Gate Research: Solana Active Addresses Hit One-Year Low|Ethereum Daily Active Validators Continue to Decline

Summary

- Bitcoin has been trading in a $100,300–$107,500 range over the past week, and its consolidation phase is expected to continue.

- Visa launches a stablecoin payment pilot, enabling platforms to pay content creators and freelancers directly in USDC.

- VCI Global plans to invest $100 million to acquire OOB, the token of Tether-backed crypto payment platform Oobit.

- Ethereum validator count has dropped back to April 2024 levels, while the validator exit queue has reached a record high.

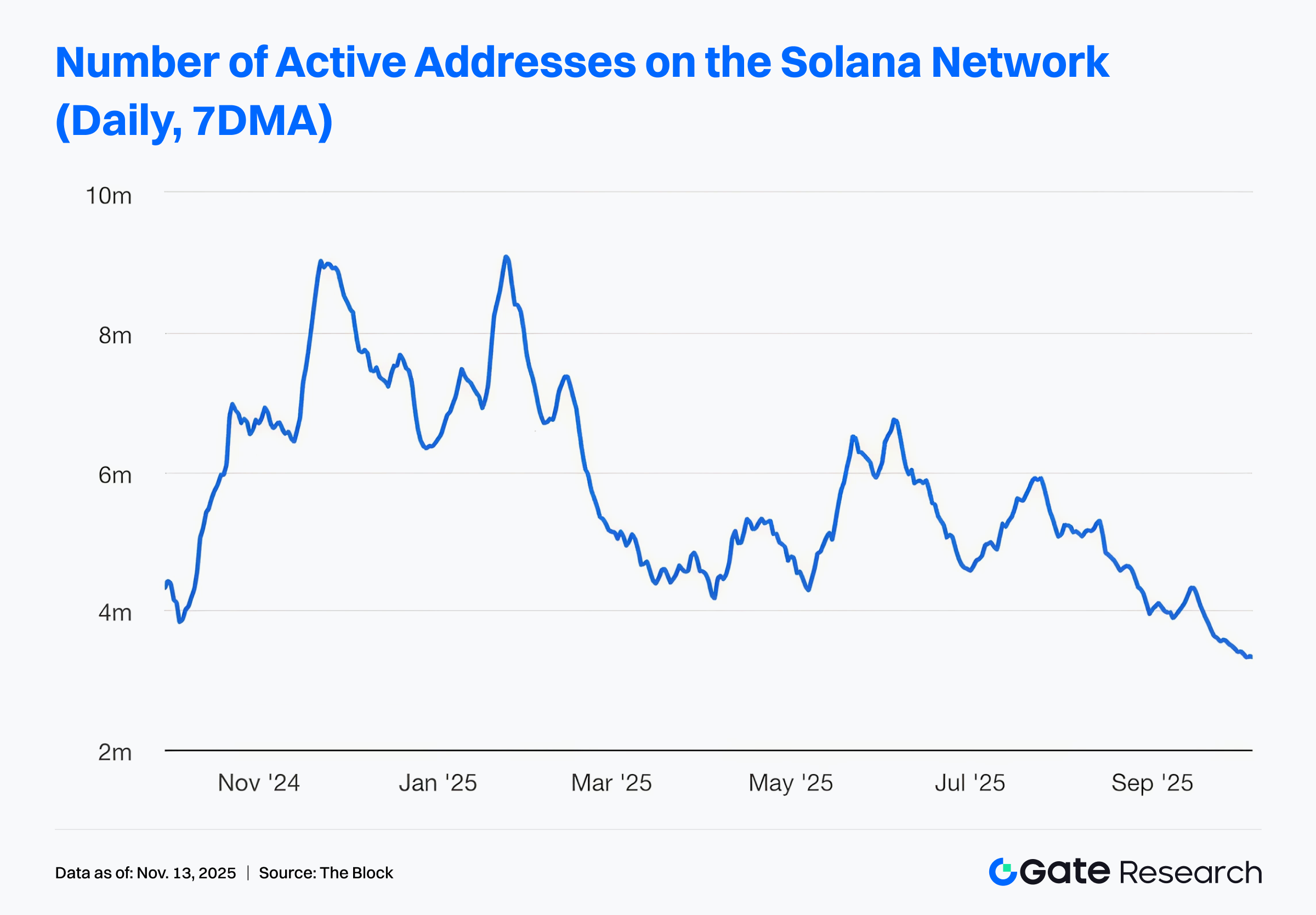

- Solana’s active addresses have fallen to 3.3 million, marking a one-year low.

- The x402 network’s facilitators have processed over 18.82 million transactions, a 35-fold increase since May.

