2025 MAVIA Price Prediction: Expert Analysis and Future Market Outlook for the Decentralized Gaming Token

Introduction: MAVIA's Market Position and Investment Value

Heroes of Mavia (MAVIA) is a Web3 mobile base-builder strategy game inspired by the blockbuster mobile game "Clash of Clans." Since its launch in 2021, the project has pioneered the integration of blockchain technology into mainstream mobile gaming while maintaining compliance with major app platforms. As of December 2025, MAVIA has achieved a market capitalization of $12.43 million with a circulating supply of approximately 111.93 million tokens, trading at around $0.04972. This innovative asset is playing an increasingly critical role in bridging Web2 gamers to the Web3 ecosystem through true digital ownership of in-game assets.

This article will provide a comprehensive analysis of MAVIA's price trends and market dynamics, combining historical price performance, market supply-demand fundamentals, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment guidance for investors.

Heroes of Mavia (MAVIA) Market Analysis Report

I. MAVIA Price History Review and Market Status

MAVIA Historical Price Evolution

- February 2024: All-time high reached at $10.83, marking the peak valuation for the token

- December 2025: All-time low recorded at $0.04581 on December 2nd, representing a significant market correction

MAVIA Current Market Conditions

Price Performance (As of December 23, 2025)

MAVIA is currently trading at $0.04972, reflecting a modest recovery of 0.57% over the past hour. The token is showing resilience at support levels, with a 24-hour trading range between $0.04893 and $0.0503. However, the broader trend remains bearish, with the token down 0.3% over the last 24 hours and 0.04% over the past 7 days.

Market Capitalization Metrics

- Market Cap: $5,565,215.58

- Fully Diluted Valuation: $12,430,000

- Circulating Supply: 111,931,126 MAVIA (44.77% of total supply)

- Total Supply: 250,000,000 MAVIA

- 24-Hour Trading Volume: $244,020.75

Long-term Price Deterioration

The 30-day performance shows a significant decline of 22.45%, while the 1-year performance reflects a severe downtrend of 95.46% from historical levels. The token has lost substantial value from its all-time high of $10.83 (initial offering price was $0.80), indicating considerable market correction since launch.

Market Position

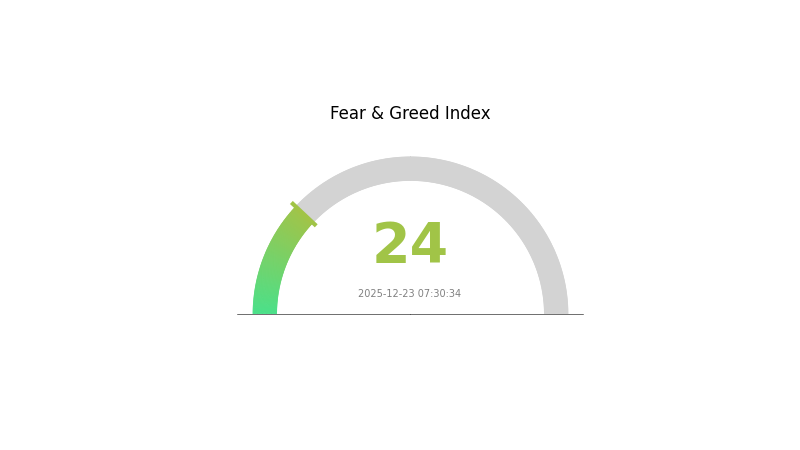

MAVIA ranks 1,469 among all cryptocurrencies, with a market dominance of 0.00039%. The token is traded across 22 exchanges, demonstrating modest liquidity distribution. Current market sentiment indicates "Extreme Fear" in the overall cryptocurrency market (VIX score: 24).

Click to view current MAVIA Market Price

MAVIA Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index standing at 24. This reading reflects significant market pessimism and heightened investor anxiety. During such periods, panic selling often intensifies, creating potential opportunities for contrarian investors. However, extreme fear can persist for extended periods, and prices may continue declining. It's crucial to maintain emotional discipline and avoid making impulsive decisions. Consider dollar-cost averaging strategies or waiting for more stable market conditions before making major investment moves on Gate.com.

