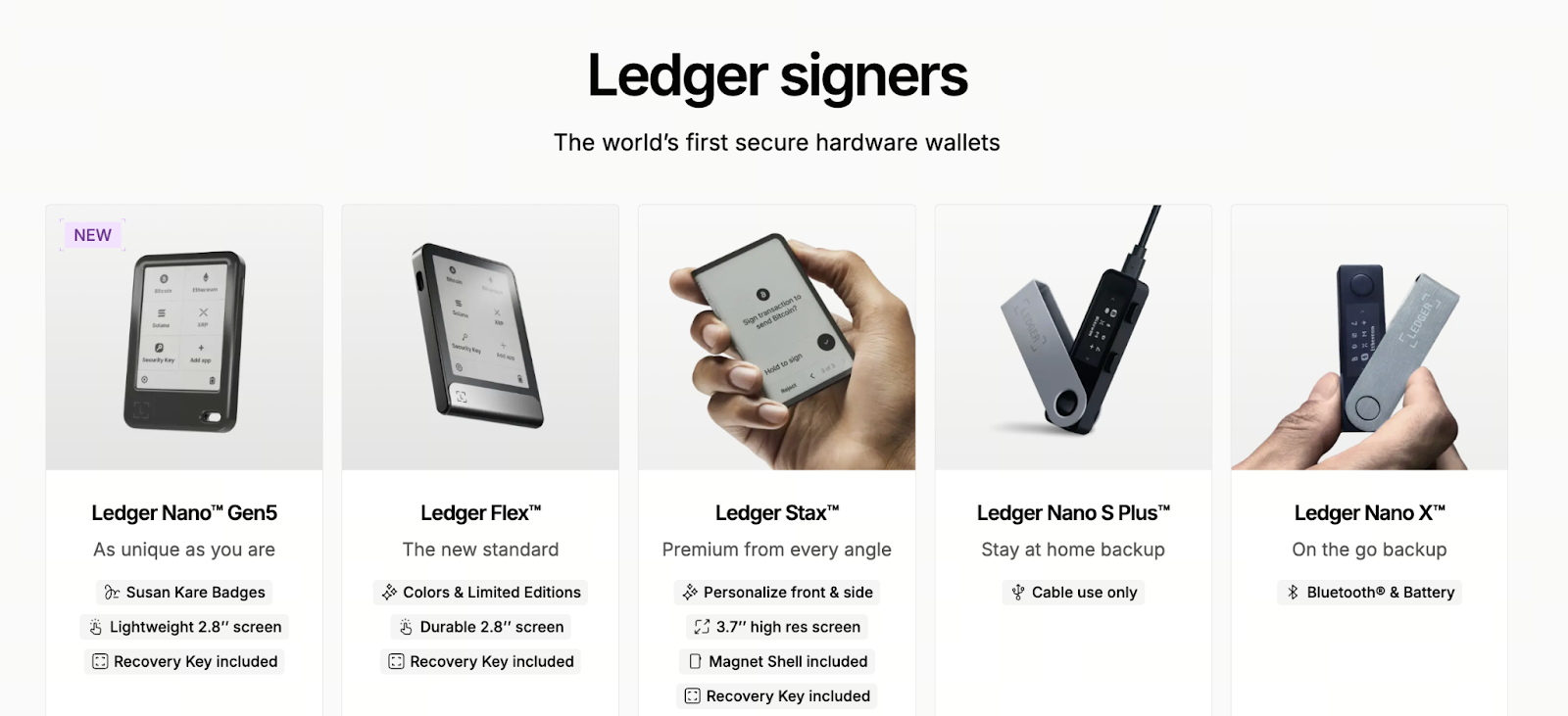

Image credit: https://shop.ledger.com/

A cold wallet is a type of cryptocurrency wallet that stores private keys or cryptographic credentials offline. Also referred to as an “offline wallet,” it operates without internet connectivity or network access, significantly reducing the risk of online threats such as hacking or malware. For example, storing private keys on a USB device that has never been connected to the internet or keeping a handwritten or printed paper record are both considered cold wallets. The term “air-gapped wallet” specifically refers to wallets that are completely isolated from any network, which is a subset of cold wallets.

Cold Wallet vs. Hot Wallet

A hot wallet is a cryptocurrency wallet connected to the internet, enabling immediate online transactions and access—examples include mobile apps, web wallets, or exchange-hosted wallets. In contrast, cold wallets remain offline or connect rarely, offering superior security but less convenience. As a best practice, many users combine strategies: keeping small amounts for daily use in hot wallets and storing larger, long-term holdings in cold wallets.

Main Types of Cold Wallets

Cold wallets come in various forms. The most common types are:

- Hardware Wallet: This is a dedicated device, often shaped like a USB stick, that securely stores private keys and remains offline except when needed.

- Paper Wallet: Public and private keys are written or printed on paper and kept entirely offline for maximum isolation.

- Deep Cold Storage: Devices are stored in safes or underground vaults. This provides extremely high security but makes access highly inconvenient. The term “Deep Cold Storage” should be consistently capitalized.

Why Use a Cold Wallet? Pros and Cons

Advantages

- Enhanced security: Keeping private keys offline makes remote hacking virtually impossible.

- Ideal for long-term storage: This method is well-suited for “buy-and-hold” strategies that require robust protection.

Disadvantages

- Less convenient: Each transaction or transfer requires more complex procedures.

- Risk of asset loss: If the device is lost, destroyed, or the seed phrase is forgotten, recovery may be impossible. Note that “seed phrase” and “private key” refer to distinct concepts and should be used consistently according to their technical meanings.

- Physical vulnerabilities: Despite offline security, there are still risks. Physical damage, backup failure, and air-gap attacks can occur. These risks should be stated as distinct points for clarity.

How to Set Up and Use a Cold Wallet Safely?

- Purchase a reputable hardware wallet brand or create a paper wallet yourself.

- Generate private keys or seed phrases in a secure, offline environment.

- Backup your seed phrase or private key properly (e.g., in a fireproof safe or secure vault).

- Keep your device disconnected from the internet and avoid using it for daily transactions.

- Only transfer small amounts needed for daily use to hot wallets, minimizing cold wallet access.

- Routinely check device status and stay updated on security best practices.

Common Misconceptions & Precautions

- Misconception: Cold wallets are “100% secure.” In reality, lack of backups, device damage, or user error can still result in asset loss.

- Precautions: Always protect your seed phrase; avoid generating or backing up keys in a networked environment; regularly confirm device control.

- Even cold wallets can be compromised. For example, recent incidents where exchange cold wallets were stolen show the importance of comprehensive security.

Who Should Use a Cold Wallet?

- Large asset holders: Those seeking long-term storage and minimal trading activity.

- Institutional investors: Where asset security is paramount.

- Security-focused users requiring maximum protection.

If you only trade occasionally or use crypto for everyday payments, a hot wallet or hybrid approach may be more suitable.

Conclusion

In summary, a cold wallet serves as a security measure for crypto asset management rather than a universal solution. Understanding its definition, types, benefits, and drawbacks—and matching them to your needs—is key to proper use. This guide is intended to clarify the concept of cold wallets and support users in developing effective strategies for protecting their assets.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data