Gate Research Weekly Report: Gate launches earn feature|OpenSea token TGE in early October

Summary

- This week, BTC rose by 2.43% and ETH by 1.72%, while major altcoins continued their overall upward trend.

- The MYX token is currently priced at $18.34, up 18.1% in the past 24 hours and surging 1,533.7% over the past 7 days.

- Gate launched its “Earn on Spot” feature, supporting mainstream assets.

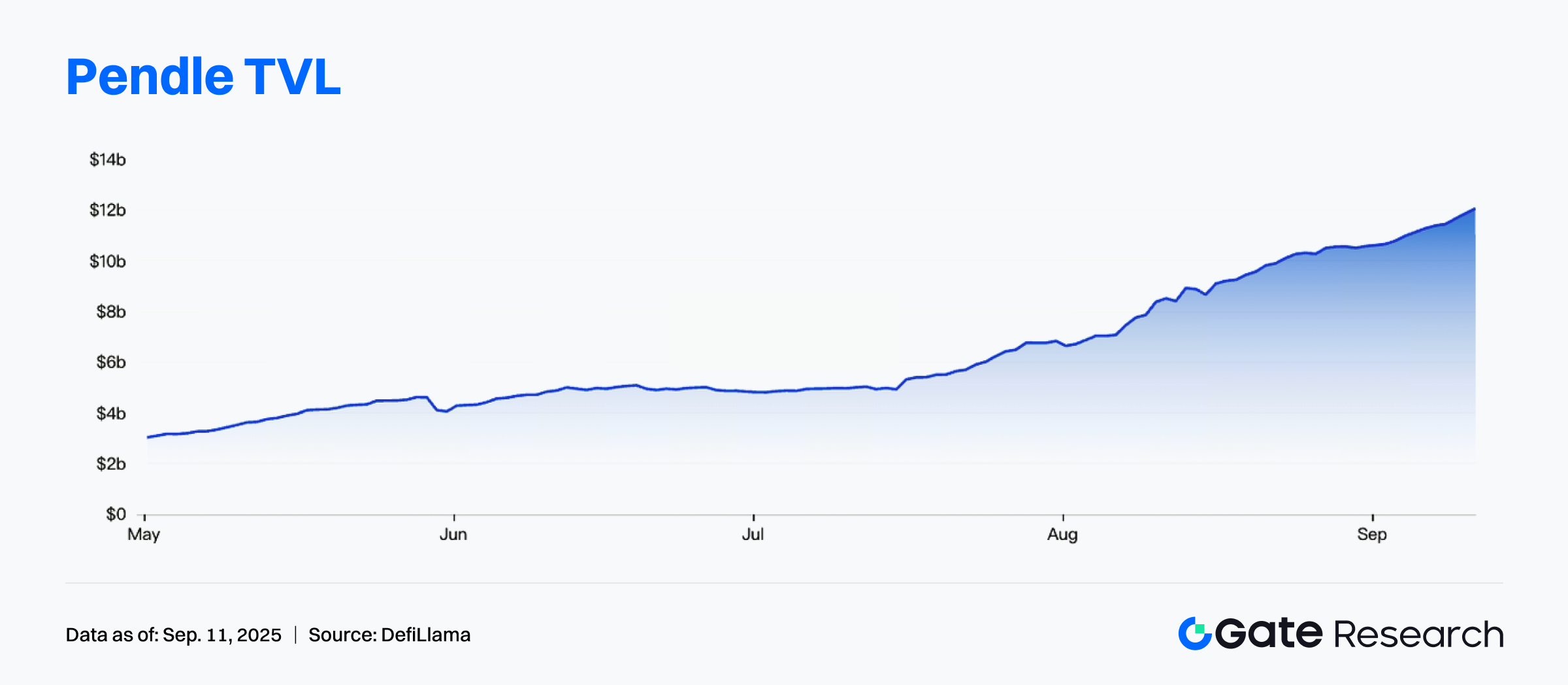

- Pendle’s TVL increased by over 10% in the past 7 days, reaching a new all-time high.