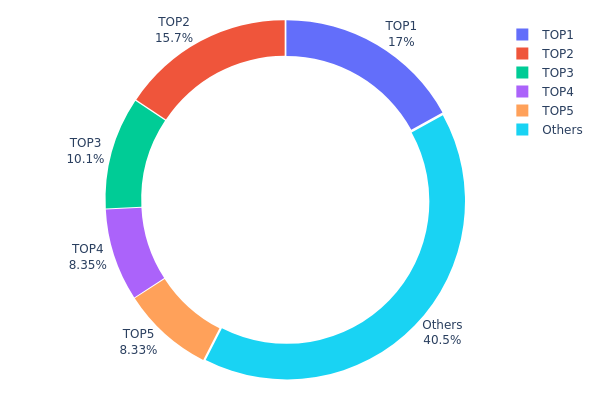

MAVIA Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across the blockchain network by tracking the percentage of total supply held by individual addresses. This metric serves as a critical indicator of market structure, revealing the degree of decentralization and potential concentration risks within the token ecosystem.

MAVIA's current holdings distribution demonstrates moderate concentration characteristics, with the top five addresses collectively controlling approximately 59.44% of the circulating supply. The largest holder commands 16.98% of tokens, while the second-largest holds 15.66%, indicating a relatively balanced distribution among leading stakeholders compared to extreme concentration scenarios. However, the cumulative dominance of the top five addresses—representing nearly three-fifths of total supply—suggests that key stakeholders retain substantial influence over token dynamics. The remaining 40.56% dispersed among other addresses demonstrates a degree of decentralization, though this figure may mask further micro-concentrations within the "Others" category.

The current distribution pattern presents both structural considerations and market implications. While the presence of multiple significant holders reduces single-point-of-failure risks associated with extreme whale concentration, the substantial holdings by top addresses could influence price discovery mechanisms and market volatility during periods of significant trading activity. The relatively balanced top-tier distribution, where no single address exceeds 17% of supply, mitigates extreme manipulation concerns compared to highly skewed scenarios. However, coordinated movements by the five largest holders could theoretically impact short-term price action. From a decentralization perspective, MAVIA exhibits moderate tokenomics health, with sufficient distribution to support organic market participation while acknowledging that meaningful governance or market influence remains concentrated among a limited number of stakeholders.

Click to view current MAVIA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe6c2...7abd4d | 42451.35K | 16.98% |

| 2 | 0xf8d3...e109db | 39150.03K | 15.66% |

| 3 | 0x6d04...45be6e | 25365.82K | 10.14% |

| 4 | 0xf42a...36f173 | 20871.14K | 8.34% |

| 5 | 0xedc6...c487c9 | 20817.83K | 8.32% |

| - | Others | 101343.83K | 40.56% |

II. Core Factors Affecting MAVIA's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Global macroeconomic trends play a significant role in shaping MAVIA's price trajectory. Central bank policies and broader economic conditions influence investor sentiment across cryptocurrency markets.

-

Market Sentiment and Trading Strategies: Investor emotions and sentiment in traditional markets can directly impact cryptocurrency valuations. New trading strategies emerging from market participants may introduce volatility and create price discovery mechanisms in MAVIA trading pairs.

Technology Development and Ecosystem Building

-

DeFi Ecosystem Growth: The development and market acceptance of decentralized finance (DeFi) represents a key driving factor for MAVIA's future performance. As DeFi adoption expands, projects within this ecosystem, including gaming tokens like MAVIA, may experience increased utility and demand.

-

Regulatory Environment: Policy regulation and compliance frameworks significantly influence cryptocurrency market dynamics. Clear and supportive regulatory guidance can boost market confidence, while restrictive policies may present headwinds for token valuations.

III. 2025-2030 MAVIA Price Forecast

2025 Outlook

- Conservative Forecast: $0.03389 - $0.05607

- Base Case Forecast: $0.04984

- Optimistic Forecast: $0.07227

2026-2027 Medium-term Outlook

- Market Phase Expectation: Recovery and consolidation phase with gradual upward momentum, driven by ecosystem development and increased adoption.

