2025 SDEX Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of SDEX

SmarDex (SDEX) is an innovative decentralized exchange developed by independent researchers from EPFL, Europe's top-ranked university. Since its launch in 2023, the project has gained recognition for its groundbreaking technology that minimizes impermanent loss while often creating impermanent gain. As of December 2025, SDEX has achieved a market capitalization of approximately $50.0 million, with a circulating supply of around 9.34 billion tokens, currently trading at $0.005017. This pioneering protocol, supported by scientific research and advanced algorithms that dynamically adjust liquidity pool ratios, is playing an increasingly critical role in creating a more profitable and sustainable decentralized finance experience.

This article will provide a comprehensive analysis of SDEX's price trajectory through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors interested in this innovative DeFi protocol.

I. SDEX Price History Review and Market Status

SDEX Historical Price Trajectory

- September 8, 2023: Project launched at an initial price of $0.000129, marking the beginning of SDEX's market presence.

- March 11, 2024: SDEX reached its all-time high (ATH) of $0.026562, representing a significant appreciation period of approximately 206x from the launch price.

- December 18, 2025: SDEX traded at $0.005017, down 81.1% from its previous all-time high, reflecting broader market corrections and price consolidation.

SDEX Current Market Condition

As of December 18, 2025, SDEX is trading at $0.005017 with a 24-hour trading volume of approximately $109,889.63. The token has experienced a -7.77% decline over the past 24 hours, though it demonstrates strong medium-term momentum with a +109.13% gain over the 7-day period and an +84.17% increase over the 30-day timeframe. However, the 1-year performance reflects a -68.26% decline from peak levels.

SDEX maintains a market capitalization of approximately $50,000,754.81 with a fully diluted valuation (FDV) at $50,000,754.81. The circulating supply stands at 9,344,697,587.37 tokens out of a maximum supply of 10,000,000,000 tokens, representing 93.45% circulation. The token is ranked 516th by market capitalization, with a market dominance of 0.0016%. Currently, SDEX is distributed across 8,116 token holders and actively trades on 5 exchanges.

The 24-hour trading range shows a high of $0.005566 and a low of $0.004841, indicating moderate intraday volatility. The positive 1-hour performance of +0.13% suggests slight upward momentum in the most recent trading session.

Click to view current SDEX market price

SDEX Market Sentiment Index

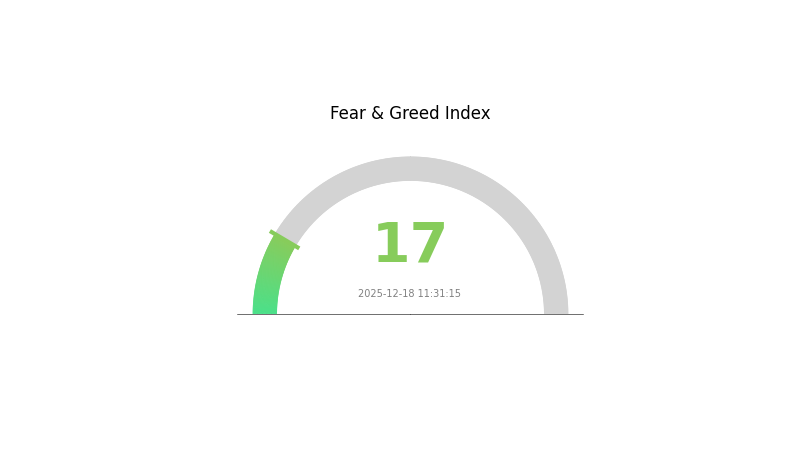

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 17, signaling significant market pessimism. This historically low level indicates investors are highly risk-averse, often presenting contrarian buying opportunities for long-term believers. During such phases, market volatility tends to peak, and panic selling becomes prevalent. However, extreme fear has historically preceded notable recoveries. Investors should exercise caution, conduct thorough due diligence, and consider their risk tolerance before making investment decisions during these turbulent market conditions.