- The OpenSea Foundation plans to announce the SEA token TGE in early October.

- The Altcoin Season Index climbed rapidly, indicating clear signs of capital rotation.

Market Overview

Market Commentary

- BTC – This week, BTC rose by 2.43%. After a period of consolidation, BTC has continued to climb, briefly touching a high of $124,400, setting a new cycle high. From a moving average perspective, the short-term MA5 and MA10 are steadily rising, with price consistently above MA30, reflecting an ongoing bullish trend. Weekly trading volumes remain relatively active, suggesting strong buy-side momentum. If BTC can hold above the $118,000–$120,000 range, it may challenge previous highs and extend upward. However, prolonged sideways movement near the highs could trigger selling pressure. A break below $112,000, accompanied by falling volumes, may indicate a technical pullback. Overall, the mid-term trend remains bullish, with the next key target being the $125,000 resistance level.

- ETH – This week, ETH rose by 1.72%. After bottoming near $1,385, ETH staged a strong rebound, recently reaching as high as $4,956, approaching a key resistance area. MA5 and MA10 have clearly turned upward and are diverging from MA30, showing strong short- and mid-term bullish momentum. Weekly charts show a large bullish candle with high volume, highlighting clear capital inflows. If ETH can hold above $4,200, it may retest and potentially break the $5,000 psychological barrier. However, after consecutive gains, short-term overbought risks exist. A drop below $4,000 with weakening volume could trigger a pullback to confirm support. Overall, ETH’s mid-term structure remains bullish, and with sustained volume, further highs are possible.

- Altcoins – Major altcoins continued their upward trend this week. MYX Finance surged nearly 20% in the short term, standing out among the top 100 tokens by market cap. Other projects such as Hyperliquid and Story IP also demonstrated upside potential.

- Stablecoins – The total stablecoin market cap currently stands at $290.1 billion. Stablecoins like USDC and USDe have attracted strong market attention.

- Gas Fees – Ethereum network gas fees declined this week. As of September 11, the average daily gas fee was 0.172 Gwei.

Trending Tokens

This week, the RWA (Real World Assets) sector led the gains, benefiting from regulatory momentum and innovations in stablecoin supply. Although the Stablecoin sector did not post significant gains, it continued to steadily accumulate market capitalization, underscoring its indispensable role in the market. Layer-1 platforms rose moderately, reflecting sustained market favor for base-chain ecosystems. It is evident that regulatory direction and infrastructure improvement remain the core drivers behind the current sector performance.MYX MYX Finance (+18.1%, Circulating Market Cap $3.82B)

According to Gate market data, MYX is currently priced at $18.34, up 18.1% in 24 hours and surging 1,533.7% over the past 7 days. MYX Finance is a DeFi protocol focused on efficient cross-chain asset trading and derivatives markets, aiming to provide users with secure, highly liquid infrastructure. Its core mechanism aggregates multi-chain liquidity and optimizes order matching to enhance returns for traders and liquidity providers.

The explosive rally in MYX this week was driven mainly by hype around Donald Trump-related tokens and a surge in derivatives trading volumes. On-chain data shows MYX gained over 1,000% in a short time, accompanied by sharp increases in trading volume and open interest. Analysts suggest that short positions were squeezed, further amplifying the rally. In the context of meme-driven narratives and renewed risk appetite, MYX became a focal point for capital inflows.M MemeCore (–4.5%, Circulating Market Cap $330B)

According to Gate market data, MemeCore is currently priced at $1.96. Despite falling 4.5% in the past 24 hours, it gained over 101.2% over the past 7 days, maintaining overall strength. MemeCore is a Web3 protocol driven by meme culture, aiming to build a decentralized entertainment and finance ecosystem through community creativity, content economy, and token incentives.