Market Overview

Market Commentary

- BTC market — Bitcoin is currently trading around $102,000. After recent consolidation, it is attempting a rebound. The price previously found support near the major demand zone at $100,000 but encountered significant resistance around $105,000, pulling back again to approximately $101,000. Although buying interest shows signs of warming, the overall market structure suggests that if trading volume does not increase substantially, this rebound may be only a temporary correction. Technically, the $106,000–$110,000 range has turned into a key supply zone. If buyers can break above and hold $110,000, the next target would be $114,000. Conversely, failure to stabilize could end this rebound, with a potential retest of the $100,000 level. From a macro perspective, interbank funding costs remain stable, and the government shutdown risk has been resolved, which may boost market risk appetite and support Bitcoin and major crypto assets.

- ETH market — Ethereum, after failing to sustain upward momentum above $3,600, has fallen back to test key support levels. The current market structure indicates that the recent rebound may only be a short-term correction within a larger consolidation phase. On the daily chart, ETH remains within a downward Bollinger Band channel, repeatedly constrained by the upper and middle bands, reflecting the dominance of the downtrend. The price has not stabilized above the $3,600–$3,700 resistance zone. When retesting the lower channel boundary and the 200-day moving average (~$3,300), selling pressure has reappeared. This zone has become a key battleground between bulls and bears. A daily close below the 200-day MA could trigger further downside, with a target in the $3,000–$3,100 major demand area, where strong buying support exists. Conversely, if the price successfully returns above $3,600 and holds, it could confirm a bullish recovery structure, opening the upside to the $3,900–$4,000 range.

- Altcoins — Major altcoins have shown a structural rotation trend this week. The Altseason Index stands at 28. Since late October, altcoins have been consolidating, and trading should remain cautious.

- Stablecoins — The total stablecoin market capitalization is currently $305.6 billion. Short-term adjustments caused a decline of $22.86 million over the past week, but the long-term trend remains steadily upward.

- Gas Fees — Ethereum network gas fees have dropped from a peak average of 2.73 Gwei on November 4. As of November 13, the daily average gas fee was 0.145 Gwei.

Trending Tokens

Over the past 24 hours, the crypto market has shown a mixed performance. Bitcoin fell 0.83%, weighing on market sentiment, while Ethereum rose 0.56%, demonstrating relative resilience. Some major altcoins, such as XRP (+1.27%) and DOGE (+0.07%), gained slightly, but others like SOL recorded losses, indicating a structural rotation of capital. As most assets entered a short-term adjustment phase, tokens like BEAT, SUBHUB, and PARTI stood out. Below is an analysis of the reasons behind their price movements.

BEAT Audiera (+139.25%, Market Cap: $52.33M)

According to Gate market data, BEAT is currently trading at $0.36314, up 139.25% in 24 hours. Audiera is the Web3 version of the globally popular music dance game IP, Audition, with over 600 million users worldwide. The project integrates AI and blockchain technologies to create an immersive, creation-driven interactive experience. Users can interact with AI idols, create music and mint it as NFTs, and participate in full-body immersive gameplay via smart fitness mats. Its ecosystem spans mobile games, mini apps, and AI-driven creative studios.

The recent strong rebound in BEAT’s price was mainly driven by positive exchange-related developments. On November 12, a major CEX launched BEAT perpetual contracts, offering up to 50x leverage and copy-trading functionality. On the day of the announcement, BEAT’s 24-hour trading volume exceeded $1.1 billion. Against a backdrop of a roughly 7% decline in global crypto trading volume over 24 hours, the launch attracted significant short-term speculative capital, generating notable liquidity and price volatility. While market interest surged, high leverage also amplified risk, so investors should exercise caution.

SUBHUB SubHub (+76.04%, Market Cap: $618.2K)

Gate market data shows SUBHUB trading at $0.007429, up approximately 76.04% over 24 hours. SubHub is a blockchain-based Web3 subscription platform that enables creators to monetize content and distribute earnings through crypto payments and smart contracts.

The price increase was mainly driven by product updates: the SubHub team recently announced integration of an RSS subscription feature for direct Web3 content distribution and emphasized its “decentralized influence” platform on November 7. These updates position SUBHUB as a tool for creators to bypass centralized platforms. By empowering creators and promoting Web3 decentralization, the project aligns with core crypto industry values, attracting speculative capital.

PARTI Particle Network (+46.14%, Market Cap: $23.57M)

Gate market data reports PARTI trading at $0.10119, up approximately 46.14% in 24 hours. Particle Network is a leading Web3 chain-abstraction infrastructure project. Its core technology, Universal Accounts, addresses fragmentation of users, data, and liquidity across multiple chains, providing a unified account and balance system for users on all chains.

PARTI’s price surge was mainly driven by technical momentum. The price has broken above the 23.6% Fibonacci retracement level ($0.2475), with trading volume surging 307%. The 7-day RSI reached 80.79, indicating an overbought condition, while the MACD histogram turned positive for the first time since May 2025. If the price holds above the 20-day MA support zone ($0.20), upward momentum may continue.

