2025 CLORE Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: CLORE's Market Position and Investment Value

Clore.ai (CLORE) is an innovative marketplace that enables the sharing and leasing of GPU computing power, allowing users to rent out their GPUs for tasks like AI training, rendering, or mining while others access these resources at affordable prices. Since its launch in November 2022, the project has established itself as a community-driven platform that streamlines profitability while expanding accessibility to advanced computational resources.

As of December 24, 2025, CLORE's market capitalization stands at approximately $4.32 million, with a circulating supply of around 625.53 million tokens and a current price of $0.006873. This asset represents an emerging player in the decentralized computing infrastructure sector, playing an increasingly significant role in democratizing access to high-performance computational capabilities.

This article will provide a comprehensive analysis of CLORE's price trends and market dynamics, combining historical price patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for the period through 2030.

Clore.ai (CLORE) Price Analysis Report

I. CLORE Price History Review and Market Status

CLORE Historical Price Evolution

- November 10, 2023: CLORE reached its all-time low price of $0.0046, marking a significant bottom in the market.

- March 17, 2024: CLORE reached its all-time high price of $0.45, representing a peak valuation point for the token.

- December 24, 2025: CLORE trading at $0.006873, reflecting a year-over-year decline of 91.9% from its historical high.

CLORE Current Market Status

As of December 24, 2025, CLORE is trading at $0.006873 with a 24-hour trading volume of $49,578.44. The token shows mixed short-term performance: down 0.19% over the past hour, but up 0.88% in the last 24 hours and 0.47% over the past 7 days. Over the 30-day period, CLORE has gained 4.77%, suggesting recent stabilization efforts.

The current market capitalization stands at $4,299,271.18, with a fully diluted valuation of $4,323,281.87. CLORE maintains a market dominance of 0.00013%, reflecting its modest position in the broader cryptocurrency market. The circulating supply is 625,530,508.17 CLORE tokens out of a maximum supply of 1,300,000,000 tokens, with a circulation ratio of 48.12%.

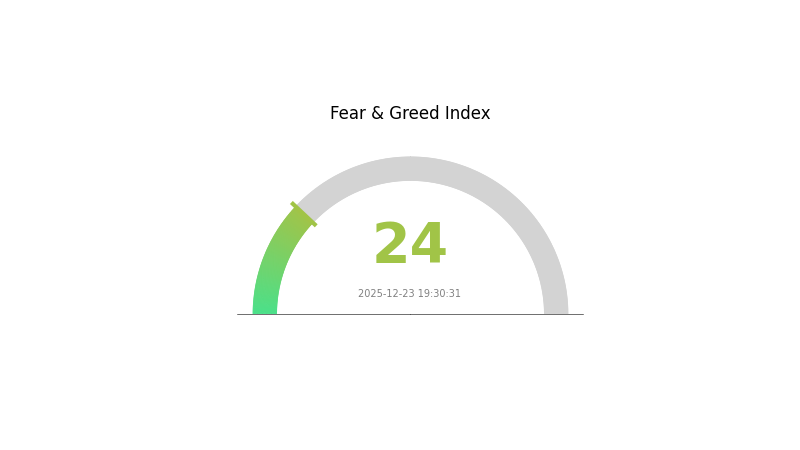

Recent market sentiment reflects extreme fear, with a VIX indicator reading of 24, suggesting heightened market anxiety. The token currently maintains 214 active holders and is traded on 5 different exchanges.

Click to view current CLORE market price

CLORE Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of 24. This indicates that market participants are highly pessimistic, with significant sell-off pressure and negative sentiment dominating. During such periods, experienced investors often view it as a potential buying opportunity, as extreme fear typically precedes market recoveries. However, traders should remain cautious and implement proper risk management strategies. Monitor key support levels closely and consider dollar-cost averaging into positions rather than making large lump-sum investments during peak fear conditions.

