2025 C Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of C

Chainbase (C) is building the Hyperdata Network for AI — a foundational layer for the DataFi era, transforming fragmented onchain signals into structured, verifiable, and AI-ready data. Since its launch, Chainbase has achieved significant milestones, including over 500 billion data calls, a vibrant community of 20,000+ developers, and 8,000+ project integrations. As of 2025, Chainbase's market capitalization has reached approximately $85.87 million, with a circulating supply of 160 million tokens and a current price hovering around $0.08587. This innovative data infrastructure asset is increasingly playing a critical role in powering the decentralized data economy where data becomes capital: composable, monetizable, and open to all.

This article will provide a comprehensive analysis of Chainbase's price trends and market dynamics, combining historical patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for the period ahead.

Chainbase (C) Market Analysis Report

I. C Price History Review and Current Market Status

C Historical Price Movement Trajectory

- July 2025: Token reached its all-time high of $0.5396 on July 18, 2025, marking the peak of market enthusiasm for the project.

- October 2025: Price declined to its all-time low of $0.0661 on October 10, 2025, representing a significant correction from historical highs.

- December 2025: Token trading near $0.08587 as of December 21, 2025, showing recovery momentum with a 57.19% gain over the past year despite recent short-term volatility.

C Current Market Status

As of December 21, 2025, Chainbase (C) is trading at $0.08587, reflecting a 24-hour price decline of 2.28% and a 1-hour decrease of 0.27%. However, the token demonstrates positive momentum on longer timeframes, with a 7-day gain of 9.07% and a robust 1-year performance of 57.19%.

The token maintains a market capitalization of $13.74 million with a fully diluted valuation of $85.87 million. Daily trading volume stands at $64,018.29, with C currently ranked at position 1,028 in terms of market cap. The circulating supply comprises 160 million tokens out of a total supply of 1 billion tokens, representing a circulation ratio of 16%.

Chainbase holds a market dominance of 0.0026%, indicating its emerging position within the broader cryptocurrency ecosystem. The token is supported by 70,716 holders and is listed on 24 different exchanges, providing reasonable liquidity and accessibility for traders and investors.

Click to view current C market price

C Market Sentiment Index

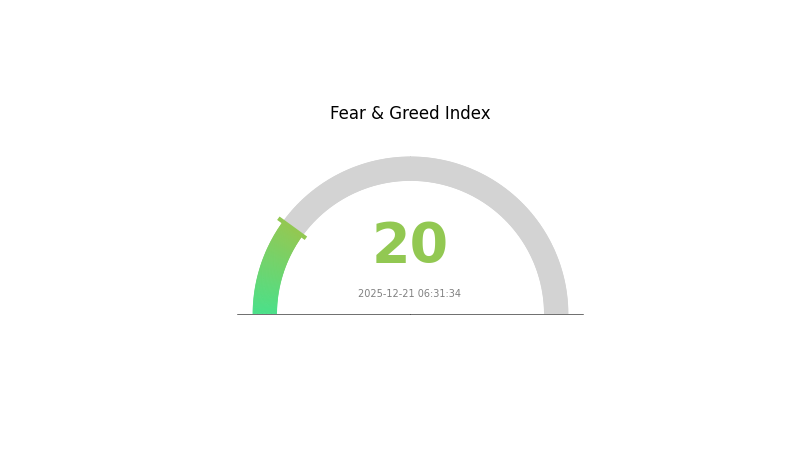

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index hitting 20. This indicates significant market pessimism and risk aversion among investors. Such extreme fear conditions often present contrarian opportunities for long-term investors, as panic selling may create attractive entry points. However, traders should exercise caution and conduct thorough risk management. Market conditions remain volatile, and it is advisable to monitor developments closely before making investment decisions. Extreme fear periods typically precede market recoveries.

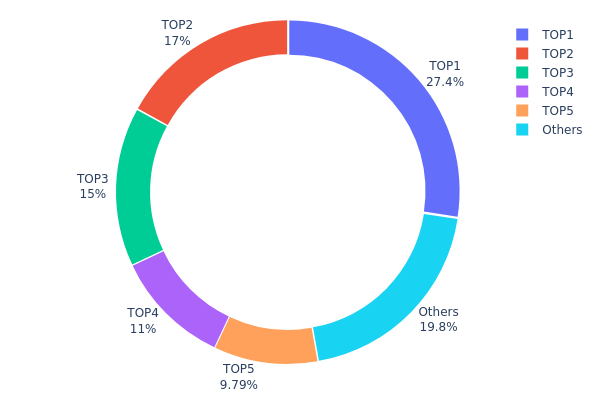

C Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the top wallet addresses within the network. By analyzing the proportion of total supply held by individual addresses, this metric provides critical insights into the decentralization level, potential market manipulation risks, and overall network health. A highly concentrated distribution among a few addresses may indicate centralization risks, while a more dispersed allocation typically suggests a more robust and decentralized market structure.

