2025 BIGTIME Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: BIGTIME's Market Position and Investment Value

Big Time (BIGTIME), as a multiplayer online role-playing game token, has made significant strides since its inception. As of 2025, BIGTIME's market capitalization has reached $62,189,706, with a circulating supply of approximately 1,908,245,059 tokens, and a price hovering around $0.03259. This asset, often referred to as a "Web3 gaming token," is playing an increasingly crucial role in the blockchain gaming sector.

This article will provide a comprehensive analysis of BIGTIME's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. BIGTIME Price History Review and Current Market Status

BIGTIME Historical Price Evolution

- 2023: BIGTIME reached its all-time high of $500 on October 12, 2023

- 2025: BIGTIME hit its all-time low of $0.01757 on October 10, 2025

- 2025: Market cycle led to a significant price drop from the all-time high to the current price of $0.03259

BIGTIME Current Market Situation

BIGTIME is currently trading at $0.03259, with a 24-hour trading volume of $279,199.73. The token has experienced a slight decline of 0.88% in the past 24 hours. BIGTIME's market capitalization stands at $62,189,706.50, ranking it at 542nd position in the cryptocurrency market. The circulating supply is 1,908,245,059.79 BIGTIME tokens, with a total supply of 5,000,000,000 tokens. Over the past year, BIGTIME has seen a significant decrease of 77.25% in its value. The token is showing mixed short-term performance, with a 0.45% increase in the last hour but a 9.46% decrease over the past week. The long-term trend appears bearish, with a 37.26% decline over the last 30 days.

Click to view the current BIGTIME market price

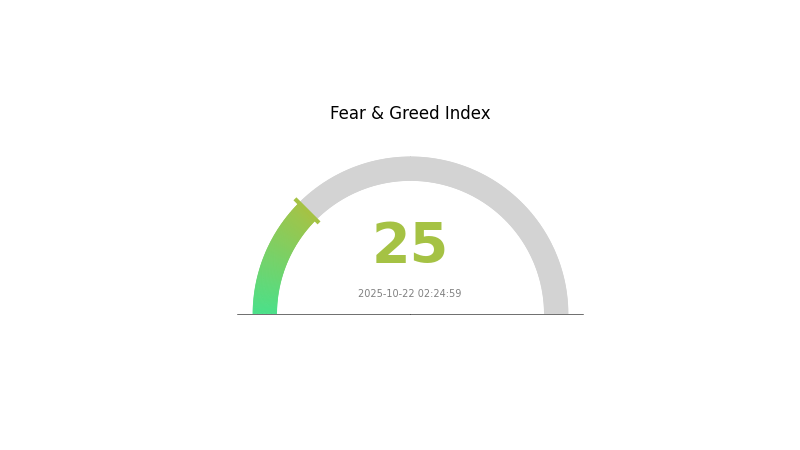

BIGTIME Market Sentiment Indicator

2025-10-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a phase of extreme fear, with the Fear and Greed Index registering a low score of 25. This indicates significant pessimism among investors, potentially creating opportunities for contrarian traders. During such periods of extreme fear, assets may be undervalued, presenting potential buying opportunities for long-term investors. However, it's crucial to conduct thorough research and exercise caution before making any investment decisions in this volatile market environment.

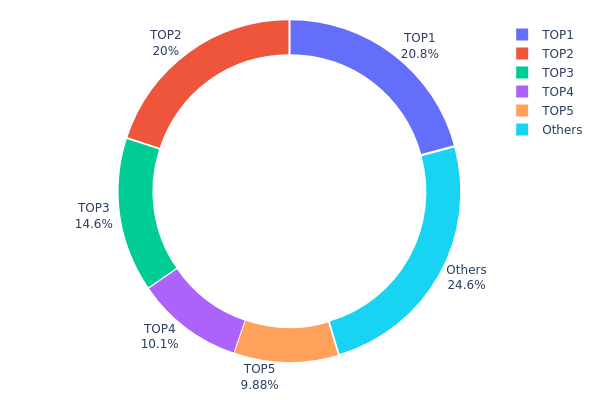

BIGTIME Holdings Distribution

The address holdings distribution data reveals significant concentration within the BIGTIME token ecosystem. The top five addresses collectively control 75.38% of the total supply, with the largest holder possessing 20.77%. This high level of concentration raises concerns about potential market manipulation and price volatility.

Such a concentrated distribution structure may impact market dynamics substantially. The top holders have the capacity to influence token price through large-scale transactions, potentially leading to increased volatility and reduced market stability. Furthermore, this concentration could undermine the project's decentralization efforts, as a small number of entities hold considerable sway over the token's circulation.

From an on-chain structural perspective, the current distribution suggests a relatively low level of decentralization for BIGTIME. While 24.62% of tokens are held by smaller addresses, the dominance of a few large holders indicates a need for broader distribution to enhance network resilience and reduce systemic risks associated with concentrated ownership.

Click to view the current BIGTIME Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x533f...c2c098 | 1038745.74K | 20.77% |

| 2 | 0x0a1b...1f5030 | 1000000.05K | 20.00% |

| 3 | 0x3691...b29967 | 730000.05K | 14.60% |

| 4 | 0x549a...5ac1f5 | 507395.85K | 10.14% |

| 5 | 0x4695...fd7d37 | 493901.76K | 9.87% |

| - | Others | 1229956.55K | 24.62% |

II. Key Factors Affecting BIGTIME's Future Price

Supply Mechanism

- In-game Economy: The supply of BIGTIME tokens is influenced by game mechanics, particularly the SPACE system and time hourglass NFTs.

