2025 MAGICPrice Prediction: Analyzing Market Trends and Future Growth Potential for MAGIC Token in the Crypto Ecosystem

Introduction: MAGIC's Market Position and Investment Value

Magic (MAGIC), as a key player in the DeFi, NFT, and gaming intersection, has made significant strides since its inception. As of 2025, MAGIC's market capitalization has reached $55,094,421, with a circulating supply of approximately 315,185,478 tokens, and a price hovering around $0.1748. This asset, often referred to as the "natural resource of the Treasure metaverse," is playing an increasingly crucial role in activating NFTs and transforming them into productive, yield-generating assets.

This article will provide a comprehensive analysis of MAGIC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MAGIC Price History Review and Current Market Status

MAGIC Historical Price Evolution

- 2021: MAGIC launched, price reached an all-time low of $0.01999252 on October 7

- 2022: Bull market peak, price surged to an all-time high of $6.32 on February 20

- 2023-2025: Market cycle fluctuations, price dropped from the peak to current levels

MAGIC Current Market Situation

As of September 29, 2025, MAGIC is trading at $0.1748. The token has experienced a 2.52% increase in the last 24 hours, with a trading volume of $214,768.04. MAGIC's market capitalization stands at $55,094,421.59, ranking it 646th in the global cryptocurrency market. The current price represents a significant decline of 97.23% from its all-time high, but it has shown a 774.34% increase from its all-time low. In the past 30 days, MAGIC has seen a substantial decrease of 22.31%, indicating recent bearish sentiment. However, the 24-hour gain suggests a potential short-term recovery trend.

Click to view the current MAGIC market price

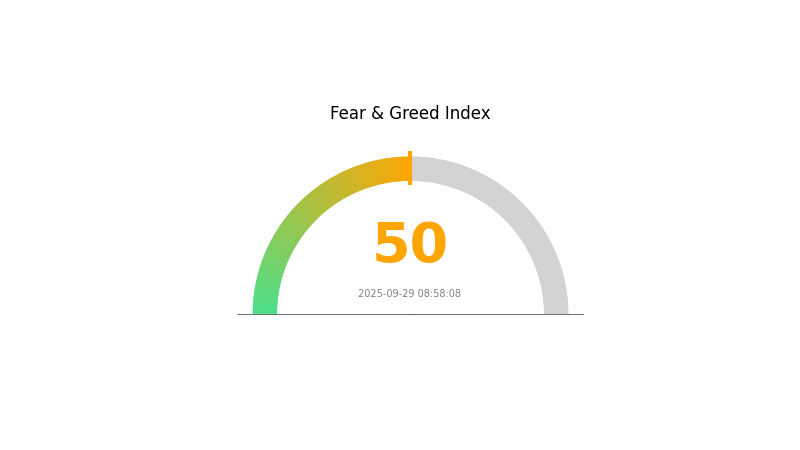

MAGIC Market Sentiment Indicator

2025-09-29 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment has stabilized at a neutral level, indicating a balance between optimism and caution among investors. This equilibrium suggests that the market is currently in a state of uncertainty, with no clear bullish or bearish trends dominating. Traders and investors should remain vigilant and consider diversifying their portfolios to mitigate potential risks. As always, it's crucial to conduct thorough research and stay informed about market developments before making any investment decisions.

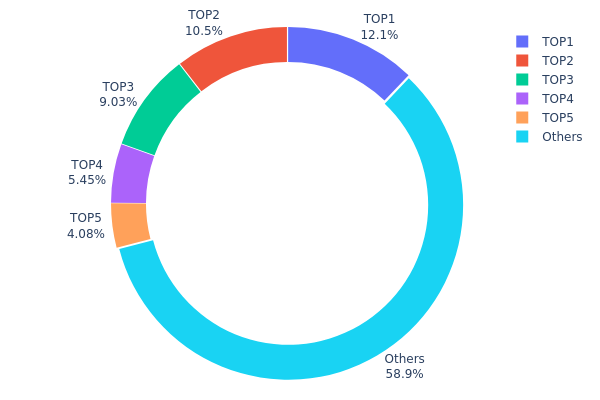

MAGIC Holdings Distribution

The address holdings distribution data for MAGIC reveals a significant concentration of tokens among the top holders. The top 5 addresses collectively control 41.14% of the total MAGIC supply, with the largest holder possessing 12.10%. This level of concentration indicates a relatively centralized ownership structure, which could potentially impact market dynamics.

Such a concentrated distribution may lead to increased price volatility and susceptibility to market manipulation. Large holders, often referred to as "whales," have the capacity to influence price movements through substantial buy or sell orders. However, it's worth noting that 58.86% of MAGIC tokens are distributed among other addresses, suggesting some degree of wider participation in the ecosystem.

This concentration pattern reflects a common characteristic in many cryptocurrency projects, where early adopters or project insiders often hold substantial portions of the supply. While this can provide stability in the short term, it may also raise concerns about long-term decentralization and equal opportunity for new participants in the MAGIC ecosystem.

