2025 GEOD Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of GEOD

GEODNET (GEOD) is the world's largest Real-Time Kinematics (RTK) network, leveraging DePIN principles to build a decentralized space weather mining station network. Since its launch in September 2024, GEODNET has established itself as a critical infrastructure provider for next-generation positioning services. As of December 18, 2025, GEOD's market capitalization has reached approximately $136.25 million, with a circulating supply of approximately 438.78 million tokens, currently trading at $0.13625. This innovative asset, recognized as a "decentralized positioning infrastructure pioneer," is playing an increasingly important role in enabling centimeter-level positioning accuracy and nanosecond-level time precision across global navigation applications.

This article will comprehensively analyze GEOD's price trajectory through 2030, integrating historical market patterns, supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

GEODNET (GEOD) Market Analysis Report

I. GEOD Price History Review and Current Market Status

GEOD Historical Price Evolution

Based on the available data as of December 18, 2025, GEOD has exhibited significant price volatility since its launch on September 7, 2024 (publish price: $0.15):

- All-Time High (ATH): $0.37899, reached on January 25, 2025, representing a 152.66% gain from the initial listing price

- All-Time Low (ATL): $0.09605, recorded on October 12, 2025, marking a 36.03% decline from the launch price

- Year-to-Date Performance: -46.42% decline from the previous year, indicating substantial bearish pressure over the extended timeframe

The price trajectory reflects a typical boom-and-bust pattern common in emerging DePIN (Decentralized Physical Infrastructure Network) projects, with an initial speculative rally followed by a correction phase and consolidation at lower levels.

GEOD Current Market Status

Price Metrics (as of December 18, 2025, 10:27:19 UTC):

- Current Price: $0.13625

- 24-Hour Range: $0.12503 - $0.14887

- 24-Hour Change: -0.86%

- 7-Day Change: -6.49%

- 30-Day Change: +0.32%

Market Capitalization and Valuation:

- Market Cap (Circulating): $59,783,494.87

- Fully Diluted Valuation (FDV): $136,250,000

- Market Cap to FDV Ratio: 43.88%

- Market Dominance: 0.0043%

- Global Ranking: #455

Supply Metrics:

- Circulating Supply: 438,777,944 GEOD (43.88% of total supply)

- Total Supply: 1,000,000,000 GEOD

- Maximum Supply: 1,000,000,000 GEOD

- Token Holders: 16,483

Trading Activity:

- 24-Hour Trading Volume: $197,780.66

- Volume-to-Market Cap Ratio: 0.33% (indicating relatively low trading liquidity)

- Listed on 4 exchanges, including Gate.com

Network Status:

- Blockchain: Polygon (MATIC)

- Contract Address: 0xac0f66379a6d7801d7726d5a943356a172549adb

- Sentiment Indicator: Extreme Fear (VIX Score: 17)

The current trading activity suggests modest investor engagement, with the token trading near the midpoint of its historical range. The significant gap between circulating supply and fully diluted valuation indicates substantial token release potential, which may exert downward pressure on future valuations as tokens gradually enter circulation.