- Price Range Predictions:

- 2026: $0.03907 - $0.09097 (22% upside potential)

- 2027: $0.05245 - $0.09426 (52% upside potential)

- Key Catalysts: Enhanced platform functionality, strategic partnerships, user base expansion, and positive market sentiment recovery.

2028-2030 Long-term Outlook

- Base Scenario: $0.08513 average price range ($0.07236 - $0.10301), assuming steady ecosystem growth and moderate market adoption.

- Optimistic Scenario: $0.10724 average price range ($0.07185 - $0.13513 by 2030), contingent upon accelerated platform integration and mainstream recognition.

- Transformative Scenario: $0.12041 - $0.13513 price range (89-115% cumulative gains by 2030), assuming breakthrough developments in blockchain gaming and metaverse adoption.

- Key Observation: MAVIA demonstrates consistent upward trajectory with compound growth pattern, reflecting strengthening market fundamentals and increasing institutional interest through 2030.

Disclaimer: These forecasts are speculative projections based on historical data analysis. Actual prices may vary significantly based on market conditions, regulatory changes, and unforeseen events. Investors should conduct thorough due diligence and consider trading on regulated platforms like Gate.com before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07227 | 0.04984 | 0.03389 | 0 |

| 2026 | 0.09097 | 0.06105 | 0.03907 | 22 |

| 2027 | 0.09426 | 0.07601 | 0.05245 | 52 |

| 2028 | 0.10301 | 0.08513 | 0.07236 | 71 |

| 2029 | 0.12041 | 0.09407 | 0.06585 | 89 |

| 2030 | 0.13513 | 0.10724 | 0.07185 | 115 |

Heroes of Mavia (MAVIA) Professional Investment Strategy and Risk Management Report

IV. MAVIA Professional Investment Strategy and Risk Management

MAVIA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Players and Web3 gaming enthusiasts with long-term blockchain adoption belief

- Operation suggestions:

- Accumulate MAVIA tokens during market downturns, taking advantage of the current price level ($0.04972) which is significantly below the all-time high of $10.83

- Hold tokens for a minimum of 12-24 months to benefit from potential game expansion and user base growth

- Participate in in-game governance decisions to maximize the value of true asset ownership that Heroes of Mavia provides

(2) Active Trading Strategy

-

Market observation approach:

- Monitor 24-hour price fluctuations: Current 24h change of -0.3% indicates relatively stable trading conditions

- Track 30-day performance: The -22.45% decline over 30 days suggests potential consolidation phase

- Observe volume patterns: 24-hour trading volume of $244,020.75 indicates moderate liquidity across 22 exchanges

-

Wave trading considerations:

- Enter positions during weakness periods, particularly when daily volatility exceeds historical averages

- Monitor blockchain adoption metrics and game user engagement as fundamental indicators

MAVIA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of total crypto portfolio

- Active investors: 2-5% of total crypto portfolio

- Professional investors: 5-10% of total crypto portfolio, with additional hedging strategies

(2) Risk Hedging Approaches

- Diversification strategy: Combine MAVIA holdings with established gaming tokens and blue-chip cryptocurrencies to reduce single-project risk

- Position sizing: Never allocate more than you can afford to lose, given the project's market position (ranking #1469) and relatively low market capitalization of $12.43 million

(3) Security Storage Solutions

- Hot wallet solution: Gate.com Web3 wallet for active trading and staking participation

- Security precautions: Enable two-factor authentication, use hardware security keys, never share private keys or seed phrases, and regularly audit transaction history for unauthorized activity

V. MAVIA Potential Risks and Challenges

MAVIA Market Risk

- Extreme price volatility: The token has declined 95.46% over the past year, demonstrating significant downside risk potential for investors

- Low market capitalization: With a fully diluted valuation of only $12.43 million, MAVIA is highly vulnerable to sudden price swings from large trades

- Limited liquidity: Despite listing on 22 exchanges, the relatively low 24-hour volume suggests potential difficulty in executing large position exits

MAVIA Regulatory Risk

- Gaming regulation uncertainty: Web3 gaming faces potential regulatory scrutiny from major app stores and gaming authorities, which could impact user acquisition and game distribution