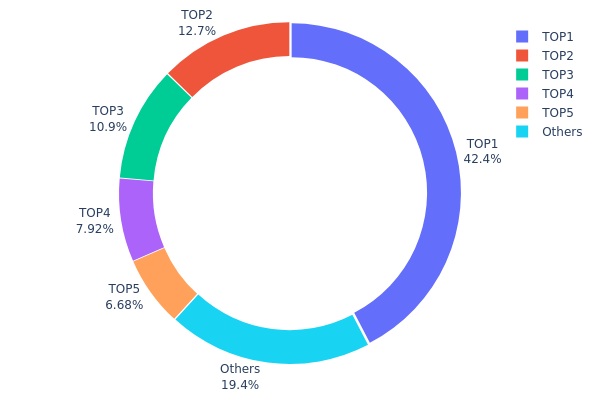

CLORE Holdings Distribution

The address holdings distribution chart illustrates the concentration of CLORE tokens across blockchain addresses, revealing the degree of token ownership centralization and potential market influence. This metric is fundamental to assessing the decentralization status and on-chain structural stability of the project, as it directly reflects the distribution of voting power, liquidity control, and market manipulation risks.

Analysis of the current data reveals a pronounced concentration pattern in CLORE's token distribution. The top address holds 42.35% of total supply, while the combined holdings of the top five addresses account for 80.52% of all tokens in circulation. This level of concentration presents significant centralization characteristics. Notably, the top two addresses alone control over 55% of the total supply, indicating substantial market power concentrated among a limited number of stakeholders. The remaining addresses classified as "Others" represent only 19.48%, demonstrating that token distribution remains heavily skewed toward major holders rather than achieving broad-based community ownership.

The current address distribution structure introduces material considerations for market dynamics. With such high concentration among top holders, the potential for significant price volatility exists, as coordinated movements or liquidation events by major stakeholders could substantially impact market conditions. Furthermore, the centralized nature of holdings may affect protocol governance decisions if these addresses correspond to core team members or early investors. However, it should be noted that the remaining 19.48% distributed across multiple addresses provides some degree of secondary liquidity distribution. This structural arrangement suggests that CLORE currently exhibits moderate-to-high centralization, with decentralization efforts potentially warranting consideration for long-term sustainability and market credibility.

Visit CLORE Holdings Distribution on Gate.com for real-time data.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7e12...9c775a | 550629.77K | 42.35% |

| 2 | 0x1ffb...2d49c7 | 165292.27K | 12.71% |

| 3 | 0xc4c9...68cbb0 | 141490.64K | 10.88% |

| 4 | 0x0d07...b492fe | 102942.40K | 7.91% |

| 5 | 0xd903...90d14f | 86816.25K | 6.67% |

| - | Others | 252828.66K | 19.48% |

II. Core Factors Influencing CLORE's Future Price

Supply and Demand Dynamics

-

Market Sentiment Impact: Market sentiment plays a crucial role in CLORE price predictions. Optimistic and "greedy" sentiment can drive bullish forecasts, while fear or negative news may lead to bearish outlooks. Market sentiment analysis combined with on-chain indicators remains a key tool for predicting CLORE price movements in the near and medium term.

-

Current Price Position: CLORE is currently trading at approximately $0.01, with price predictions varying based on multiple factors including supply-demand dynamics and market conditions.

Macroeconomic Environment

-

Monetary Policy Impact: Global economic growth is expected to continue at approximately 3.2% in 2024-2025, with global inflation gradually declining from 6.8% in 2023 to an estimated 4.5% by 2025. Central bank policies aimed at ensuring smooth inflation reduction will continue to influence cryptocurrency markets and investor risk appetite.

-

Inflation Hedge Characteristics: In an inflationary environment, cryptocurrencies like CLORE may serve as alternative assets as investors seek to diversify away from traditional holdings. However, the effectiveness depends on broader macroeconomic trends and monetary policy trajectories.

-

Geopolitical Factors: Geopolitical tensions and uncertainties can affect market sentiment and capital flows into alternative assets. Changes in trade dynamics and international economic relations may influence cryptocurrency adoption and investment patterns.

