2025 AICPrice Prediction: Navigating Market Trends and Technological Innovations in the Evolving Digital Asset Landscape

Introduction: AIC's Market Position and Investment Value

AI Companions (AIC), as a pioneer in personalized digital companionship experiences, has made significant strides since its inception. As of 2025, AIC's market capitalization has reached $252,580,000, with a circulating supply of approximately 1,000,000,000 tokens, and a price hovering around $0.25258. This asset, often referred to as the "next-generation virtual relationship platform," is playing an increasingly crucial role in the fields of artificial intelligence, virtual reality, and blockchain technology.

This article will provide a comprehensive analysis of AIC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. AIC Price History Review and Current Market Status

AIC Historical Price Evolution Trajectory

- 2024: Project launch, price started at $0.005

- 2024 November: AIC reached its all-time low of $0.03598

- 2025 February: AIC hit its all-time high of $0.5575

AIC Current Market Situation

As of September 23, 2025, AIC is trading at $0.25258. The token has shown significant volatility in the past 24 hours, with a price increase of 105.15%. This surge has brought the current price closer to its all-time high, though it remains about 54.69% below that peak.

The market capitalization of AIC stands at $252,580,000, ranking it 257th among all cryptocurrencies. The 24-hour trading volume is $959,566.65, indicating active market participation.

AIC has demonstrated strong performance across various timeframes. Over the past week, it has gained 73%, while the 30-day and 1-year returns stand at 57.42% and 144.74% respectively. These figures suggest a generally upward trend in the medium to long term.

The circulating supply of AIC is 1,000,000,000 tokens, which is also its total and maximum supply. This indicates that all tokens are in circulation, potentially limiting future inflation.

Click to view the current AIC market price

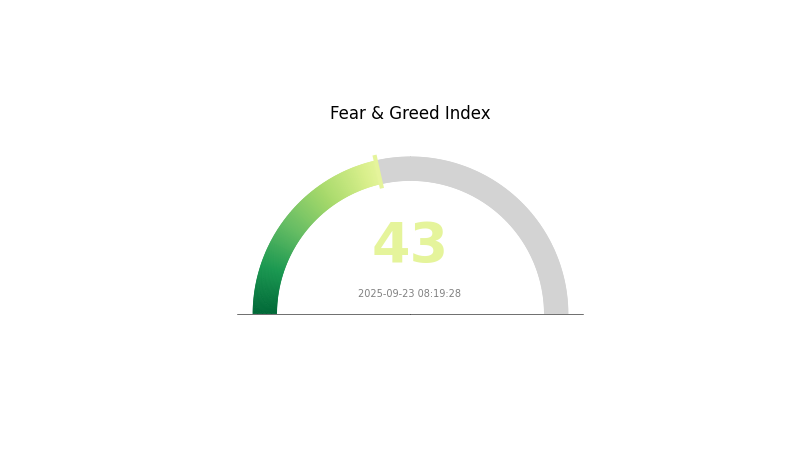

AIC Market Sentiment Indicator

2025-09-23 Fear and Greed Index: 43 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 43, indicating a fearful atmosphere. This suggests investors are approaching the market with caution, potentially creating buying opportunities for contrarian traders. However, it's crucial to conduct thorough research and manage risks carefully in this uncertain environment. Remember, market sentiment can shift rapidly, so stay informed and consider diversifying your portfolio to navigate these challenging conditions.

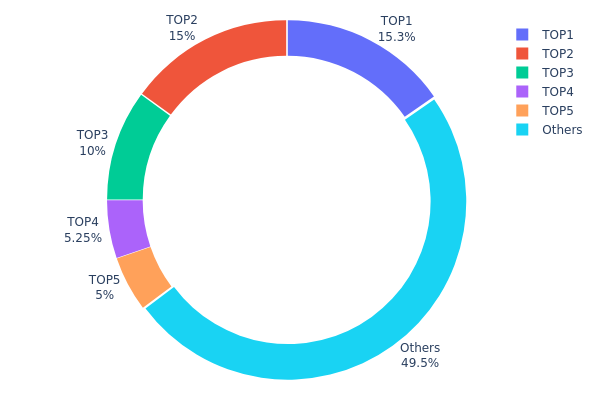

AIC Holdings Distribution

The address holdings distribution chart provides a snapshot of AIC token concentration among top holders. Analyzing this data reveals a significant level of centralization in AIC's ownership structure. The top five addresses collectively control 50.54% of the total supply, with the two largest holders each possessing over 15% of AIC tokens.

This concentration level raises concerns about potential market manipulation and price volatility. With half of the supply controlled by just five addresses, large-scale movements or liquidations from these wallets could significantly impact AIC's market dynamics. The high concentration also suggests a lower degree of decentralization, which may affect the token's resilience to external pressures.

However, it's worth noting that nearly half (49.46%) of AIC tokens are distributed among other addresses, indicating some level of wider distribution. This balance between major holders and smaller investors could provide a degree of stability, but the overall token distribution still leans towards a centralized structure, potentially impacting AIC's long-term market behavior and governance dynamics.