- Current Impact: As BIGTIME token production increases, market selling pressure grows, challenging the sustainability of the internal economic system.

Technical Development and Ecosystem Building

- Economic Circulation System: BIGTIME tokens are generated through gameplay and have multiple consumption values within the game, aiming to create a sustainable economic ecosystem.

- NFT Mechanics: Time guardian and hourglass NFTs act as price barriers, controlling the influx of new players and potentially impacting token prices positively by regulating asset distribution rates.

III. BIGTIME Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.02766 - $0.03254

- Neutral forecast: $0.03254 - $0.04035

- Optimistic forecast: $0.04035 - $0.04816 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range predictions:

- 2027: $0.03305 - $0.06279

- 2028: $0.04455 - $0.077

- Key catalysts: Technological advancements, broader market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.066 - $0.07425 (assuming steady market growth and adoption)

- Optimistic scenario: $0.0825 - $0.08242 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.08242 - $0.09 (with breakthrough use cases and mainstream integration)

- 2030-12-31: BIGTIME $0.07425 (127% increase from 2025, reflecting substantial growth potential)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04816 | 0.03254 | 0.02766 | 0 |

| 2026 | 0.05407 | 0.04035 | 0.0226 | 23 |

| 2027 | 0.06279 | 0.04721 | 0.03305 | 44 |

| 2028 | 0.077 | 0.055 | 0.04455 | 68 |

| 2029 | 0.0825 | 0.066 | 0.04752 | 102 |

| 2030 | 0.08242 | 0.07425 | 0.04009 | 127 |

IV. BIGTIME Professional Investment Strategy and Risk Management

BIGTIME Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and gaming enthusiasts

- Operation suggestions:

- Accumulate BIGTIME tokens during market dips

- Monitor the development and adoption of the Big Time game platform

- Store tokens securely in a hardware wallet or reputable exchange

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor game updates and user engagement metrics

BIGTIME Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance BIGTIME with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for BIGTIME

BIGTIME Market Risks

- Volatility: High price fluctuations common in the crypto gaming sector

- Competition: Emerging blockchain games may impact Big Time's market share

- User adoption: Slow growth in player base could affect token value

BIGTIME Regulatory Risks

- Uncertain regulations: Potential changes in crypto gaming regulations globally

- Tax implications: Evolving tax laws for in-game assets and token trading

- KYC/AML requirements: Stricter identity verification may impact accessibility

BIGTIME Technical Risks

- Smart contract vulnerabilities: Potential security flaws in the token contract

- Scalability issues: Challenges in handling increased user load on the game platform

- Interoperability: Difficulties in integrating with other blockchain networks or games

VI. Conclusion and Action Recommendations

BIGTIME Investment Value Assessment

BIGTIME presents a unique opportunity in the blockchain gaming sector, with potential for long-term growth. However, investors should be aware of the high volatility and regulatory uncertainties in the short term.

BIGTIME Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about blockchain gaming ✅ Experienced investors: Consider a balanced approach, allocating based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence on the Big Time project and team

BIGTIME Trading Participation Methods

- Spot trading: Buy and sell BIGTIME tokens on Gate.com

- Staking: Participate in staking programs if offered by the Big Time platform

- In-game purchases: Acquire BIGTIME tokens through gameplay and item trading

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is bigtime crypto price prediction?

As of 2025, BIGTIME price prediction ranges from $0.40 to $0.55, based on game monetization and token utility. Market trends indicate moderate volatility.

Will BigTime go up?

Yes, BigTime is expected to go up. Predictions suggest it could reach $1.57 by 2030 and potentially $5.76 by 2040, showing significant growth potential.

Is Big Time pay-to-win?

No, Big Time is not pay-to-win. It offers free gameplay with optional purchases, allowing players to compete fairly without spending money.

How much is Big Time worth?

As of October 2025, Big Time (BIGTIME) is worth $0.03249 per token, with a market cap of $61.99 million and a 24-hour trading volume of $296,620.

2025 ISLAND Price Prediction: Navigating the Future of Crypto's Paradise Oasis

2025 POLISPrice Prediction: Analyzing Key Factors and Market Trends for Star Atlas Governance Token

VIC vs SAND: Comparing Two Leading Blockchain Gaming Ecosystems for Metaverse Development

2025 VOXEL Price Prediction: Future Market Analysis and Investment Opportunities in the Metaverse Economy

2025 GEMS Price Prediction: Will This Gaming Token Surge to New Heights?

2025 MBXPrice Prediction: Analyzing Market Trends and Future Valuation Prospects for MBX Token

Cysic: Zero-Knowledge Infrastructure Platform for AI and Decentralized Computing

US Bank Regulator OCC Facilitates National Banks Cryptocurrency Trading

ASTER Spot Trading Guide: Real-Time Price Analysis and Trading Volume Insights

Twenty One Capital Bitcoin Stock Falls 25% Following Cantor Equity Merger

Dropee Daily Combo December 10, 2025