Key Price Influencing Factors

-

Regulatory Dynamics: Regulatory developments, including ETF approvals and government policies, are significant drivers of CLORE price movements. Positive regulatory clarity can enhance institutional adoption rates.

-

Institutional Adoption: Increases in institutional adoption rates and sustained institutional demand are expected to have substantial impacts on CLORE's annual price trajectory.

-

Technical Analysis Forecasts: Cryptocurrency experts applying technical analysis to CLORE's historical performance project the following price ranges:

- 2026: Low of $0.09131, high of $0.1466, average of $0.11334

- 2027: Low of $0.11596, high of $0.19938, average of $0.14848

- 2028: Low of $0.14727, high of $0.27116, average of $0.19451

III. 2025-2030 CLORE Price Forecast

2025 Outlook

- Conservative Prediction: $0.00544 - $0.00688

- Neutral Prediction: $0.00688

- Optimistic Prediction: $0.00977 (requires sustained market confidence and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Predictions:

- 2026: $0.00450 - $0.01032 (anticipated 21% increase)

- 2027: $0.00476 - $0.01026 (anticipated 35% increase)

- Key Catalysts: Protocol upgrades, increased adoption metrics, institutional interest in the project ecosystem, and broader cryptocurrency market recovery trends

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00499 - $0.01273 (assuming steady adoption and favorable market conditions)

- Optimistic Scenario: $0.00843 - $0.01454 (assuming accelerated ecosystem growth and mainstream integration)

- Transformational Scenario: $0.00957 - $0.01454 by 2029-2030 (contingent on breakthrough technological innovations and significant market expansion)

- 2030-12-24: CLORE $0.01454 (peak potential valuation reflecting cumulative 77% growth from 2025 baseline)

Note: Price forecasts are derived from market analysis and should be monitored through reliable platforms such as Gate.com. Always conduct independent research before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00977 | 0.00688 | 0.00544 | 0 |

| 2026 | 0.01032 | 0.00832 | 0.0045 | 21 |

| 2027 | 0.01026 | 0.00932 | 0.00476 | 35 |

| 2028 | 0.01273 | 0.00979 | 0.00499 | 42 |

| 2029 | 0.01317 | 0.01126 | 0.00957 | 63 |

| 2030 | 0.01454 | 0.01222 | 0.00843 | 77 |

Clore.ai (CLORE) Professional Investment Strategy and Risk Management Report

I. Executive Summary

Clore.ai is an innovative GPU computing marketplace that enables users to share and lease GPU computing power for AI training, rendering, and mining tasks. As of December 24, 2025, CLORE trades at $0.006873 with a market capitalization of approximately $4.3 million and a 24-hour trading volume of $49,578.44. The token has experienced significant volatility, trading down 91.9% over the past year from its all-time high of $0.45 reached on March 17, 2024.

II. Market Overview and Price Performance

Current Market Metrics

| Metric | Value |

|---|---|

| Current Price | $0.006873 |

| Market Cap | $4,299,271.18 |

| Fully Diluted Valuation | $4,323,281.87 |

| Circulating Supply | 625,530,508.17 CLORE |

| Total Supply | 629,023,988.17 CLORE |

| Maximum Supply | 1,300,000,000 CLORE |

| 24h Trading Volume | $49,578.44 |

| Market Dominance | 0.00013% |

Price Trend Analysis

| Timeframe | Change | Amount |

|---|---|---|

| 1 Hour | -0.19% | -$0.000013 |

| 24 Hours | +0.88% | +$0.000060 |

| 7 Days | +0.47% | +$0.000032 |

| 30 Days | +4.77% | +$0.000313 |

| 1 Year | -91.9% | -$0.077979 |

Historical Price Levels

- All-Time High (ATH): $0.45 (March 17, 2024)

- All-Time Low (ATL): $0.0046 (November 10, 2023)

- Current 24h High: $0.007267

- Current 24h Low: $0.0067

III. Project Fundamentals and Ecosystem Analysis

Project Overview

Clore.ai operates as a decentralized marketplace facilitating GPU computing power sharing and leasing. The platform addresses the growing demand for affordable computational resources by connecting GPU owners with those needing high-performance computing capabilities.

