Yieldbasis: Redefining Passive Income for BTC and ETH Holders

What Is Yieldbasis?

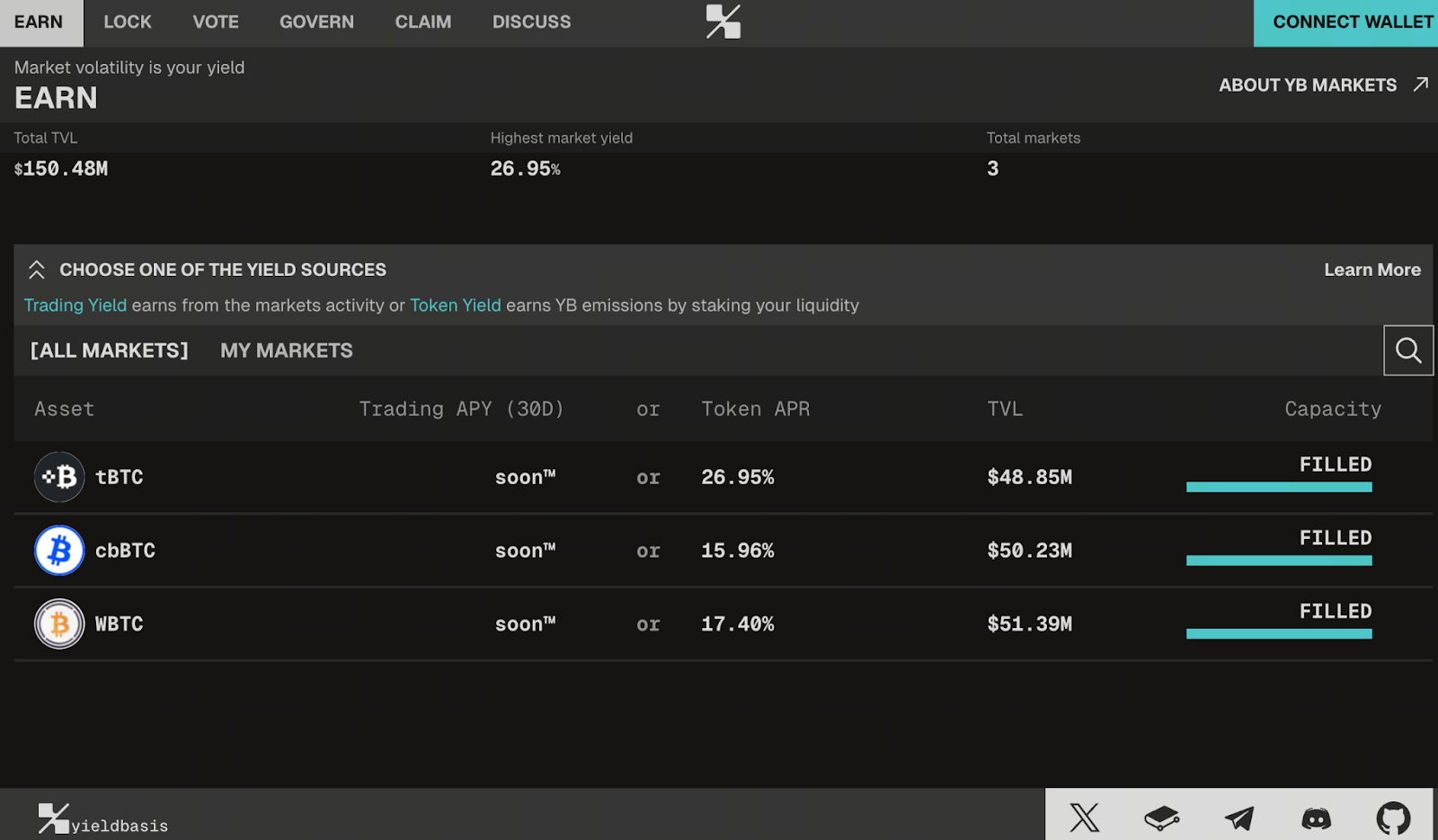

(Source: yieldbasis)

Yieldbasis is a next-generation DeFi protocol developed by Curve Finance founder Michael Egorov. Tailored for long-term BTC and ETH holders, it delivers stable and transparent yield through an automated leveraged AMM structure. Users can deposit assets into liquidity pools and earn trading fee revenue, all without the risk of impermanent loss.

All operations are performed automatically by smart contracts. Users simply deposit assets to participate in yield distribution—no manual leverage or risk management required.

Double-Leveraged Liquidity Model

Yieldbasis’s breakthrough is its “Leveraged Liquidity” mechanism. This structure uses 2× leverage, enabling liquidity providers’ positions to track BTC’s price on a 1:1 basis, eliminating asset shrinkage caused by price volatility. For users, this means:

- No impermanent loss while providing liquidity;

- Consistent, stable trading fee income;

- The flexibility to either claim rewards directly or stake for additional token incentives, according to individual strategies.

Usage Process Overview

Yieldbasis offers an intuitive user experience. To participate, follow these steps:

- Deposit BTC → Mint ybBTC

- The system automatically borrows crvUSD and supplies it to the Curve pool

- Users then choose:

- Hold ybBTC to receive BTC trading fee yield directly;

- Or stake ybBTC to earn protocol token YB rewards.

- When exiting, burn ybBTC. The system automatically closes the position, repays the debt, and returns the original BTC plus earned yield.

The process is fully automated—one action ensures ongoing yield sharing from the protocol.