The current holdings distribution of C exhibits notable concentration characteristics. The top five addresses collectively control approximately 80.21% of the total supply, with the leading address (0x81e7...fdb2b2) alone holding 27.42%. This significant concentration is further reinforced by the second and third addresses holding 17.00% and 15.00% respectively. While the remaining "Others" category accounts for 19.79%, the distribution pattern reveals a clear top-heavy structure where wealth is disproportionately concentrated among a limited number of holders. Such concentration levels raise legitimate concerns regarding the token's true decentralization status and its vulnerability to potential coordinated actions by major stakeholders.

From a market dynamics perspective, this concentration pattern carries substantial implications for price stability and market structure. The substantial holdings by top addresses create an asymmetric risk environment where large token movements from these key holders could trigger significant price volatility. Additionally, the concentrated ownership structure may facilitate potential market manipulation scenarios, as coordinated selling or strategic positioning by top holders could disproportionately influence price discovery mechanisms. The 19.79% distribution among dispersed holders, while providing some degree of buffer against total centralization, remains insufficient to offset the influence of the major stakeholders. Overall, the current address distribution reflects a market still in early maturation stages, with governance power and price influence heavily weighted toward a select group of entities.

Click to view current C Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x81e7...fdb2b2 | 274285.72K | 27.42% |

| 2 | 0x2219...4fb170 | 170000.00K | 17.00% |

| 3 | 0xee91...a6504b | 150000.00K | 15.00% |

| 4 | 0xff5a...931888 | 110000.00K | 11.00% |

| 5 | 0x2d49...950ccd | 97931.86K | 9.79% |

| - | Others | 197782.42K | 19.79% |

II. Core Factors Influencing C's Future Price

Supply Mechanism

- Halving Mechanism: Block rewards decrease periodically, reducing the rate of new coin issuance. This is the primary supply control mechanism for C.

- Historical Pattern: Following previous halving cycles, long-term prices have typically experienced significant increases.

- Current Impact: The halving mechanism continues to constrain supply growth, which historically has supported upward price pressure over extended periods.

Macroeconomic Environment

- Monetary Policy Impact: Global macroeconomic data including GDP, inflation rates, and unemployment levels influence cryptocurrency valuations. Interest rate decisions by major central banks affect market sentiment and capital allocation toward digital assets.

- Geopolitical Factors: International situations and global economic conditions create market volatility that directly impacts C's price trajectory.

III. 2025-2030 Price Prediction for C

2025 Outlook

- Conservative Forecast: $0.0567 - $0.0859

- Base Case Forecast: $0.0859

- Optimistic Forecast: $0.1211 (requiring sustained market momentum and positive regulatory developments)

2026-2027 Medium-term Outlook

- Expected Market Stage: Consolidation and recovery phase with gradual upward pressure

- Price Range Predictions:

- 2026: $0.0538 - $0.1107 (approximately 20% upside potential)

- 2027: $0.0557 - $0.1189 (approximately 24% upside potential)

- Key Catalysts: Institutional adoption acceleration, technological upgrades, macroeconomic sentiment shifts, and ecosystem expansion initiatives

2028-2030 Long-term Outlook

- Base Scenario: $0.0723 - $0.1413 (assuming steady adoption and mainstream integration)

- Optimistic Scenario: $0.1210 - $0.1424 (assuming accelerated institutional inflows and positive regulatory clarity)

- Transformative Scenario: $0.1241 - $0.1671 (assuming breakthrough technological innovations and widespread institutional acceptance)

- 2030-12-31: C token reaching $0.1671 (representing 56% cumulative appreciation from current levels amid sustained positive fundamentals)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1211 | 0.08589 | 0.05669 | 0 |

| 2026 | 0.11074 | 0.1035 | 0.05382 | 20 |

| 2027 | 0.1189 | 0.10712 | 0.0557 | 24 |

| 2028 | 0.14126 | 0.11301 | 0.07233 | 31 |

| 2029 | 0.14239 | 0.12714 | 0.09027 | 48 |

| 2030 | 0.16711 | 0.13477 | 0.12398 | 56 |

Chainbase (C) Professional Investment Strategy and Risk Management Report

IV. C Investment Methodology

C Investment Approaches

(1) Long-term Holding Strategy

- Suitable Investors: Data infrastructure believers, Web3 developers, decentralized data economy advocates

- Operation Recommendations:

- Accumulate during market downturns when price drops below $0.08, taking advantage of volatility

- Hold through market cycles to benefit from Chainbase's expanding developer ecosystem (currently 20,000+ developers) and growing data call volume (500+ billion calls)

- Reinvest rewards from network participation to compound holdings over 2-3 year periods

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Monitor trend confirmation on 4-hour and daily charts to identify momentum shifts

- Relative Strength Index (RSI): Identify overbought conditions above 70 and oversold conditions below 30 for entry/exit timing

-

Swing Trading Key Points:

- Execute entries during consolidation phases when trading volume exceeds 24-hour average of $64,018

- Monitor 7-day performance indicator (currently +9.07%) for uptrend confirmation before position increases

- Set stop-loss orders at historical support level of $0.0661 to limit downside risk

C Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-5% of portfolio allocation