Core Value Proposition

- GPU Leasing Marketplace: Users can rent idle GPU computing power for various applications

- Affordable Computational Access: Reduces costs for AI training, rendering, and other computationally intensive tasks

- Data Center Services: Provides secure, managed hosting solutions through proprietary data centers

- Community-Driven Economics: Incentivizes participation through mechanisms like Clore Mining

- Accessibility Expansion: Democratizes access to advanced computational resources

Token Economics

- Circulating Supply Ratio: 48.12% of maximum supply currently in circulation

- Market Cap to FDV Ratio: Indicates room for potential supply expansion impact

- Total Holders: 214 (as of the latest update)

- Exchange Listings: Available on 5 trading venues

IV. CLORE Professional Investment Strategy and Risk Management

CLORE Investment Methodology

(1) Long-Term Holding Strategy

Suitable Investors: Patient capital allocators with 2+ year investment horizons, those bullish on GPU computing infrastructure trends, and investors seeking exposure to AI infrastructure buildout.

Operational Guidelines:

- Accumulate positions gradually during price weakness below $0.005

- Hold through market cycles, as GPU demand may increase with AI adoption

- Rebalance allocation quarterly based on market performance and risk assessment

- Monitor project development milestones and ecosystem growth metrics

Storage Solutions:

- Use Gate.com for secure exchange custody with insurance coverage

- Consider self-custody through Gate's Web3 wallet for amounts exceeding 10,000 CLORE tokens

- Implement multi-signature security protocols for holdings above 50,000 tokens

(2) Active Trading Strategy

Technical Analysis Considerations:

- Support Levels: $0.005 (psychological support), $0.006 (recent trading range bottom)

- Resistance Levels: $0.008 (near-term resistance), $0.01 (medium-term target)

Swing Trading Considerations:

- Monitor volume patterns around psychological price levels ($0.005, $0.01)

- Trade on 4-hour and daily timeframes for swing positions

- Consider entry points when RSI drops below 30 on daily charts

- Set profit targets at 15-25% gains given the token's volatility profile

CLORE Risk Management Framework

(1) Asset Allocation Principles

| Investor Profile | Recommended CLORE Allocation |

|---|---|

| Conservative Investors | 0.5% - 1% of portfolio |

| Aggressive Investors | 2% - 5% of portfolio |

| Professional Traders | 5% - 10% with strict stop-losses |

(2) Risk Hedging Approaches

- Portfolio Diversification: Limit CLORE to no more than 5% of total crypto holdings

- Dollar-Cost Averaging: Invest fixed amounts monthly to reduce timing risk

- Stop-Loss Implementation: Set trailing stops at 15-20% below entry points

- Profit Realization: Take partial profits at predetermined resistance levels

(3) Secure Storage Solutions

- Hot Wallet (Trading): Gate.com exchange wallet for active trading positions

- Cold Storage: Gate's Web3 wallet for long-term holdings above 5,000 CLORE

- Hardware Security: For institutional-sized positions (500,000+ CLORE), implement multi-signature governance

Security Precautions:

- Enable two-factor authentication on all exchange accounts

- Never share private keys or seed phrases

- Verify contract address before token transfers: 0xe60201989b8628f43dc0605f585a72bcf1f1e977 (Ethereum)

- Regularly audit wallet transactions for unauthorized activity

V. Potential Risks and Challenges

CLORE Market Risks

- Extreme Volatility: The token has declined 91.9% from ATH, exposing holders to severe price fluctuations and potential further downside

- Low Liquidity: Daily trading volume of $49,578 indicates limited market depth and potential slippage on large orders

- Small Market Cap: At $4.3 million, the token remains highly susceptible to price manipulation and sudden market moves

- Limited Trading Venues: Available on only 5 exchanges restricts accessibility and increases execution risk

CLORE Regulatory Risks

- Uncertain Regulatory Status: GPU computing platforms may face evolving regulatory scrutiny as they scale

- Jurisdictional Constraints: Changes in crypto regulations could restrict platform operations in key markets

