# PreciousMetalsPullBack

19.38K

Risk assets fell overnight. Gold slid $300 to $5,155/oz, and silver dropped up to 8% to $108.23/oz. Are you buying the dip or cutting exposure? Share your Gate TradFi metals strategy!

MrFlower_

#PreciousMetalsPullBack Bitcoin Faces a Defining Phase Ahead

1️⃣

Bitcoin remains under sustained pressure as global financial markets continue shifting deeper into a risk-off environment. After failing to recover convincingly from the sharp January selloff, BTC is still trading well below its previous macro highs, signaling that investor confidence has not yet fully returned. The broader tone across markets suggests that capital preservation is currently prioritized over growth, placing cryptocurrencies in a vulnerable position.

2️⃣

The weakness in Bitcoin is not occurring in isolation. Tradit

1️⃣

Bitcoin remains under sustained pressure as global financial markets continue shifting deeper into a risk-off environment. After failing to recover convincingly from the sharp January selloff, BTC is still trading well below its previous macro highs, signaling that investor confidence has not yet fully returned. The broader tone across markets suggests that capital preservation is currently prioritized over growth, placing cryptocurrencies in a vulnerable position.

2️⃣

The weakness in Bitcoin is not occurring in isolation. Tradit

BTC-0,21%

- Reward

- 3

- 3