Yield Structure and Incentive Distribution

Yieldbasis primarily generates yield from trading fees in the Curve BTC/crvUSD pool. Rewards are distributed according to user participation:

- Non-staked ybBTC holders: Receive BTC fee sharing directly, net of dynamic management fees—resulting in pure profit.

- Staked ybBTC users: Forgo immediate yield but earn YB token incentives and gain governance rights.

- veYB holders: Locking YB tokens provides management fee sharing, plus voting and governance privileges.

The system distributes 50% of all pool yield to participants; the remaining 50% supports protocol rebalancing and liquidity, creating a self-sustaining yield cycle.

YB Token Functions

The native token $YB is central to protocol operations, serving three core functions:

- Governance: Users vote on protocol parameters, fee structures, and liquidity reward directions.

- Fee Distribution: veYB holders periodically receive protocol profit sharing.

- Staking Rewards: Staking ybBTC earns regular YB token distributions, incentivizing long-term participation.

Token Distribution Structure

The YB token allocation balances community incentives, team development, and long-term ecosystem growth, as follows:

- 30% Community Incentives: For liquidity providers and governance participants.

- 25% Team: Supporting protocol development and maintenance.

- 15% Ecosystem Reserve: For cross-chain collaboration and protocol integration.

- 12.1% Investors: Rewarding early supporters and strategic partners.

- 7.5% Curve Tech Licensing: For underlying architecture licensing.

- 7.4% Protocol Development Reserve: Supporting upgrades and new feature development.

- 3% Voting & Liquidity Incentives: Enhancing governance and market participation.

This structure ensures sustainable protocol growth, enabling both the community and users to share in its success.

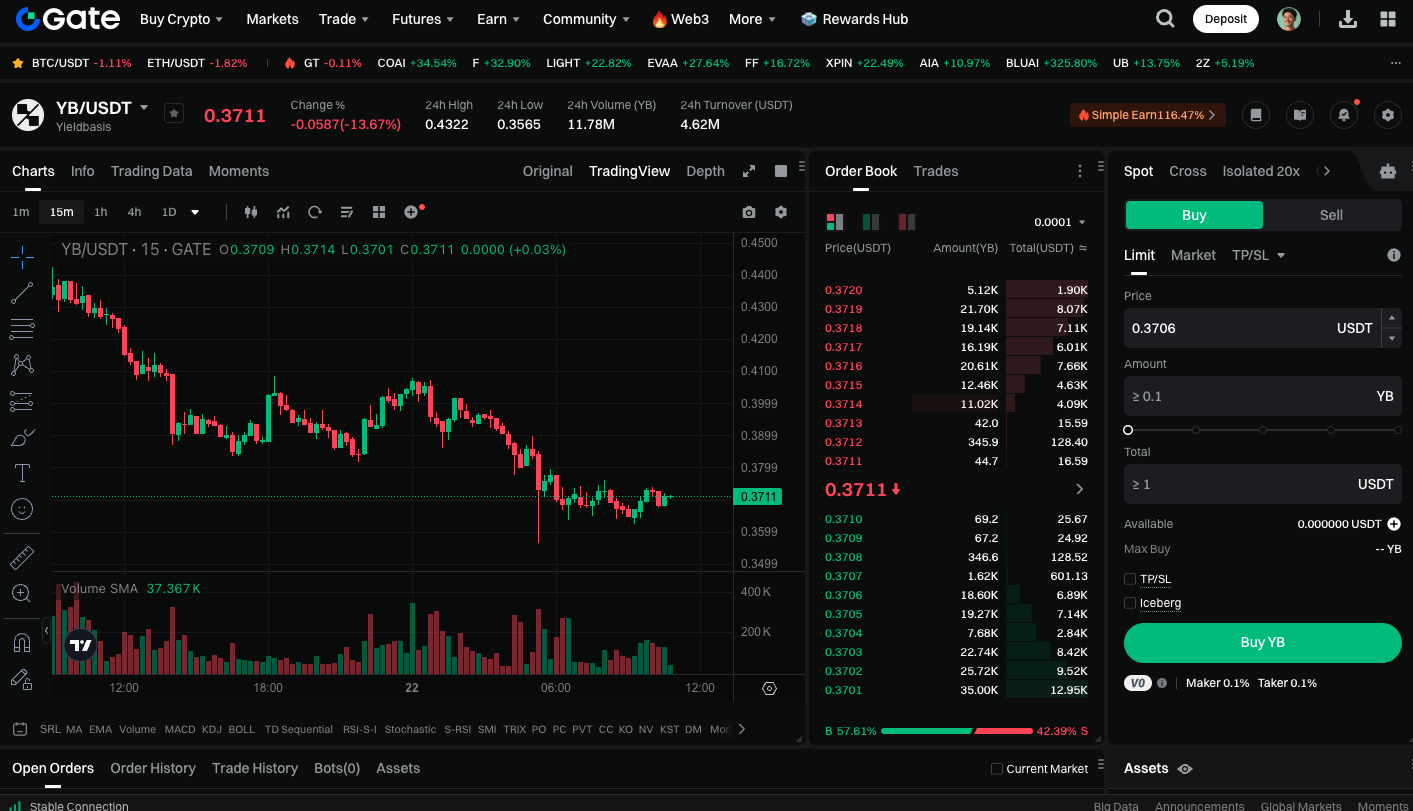

Start trading YB spot now: https://www.gate.com/zh-tw/trade/YB_USDT

Summary

Yieldbasis introduces a new passive yield model for the DeFi ecosystem, enabling BTC and ETH holders to earn stable, sustainable returns without altering their asset exposure. This true yield approach, built on trading fees, replaces risky leverage and inflationary incentives—ushering in a new era of decentralized yield.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution