2025 RATSPrice Prediction: Analyzing Market Trends and Future Potential of RATS Token in the Evolving Crypto Landscape

Introduction: RATS Market Position and Investment Value

RATS (RATS), as an "animal token" created on the Bitcoin blockchain using the BRC-20 protocol, has gained attention since its inception. As of 2025, RATS has a market capitalization of $27,310,000, with a circulating supply of 1,000,000,000,000 tokens, and a price hovering around $0.00002731. This asset, named after one of the most abundant mammals on Earth, is playing an increasingly significant role in the realm of BRC-20 tokens on the Bitcoin network.

This article will comprehensively analyze RATS' price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. RATS Price History Review and Current Market Status

RATS Historical Price Evolution Trajectory

- 2023: RATS launched on Bitcoin blockchain using BRC-20 protocol, price fluctuated significantly

- 2024: Market cycle shifts, price dropped from $0.00067631 (ATH) to $0.000002 (ATL)

- 2025: Gradual recovery, price stabilized around $0.00002731

RATS Current Market Situation

As of October 4, 2025, RATS is trading at $0.00002731. The token has shown a positive momentum in the short term, with a 1.1% increase in the last 24 hours and a 0.77% gain in the past hour. The 7-day performance also indicates a slight uptrend with a 0.80% increase. More notably, RATS has demonstrated significant growth over the past month, surging by 33.03%.

However, the long-term performance tells a different story. Compared to a year ago, RATS has experienced a substantial decline of 74.58%, reflecting the volatile nature of the crypto market. The token's all-time high of $0.00067631 was recorded on December 15, 2023, while its all-time low of $0.000002 occurred on November 15, 2023.

RATS currently has a market capitalization of $27,310,000, ranking it at 964th in the overall cryptocurrency market. With a circulating supply of 1,000,000,000,000 RATS, which is also its maximum supply, the token has a fully diluted market cap equal to its current market cap.

The 24-hour trading volume stands at $1,515,979.76, indicating moderate market activity. The token's market dominance is relatively small at 0.00061% of the total cryptocurrency market.

Click to view the current RATS market price

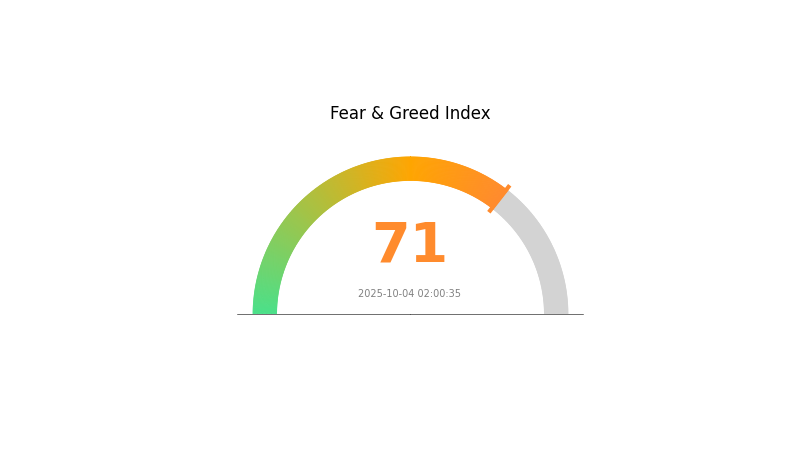

RATS Market Sentiment Indicator

2025-10-04 Fear and Greed Index: 71 (Greed)

Click to view the current Fear & Greed Index

The crypto market is showing signs of exuberance as the Fear and Greed Index reaches 71, indicating a state of greed. This suggests investors are becoming increasingly optimistic, potentially driven by recent price rallies or positive news. However, high levels of greed can also signal overbought conditions and increased risk. Traders should exercise caution and consider taking profits or rebalancing their portfolios. As always, it's crucial to conduct thorough research and manage risk appropriately in this volatile market.