- Compliance Uncertainty: Lending/renting mechanisms may trigger securities or derivatives regulations in certain jurisdictions

CLORE Technology Risks

- Platform Security: Marketplace for computing resources must maintain robust security against hacking and unauthorized access

- Scaling Challenges: Growing user base requires continuous infrastructure development and optimization

- Data Center Reliability: Dependency on data center operations creates operational risk if infrastructure fails

- Integration Complexity: Integration with diverse GPU types and computing environments increases technical complexity

VI. Conclusion and Action Recommendations

CLORE Investment Value Assessment

Clore.ai represents a speculative investment in GPU computing infrastructure with significant long-term potential but considerable near-term risks. The project operates in a vital niche—democratizing expensive computational resources—but faces headwinds from extreme volatility, limited market depth, and unproven market traction. The 91.9% decline from ATH suggests either significant overvaluation at peak or substantial market skepticism regarding execution. Success depends on achieving meaningful adoption within the GPU-sharing marketplace and demonstrating sustainable unit economics.

CLORE Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of portfolio) through dollar-cost averaging over 3-6 months. Use Gate.com for initial purchases and store in hot wallet only while learning. Focus on understanding the project fundamentals before scaling investment.

✅ Experienced Investors: Consider 2-5% portfolio allocation with technical analysis entry signals. Implement disciplined stop-losses at 20% below entry. Combine long-term holdings with swing trading on defined support/resistance levels.

✅ Institutional Investors: Conduct comprehensive technical due diligence on project team and adoption metrics. Consider position sizing at 3-5% with formal governance structures. Engage directly with project developers to assess roadmap and growth trajectory.

CLORE Trading Participation Methods

- Exchange Trading: Purchase directly on Gate.com using USD or stablecoin pairs (USDT, USDC) with spot trading orders

- Direct Swaps: Use decentralized exchange functionality within Gate's Web3 wallet for token swaps

- Institutional Channels: Gate.com's institutional services for large position management with customized liquidity solutions

Cryptocurrency investments carry extreme risk and volatility. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and conduct thorough due diligence. Consult qualified financial advisors before investing. Never invest capital you cannot afford to lose completely.

FAQ

How much is the clore coin worth?

The Clore coin (CLORE) is currently worth $0.00695, with a 24-hour trading volume of $2.23 million. It has a circulating supply of 628.84M CLORE and a maximum supply of 1.3B CLORE.

What is CLORE coin and what is it used for?

CLORE coin is the native token of the Clore.ai platform. It rewards hosters for contributing computing resources and encourages platform engagement. The token also supports a Proof of Holding system that provides additional benefits to token holders.

What are the risks and challenges for CLORE price growth?

CLORE price growth faces market volatility and cryptocurrency risks. Competition in AI computing, adoption rate limitations, and market sentiment fluctuations present challenges. Regulatory changes and technology development pace also impact price potential.

How does CLORE compare to other cloud computing tokens?

CLORE features a unique Proof of Holding system that rewards long-term holders with reduced fees and increased earnings, differentiating it from competitors relying on traditional Proof of Work or Proof of Stake mechanisms. This distinctive economic model provides stronger incentives for user retention.

Is Shieldeum (SDM) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Clore.ai (CLORE) a good investment?: Analyzing the Potential and Risks of this Emerging AI Token

Is PinGo (PINGO) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 PINGO Price Prediction: Analyzing Potential Growth and Market Trends for the Emerging Cryptocurrency

2025 AIOT Price Prediction: Expert Analysis and Market Trends for the Next Generation of Connected Devices

Is Bless (BLESS) a good investment? Comprehensive Analysis of Features, Risks, and Market Potential

What is DINO price volatility: 24-hour fluctuation between $0.00062531 and $0.00086918?

What is on-chain data analysis and how do active addresses reveal crypto market trends?

Can Cryptocurrency Be Converted to Cash?

APR Meaning in Crypto Explained: How Annual Percentage Rate Really Works

# What Are the Security Risks and Smart Contract Vulnerabilities in CARV Token?