2025 SWELL Price Prediction: Analyzing Market Trends and Future Value Potential in the Evolving Crypto Ecosystem

Introduction: SWELL's Market Position and Investment Value

Swell Network (SWELL), as a non-custodial staking protocol, has been delivering the world's best liquid staking and restaking experience since its inception. As of 2025, SWELL's market capitalization has reached $24,014,786, with a circulating supply of approximately 2,640,438,369 tokens, and a price hovering around $0.009095. This asset, known as the "DeFi simplifier," is playing an increasingly crucial role in securing the future of Ethereum and restaking services.

This article will comprehensively analyze SWELL's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. SWELL Price History Review and Current Market Status

SWELL Historical Price Evolution

- 2024: SWELL reached its all-time high of $0.19992 on September 29, 2024

- 2025: SWELL hit its all-time low of $0.007003 on April 9, 2025

- 2025: Market cycle led to a significant price drop from the all-time high to the current price of $0.009095

SWELL Current Market Situation

As of October 4, 2025, SWELL is trading at $0.009095. The token has experienced a 1.35% increase in the past 24 hours, with a trading volume of $762,239.43. SWELL's market capitalization stands at $24,014,786.97, ranking it at 1009 in the cryptocurrency market. The circulating supply is 2,640,438,369.93 SWELL, which represents 26.40% of the total supply of 10,000,000,000 tokens. Over the past week, SWELL has shown a positive trend with a 3.76% increase, although it has experienced a slight decline of 2.06% over the past 30 days. The current price represents a significant 89.37% decrease from its price one year ago.

Click to view the current SWELL market price

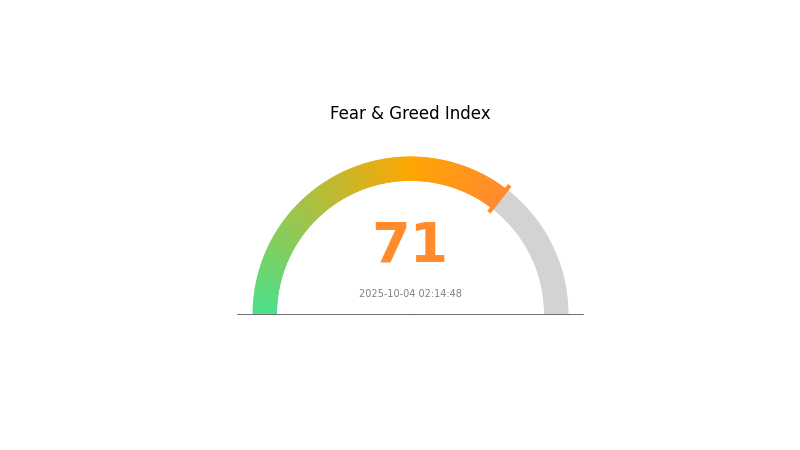

SWELL Market Sentiment Indicator

2025-10-04 Fear and Greed Index: 71 (Greed)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a wave of optimism, with the Fear and Greed Index standing at 71, indicating a strong "Greed" sentiment. This suggests that investors are feeling confident and bullish about the market's prospects. However, it's important to remember that extreme greed can sometimes lead to overvaluation and increased volatility. Traders should exercise caution and consider diversifying their portfolios to mitigate potential risks in this exuberant market environment.

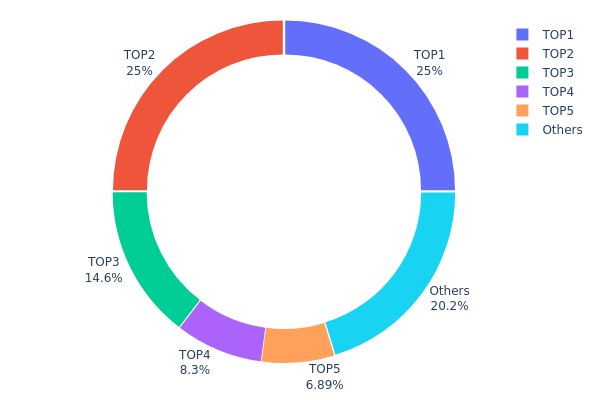

SWELL Holdings Distribution

The address holdings distribution data for SWELL reveals a highly concentrated token ownership structure. The top two addresses each hold 25% of the total supply, collectively accounting for 50% of all SWELL tokens. The top five addresses control 79.75% of the supply, leaving only 20.25% distributed among other holders.

This concentration of tokens in a few hands raises concerns about market stability and potential price manipulation. With such a significant portion of the supply controlled by a small number of entities, there is an increased risk of large sell-offs or coordinated actions that could dramatically impact SWELL's market price. Furthermore, this centralization contradicts the principles of decentralization often associated with cryptocurrency projects.

The current distribution structure suggests a relatively low level of on-chain decentralization for SWELL. While this concentration might provide some stability in the short term, it also presents risks to the long-term health and adoption of the token ecosystem. Potential investors and users should be aware of these dynamics when considering their involvement with SWELL.

Click to view the current SWELL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2019...a6dc1a | 2500000.00K | 25.00% |

| 2 | 0x4b9c...6a2bef | 2500000.00K | 25.00% |

| 3 | 0x7815...c36a6d | 1457735.93K | 14.57% |

| 4 | 0x0934...9d85b7 | 830096.80K | 8.30% |

| 5 | 0x3b34...29a1fa | 688888.89K | 6.88% |

| - | Others | 2023278.38K | 20.25% |

II. Key Factors Affecting SWELL's Future Price

Supply Mechanism

- ETH Staking: SWELL's core function allows users to stake ETH and receive yield-bearing tokens in return.

- Current Impact: The adoption of rswETH (SWELL's staking token) is expected to continue increasing due to demand-driving factors.

Institutional and Whale Dynamics

- Corporate Adoption: SWELL is positioned to capture a significant portion of DeFi activities related to re-staking.

Macroeconomic Environment

- Monetary Policy Impact: Market sentiment and macroeconomic factors significantly influence ETH and rswETH prices, affecting staking yields.

- Inflation Hedging Properties: As a cryptocurrency, SWELL may be influenced by general market volatility and economic conditions affecting the crypto market.

Technical Development and Ecosystem Building

- Layer 2 Integration: SWELL is considered to be well-positioned among all Layer 2 solutions for capturing re-staking related DeFi activities.

- Ecosystem Applications: The increasing adoption of rswETH is expected to drive demand for SWELL within the DeFi ecosystem.

III. SWELL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0049 - $0.007

- Neutral prediction: $0.007 - $0.01

- Optimistic prediction: $0.01 - $0.01243 (requires significant market adoption and positive crypto sentiment)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.01026 - $0.01607

- 2028: $0.00961 - $0.01593

- Key catalysts: Broader cryptocurrency market trends, SWELL project developments, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.01335 - $0.01750 (assuming steady market growth and project progression)

- Optimistic scenario: $0.01750 - $0.02053 (assuming strong market performance and significant SWELL adoption)

- Transformative scenario: Above $0.02053 (under extremely favorable market conditions and breakthrough SWELL use cases)

- 2030-12-31: SWELL $0.01616 (average prediction, indicating potential for substantial growth from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01243 | 0.00907 | 0.0049 | 0 |

| 2026 | 0.01204 | 0.01075 | 0.00677 | 18 |

| 2027 | 0.01607 | 0.0114 | 0.01026 | 25 |

| 2028 | 0.01593 | 0.01373 | 0.00961 | 50 |

| 2029 | 0.0175 | 0.01483 | 0.01335 | 63 |

| 2030 | 0.02053 | 0.01616 | 0.01245 | 77 |

IV. SWELL Professional Investment Strategies and Risk Management

SWELL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Ethereum ecosystem

- Operation suggestions:

- Accumulate SWELL tokens during market dips

- Stake SWELL tokens to earn passive income

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Ethereum network upgrades and their impact on SWELL

- Pay attention to overall DeFi market sentiment

SWELL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different staking protocols

- Use of stop-loss orders: Limit potential losses in volatile markets

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use unique passwords, be cautious of phishing attempts

V. Potential Risks and Challenges for SWELL

SWELL Market Risks

- High volatility: Cryptocurrency market fluctuations can lead to significant price swings

- Competition: Increasing number of liquid staking protocols may impact SWELL's market share

- Ethereum ecosystem dependency: SWELL's success is closely tied to Ethereum's performance

SWELL Regulatory Risks

- Unclear regulations: Evolving crypto regulations may impact SWELL's operations

- Compliance challenges: Potential difficulties in adhering to varying global regulatory standards

- Tax implications: Uncertain tax treatment of staking rewards in some jurisdictions

SWELL Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability issues: Challenges in handling increased network load

- Ethereum upgrade risks: Potential disruptions during Ethereum network upgrades

VI. Conclusion and Action Recommendations

SWELL Investment Value Assessment

SWELL presents a unique opportunity in the liquid staking space, with potential for long-term growth tied to Ethereum's success. However, investors should be aware of short-term volatility and regulatory uncertainties.

SWELL Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about liquid staking ✅ Experienced investors: Consider allocating a portion of Ethereum holdings to SWELL for diversification ✅ Institutional investors: Evaluate SWELL as part of a broader DeFi and Ethereum ecosystem strategy

SWELL Participation Methods

- Purchase SWELL tokens on Gate.com

- Stake SWELL tokens directly through the Swell Network platform

- Participate in governance by holding SWELL tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does Swell Crypto have a future?

Yes, Swell Crypto likely has a future. Predictions suggest potential growth, with its success tied to broader crypto adoption and market trends. However, its long-term prospects remain uncertain and subject to various factors.

How much is Swell crypto worth?

As of 2025-10-04, Swell crypto is worth $0.009212 per token, with a 24-hour trading value of $4,476,771. The price has increased by 2.26% in the past day.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with forecasts suggesting it could reach $140,652. Chainlink follows with a predicted price of $62.60.

What is the price prediction for ripple in 2030?

Based on long-term market analysis, Ripple's price is predicted to reach up to $26.50 by 2030, reflecting its potential growth as a global payment solution.

What is EGP: Understanding Exterior Gateway Protocol in Network Routing

How does MITO's cross-chain architecture compare to competitors in 2025?

What is EIGEN: A Powerful C++ Library for Linear Algebra and Matrix Operations

Understanding StakeStone Circulating Supply: A Comprehensive Guide

WEETH vs OP: The Battle of Innovative Wearable Tech in Fitness Tracking

LAIR vs OP: The Epic Clash of Artificial Intelligence and Human Ingenuity

How to Analyze On-Chain Data: Active Addresses, Whale Movements, and Transaction Value Trends in 2025

What are the compliance and regulatory risks of RVV crypto in 2025?

How do futures open interest, funding rates, and liquidation data predict crypto derivatives market signals in 2025?

What is MAGIC token: whitepaper logic, use cases, and team background analysis for Treasure ecosystem?

# What is RESOLV Token? Market Cap, Supply, and Trading Volume Overview