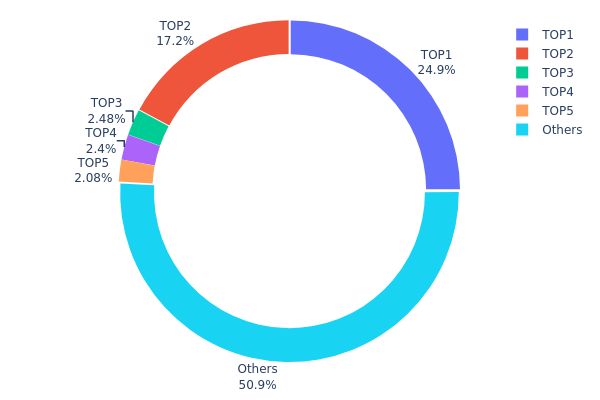

RATS Holdings Distribution

The address holdings distribution chart for RATS reveals a significant concentration of tokens among a few top holders. The top address holds 24.93% of the total supply, while the second-largest holder controls 17.16%. Together, these two addresses account for over 42% of all RATS tokens. The next three largest holders each possess between 2% and 2.5% of the supply.

This concentration pattern suggests a relatively centralized distribution of RATS tokens. With nearly half of the supply controlled by just five addresses, there is potential for these large holders to exert substantial influence on market dynamics. Such concentration could lead to increased price volatility if any of these major holders decide to liquidate their positions. Additionally, it raises concerns about the possibility of market manipulation or coordinated actions by these significant stakeholders.

The current distribution structure indicates a lower level of decentralization for RATS, which may impact its resilience to external shocks and overall market stability. While 50.96% of tokens are held by smaller addresses, the outsized influence of the top holders remains a key factor to monitor for potential impacts on RATS's market behavior and long-term development.

Click to view the current RATS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 16G1xY...Vp9Wxh | 249366933.78K | 24.93% |

| 2 | 1GrwDk...L5kmqC | 171690120.46K | 17.16% |

| 3 | bc1pxl...jjjl6w | 24823649.37K | 2.48% |

| 4 | 33fAEG...Hs1Nsn | 24000009.90K | 2.40% |

| 5 | bc1p8y...f8fjzf | 20792000.00K | 2.07% |

| - | Others | 509327286.49K | 50.96% |

II. Key Factors Affecting RATS Future Price

Supply Mechanism

- Fixed Total Supply: RATS has a fixed total supply, which can lead to price increases when demand rises significantly.

- Current Impact: The limited supply may create upward price pressure if investor interest continues to grow.

Institutional and Whale Dynamics

- Institutional Adoption: The level of institutional adoption can significantly influence RATS price movements.

- Government Policies: Regulatory developments, such as ETF approvals and government policies, play a crucial role in shaping RATS's market performance.

Macroeconomic Environment

- Monetary Policy Impact: Broader macroeconomic trends, including inflation rates and interest rate decisions by central banks, affect RATS's price.

- Inflation Hedging Properties: RATS may be viewed as a potential hedge against inflation, influencing its demand and price.

Technical Development and Ecosystem Building

- Market Liquidity: Improvements in market liquidity, potentially through listing on major exchanges like Gate.com, could positively impact RATS's price and investor confidence.

- Ecosystem Applications: The development of DApps and ecosystem projects built on or utilizing RATS could drive adoption and price growth.