SDEX Holdings Distribution

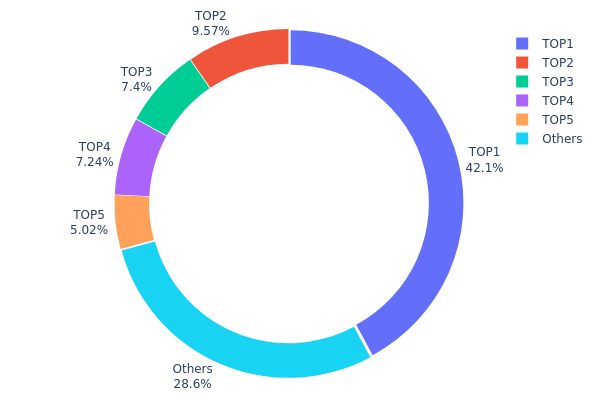

The address holdings distribution map illustrates the concentration of token ownership across the blockchain network by identifying the top holders and their respective share of total circulating supply. This metric serves as a critical indicator for assessing decentralization levels, market structure integrity, and potential vulnerability to coordinated price movements or manipulation by dominant stakeholders.

SDEX currently exhibits significant concentration risk, with the top holder commanding 42.12% of total supply—substantially exceeding the threshold typically considered healthy for decentralized asset distribution. The top five addresses collectively control 71.33% of all tokens in circulation, indicating pronounced centralization. While the remaining 28.67% distributed among other addresses demonstrates some level of fragmentation, the dominance of the leading four addresses reveals a market structure where price discovery and trading dynamics remain heavily influenced by a limited number of stakeholders.

This concentration pattern presents notable implications for market stability and governance. The concentration particularly among the top holder creates considerable single-point-of-failure risk, wherein large liquidations or coordinated sell-offs could trigger substantial price volatility. Additionally, the asymmetric distribution of voting power in protocol governance mechanisms may be concentrated among these major holders, potentially limiting the democratic participation of smaller stakeholders. The current holdings distribution reflects a market structure characteristic of projects in earlier developmental phases or those with significant institutional allocation, requiring ongoing monitoring to assess whether decentralization progresses as the ecosystem matures.

Click to view current SDEX holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8049...eb1a31 | 4212963.80K | 42.12% |

| 2 | 0x3ee1...8fa585 | 956923.56K | 9.56% |

| 3 | 0xccff...3ff846 | 739799.76K | 7.39% |

| 4 | 0x7d85...a77523 | 724260.28K | 7.24% |

| 5 | 0xc049...8a2b1f | 502247.59K | 5.02% |

| - | Others | 2863805.02K | 28.67% |

II. Core Factors Affecting SDEX's Future Price

Regulatory Environment

- Policy Impact: Government policies and regulatory frameworks directly influence the market acceptance of SDEX, affecting its value relative to fiat currencies. Regulatory crackdowns and negative compliance developments can trigger market panic and price declines, while supportive regulatory environments tend to foster investor confidence.

Market Sentiment and Adoption

-

Investor Confidence: Investor sentiment and confidence have a direct impact on SDEX price movements. Positive news regarding widespread adoption or major technological breakthroughs typically trigger market optimism and drive price appreciation. Conversely, security vulnerabilities and regulatory setbacks can cause market anxiety and price contractions.

-

Long-term Adoption Trends: Long-term price trajectories are primarily determined by adoption rates and technological development progress. Broader market sentiment, trading volume, and user adoption trends collectively influence SDEX's valuation.

Macroeconomic Environment

- Interest Rate and Inflation Dynamics: SDEX prices are influenced by macroeconomic factors including interest rate policies and inflation data. While these factors may drive short-term price volatility, the broader macroeconomic trends and policy environment play significant roles in shaping medium to long-term price movements.