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊View More

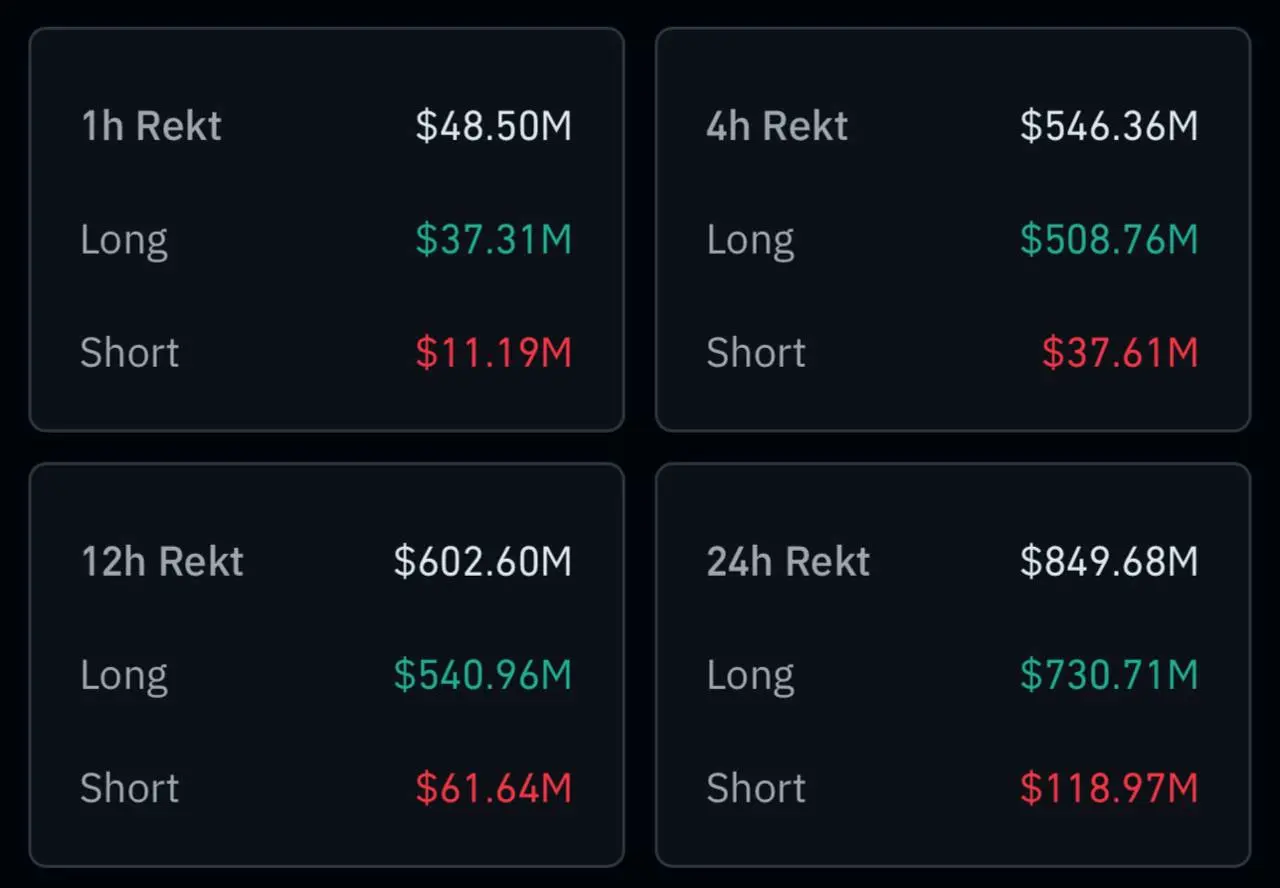

Insane volatility In the last 24 hours:

In the last 24 hours:

Gold: −10.9%, erased $4.1 Trillion

Silver: −21.5%, erased $1.4 Trillion

Copper: −10.3%, erased $40 Billion

Palladium: –20%, erased 65 Billion

Platinum: –23%, erased 143 Billion

S&P 500: −0.6%, erased $380 Billion

Nasdaq: −1.2%, erased $480 Billion

Russell 2000: −0.76%, erased $25 Billion

Bitcoin: −6.6%, erased $108 Billion

Ethereum: −7.5%, erased $25 Billion

Over $6.5 TRILLION erased across metals, equities, and crypto in a single day.#BTC #PreciousMetalsPullBack

In the last 24 hours:

Gold: −10.9%, erased $4.1 Trillion

Silver: −21.5%, erased $1.4 Trillion

Copper: −10.3%, erased $40 Billion

Palladium: –20%, erased 65 Billion

Platinum: –23%, erased 143 Billion

S&P 500: −0.6%, erased $380 Billion

Nasdaq: −1.2%, erased $480 Billion

Russell 2000: −0.76%, erased $25 Billion

Bitcoin: −6.6%, erased $108 Billion

Ethereum: −7.5%, erased $25 Billion

Over $6.5 TRILLION erased across metals, equities, and crypto in a single day.#BTC #PreciousMetalsPullBack

- Reward

- like

- Comment

- Repost

- Share

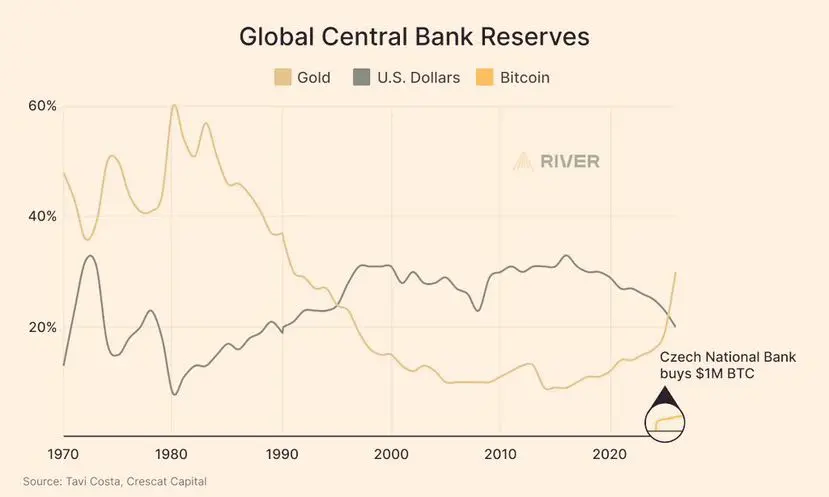

Global Central Bank Reserves Are Quietly Shifting — and Bitcoin Has Entered the Conversation

For decades, central bank reserves were effectively a two-asset system.