MemeCore recently surpassed a $1 billion market cap, attracting strong investor interest. Its rally was mainly fueled by regulatory progress in Korea: the project is applying for VASP licensing and planning to acquire a KOSDAQ-listed company to enable KRW fiat pairs. Meanwhile, on-chain adjustments such as reducing block rewards by ~73% and optimizing liquidity pool mechanisms lowered inflation and improved validator incentives. These developments, coupled with renewed meme-sector enthusiasm, drove the price higher.WLD Worldcoin (–9.1%, Circulating Market Cap $1.31B)

According to Gate market data, WLD is currently priced at $1.80, down 9.1% in the past 24 hours, but still up 100.1% over 7 days. Worldcoin, founded by OpenAI co-founder Sam Altman, aims to build a global digital identity and financial network using iris-scanning Orb devices for “proof of personhood.” WLD serves as both an incentive and a utility token within the ecosystem.

This week’s rally was fueled by institutional capital inflows and exchange listings. Eightco Holdings announced a $250 million treasury allocation into WLD, boosting confidence. Additionally, Korea’s Upbit exchange listed WLD, driving regional liquidity and trading activity. With rising global interest in digital identity and payments, WLD doubled in price over the week on both capital inflows and market sentiment.

Focus of the Week

Linea completes TGE and announces airdrop details

Ethereum Layer 2 project Linea completed its TGE on September 10, announcing airdrop details. Eligibility was based on participation in LXP and LXP-L activities. The claim window runs from September 10 to December 9, 2025 (90 days). All tokens are fully unlocked upon claiming, with no vesting period. Distribution allocates 85% to the ecosystem, with 10% to early users/builders and 75% to the ecosystem fund.

This structure highlights Linea’s focus on long-term ecosystem growth rather than short-term price action. While initial selling pressure may arise from unlocked airdrops, the large ecosystem fund allocation is expected to attract developers and partnerships over time.

OpenSea Foundation to announce SEA token TGE in early October

The OpenSea Foundation plans to announce SEA token TGE details in early October. From September 15, the platform will establish a prize pool funded partly by trading fees: 1% for NFTs and 0.85% for tokens, with 50% of fees directed into the pool. Once the TGE is live, the prize pool will link with SEA token to create a rewards mechanism.

This is essentially a rebate-based token model. By directing half of fees back to users, OpenSea aims to boost trading volumes and user incentives before and after TGE. However, market participants remain cautious about distribution and unlock details, as overly strong incentives could cause short-term volatility.

Gate launches “Earn on Spot” feature

On September 10, Gate launched “Earn on Spot.” Users can activate it in their spot accounts to automatically earn yield without locking assets. Initially supporting BTC, ETH, GT, SOL, POL, SUI, ALGO, DOT, ATOM, AVAX, INJ, APT, ZETA, and FLR. Rewards are credited daily starting the day after activation, compounding automatically.

This product balances flexibility and returns, allowing investors to earn passive income while maintaining liquidity — particularly attractive for long-term holders of major assets.

Key Market Data Highlights

Pendle’s TVL climbs over 10% in 7 days, hitting new highs

Pendle’s TVL surpassed $12 billion in early September, up 10% in the past week and 180% YTD. Pendle splits yield-bearing assets (e.g., staked ETH) into Principal Tokens (PT) and Yield Tokens (YT), enabling fixed yield, trading, and liquidity incentives via AMM and governance token PENDLE.

The surge was driven by the Ethena-Pendle-Aave yield engine: users split USDe into PT + YT on Pendle, then use PT as collateral on Aave to recycle capital back into USDe/Pendle, amplifying inflows. Pendle’s multi-chain expansion and potential integrations (e.g., Hyperliquid) also fueled confidence. Analysts note PENDLE remains undervalued relative to its TVL and fee revenue, further boosting investor sentiment.

Private placement drives WLD rally, weekly gain over 100%

According to Gate, WLD gained over 100% this week. The rally was triggered by Eightco Holdings’ $250 million private placement to acquire WLD as treasury reserves, alongside a ticker change from OCTO to ORBS. The news sent Eightco stock up over 3,000% in days, fueling WLD demand. Backers included World Foundation, Discovery Capital, and Brevan Howard, with BitMine making its first major bet outside Ethereum. Following the announcement, WLD spiked nearly 50% in one day and 80% over the week, hitting 7-month highs.