Key Market Data Highlights

Visa Launches Stablecoin Payment Pilot, Enabling Direct USDC Payments

Global payments giant Visa announced at the 2025 Web Summit in Europe the launch of a pilot program that allows businesses to pay content creators, freelancers, and gig workers directly in USD-pegged stablecoins (such as USD Coin, USDC) via its Visa Direct platform, while the businesses’ funding remains in fiat. Recipients only need a compatible wallet and to complete KYC/AML procedures to receive payments.

This pilot represents a further expansion of Visa’s stablecoin initiative. In September, Visa conducted a “stablecoin pre-funding” pilot that allowed businesses to fund Visa Direct accounts with stablecoins. This new program is the first to enable end users to receive payments directly in stablecoins. Visa plans to expand the initiative in the second half of 2026.

Integrating stablecoins as a payment method into its network signals a major step toward bridging traditional finance with blockchain-based value transfer. It could accelerate on-chain settlement adoption for creator platforms, the gig economy, and cross-border payments. Chris Newkirk, President of Visa’s Commercial and Funds Solutions, stated: “The introduction of stablecoin payments enables true minute-level fund settlement, allowing users worldwide to receive income quickly and securely.” In regions with weak banking infrastructure or volatile currencies, USDC payments offer faster, more stable access to funds, potentially reshaping payroll structures. Furthermore, while stablecoins have largely been used for trading or DeFi, this pilot marks a shift toward mainstream payment infrastructure.

VCI Global to Invest $100 Million to Acquire Oobit’s Tether-Backed Token OOB

Malaysian tech consultancy VCI Global Limited announced plans to invest a total of $100 million to acquire OOB, the native token of Oobit, a Tether-backed crypto payment platform. Upon completion, Tether, as one of Oobit’s largest shareholders, is expected to become VCI Global’s largest shareholder.

OOB tokens will support Oobit’s crypto payment ecosystem, including P2P payments, merchant POS settlements, cross-chain low-cost remittances, and reward incentives. Additionally, OOB will migrate from Ethereum to Solana to improve transaction speed and scalability.

From an industry perspective, this deal highlights the deepening integration between payment infrastructure and crypto token ecosystems. As a leading stablecoin issuer, Tether’s involvement in Oobit extends its reach from stablecoin issuance to crypto payments, token economies, and digital asset infrastructure. For investors, VCI Global’s acquisition of OOB into its “digital asset treasury” and role as OOB Foundation’s fiscal manager not only provides strong capital backing but also positions the token for broader ecosystem applications and value capture.

Ethereum Validator Count Drops Back to April 2024 Levels, Exit Queue Reaches Record High

The number of Ethereum validators has fallen back to April 2024 levels, with daily active validators declining by approximately 10% since July—the largest drop since Ethereum transitioned to Proof-of-Stake. Meanwhile, the waiting time in the validator exit queue has reached a record high.

This suggests that the Ethereum network may be shifting from an “expansion” phase to a “consolidation” phase. From a network security perspective, although the exit mechanism is designed to prevent mass validator withdrawals from disrupting consensus, declining validator activity and prolonged exit queues could reduce network participation and decentralization, potentially impacting long-term network stability and ecosystem confidence. The increase in exits may also reflect some node operators withdrawing due to lower yields, higher costs, or protocol optimization requirements, indicating that the staking ecosystem could face yield compression and changes in participant composition.

Focus of the Week

Solana Active Addresses Drop to 3.3 Million, a One-Year Low

On-chain data shows that Solana’s monthly active addresses have fallen to approximately 3.3 million, marking the lowest level in the past 12 months. This represents a decline of over 60% from the peak of more than 9 million in January, reflecting a notable cooling of market activity. From late 2024 to early 2025, Solana experienced unprecedented user growth as the network became a hub for Meme coin issuance and trading. However, as the Meme craze gradually subsided from mid-year, on-chain speculative activity declined sharply, with some users’ attention and capital shifting to other narratives, such as RWA and AI assets.

Although the decline in active addresses has caused short-term market concern, structurally, this is a natural transition from a speculation-driven to a utility- and application-driven ecosystem. The Meme coin boom drove explosive user growth but failed to achieve long-term retention. The current cooldown may help eliminate short-term bubbles, freeing resources and attention for more practical applications like DeFi, RWA, and AI agents. The ecosystem still has highlights: pump.fun, the most representative token issuance platform in Solana, maintains high activity, with daily trading volume consistently above $1 million and a market share of about 90% among similar platforms, carrying much of the remaining on-chain activity.