III. RATS Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00003 - $0.00003

- Neutral forecast: $0.00003 - $0.00004

- Optimistic forecast: $0.00004 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range prediction:

- 2026: $0.00003 - $0.00004

- 2027: $0.00002 - $0.00005

- Key catalysts: Increased adoption and market recovery

2028-2030 Long-term Outlook

- Base scenario: $0.00005 - $0.00006 (assuming steady market growth)

- Optimistic scenario: $0.00006 (assuming strong market performance)

- Transformative scenario: $0.00006+ (under extremely favorable conditions)

- 2030-12-31: RATS $0.00006 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00004 | 0.00003 | 0.00003 | 0 |

| 2026 | 0.00004 | 0.00003 | 0.00003 | 22 |

| 2027 | 0.00005 | 0.00004 | 0.00002 | 36 |

| 2028 | 0.00005 | 0.00005 | 0.00003 | 66 |

| 2029 | 0.00005 | 0.00005 | 0.00003 | 71 |

| 2030 | 0.00006 | 0.00005 | 0.00004 | 82 |

IV. RATS Professional Investment Strategies and Risk Management

RATS Investment Methodology

(1) Long-term Holding Strategy

- Target investors: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate RATS tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure BRC-20 compatible wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Bitcoin market trends as they may influence RATS price

- Set stop-loss orders to manage downside risk

RATS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Allocate investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, regular security audits

V. Potential Risks and Challenges for RATS

RATS Market Risks

- High volatility: BRC-20 tokens can experience extreme price fluctuations

- Low liquidity: Limited trading volume may lead to slippage

- Correlation with Bitcoin: RATS price may be influenced by BTC market movements

RATS Regulatory Risks

- Uncertain regulatory environment: BRC-20 tokens may face scrutiny from regulators

- Compliance issues: Potential challenges in adhering to evolving crypto regulations

- Exchange delisting risk: Possibility of being removed from trading platforms

RATS Technical Risks

- Smart contract vulnerabilities: Potential bugs in the BRC-20 protocol

- Scalability limitations: Bitcoin network congestion may affect RATS transactions

- Wallet compatibility issues: Limited support from some crypto wallets

VI. Conclusion and Action Recommendations

RATS Investment Value Assessment

RATS presents a speculative opportunity in the BRC-20 token ecosystem, with potential for high returns but also significant risks due to its novelty and market volatility.

RATS Investment Recommendations

✅ Beginners: Allocate only a small portion of portfolio, focus on education ✅ Experienced investors: Consider short-term trading opportunities with strict risk management ✅ Institutional investors: Monitor RATS as part of broader BRC-20 token research

RATS Trading Participation Methods

- Spot trading: Buy and sell RATS on supported exchanges like Gate.com

- Dollar-cost averaging: Regular small purchases to mitigate price volatility

- Limit orders: Set buy and sell orders at predetermined price levels

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is RATS Coin a good investment today?

Yes, RATS Coin could be a good investment today. Despite past declines, market trends suggest potential for significant growth in the coming years. Always research thoroughly before investing.

What is the price prediction for RATS Kingdom?

As of 2025, RATS Kingdom's price is predicted to show bullish momentum. Market analysis suggests potential for significant growth, making it an attractive investment opportunity in the current crypto landscape.

How much is the RATS token worth?

As of 2025-10-04, the RATS token is worth $0.00002728. This price reflects the current market value based on live trading data.

What is the price prediction for RATS ordinals?

RATS ordinals are predicted to reach $0.0000333 in 2025, $0.000516 in 2026, and $0.00514 in 2030, based on market trends and growth projections.

why is crypto crashing and will it recover ?

Will Crypto Recover ?

RATS vs STX: A Comprehensive Comparison of Performance Metrics in Financial Trading Systems

Is RATS (RATS) a good investment?: Analyzing the Potential Returns and Risks of the Digital Asset in Today's Cryptocurrency Market

MIGGLES vs BTC: The Battle Between a New Crypto Protocol and the Original Digital Gold

Is RATS (RATS) a good investment?: Analyzing the potential and risks of this cryptocurrency in today's volatile market

Guide to Participating and Claiming SEI Airdrop Rewards

Effective Strategies for Algorithmic Trading in Cryptocurrency

Understanding Bitcoin Valuation with the Stock-to-Flow Model

Understanding How Transaction Speed Impacts Blockchain Efficiency

Web3 Identity Management with ENS Domains