Click to view current GEOD market price

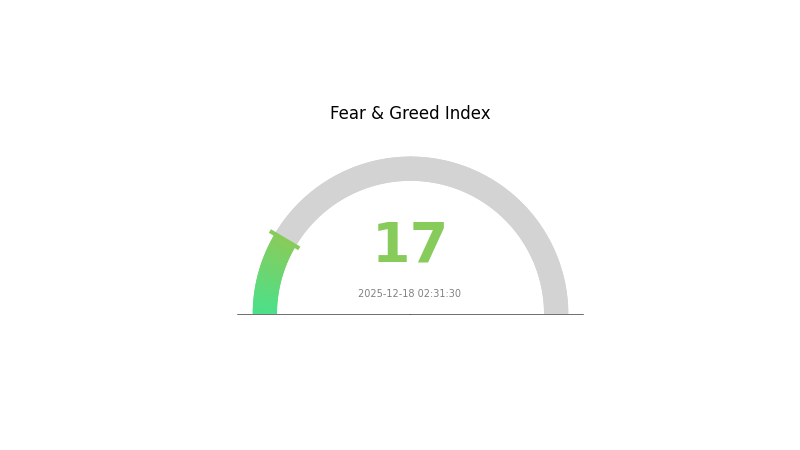

GEOD Market Sentiment Index

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 17. This exceptionally low reading signals intense market pessimism and widespread panic among investors. During such periods, asset prices often face significant downward pressure as fear-driven selling accelerates. However, contrarian investors view extreme fear as a potential buying opportunity, as historically, such sentiment extremes frequently precede market reversals. Traders should exercise caution while monitoring key support levels closely. Risk management remains paramount in highly volatile market conditions like these.

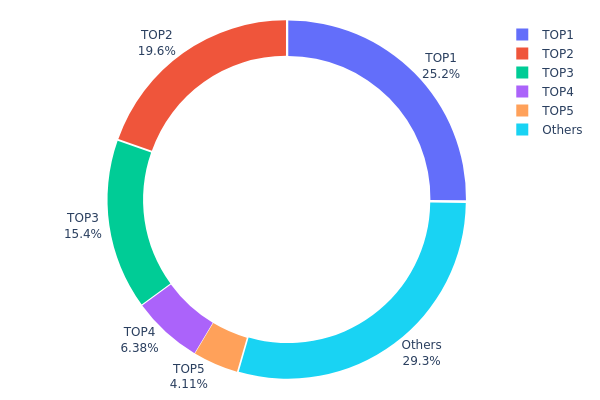

GEOD Holdings Distribution

The address holdings distribution chart illustrates the concentration of GEOD tokens across the blockchain network by tracking the top token holders and their respective portfolio percentages. This metric serves as a critical indicator of token decentralization, market structure stability, and potential vulnerability to coordinated price movements or market manipulation.

Analysis of the current GEOD holdings data reveals a moderate concentration pattern. The top three addresses collectively control approximately 60.20% of total token supply, with the largest holder maintaining 25.18% and the second-largest holding 19.61% of circulating GEOD. While this concentration level is noteworthy, the distribution does not exhibit extreme centralization as the "Others" category accounts for 29.31% of holdings, indicating a dispersed secondary holder base. The fourth and fifth largest addresses hold 6.38% and 4.11% respectively, further demonstrating a gradual decline in individual holder influence.

This distribution pattern suggests a hybrid market structure characterized by identifiable whale concentration balanced against a meaningful decentralized holder base. The 60% concentration among top three addresses presents moderate risk for potential price volatility or coordinated market action, though the significant "Others" allocation provides some resilience against unilateral price manipulation. From a market stability perspective, this configuration indicates GEOD maintains reasonable decentralization characteristics while retaining sufficient institutional or strategic holder involvement to support network development and liquidity provision. Monitoring shifts in this distribution will remain essential for assessing long-term governance risks and network resilience.

Click to view current GEOD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xca3e...2324b2 | 245000.00K | 25.18% |

| 2 | 0x2006...6bc7ab | 190771.32K | 19.61% |

| 3 | 0xfa5f...11b14f | 150000.00K | 15.41% |

| 4 | 0x3a69...92653b | 62084.08K | 6.38% |

| 5 | 0x47c8...da907d | 40000.01K | 4.11% |

| - | Others | 284941.15K | 29.31% |

II. Core Factors Influencing GEOD's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Monetary policy adjustments and interest rate changes can alter investment attractiveness. Central bank policy decisions directly affect the relative appeal of GEOD as an investment asset.

-

Inflation Hedging Properties: In inflationary environments, GEOD possesses potential "digital gold" characteristics that may drive investor demand as a value preservation tool.

-

Geopolitical Factors: International geopolitical uncertainty may increase investment demand for GEOD as investors seek alternative assets during periods of global instability.