Bitcoin Open Interest Falls Over 30% from October Peak to Seven-Month Low

CryptoQuant data shows that Bitcoin open interest across major exchanges has fallen to approximately $32.7 billion, the lowest level in seven months. Compared with the October peak of $47.5 billion, this represents a decline of more than 30%, reflecting a significant deleveraging and risk cooling in the market. This drop coincides with a cooling in spot Bitcoin ETF inflows—after weeks of net inflows, some funds even experienced slight outflows, indicating investors are reassessing short-term risk exposure and market pricing. Meanwhile, derivative market activity has generally slowed, with institutional capital taking a wait-and-see approach, awaiting clearer macro policy signals and crypto regulatory updates. This aligns with the typical year-end low-volatility phase.

In the short term, declining open interest indicates reduced speculative heat and lower price volatility. From a medium- to long-term perspective, this deleveraging may build new momentum for the market. Recent months of concentrated leveraged buying drove short-term overheat; the current cooldown helps clear floating positions and reduce systemic risk, creating room for a more stable upward cycle. The slowdown in ETF inflows largely reflects short-term capital rhythm adjustments rather than structural withdrawals. Institutional interest in long-term Bitcoin allocation remains strong, and with marginal improvements in macro liquidity and the upcoming halving, the derivative market “cooling” is more likely a healthy consolidation signal than a trend reversal.

x402 Network Facilitators Process Over 18.82 Million Transactions, 35x Growth Since May

Since the official launch of the x402 protocol, network facilitators have cumulatively processed over 18.82 million transactions, a 35-fold increase compared with May, indicating rapid adoption across multiple applications and platforms. Currently, about 82% of transactions are handled by two major facilitators, Coinbase and Daydreams, showing that activity remains concentrated in core nodes. Notably, Daydreams has experienced significant growth—its cumulative transaction volume has surpassed 1.4 million, increasing 16-fold in just the past two weeks.

The exponential growth in facilitator activity suggests that more developers and applications are integrating the protocol into agent workflows, driving the accumulation of “real transaction demand” within the ecosystem. Most transactions originate from actual agent interactions and application-layer payments, including compute fees, API calls, and data access, reflecting a network effect driven by real economic activity. However, the data also highlights a potential limitation: the concentration of transactions in a few core facilitators indicates that the ecosystem remains in a transitional stage with dependency on centralized nodes.

Funding Weekly Recap

According to RootData, from November 7 to November 13, 2025, a total of 10 crypto and related projects announced completed funding rounds or acquisitions, covering multiple sectors including DEXs, infrastructure, social gaming, stablecoins, and AI. Below is a brief introduction to the top-funded projects of the week:

Lighter

On November 11, Lighter announced a $68 million funding round, led by Founders Fund. Lighter is a perpetual contract trading protocol designed to provide scalable, secure, transparent, non-custodial, and verifiable order-book trading infrastructure for the Ethereum ecosystem.

Commonware

On November 7, Commonware announced a $25 million funding round, led by Tempo. Commonware is developing an open-source blockchain framework in Rust, aimed at achieving high throughput, modular scalability, and embedded interoperability. Similar to Cosmos SDK, this framework will allow developers to easily build and deploy custom blockchains, balancing performance and flexibility.

Kyuzo’s Friends

On November 12, Kyuzo’s Friends announced a $11 million funding round, which will accelerate the launch of its first licensed IP game on the Key Origin platform. Kyuzo’s Friends is a social game that integrates AI and Web3 elements, bringing the DNAxCAT IP into an immersive experience with interactive and reward-driven gameplay. The game focuses on social interaction and player collaboration, allowing players to explore maps, build and upgrade structures, and cooperate or compete with friends, fostering a more community-driven gaming ecosystem.

Next Week to Watch

Token Unlocks

- CONX – Approximately $31.7 million worth of tokens will be unlocked, representing 2.92% of the circulating supply.

- ARB – Approximately $24.52 million worth of tokens will be unlocked, representing 1.94% of the circulating supply.

- STRK – Approximately $17.86 million worth of tokens will be unlocked, representing 5.34% of the circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Gate, https://www.gate.com/crypto-market-data

- Coingecoko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Theblock, https://www.theblock.co/post/378441/visa-stablecoin-payouts-usdc-creators-pilot

- Theblock, https://www.theblock.co/post/378485/vci-global-oob-token-tether

- X, https://x.com/DefiantNews/status/1988328801991053430

- The Block, https://www.theblock.co/post/378234/solana-active-addresses-fall-to-12-month-low-as-memecoin-frenzy-fades

- Finbold, https://finbold.com/bitcoin-open-interest-on-exchanges-falls-to-lowest-level-in-7-months/

- X, https://x.com/Decentralisedco/status/1988619396785254896

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

How to Do Your Own Research (DYOR)?

What Is Technical Analysis?

12 Best Sites to Hunt Crypto Airdrops in 2025