Unsecured stablecoin credit

The users of the global unsecured consumer credit market are the fattened lamb of modern finance — slow, foolish and innumerate.

As unsecured consumer credit shifts on to stablecoin rails, the mechanics will change, and there is room for new players to claim a share of the slaughter.

Market Big

The dominant form of unsecured borrowing in the United States is the credit card: a ubiquitous, liquid, and instantly accessible line of credit that allows consumers to borrow at the point of purchase without posting collateral. Outstanding credit card debt has grown steadily and is now roughly $1.21 trillion

Technology stale

The last major disruption in credit card lending came in the 1990s, when Capital One introduced risk-based pricing, a breakthrough that reshaped consumer credit. Since then, despite the rise of neobanks and fintechs, the structure of the credit card industry has remained largely unchanged.

But stablecoins and onchain credit protocols introduce a new foundation: programmable money, transparent markets, and real-time funding. Together, they could finally break the cycle, reimagining how credit is originated, financed, and repaid in a digital, borderless economy.

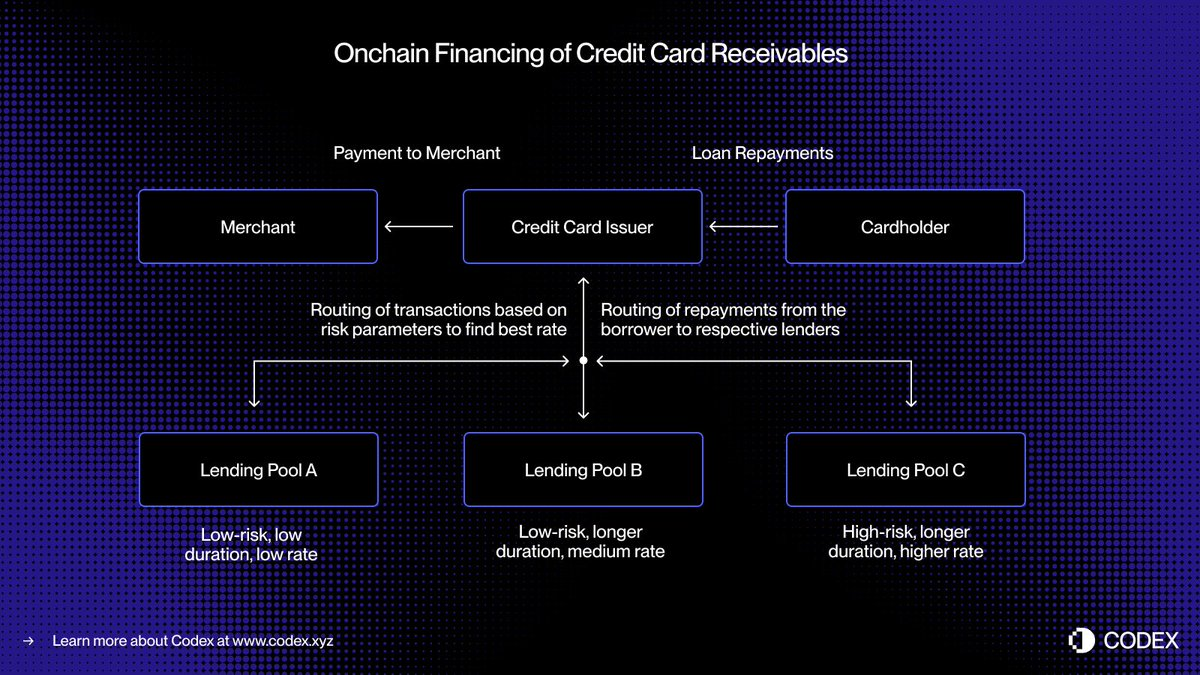

- In today’s card payment system, there is a lag between authorization, when a transaction is approved, and settlement, when the issuer transfers funds to the merchant through the card network. By moving the funding process onchain, these receivables can be tokenized and financed in real-time.

- Imagine a consumer making a $5,000 purchase. The transaction is authorized instantly. Before settling with Visa or Mastercard, the issuer tokenizes the receivable onchain and receives $5,000 in USDC from decentralized credit pools. When settlement occurs, the issuer sends those funds to the merchant.

- Later, when the borrower repays, the repayment automatically flows back to the onchain lenders via smart contracts. Again, in real-time.

This approach enables real-time liquidity, transparent funding, and automatic repayment, reducing counterparty risk and eliminating many of the manual processes that still underpin consumer credit today.

From Securitizations to Lending Pools

For decades, the consumer credit market has relied on deposits and securitization to fund lending at scale. Banks and card issuers bundle thousands of receivables into asset-backed securities (ABS) and sell them to institutional investors. This structure has provided deep liquidity, but also introduced complexity and opacity.

Buy Now, Pay Later lenders such as Affirm and Afterpay have already demonstrated how underwriting can evolve. Instead of granting a general credit line, they underwrite each purchase at the point of sale, treating a $10,000 couch differently from a $200 pair of sneakers.

- This transaction-level underwriting produces discrete, standardized receivables, each with a clear borrower, term, and risk profile, making them ideal for real-time funding via onchain lending pools.

- Onchain lending could extend this concept further by enabling specialized credit pools designed around specific borrower profiles or purchase categories. A pool might, for example, fund small-ticket transactions for prime borrowers, while another specializes in travel financing for near-prime consumers.

- Over time, these pools could evolve into highly targeted credit markets, with dynamic pricing and transparent performance metrics accessible to all participants.

Such programmability opens the door to more efficient allocation of capital, better rates for consumers, and a global marketplace for unsecured consumer credit, one that is open, transparent, and instantly auditable.

The Emerging Onchain Credit Stack

Reimagining unsecured lending for the onchain era is not just a matter of porting credit products to blockchain, it requires rebuilding the entire credit infrastructure from the ground up. In addition to issuers and processors, the traditional lending ecosystem depends on a complex web of intermediaries:

- New forms of credit scoring will be needed. Traditional credit scores like FICO and VantageScore may be ported to blockchain, but decentralized identity and reputation systems could play an even larger role.

- Lenders, too, will require credibility assessments, the onchain equivalent of ratings from S&P, Moody’s, or Fitch, to evaluate the quality of underwriting and loan performance.

- Finally, the less glamorous but essential side of lending collections, will need to evolve. Stablecoin-denominated obligations still require enforcement mechanisms and recovery processes, integrating onchain automation with offchain legal frameworks.

Stablecoin cards have already bridged the gap between fiat and onchain spending. Lending protocols and tokenized money market funds have redefined saving and yield. Bringing unsecured credit onchain completes the triangle, enabling consumers to borrow seamlessly, while investors fund credit transparently, all powered by open financial infrastructure.

Disclaimer:

- This article is reprinted from [haonan]. All copyrights belong to the original author [haonan]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.