Technology Development and Ecosystem Building

-

Enterprise Integration: Enterprise adoption of GEOD through integration into real-world applications drives growth in demand and practical utility.

-

Regulatory Environment: Government policy changes and regulatory adjustments by major economies may impact GEOD application and price performance.

III. 2025-2030 GEOD Price Forecast

2025 Outlook

- Conservative Forecast: $0.07944 - $0.13464

- Neutral Forecast: $0.13464

- Bearish Forecast: $0.17772 (requires market recovery catalyst)

Current market conditions suggest cautious positioning as GEOD enters a consolidation phase with -1% expected change for the year.

2026-2028 Mid-term Outlook

-

Market Stage Expectation: Recovery and gradual accumulation phase with increasing institutional interest and platform adoption metrics improving year-over-year.

-

Price Range Predictions:

- 2026: $0.14837 - $0.21553 (14% upside potential)

- 2027: $0.10408 - $0.2379 (36% cumulative growth)

- 2028: $0.12289 - $0.23942 (55% cumulative growth)

-

Key Catalysts: Enhanced ecosystem development, increased trading volume on Gate.com and partner platforms, strengthened tokenomics implementation, and growing user base expansion.

2029-2030 Long-term Outlook

-

Base Case Scenario: $0.21703 - $0.32038 (65-89% cumulative growth from 2025 levels)

- Assumes steady market maturation and consistent adoption trajectory

-

Optimistic Scenario: $0.29109 - $0.32038 (89% appreciation)

- Requires sustained positive regulatory environment and accelerated mainstream adoption

-

Transformative Scenario: $0.32038+ (exceptional upside)

- Contingent on breakthrough technological innovations, significant partnership announcements, and mainstream financial integration

2030-12-18: GEOD demonstrates substantial long-term value accumulation potential with average price reaching $0.25837 by mid-decade, representing significant portfolio diversification opportunity for strategic investors.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.17772 | 0.13464 | 0.07944 | -1 |

| 2026 | 0.21553 | 0.15618 | 0.14837 | 14 |

| 2027 | 0.2379 | 0.18586 | 0.10408 | 36 |

| 2028 | 0.23942 | 0.21188 | 0.12289 | 55 |

| 2029 | 0.29109 | 0.22565 | 0.11734 | 65 |

| 2030 | 0.32038 | 0.25837 | 0.21703 | 89 |

GEODNET (GEOD) Professional Investment Report

IV. GEOD Professional Investment Strategy and Risk Management

GEOD Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Infrastructure investors and Web3 technology believers

- Operational Suggestions:

- Establish a position during market corrections and accumulate GEOD tokens during price dips

- Hold positions for 2+ years to benefit from the expansion of DePIN infrastructure and RTK network adoption

- Set price targets based on adoption milestones of GEODNET's space weather mining stations

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the $0.12503 support (24H low) and $0.14887 resistance (24H high)

- Moving Averages: Track 7-day and 30-day average prices to identify trend reversals

- Wave Trading Key Points:

- Current price at $0.13625 represents a consolidation zone with -6.49% 7-day decline

- Monitor volume patterns around the $0.12503 level for potential breakout opportunities

- Consider profit-taking near the historical high of $0.37899 achieved on January 25, 2025

GEOD Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 3-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation, depending on conviction in DePIN infrastructure trends

(2) Risk Hedging Solutions

- Diversification Strategy: Combine GEOD holdings with established layer-1 or layer-2 blockchain assets to reduce concentration risk

- Position Sizing: Use stop-loss orders at -15% below entry price to manage downside exposure

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet provides convenient access for frequent traders with built-in security features

- Cold Storage Approach: Transfer GEOD tokens to hardware storage solutions for long-term holdings exceeding 12 months

- Security Precautions: Enable two-factor authentication, maintain private key backups in secure locations, and never share seed phrases with third parties