Click to view the current AIC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xbe1e...9859f5 | 153000.99K | 15.30% |

| 2 | 0x1cab...e08bb6 | 150000.00K | 15.00% |

| 3 | 0x5fd9...b31173 | 100000.00K | 10.00% |

| 4 | 0x0d07...b492fe | 52485.34K | 5.24% |

| 5 | 0x643a...8e0087 | 50000.10K | 5.00% |

| - | Others | 494513.57K | 49.46% |

II. Key Factors Influencing AIC's Future Price

Supply Mechanism

- Fixed Supply: AIC has a fixed total supply, which could create scarcity and potentially drive up prices as demand increases.

- Historical Pattern: Limited supply has historically contributed to price appreciation in cryptocurrencies with fixed supplies.

- Current Impact: The fixed supply may continue to support AIC's price, especially if demand grows.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, AIC may be viewed as a potential hedge against inflation, similar to other digital assets.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions could influence investors' interest in alternative assets like AIC.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development of DApps and other ecosystem projects on the AIC network could increase its utility and attract more users, potentially impacting its price positively.

III. AIC Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.24874 - $0.2591

- Neutral forecast: $0.2591 - $0.32

- Optimistic forecast: $0.32 - $0.38088 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.2487 - $0.54936

- 2028: $0.44646 - $0.61676

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2030 Long-term Outlook

- Base scenario: $0.62296 - $0.64891 (assuming steady market growth and adoption)

- Optimistic scenario: $0.64891 - $0.80 (assuming strong market performance and increased utility)

- Transformative scenario: $0.80 - $0.93444 (assuming breakthrough developments and mass adoption)

- 2030-12-31: AIC $0.93444 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.38088 | 0.2591 | 0.24874 | 2 |

| 2026 | 0.42238 | 0.31999 | 0.18879 | 26 |

| 2027 | 0.54936 | 0.37119 | 0.2487 | 46 |

| 2028 | 0.61676 | 0.46027 | 0.44646 | 82 |

| 2029 | 0.75931 | 0.53852 | 0.36081 | 113 |

| 2030 | 0.93444 | 0.64891 | 0.62296 | 156 |

IV. AIC Professional Investment Strategies and Risk Management

AIC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate AIC tokens during market dips

- Hold for at least 1-2 years to potentially benefit from project growth

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage risk

AIC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet solution: Use reputable mobile or desktop wallets with strong security features

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for AIC

AIC Market Risks

- High volatility: AIC price may experience significant fluctuations

- Competition: Other AI and VR projects may emerge as strong competitors

- Market sentiment: Overall crypto market conditions can impact AIC's performance

AIC Regulatory Risks

- Uncertain regulations: Future government policies may affect AI and VR cryptocurrencies

- Data privacy concerns: Stricter regulations on AI and personal data could impact the project

- Cross-border restrictions: International regulations may limit AIC's global adoption

AIC Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the underlying code

- Scalability challenges: Rapid user growth may strain the platform's infrastructure

- AI development hurdles: Unforeseen obstacles in advancing AI technology

VI. Conclusion and Action Recommendations

AIC Investment Value Assessment

AI Companions (AIC) presents an innovative fusion of AI, VR, and blockchain technology, offering potential long-term value in the rapidly growing digital relationship market. However, investors should be aware of short-term volatility and the emerging nature of the technology.

AIC Investment Recommendations

✅ Beginners: Start with small, regular investments to build a position over time

✅ Experienced investors: Consider a moderate allocation within a diversified crypto portfolio

✅ Institutional investors: Explore strategic partnerships or larger positions based on thorough due diligence

AIC Trading Participation Methods

- Spot trading: Buy and sell AIC tokens on Gate.com

- Staking: Participate in staking programs if offered by the project

- DeFi integration: Explore decentralized finance options involving AIC tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is the AIC coin worth?

As of September 2025, the AIC coin is valued at approximately $0.85, showing a steady growth trend in the crypto market.

What is the price prediction for Cardano AI?

Based on current market trends and AI analysis, Cardano AI's price is predicted to reach $0.15 by the end of 2025, with potential for further growth in 2026.

Which AI is best for stock price prediction?

For stock price prediction, advanced machine learning models like LSTM, transformer-based models, and ensemble methods are considered most effective.

What is the top crypto price prediction in 2025?

Bitcoin is predicted to reach $150,000 by the end of 2025, making it the top crypto price prediction for that year.

2025 NETMINDPrice Prediction: Analyzing Market Trends, Technology Adoption, and Growth Potential in the Evolving AI Ecosystem

2025 FAI Price Prediction: Analyzing Market Trends and Potential Growth Factors for FAI Token

2025 OGPU Price Prediction: Analyzing Market Trends and Technological Advancements in GPU Technology

2025 AGENT Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 ARC Price Prediction: Bullish Trends and Key Factors Shaping the Future of Algorand's Governance Token

HBAR to AUD Price Performance

Complete Guide to High-Speed Layer 1 solutions in Web3 Networks

GBP to USDT Exchange Rate Guide: How Smart Traders Protect Their Capital

Understanding Automated Market Makers in Cryptocurrency Trading

Top DeFi Innovations to Watch in 2024

Understanding Flash Loans: A Comprehensive Guide to Unsecured Lending in DeFi