- Token classification concerns: Regulatory bodies may challenge the classification of MAVIA as a utility token versus a security, potentially requiring regulatory compliance adjustments

- Geographic restrictions: Certain jurisdictions may impose restrictions on Web3 gaming tokens, limiting the addressable market for the project

MAVIA Technical Risk

- Smart contract vulnerabilities: As an ERC20 token deployed on Ethereum and Base networks, the project depends on contract security and is subject to potential exploits

- Blockchain network dependencies: The project relies on Ethereum and Base layer performance and security; network congestion or failures could impact token transactions and game functionality

- User adoption barriers: Technical friction in onboarding Web2 users to Web3 gaming environments remains a significant operational challenge

VI. Conclusion and Action Recommendations

MAVIA Investment Value Assessment

Heroes of Mavia represents a speculative opportunity in the Web3 gaming sector with meaningful long-term potential but considerable short-term risks. The project's creative integration of blockchain technology with proven mobile gaming mechanics (inspired by Clash of Clans) addresses a genuine market need for mass-market Web3 adoption. However, the 95.46% decline from all-time high, combined with a relatively modest market capitalization of $12.43 million and limited trading volume, indicates that the project remains in early stages with execution risk. Success depends critically on user acquisition, regulatory compliance, and sustained engagement with the gaming community.

MAVIA Investment Recommendations

✅ Beginners: Start with a small allocation (1-2% of crypto portfolio) through Gate.com platform while learning about Web3 gaming dynamics; avoid leverage or complex trading strategies

✅ Experienced investors: Consider tactical accumulation during weakness periods, establish clear entry and exit targets, and implement stop-loss orders to manage downside risk

✅ Institutional investors: Conduct comprehensive due diligence on game metrics (user acquisition, daily active users, revenue generation), evaluate regulatory landscape changes, and consider position sizing appropriate to the project's market depth

MAVIA Trading Participation Methods

- Direct purchase: Buy MAVIA tokens on Gate.com exchange, which offers $0.04972 per token at current market rates with competitive trading fees

- In-game participation: Acquire and utilize MAVIA tokens within the Heroes of Mavia gaming ecosystem to experience true asset ownership functionality

- Strategic accumulation: Build positions over time through dollar-cost averaging to reduce timing risk in volatile markets

Cryptocurrency investment carries extreme risk and is highly speculative. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. Always consult with professional financial advisors before making significant investment decisions. Never invest more than you can afford to lose completely.

FAQ

Is the MAVIA token a good investment?

MAVIA token shows potential with strong gaming fundamentals and community engagement. However, conduct thorough research before investing, as crypto markets are volatile and unpredictable.

What is the price prediction for MAVIA token in 2025?

MAVIA token is anticipated to trade between $0.03454 and $0.04951 in 2025, based on current market trends and technical analysis.

What is MAVIA coin used for?

MAVIA coin serves as the governance token for Mavia DAO and functions as the exclusive currency for skill-based wagered matches in Mavia Arena. It is also the primary utility token for in-game purchases and transactions within The Pixlverse ecosystem.

What are the risks of investing in MAVIA?

MAVIA faces governance and disclosure risks. Coinone issued a high-risk warning due to inadequate disclosures and arbitrary project changes. Potential risks include trading suspensions, delisting, and downward price pressure. Long-term viability depends on the team's corrective actions.

2025 A2Z Price Prediction: Expert Forecast and Market Analysis for the Upcoming Year

NXPC Price Trends and Web3 Application Analysis in 2025

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

2025 UNA Price Prediction: Bullish Trends and Key Factors Shaping the Token's Future Value

Is Sidus (SIDUS) a good investment?: Analyzing the Potential and Risks of this Gaming Cryptocurrency

Is Gomble (GM) a good investment?: Analyzing the automaker's financial performance and future prospects

Pioneering Home Equity Lending on Blockchain Technology

Revolutionizing Football Through Blockchain: A New Era for FIFA in Web3

Avalanche Welcomes First Decentralized Order Book Subnet with $1M Support

Uncovering Hyperliquid’s Market PR Strategy: A Comprehensive Analysis from Financial Process Involvement to Competitive Tactics

Unlocking the Trillion-Dollar Private Debt Market with Blockchain Technology