III. 2025-2030 SDEX Price Forecast

2025 Outlook

- Conservative Forecast: $0.00256 - $0.00502

- Neutral Forecast: $0.00502

- Bullish Forecast: $0.00728 (requires sustained market momentum and increased adoption)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and accumulation phase with strengthening market fundamentals

- Price Range Predictions:

- 2026: $0.00541 - $0.00781 (22% upside potential)

- 2027: $0.00447 - $0.00838 (39% upside potential)

- 2028: $0.00576 - $0.00891 (53% upside potential)

- Key Catalysts: Ecosystem expansion, strategic partnerships, protocol upgrades, and increasing institutional interest in the asset

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00514 - $0.00904 (65% cumulative growth by 2029, assuming moderate adoption rates and stable market conditions)

- Bullish Scenario: $0.00866 - $0.01074 (72% cumulative growth by 2030, assuming accelerated mainstream adoption and positive regulatory developments)

- Transformational Scenario: Exceeding $0.01074 (extreme bullish conditions including breakthrough technological milestones, widespread integration across major platforms, and significant macroeconomic tailwinds)

- 2030-12-31: SDEX trading at $0.01074 (representing a 72% appreciation from 2025 baseline levels, reflecting multi-year bullish accumulation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00728 | 0.00502 | 0.00256 | 0 |

| 2026 | 0.00781 | 0.00615 | 0.00541 | 22 |

| 2027 | 0.00838 | 0.00698 | 0.00447 | 39 |

| 2028 | 0.00891 | 0.00768 | 0.00576 | 53 |

| 2029 | 0.00904 | 0.00829 | 0.00514 | 65 |

| 2030 | 0.01074 | 0.00866 | 0.00555 | 72 |

SmarDex (SDEX) Professional Investment Analysis Report

IV. SDEX Professional Investment Strategy and Risk Management

SDEX Investment Methodology

(1) Long-Term Holding Strategy

- Target Audience: DeFi protocol believers, liquidity providers seeking sustainable yield, and investors with medium to long-term horizons (6+ months)

- Operational Recommendations:

- Accumulate SDEX during market downturns when volatility is elevated, particularly during broader crypto market corrections

- Dollar-cost averaging (DCA) approach to minimize timing risk and reduce the impact of price volatility

- Participate in liquidity provision on SmarDex platform to earn trading fees and benefit from the protocol's impermanent gain mechanisms

(2) Active Trading Strategy

- Market Context: Given the 24-hour price decline of -7.77% and strong 7-day gains of +109.13%, traders should monitor momentum shifts carefully

- Wave Trading Key Points:

- Monitor support levels around $0.004841 (24-hour low) and resistance at historical ranges

- Track volume patterns relative to the 24-hour average of approximately 109,889.63 SDEX to confirm trend strength

SDEX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation maximum, focusing on long-term protocol development thesis

- Active Investors: 3-8% portfolio allocation, employing tactical entry and exit strategies

- Professional Investors: 8-15% portfolio allocation with hedging strategies and derivative instruments

(2) Risk Hedging Solutions

- Portfolio Diversification: Maintain exposure across multiple DeFi protocols and layer-1/layer-2 blockchain ecosystems to reduce concentration risk

- Stablecoin Reserves: Maintain 40-50% of allocated capital in stablecoins to capitalize on price dips and manage downside exposure

(3) Secure Storage Solutions

- Exchange Storage: Gate.com custody services for active traders requiring immediate liquidity access

- Security Considerations: Never store private keys on exchange accounts; use only hardware-verified transactions for large holdings

V. SDEX Potential Risks and Challenges

SDEX Market Risks

- High Volatility Exposure: SDEX has experienced -68.26% decline over one year, demonstrating significant price volatility that can result in substantial losses

- Low Liquidity in Secondary Markets: With only 5 listed exchanges and relatively modest 24-hour trading volume, SDEX may face liquidity constraints during market stress periods

- Market Concentration: Limited holder base of 8,116 addresses suggests potential concentration risk where large holders could materially impact price discovery

SDEX Regulatory Risks

- DeFi Regulatory Uncertainty: Ongoing global regulatory scrutiny of decentralized finance protocols creates potential compliance challenges that could impact protocol operations or token value

- Jurisdictional Challenges: As SDEX operates globally through a decentralized model, different regulatory regimes may impose conflicting requirements affecting user accessibility

- Smart Contract Governance: Changes to regulatory frameworks may necessitate protocol modifications that could dilute competitive advantages or user experience