Gold served as the long-term store of value.

The U.S. dollar functioned as the global liquidity anchor.

The chart above shows how that balance evolved over time. Gold’s dominance declined after the 1970s, while dollar reserves expanded as global trade and financial markets became dollar-centric. That structure held for years, even through multiple crises.

What is changing now is not the size of Bitcoin in reserves, but its existenc

For decades, central bank reserves were effectively a two-asset system.

Gold served as the long-term store of value.

The U.S. dollar functioned as the global liquidity anchor.

The chart above shows how that balance evolved over time. Gold’s dominance declined after the 1970s, while dollar reserves expanded as global trade and financial markets became dollar-centric. That structure held for years, even through multiple crises.

What is changing now is not the size of Bitcoin in reserves, but its existenc

BTC-0,21%

- Reward

- 2

- Comment

- Repost

- Share

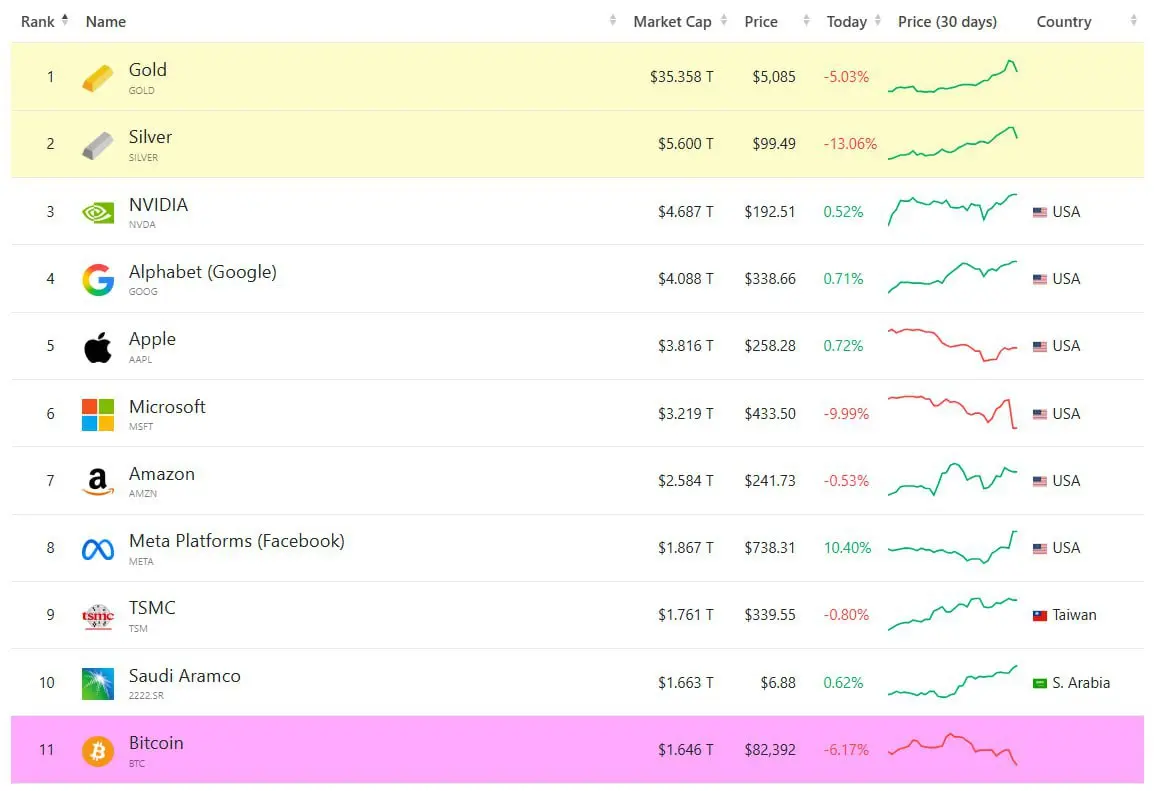

$BTC Bitcoin is no longer in the top 10 global assets by market cap, currently ranked 11th.

