XRP Price Prediction: 15% Short-Term Surge Possible Despite ETF Delay

XRP ETF Review Delayed

The U.S. Securities and Exchange Commission (SEC) has deferred its review of several XRP ETF applications due to a temporary government shutdown. This delay impacts proposals from major institutions including Grayscale, Bitwise, WisdomTree, Franklin Templeton, 21Shares, CoinShares, and Canary Capital. Although the process is on hold, these applications have not been rejected—it’s strictly an administrative setback. Institutional investors remain bullish, with some funds maintaining exposure to XRP through futures and other derivatives as they await the resumption of the review process.

Institutional Capital Remains Steady

Market analysts emphasize that large institutions continue to show strong interest in XRP. Most investors expect ETF approval before year-end; if granted, initial inflows could reach $5–8 billion USD, potentially surpassing $18 billion USD by year-end. Europe has already launched XRP ETPs (Exchange Traded Products), operating under the MiCA regulatory framework and providing global investors with indirect access.

RLUSD and Bank Partnerships Enhance Use Cases

Ripple’s latest stablecoin, RLUSD, is custodied by BNY Mellon. This move directly links to future ETF settlement systems, enabling faster and more transparent cross-border payments and settlements. Ripple is also partnering with major banks such as State Street to advance money market tokenization, adopting the global communication standard ISO 20022 to complement the XRP Ledger’s technology.

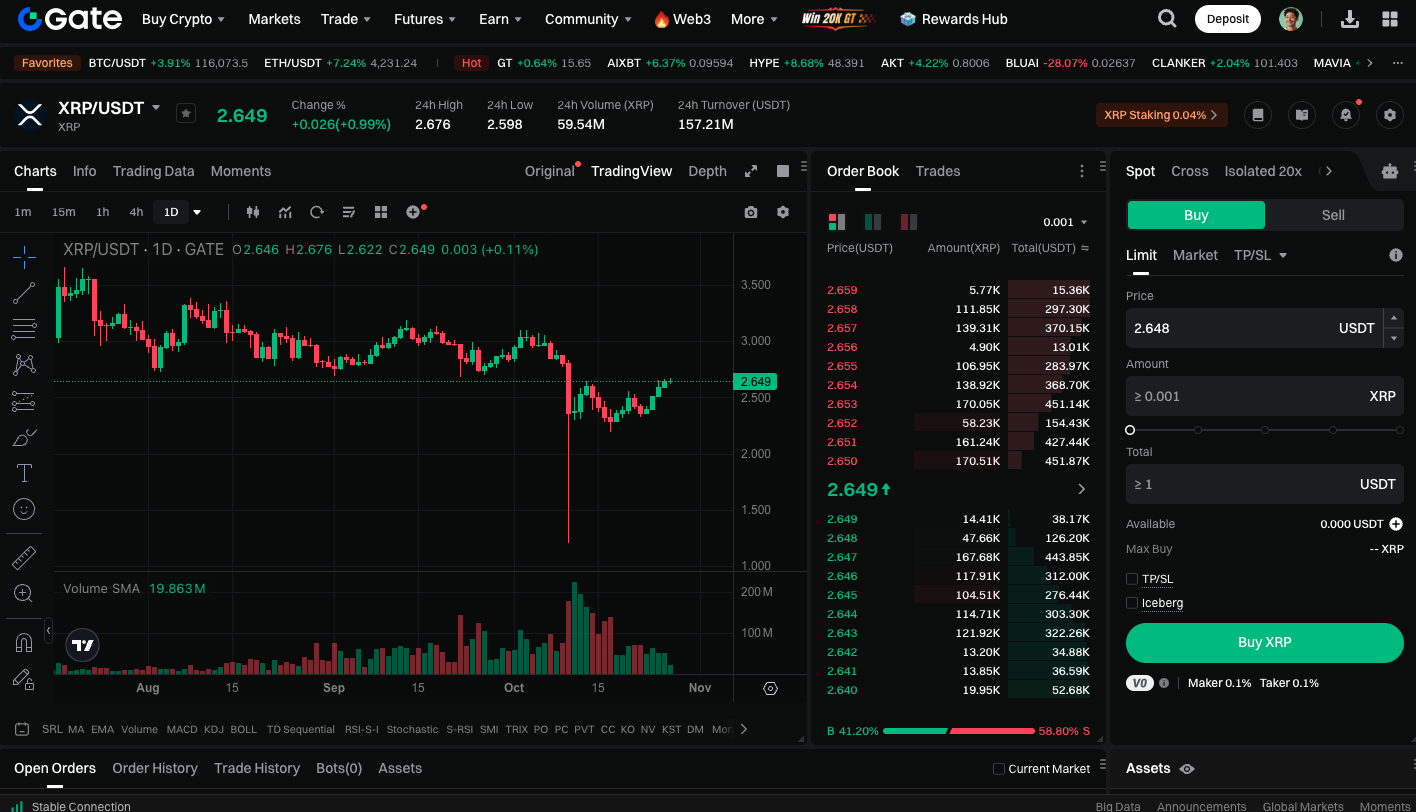

XRP Technical Analysis

Technical analysis shows XRP’s daily chart is testing the critical resistance range at $2.60–$2.70. A decisive break above $2.70 would set the next target at $2.87, with further upside potentially challenging $3. XRP has recently formed a reversal head-and-shoulders bottom, with a neckline at $2.50. If it holds above this neckline, the theoretical target range is $2.88–$2.90, indicating a potential rally of about 10% to 15% from the breakout point.

$2.70 Is the Key Bullish Barrier

Despite a short-term rebound, XRP remains within a broader downtrend, marked by lower highs and lower lows. Sustained trading above $2.70 would be the first clear signal of a trend reversal. At present, bullish momentum is mainly driven by technical divergence and institutional expectations. If trading volume continues to increase in the coming weeks, the short-term rally is likely to persist.

Start trading XRP spot immediately: https://www.gate.com/trade/XRP_USDT

Summary

Although the ETF review delay has increased market anxiety, it also demonstrates regulators’ commitment to establishing a transparent framework for XRP. The launch of Ripple’s RLUSD stablecoin, its tokenization partnerships with banks, and clearer global regulations all point to XRP’s gradual transformation from a speculative asset into a foundational element of financial infrastructure.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution