2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

Introduction: SMART's Market Position and Investment Value

SMART (SMART), as the main network coin of the Smart blockchain, has made significant progress since its inception. As of 2025, SMART's market capitalization has reached $43.55 billion, with a circulating supply of approximately 9 billion coins, and a price hovering around $0.0048. This asset, known as the "Smart Network Token," is playing an increasingly crucial role in the rapid creation of decentralized networks and tokens.

This article will comprehensively analyze SMART's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. SMART Price History Review and Current Market Status

SMART Historical Price Evolution Trajectory

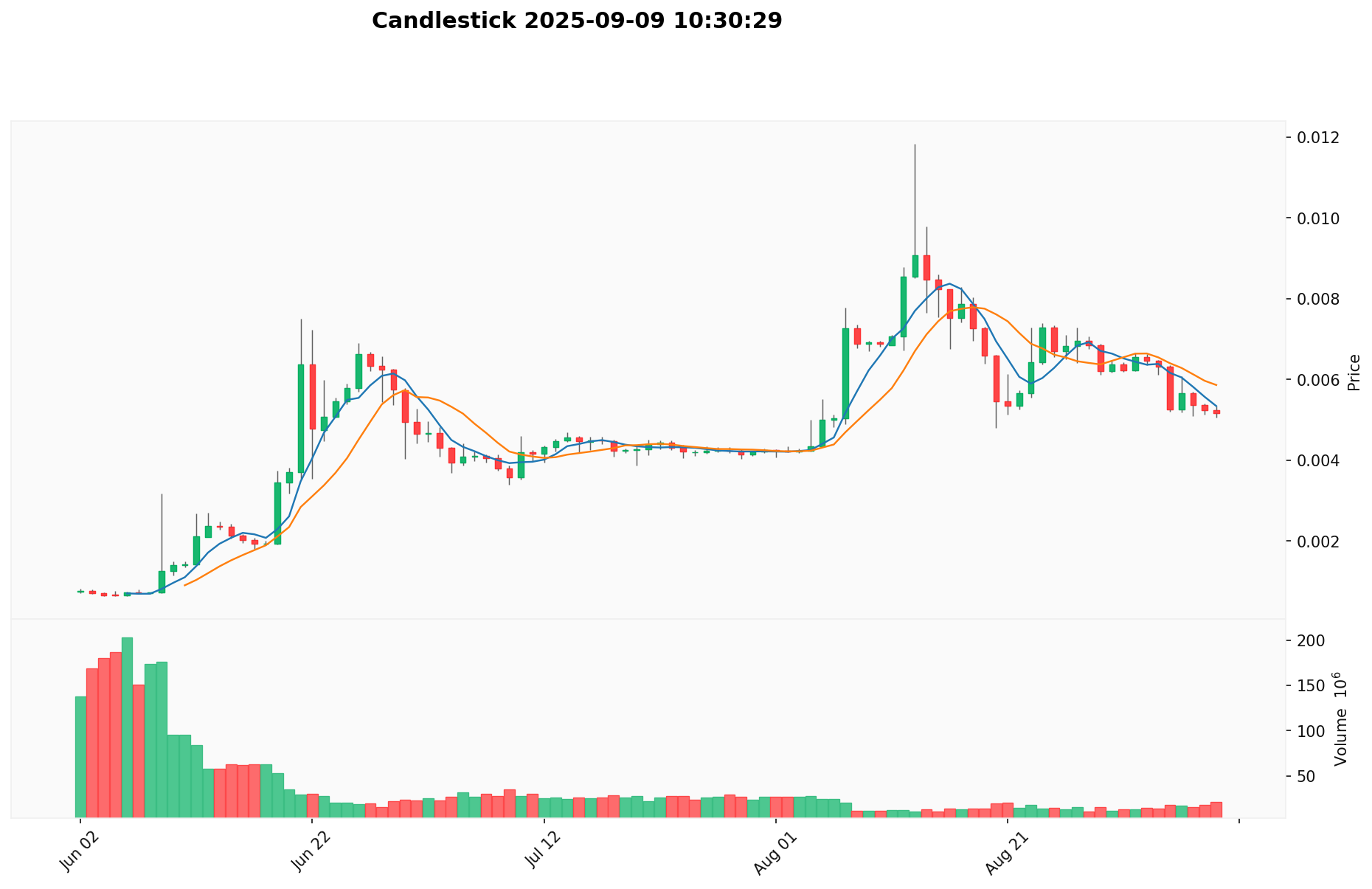

- 2024: SMART reached its all-time low of $0.0003871791 on March 9, marking a significant bottom in its price history.

- 2025: The project hit its all-time high of $0.011835 on August 13, showcasing a remarkable recovery and growth phase.

SMART Current Market Situation

As of September 9, 2025, SMART is trading at $0.0048392, experiencing a 5.57% decrease in the last 24 hours. The token has seen significant volatility, with a 24-hour trading range between $0.0047772 and $0.0053304. Despite the recent dip, SMART has shown impressive long-term performance, boasting a 121.2% increase over the past year.

SMART's market capitalization currently stands at $43,552,849,359.84, ranking it 8th in the overall cryptocurrency market with a 1.047% market dominance. The circulating supply matches the total and maximum supply at 9,000,010,200,000 SMART tokens, indicating full distribution.

Short-term price trends show bearish momentum across various timeframes. The token has experienced declines of 1.39% in the past hour, 24.63% over the last week, and 29.16% in the past month. This suggests that SMART is currently in a correction phase after its recent all-time high in August.

Click to view the current SMART market price

SMART Market Sentiment Index

2025-09-09 Fear and Greed Index: 48 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains neutral today, with the Fear and Greed Index hovering at 48. This balanced state suggests investors are neither overly optimistic nor pessimistic. While caution persists, there's also a sense of opportunity. Traders should stay vigilant, as market conditions can shift rapidly. Diversification and risk management are crucial strategies in this environment. Keep an eye on key technical indicators and global economic news for potential market moves.

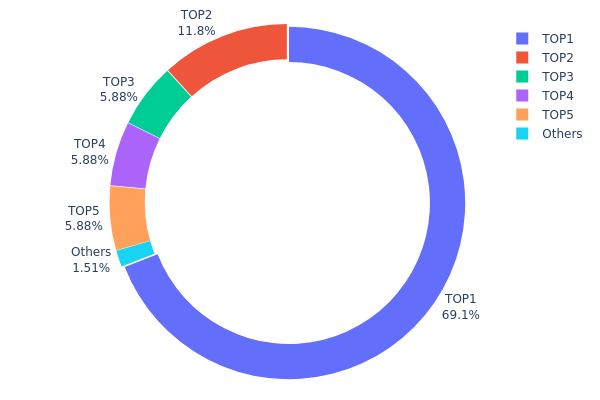

SMART Holdings Distribution

The address holdings distribution data for SMART reveals a highly concentrated ownership structure. The top address holds a staggering 69.01% of the total supply, while the next four largest addresses collectively control an additional 29.37%. This means that just five addresses account for 98.38% of all SMART tokens in circulation.

Such extreme concentration raises concerns about market manipulation and centralization. With a single address controlling over two-thirds of the supply, there is significant potential for price volatility should this holder decide to liquidate or transfer large portions of their holdings. Furthermore, the high concentration in so few hands could undermine the project's claims of decentralization and potentially impact governance decisions if SMART employs a token-based voting system.

This concentration also suggests a relatively immature or illiquid market for SMART tokens, with limited distribution among a broader user base. Investors should be aware that this holding structure may lead to increased price instability and could pose risks to the long-term sustainability of the SMART ecosystem.

Click to view the current SMART Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | sfFprP...MxFCQh | 587918441.96K | 69.01% |

| 2 | sUwU6J...15J7Eg | 100226118.95K | 11.76% |

| 3 | sLbzsn...ZYZGmJ | 50000000.00K | 5.87% |

| 4 | sdvURG...nkcLcL | 50000000.00K | 5.87% |

| 5 | sbTUVh...oy7ogc | 49999998.01K | 5.87% |

| - | Others | 12875936.52K | 1.62% |

II. Core Factors Affecting SMART's Future Price

Supply Mechanism

- Circulating Supply: The current circulating supply of SMART is 1,413,859,297.52334 tokens.

- Maximum Supply: The maximum supply is capped at 5,000,000,000 SMART tokens.

- Current Impact: With a fixed maximum supply, any increase in demand could potentially drive up the price as the supply becomes more scarce over time.

Institutional and Whale Dynamics

- Corporate Adoption: There is currently limited information about major corporations adopting SMART.

- Government Policies: No specific national policies directly related to SMART have been identified.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, SMART may be viewed as a potential hedge against inflation, similar to other digital assets.