Crypto Market Update:

The market is still moving slowly, and honestly, it feels a bit dull right now. BTC is stuck around the $88k–$89k zone and continues to struggle with momentum. No strong breakout, no major breakdown — just a lot of sideways movement.

ETH and most altcoins are also following the same pattern, holding key levels but lacking volume and conviction. Right now, traders are being cautious, waiting for a clear trigger before making bigger moves.

This phase can test patience, but these q

Crypto Market Update:

The market is still moving slowly, and honestly, it feels a bit dull right now. BTC is stuck around the $88k–$89k zone and continues to struggle with momentum. No strong breakout, no major breakdown — just a lot of sideways movement.

ETH and most altcoins are also following the same pattern, holding key levels but lacking volume and conviction. Right now, traders are being cautious, waiting for a clear trigger before making bigger moves.

This phase can test patience, but these q

BTC-0,21%

- Reward

- 2

- 1

- Repost

- Share

Apollo123 :

:

☺️😅😜😅😚😚😚😚😅😅😜😅😜☺️☺️☺️😜☺️😜☺️😜☺️😜☺️😜☺️😜☺️😜☺️😜☺️😜☺️😜☺️😜☺️☺️😜☺️☺️😜☺️😜☺️☺️😜☺️😜☺️☺️🚨 Crypto Market Wiped Out Overnight! 🚨

💥 Total crypto market cap crashes below $3 TRILLION

📉 Crypto-related stocks dump nearly 10% in one session

This wasn’t noise — it was a liquidity shock.

Leverage flushed. Weak hands shaken. Fear activated.

But here’s the truth traders miss 👇

🔥 Extreme fear = future opportunity forming

🧠 Smart money watches, waits, and prepares

Markets don’t end in panic —

They reset before the next big move 💣

Follow for real market structure, not hype 💎

The next trend rewards the prepared, not the emotional ❤️#PreciousMetalsPullBack $BTC

💥 Total crypto market cap crashes below $3 TRILLION

📉 Crypto-related stocks dump nearly 10% in one session

This wasn’t noise — it was a liquidity shock.

Leverage flushed. Weak hands shaken. Fear activated.

But here’s the truth traders miss 👇

🔥 Extreme fear = future opportunity forming

🧠 Smart money watches, waits, and prepares

Markets don’t end in panic —

They reset before the next big move 💣

Follow for real market structure, not hype 💎

The next trend rewards the prepared, not the emotional ❤️#PreciousMetalsPullBack $BTC

BTC-0,21%

- Reward

- 2

- Comment

- Repost

- Share

#PreciousMetalsPullBack Bitcoin continues to face heavy pressure as global markets move deeper into a risk-off phase. After dropping sharply on January 29, BTC fell to an intraday low near $83,383, marking its weakest level since November. Although a minor bounce followed, Bitcoin remains trapped in the $84,000–$85,000 range, representing a 33% decline from the October peak near $126,000.

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

BTC-0,21%

- Reward

- 8

- 5

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

According to Coinglass data, $508,760,000 in LONG positions were liquidated in 4 hours.

BTC below $84,000.

#PreciousMetalsPullBack #GateLiveMiningProgramPublicBeta

BTC below $84,000.

#PreciousMetalsPullBack #GateLiveMiningProgramPublicBeta

BTC-0,21%

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

Happy New Year! 🤑#PreciousMetalsPullBack 1. The "Dual Engine" Demand

Unlike gold, which is primarily a monetary hedge, silver’s value in 2026 is being driven by a powerful "dual engine":

Industrial Scarcity: With silver prices breaking past $100/oz earlier this year, the demand from green tech (solar PVs alone consume ~125 Moz annually) and AI data centers has created a persistent supply deficit.