- Active Investors: 5-10% of portfolio allocation

- Professional Investors: 10-15% of portfolio allocation

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Distribute purchases evenly over 8-12 weeks to reduce timing risk and smooth out volatility exposure

- Portfolio Rebalancing: Adjust C holdings quarterly based on changing market conditions and reassess against current price levels

(3) Secure Storage Solutions

- Custody Solutions: Gate.com Web3 Wallet for non-custodial storage with direct control over private keys

- Exchange Holding: Maintain trading liquidity on Gate.com for frequent traders requiring immediate execution capability

- Security Considerations: Enable two-factor authentication, use hardware backup for seed phrases, avoid sharing private keys, regularly audit wallet permissions

V. Chainbase Potential Risks and Challenges

C Market Risks

- Low Trading Liquidity: With 24-hour volume of $64,018 across 24 exchanges, large position trades may experience significant slippage and price impact

- High Volatility: Token has experienced 57.19% annual gains alongside occasional sharp drawdowns, creating uncertain return expectations

- Market Cap Concentration: Current market cap of $13.74 million represents a relatively small position in the cryptocurrency ecosystem, increasing susceptibility to market sentiment shifts

C Regulatory Risks

- Classification Uncertainty: Regulatory treatment of blockchain data infrastructure tokens remains undefined across major jurisdictions

- Data Privacy Regulations: Evolving compliance requirements for on-chain data handling and AI data usage may impact operational scope

- Geographic Restrictions: Potential trading restrictions or de-listing from certain regions based on local regulatory frameworks

C Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token on Base network, exposure to potential contract exploits or blockchain network failures

- Development Execution Risk: Ability to maintain developer momentum and technical roadmap execution directly impacts token utility and adoption

- Network Scalability: Competition from alternative data infrastructure solutions may affect market share and network effects

VI. Conclusions and Action Recommendations

C Investment Value Assessment

Chainbase represents an emerging infrastructure play within the AI-driven data economy. The project demonstrates significant developer traction (20,000+ active developers) and network effects (500+ billion data calls, 8,000+ integrations). However, investors should recognize the early-stage nature of both the token and the DataFi ecosystem. At $0.08587 with 16% fully diluted market cap ratio, the token presents asymmetric risk-reward characteristics typical of infrastructure projects. Long-term value depends heavily on sustained developer adoption and mainstream enterprise integration of Chainbase's data infrastructure services.

C Investment Recommendations

✅ Beginners: Start with small DCA purchases (weekly or bi-weekly allocation) during confirmed downtrends to establish positions without market timing risk. Maintain 2-3% portfolio allocation maximum.

✅ Experienced Investors: Combine long-term core holdings with tactical trading around technical support ($0.08) and resistance levels. Use 5-10% portfolio allocation with active rebalancing quarterly.

✅ Institutional Investors: Conduct detailed technical due diligence on Chainbase's data infrastructure competitive positioning and developer retention metrics. Consider larger allocations (10-15%) only after direct engagement with project team regarding roadmap execution and enterprise adoption metrics.

C Trading Participation Methods

- Direct Purchase on Gate.com: Access C token trading pairs with competitive spreads and high liquidity on the Gate.com platform

- Dollar-Cost Averaging: Establish recurring purchases through Gate.com to reduce volatility impact and timing risk

- Limit Orders: Place strategic limit buy orders at support levels ($0.0661-$0.08) to accumulate during market corrections

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is the price target for C in 2025?

Based on analyst consensus, C's 2025 price target ranges from $70 to $82, with an average target around $77.50. This forecast is derived from projected 2025 EPS estimates averaging $7.75, reflecting anticipated earnings growth and market conditions.

Is C stock a buy, sell, or hold?

Based on current analyst consensus, C stock is recommended as a Strong Buy. Most analysts project positive momentum, making it an attractive entry point for investors seeking exposure to this asset.

What is the target price for C?

The target price for C is $104.79 on average, based on 213 analyst price targets. The price range spans from $75.5 to $134, reflecting varied market expectations.

How volatile is C stock?

C stock's volatility is 26.86% as of December 2025, reflecting moderate price fluctuations. This level indicates typical market movements for the asset, making it suitable for traders with balanced risk tolerance.

Mira Network Price Prediction and Market Insights

2025 PHB Price Prediction: Future Outlook and Market Analysis for Phoenix Global Token

What Is Unibase (UB) and How Does Its Decentralized AI Memory Work?

What is AIEPK: The Future of Artificial Intelligence in Education and Knowledge Processing

How Does XLM-RoBERTa Compare to Other Multilingual Models in 2025?

What is LKI: Unveiling the Mystery Behind the Three-Letter Acronym

Is LimeWire (LMWR) a good investment?: A Comprehensive Analysis of Risk, Potential, and Market Outlook

Worldcoin Future: Can AI and Investment Drive WLD to $4 by 2030?

How Do Crypto Derivatives Market Signals Reveal Future Price Trends With Funding Rates and Liquidation Data?

How to Measure Crypto Community and Ecosystem Engagement: Twitter Followers, Developer Contributions, and DApp Activity

WCOIN Launch Details, Price Outlook, and Acquisition Guide on Telegram