SDEX Technology Risks

- Smart Contract Vulnerability: Despite development by EPFL researchers, smart contracts remain subject to undiscovered vulnerabilities that could compromise user funds or protocol functionality

- Algorithm Reliability: The novel impermanent loss mitigation technology, while scientifically supported, lacks extensive real-world operational history compared to established DeFi protocols

- Liquidity Pool Sustainability: Dynamic ratio adjustment mechanisms may experience unforeseen edge cases or market conditions that reduce their effectiveness

VI. Conclusion and Action Recommendations

SDEX Investment Value Assessment

SmarDex presents an innovative approach to decentralized exchange design through its impermanent loss mitigation technology, developed by EPFL researchers and supported by scientific research. The protocol's core value proposition—converting impermanent loss into potential impermanent gain—distinguishes it from traditional AMM models. However, the significant 1-year decline of -68.26%, limited exchange presence, and nascent technological implementation require careful consideration.

The project demonstrates scientific merit and genuine innovation, but faces challenges in capital efficiency, market adoption, and long-term sustainability compared to established DeFi protocols.

SDEX Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of portfolio) through Gate.com, focusing on understanding the protocol mechanics and monitoring development progress before significant capital commitment

✅ Experienced Investors: Consider 3-5% allocation using DCA strategy, actively monitoring protocol metrics, community development, and competitive positioning while maintaining disciplined stop-loss levels

✅ Institutional Investors: Evaluate 5-10% allocation within DeFi infrastructure strategies, conducting comprehensive due diligence on smart contract audits, team credentials, and protocol economics before deployment

SDEX Trading Participation Methods

- Exchange Trading on Gate.com: Purchase SDEX directly through Gate.com's spot trading interface using major stablecoin pairs for immediate market exposure

- liquidity provision: Deposit SDEX with paired assets into SmarDex liquidity pools to earn protocol fees and experience the platform's impermanent gain mechanisms firsthand

- Long-Term Staking: Hold SDEX tokens while monitoring protocol governance developments and potential staking or reward mechanisms

Cryptocurrency investment carries extreme risk. This analysis does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Consult professional financial advisors before making investment decisions. Never invest capital you cannot afford to lose.

FAQ

What is SDEX crypto?

SDEX is the native utility token of the SMARDEX protocol, a decentralized exchange platform. It enables liquidity mining, staking, and enhanced trading across multiple blockchains. Users earn SDEX by providing liquidity to designated pools within the ecosystem.

How much is a Sdexex token worth?

As of December 18, 2025, a Sdexex token is worth approximately $0.059573. The token price remains stable with minimal fluctuation in recent market activity.

What is the PI price prediction for 2025?

PI price predictions for 2025 range widely based on market conditions and adoption rates. Bullish scenarios suggest prices could reach $0.60-$0.80, while conservative estimates remain lower due to ecosystem development uncertainties and market dynamics.

What is the future of DeXe coin?

DeXe coin demonstrates strong potential as a decentralized exchange token with growing adoption in the Web3 ecosystem. Increasing trading volumes, enhanced platform features, and expanding user base position it for significant long-term growth, with expectations for continued market appreciation.

2025 EULPrice Prediction: Market Analysis and Future Trends for Euler Finance Token in the DeFi Ecosystem

2025 EDGEPrice Prediction: Analysis of Growth Potential and Market Factors Influencing the Future Value

2025 BENQI Price Prediction: Analyzing Market Trends and Future Valuation for the DeFi Protocol

2025 ASTER Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

2025 OMG Price Prediction: Analyzing Market Trends and Future Potential of the Token in a Maturing Crypto Ecosystem

2025 MORPHO Price Prediction: Analyzing Market Trends and Growth Potential for the DeFi Token

Top 10 Cryptocurrency Payment Cards for 2025: An In-Depth Review

Pi Network Launch Date: Discover Listing Insights, Future Price Forecast, and Purchase Guide

Bobo The Bear NFT Meme Token Achieves $150 Million Market Cap Milestone

Understanding the Simple Moving Average Formula

Ethereum Approaches $4000: Will It Surpass Resistance or Face Reversal?