Monetary Hedge: As gold nears $5,000/oz, tokenized silver has become the "high-beta" alternative for investors looking for safe-haven protection with more aggressive upside.

2. Tokenization as a De-correlator

Traditio

Unlike gold, which is primarily a monetary hedge, silver’s value in 2026 is being driven by a powerful "dual engine":

Industrial Scarcity: With silver prices breaking past $100/oz earlier this year, the demand from green tech (solar PVs alone consume ~125 Moz annually) and AI data centers has created a persistent supply deficit.

Monetary Hedge: As gold nears $5,000/oz, tokenized silver has become the "high-beta" alternative for investors looking for safe-haven protection with more aggressive upside.

2. Tokenization as a De-correlator

Traditio

DEFI-3,33%

- Reward

- 6

- 11

- Repost

- Share

AngelEye :

:

Buy To Earn 💎View More

#PreciousMetalsPullBack #贵金属行情下跌 #贵金属巨震 Markets reminded everyone of a brutal truth today: there is no such thing as a one-way trade.

BTC and ETH collapsed hard.

Altcoins didn’t “correct” — they bled.

US equities slid in unison, risk appetite vanished overnight.

And while crypto traders panicked, gold did something far more dangerous — it shook out weak hands.

Gold plunged nearly $300 to $5,155/oz, silver dropped up to 8% to $108.23/oz.

This wasn’t a random dip. This was forced liquidation + leverage unwind after weeks of crowded long positioning.

Let’s be clear:

If you think this move means “

BTC and ETH collapsed hard.

Altcoins didn’t “correct” — they bled.

US equities slid in unison, risk appetite vanished overnight.

And while crypto traders panicked, gold did something far more dangerous — it shook out weak hands.

Gold plunged nearly $300 to $5,155/oz, silver dropped up to 8% to $108.23/oz.

This wasn’t a random dip. This was forced liquidation + leverage unwind after weeks of crowded long positioning.

Let’s be clear:

If you think this move means “

- Reward

- 5

- 2

- Repost

- Share

ybaser :

:

very good information to readView More

#CryptoMarketPullback

Markets are cooling off after a strong run — and that’s completely normal. 📉

A crypto pullback doesn’t mean the trend is broken; it often means the market is resetting, shaking out weak hands, and building a healthier base.

For patient investors, pullbacks are moments to reassess, not panic. Smart money watches structure, support levels, and on-chain signals while emotions run high.

Corrections create opportunities. Discipline creates results. 🚀

#PreciousMetalsPullBack

#CryptoMarketPullback

Markets are cooling off after a strong run — and that’s completely normal. 📉

A crypto pullback doesn’t mean the trend is broken; it often means the market is resetting, shaking out weak hands, and building a healthier base.

For patient investors, pullbacks are moments to reassess, not panic. Smart money watches structure, support levels, and on-chain signals while emotions run high.

Corrections create opportunities. Discipline creates results. 🚀

#PreciousMetalsPullBack

#CryptoMarketPullback

- Reward

- 8

- 8

- Repost

- Share

HighAmbition :

:

1000x VIbes 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

19.38K Popularity

32.76K Popularity

355.4K Popularity

33.98K Popularity

51.27K Popularity

5.07K Popularity

20.51K Popularity

10.39K Popularity

84.55K Popularity

30.72K Popularity

22.97K Popularity

27.41K Popularity

10.49K Popularity

17.52K Popularity

189.15K Popularity

News

View MoreData: 384.9 BTC transferred out from Cumberland DRW, with an estimated value of approximately $26.71 million USD.

26 m

ETH drops below 2700 USDT

38 m

Data: 2,688 BNB transferred from an anonymous address, then routed through intermediary addresses before flowing into Wintermute.

39 m

Data: 3245.9 BNB transferred out from an anonymous address, then relayed to another anonymous address

59 m

Data: 263.43 BTC has been transferred to Jump Crypto, with an approximate value of $20.13 million USD.

1 h

Pin