V. GEOD Potential Risks and Challenges

GEOD Market Risks

- Price Volatility: GEOD has declined 46.42% over the past year, indicating significant volatility and potential for further drawdowns

- Liquidity Constraints: Daily trading volume of $197,780 is relatively modest for a project with $136.25 million market cap, which may cause slippage on large orders

- Market Cap Concentration: Circulating supply represents only 43.88% of total supply, with significant dilution potential as remaining tokens enter circulation

GEOD Regulatory Risks

- DePIN Framework Uncertainty: Regulatory clarity on decentralized infrastructure networks and mining operations remains unclear in many jurisdictions

- Positioning Service Compliance: Real-time kinematic positioning services may face regulatory requirements from aviation, telecommunications, or geolocation authorities

- Geographic Restrictions: Different regions may impose varying restrictions on satellite signal usage and GNSS correction services

GEOD Technology Risks

- Network Maturity: As one of the world's largest RTK networks, GEODNET faces technical challenges in scaling space weather mining stations globally

- Infrastructure Dependency: Reliance on accurate GNSS and solar wind data requires continuous hardware maintenance and real-time system reliability

- Competition from Established Players: Traditional RTK service providers with decades of infrastructure experience may pose competitive challenges to the decentralized model

VI. Conclusion and Action Recommendations

GEOD Investment Value Assessment

GEODNET presents a specialized investment opportunity in the DePIN sector focused on precision positioning infrastructure. The project addresses a tangible market need for centimeter-level accuracy in global positioning systems. However, the 46.42% annual decline and modest trading volume suggest market uncertainty about adoption timelines and revenue generation mechanisms. The technology is innovative, but execution risk remains significant. Investors should view GEOD as a speculative, long-term bet on the convergence of blockchain technology with critical infrastructure services.

GEOD Investment Recommendations

✅ Beginners: Start with a minimal allocation (0.5-1% of portfolio) through Gate.com and research the DePIN sector thoroughly before increasing exposure

✅ Experienced Investors: Consider a tactical 3-5% allocation if you have conviction in satellite positioning infrastructure adoption and can tolerate 50%+ drawdowns

✅ Institutional Investors: Conduct detailed due diligence on GEODNET's mining station network deployment, revenue models, and competitive positioning before committing capital

GEOD Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase of GEOD tokens using fiat currency or other cryptocurrencies

- Dollar-Cost Averaging: Regular periodic purchases to reduce timing risk and average purchase price over time

- Gate Web3 Wallet Integration: Secure storage and direct management of GEOD holdings with seamless integration to Gate.com for trading

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are encouraged to consult with professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Geodnet a good investment?

Yes, Geodnet is a strong investment opportunity. GEOD token benefits from the booming autonomous vehicle market with significant growth potential. Its technology and market positioning support long-term value appreciation in this expanding sector.

How much will 1 Dogecoin be worth in 2025?

Based on current market predictions, Dogecoin is expected to range between $0.28 and $0.34 in 2025. The average price forecast suggests positive momentum throughout the year.

Will Dogecoin reach $1 in 2030?

Yes, Dogecoin may reach $1 by 2030 based on current market trends and projections. Long-term analysis suggests potential for significant growth, with some forecasts indicating prices could exceed $1 during this period.

Can dot coin reach $100?

Yes, DOT can potentially reach $100. With strong ecosystem development, increasing adoption of parachains, and growing institutional interest in Polkadot's interoperability solutions, significant price appreciation is possible over the long term as the crypto market matures and expands.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Ultimate Guide to MEMEX: Launch Details, Price Forecasts, and Purchase Tips

What is SYN: Understanding the TCP Synchronization Packet and Its Role in Network Communication

What is ZRC: A Comprehensive Guide to Zero-Knowledge Rollup Compression Technology

What is HOOK: A Comprehensive Guide to Understanding and Implementing Hooks in Modern Web Development

What is SPA: A Comprehensive Guide to Single Page Applications and Their Impact on Modern Web Development