Altcoin Index rises sharply, showing capital rotation

The CMC Altcoin Season Index jumped from 50 to 68 in the past week, signaling altcoins are outperforming BTC. From September 8–11, the index rose steadily, showing funds rotating into majors and mid-cap alts. With total altcoin market cap rising steadily, market expectations for an “alt season” strengthened. A month ago, the index was only 29, showing the rally’s sharp pace. With the index nearing its yearly high (87), further upside is possible, but high concentration risks a correction.

Funding Weekly Recap

According to RootData, during the period from September 4 to September 11, 2025, a total of 16 crypto and related projects announced the completion of financing or mergers and acquisitions, covering multiple tracks such as Ethereum infrastructure, decentralized AI verification, and more. Overall financing activity remained at a high level, showing that capital continues to focus on key directions including Ethereum infrastructure, AI applications, and asset tokenization. Below is a brief introduction of the top three projects by financing scale this week:

StablecoinX

Announced on September 6 the completion of a $530 million financing, mainly used to build and expand its “ENA Treasury Strategy.” StablecoinX is a treasury company / financial pool focusing on the stablecoin ecosystem, operating within the Ethena protocol. Ethena mainly issues synthetic U.S. dollar stablecoins USDe and USDtb, using a delta-neutral hedging model instead of relying entirely on traditional fiat reserves.

Gemini

Announced on September 9 the completion of a $50 million financing, to be used for expanding its institutional service capabilities and product lines, such as custody and staking services, and to establish a strategic partnership with Nasdaq’s Calypso platform for managing trading collateral.

Gemini is a U.S. cryptocurrency exchange and custody provider founded in 2014 by Cameron and Tyler Winklevoss. It is committed to providing retail and institutional users with secure, compliant digital asset trading, storage, and custody services. It supports over 70 crypto assets and emphasizes that most user funds are stored in offline cold wallets, with hot wallets used for daily trading, backed by insurance covering a certain scale of hot wallet risk.

Inversion

Announced on September 8 the completion of a $26.5 million financing, to be used to launch Inversion’s overall operations, including building its team (currently recruiting key roles such as CTO) and infrastructure development.

Inversion is a project initiated by former ParaFi partner Santiago Roel Santos and others. It is dedicated to bringing the private equity model into the blockchain space by acquiring traditional enterprises and “migrating” their operations on-chain, in order to improve efficiency, reduce costs, and expand the practical applications of the crypto ecosystem.

Next Week to Watch

Token Unlocks

According to Tokenomist data, in the next 7 days (Sept 11–Sept 18, 2025), the market will see several important large token unlocks. The top 3 are as follows:

- FTN will unlock tokens worth about $89.6M in the next 7 days, accounting for 4.6% of circulating supply.

- APT will unlock tokens worth about $51.1M in the next 7 days, accounting for 1.6% of circulating supply.

- ARB will unlock tokens worth about $47.5M in the next 7 days, accounting for 1.8% of circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Gate, https://www.gate.com/trade/ETH_USDT

- Coinmarketcap, https://coinmarketcap.com/

- jin10, https://rili.jin10.com/

- Coinmarketcap, https://coinmarketcap.com/view/stablecoin/

- X, https://x.com/LineaBuild/status/1963166921739653184

- X, https://x.com/HollanderAdam/status/1965098349800853956

- Gate, https://www.gate.com/announcements/article/47054

- etherscan, https://etherscan.io/gastracker

- Coingecko, https://www.coingecko.com/en/categories

- Defillama, https://defillama.com/protocol/pendle

- Coinmarketcap, https://coinmarketcap.com/charts/altcoin-season-index/

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

What Are Altcoins?

What is Blum? All You Need to Know About BLUM in 2025

What Is Dogecoin?

Reflections on Ethereum Governance Following the 3074 Saga

What is the Altcoin Season Index?