Click to view the current MAGIC holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x76ec...78fbd3 | 35329.40K | 12.10% |

| 2 | 0x5a52...70efcb | 30605.33K | 10.48% |

| 3 | 0xf977...41acec | 26366.01K | 9.03% |

| 4 | 0xb38e...82891d | 15924.22K | 5.45% |

| 5 | 0x611f...dfb09d | 11915.89K | 4.08% |

| - | Others | 171833.55K | 58.86% |

II. Key Factors Affecting MAGIC's Future Price

Supply Mechanism

- Historical patterns: Past supply changes have influenced price movements

- Current impact: Expected impact of current supply changes on price

Institutional and Whale Dynamics

- Institutional holdings: Major institutions' current holdings of MAGIC

Macroeconomic Environment

- Inflation hedging properties: MAGIC's performance in inflationary environments

Technical Development and Ecosystem Building

- NFT market trends: Impact of overall NFT market sentiment on MAGIC

- Ecosystem applications: Key DApps/ecosystem projects related to MAGIC

III. MAGIC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.1519 - $0.1746

- Neutral prediction: $0.1746 - $0.2000

- Optimistic prediction: $0.2000 - $0.23571 (requires significant market recovery and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential consolidation followed by gradual growth

- Price range forecast:

- 2027: $0.20926 - $0.25357

- 2028: $0.21989 - $0.35233

- Key catalysts: Technological advancements, expanded use cases, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.30110 - $0.34476 (assuming steady growth and adoption)

- Optimistic scenario: $0.34476 - $0.38842 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $0.38842 - $0.40000 (assuming breakthrough applications and mainstream integration)

- 2030-12-31: MAGIC $0.34476 (potential year-end price based on average projection)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.23571 | 0.1746 | 0.1519 | 0 |

| 2026 | 0.28722 | 0.20516 | 0.11284 | 17 |

| 2027 | 0.25357 | 0.24619 | 0.20926 | 40 |

| 2028 | 0.35233 | 0.24988 | 0.21989 | 42 |

| 2029 | 0.38842 | 0.3011 | 0.15959 | 72 |

| 2030 | 0.35855 | 0.34476 | 0.22065 | 97 |

IV. MAGIC Professional Investment Strategies and Risk Management

MAGIC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate MAGIC tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage risk

MAGIC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance MAGIC with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, backup private keys securely

V. Potential Risks and Challenges for MAGIC

MAGIC Market Risks

- High volatility: MAGIC price can experience significant fluctuations

- Market sentiment: Changes in overall crypto market sentiment can impact MAGIC

- Competition: Other gaming and NFT projects may challenge MAGIC's market position

MAGIC Regulatory Risks

- Uncertain regulations: Changing crypto regulations may affect MAGIC's operations

- Cross-border compliance: Varying international regulations could limit global adoption

- Tax implications: Evolving tax laws may impact MAGIC holders and traders

MAGIC Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the underlying code

- Scalability challenges: Possible network congestion during high-demand periods

- Interoperability issues: Challenges in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

MAGIC Investment Value Assessment

MAGIC presents a unique value proposition in the intersection of DeFi, NFTs, and gaming. While it offers long-term potential in the expanding metaverse ecosystem, short-term volatility and regulatory uncertainties pose significant risks.

MAGIC Investment Recommendations

✅ Beginners: Start with small positions and focus on learning the ecosystem ✅ Experienced investors: Consider a balanced approach with both holding and trading strategies ✅ Institutional investors: Conduct thorough due diligence and consider MAGIC as part of a diversified crypto portfolio

MAGIC Trading Participation Methods

- Spot trading: Buy and sell MAGIC on Gate.com's spot market

- Staking: Participate in MAGIC staking programs if available

- NFT trading: Engage with MAGIC-related NFTs on supported platforms

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will be the price of Matic in 2025?

Based on current trends, Matic's price in 2025 could reach a maximum of $0.2503, with potential fluctuations down to $0.2143.

What is the price of $magic?

As of 2025-09-29, the price of $MAGIC is $0.1701, with a market cap of $53.6 million.

What is magic crypto?

MAGIC is the native token of Treasure, an AI-powered entertainment platform. It's used within the network and is listed on major exchanges.

Will the magic eden token go up?

Yes, Magic Eden token is expected to increase in value. Long-term forecasts are bullish, with predictions suggesting growth by 2027.

ATEAM vs KAVA: Battle of the Blockchain Giants in the DeFi Arena

What Are Credentials in Crypto and Web3 ?

Is Alien Worlds (TLM) a Good Investment?: Analyzing the Metaverse Token's Potential Returns and Risks

2025 SUPER Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is SuperFarm (SUPER) a good investment?: Analyzing the Potential and Risks of this NFT Gaming Token

MV vs IMX: Comparing Marine Vessel and Intermodal Exchange Technologies in Modern Logistics

Top DeFi Innovations to Watch in 2024

Understanding Flash Loans: A Comprehensive Guide to Unsecured Lending in DeFi

The Winklevoss brothers and Gemini delve into the newly approved CFTC cryptocurrency prediction market.

Understanding DeFi: Differentiating APR and APY for Optimal Returns

Understanding the NFT Minting Journey: A Comprehensive Guide