Technical Development and Ecosystem Building

- Mining Mechanism: SMART utilizes a mineable system, allowing users to generate new tokens through mining processes.

- Masternodes: The project incorporates masternode technology, which could impact network stability and governance.

- Ecosystem Applications: SmartCash has its own explorer and community forums, indicating some level of ecosystem development.

Gate.com currently offers trading for SMART, providing liquidity and access to the token for traders and investors.

III. SMART Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00303 - $0.00481

- Neutral forecast: $0.00481 - $0.00592

- Optimistic forecast: $0.00592 - $0.00702 (requires significant market recovery)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00400 - $0.00768

- 2028: $0.00499 - $0.00976

- Key catalysts: Technological advancements, broader market trends, and increased utility of SMART

2029-2030 Long-term Outlook

- Base scenario: $0.00844 - $0.00983 (assuming steady market growth)

- Optimistic scenario: $0.01123 - $0.0116 (assuming favorable market conditions and increased adoption)

- Transformative scenario: $0.0116+ (extreme positive developments in the crypto ecosystem)

- 2030-12-31: SMART $0.00983 (potential 101% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00702 | 0.00481 | 0.00303 | -1 |

| 2026 | 0.00722 | 0.00591 | 0.00503 | 21 |

| 2027 | 0.00768 | 0.00657 | 0.004 | 34 |

| 2028 | 0.00976 | 0.00712 | 0.00499 | 46 |

| 2029 | 0.01123 | 0.00844 | 0.00743 | 73 |

| 2030 | 0.0116 | 0.00983 | 0.00757 | 101 |

IV. SMART Professional Investment Strategy and Risk Management

SMART Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors seeking exposure to blockchain technology

- Operation suggestions:

- Accumulate SMART tokens during market dips

- Set price targets and rebalance portfolio periodically

- Store tokens securely in a hardware wallet or Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- RSI (Relative Strength Index): Helps detect overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for potential breakouts

- Set stop-loss orders to manage downside risk

SMART Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 wallet

- Hot wallet solution: Official SMART wallet for active trading

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for SMART

SMART Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Limited liquidity: May impact ability to enter/exit positions quickly

- Competitor projects: Emerging blockchain platforms may affect SMART's market share

SMART Regulatory Risks

- Uncertain regulatory environment: Potential for increased government oversight

- Cross-border restrictions: Varying regulations across jurisdictions may limit adoption

- Tax implications: Evolving tax laws may impact investment returns

SMART Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the blockchain code

- Network scalability: Ability to handle increased transaction volumes

- Technological obsolescence: Rapid advancements may outpace SMART's development

VI. Conclusion and Action Recommendations

SMART Investment Value Assessment

SMART presents a unique value proposition with its Google Protobuf-based blockchain model, offering rapid creation of decentralized networks. However, investors should be aware of the project's short-term volatility and potential regulatory challenges.

SMART Investment Recommendations

✅ Beginners: Start with small positions and focus on education about blockchain technology ✅ Experienced investors: Consider SMART as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and monitor regulatory developments closely

SMART Trading Participation Methods

- Spot trading: Purchase SMART tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance applications built on the SMART blockchain

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for $wepe in 2025?

Based on current market trends, $wepe is predicted to trade between $0.00003993 and $0.00004364 in 2025, with an average price around $0.00004179.

What is the price prediction for SMRT?

SMRT is predicted to reach a high of $1.15 in July and a low of $1.10 in April, with the average price fluctuating within this range.

Will AI coin reach $1?

AI coin is likely to reach $1 based on current market trends and growing investor interest in AI-driven cryptocurrencies. Analysts project significant growth potential for AI coins in the near future.

How much is smart crypto coin worth?

As of 2025-09-09, the smart crypto coin is worth $0.00565962. It has risen 7.54% in the last 24 hours.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 DOT Price Prediction: Will Polkadot Reach $100 Amid Growing Adoption?

2025 NANO Price Prediction: Market Analysis and Growth Potential for the Digital Currency

2025 FTNPrice Prediction: Analyzing Market Trends, Tokenomics and Growth Potential of FTN in the Next Bull Cycle

Xenea Daily Quiz Answer December 12, 2025

Dropee Daily Combo December 11, 2025

Tomarket Daily Combo December 11, 2025

Understanding Impermanent Loss in Decentralized Finance

Understanding Double Spending in Cryptocurrency: Strategies for Prevention