Besides receiving $10 million in investment from WLFI, what makes Falcon unique?

DWF’s co-founder put it this way: “A protocol that enables users to enter with any asset, earn yields, and then exit with any asset to any destination—that’s Falcon Finance.”

This is a broad vision that goes far beyond a typical stablecoin project. That’s what makes USDf truly stand out. The stablecoin market is saturated—so much so that many projects seem indistinguishable, making differentiation a significant challenge. But ultimately, the winners are those who distinguish themselves through innovation.

However, being different doesn’t automatically mean Falcon is right—or that it will win. So what makes Falcon unique, and could that uniqueness give it the winning edge?

Unique Origins

USDf, the flagship of Falcon Finance, has a truly unique origin story.

Falcon Finance was founded by leaders from DWF Labs, with co-founder Andrei Grachev also serving as Falcon’s managing partner.

DWF Labs and DWF Ventures are prominent industry market makers and investment firms. They have been involved in market making for major altcoins and leading meme coins, posting impressive results during this cycle. This is the first time a top market maker has directly launched a stablecoin.

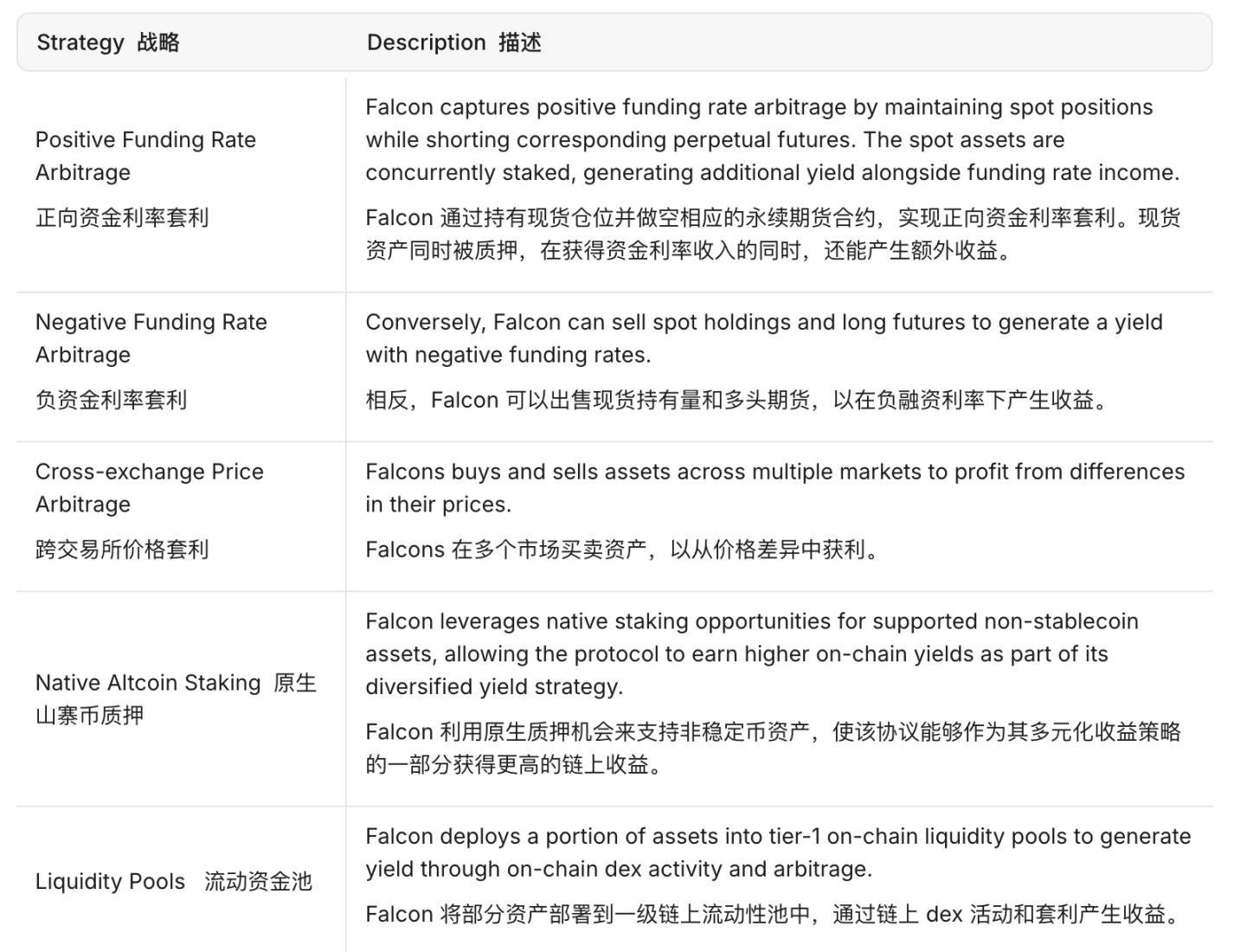

Falcon Finance’s underlying yield strategies center on large-scale hedged trading—similar to Ethena—distributing trading profits to its users. It’s essentially a trading company wrapped in an interest-bearing stablecoin protocol. (See: Beneath the Stablecoin Surface: Is ENA True Innovation or Just a Valuation Mirage?)

As a market maker, Falcon enjoys an inherent advantage in both trading and yield-generation strategies.

Distinct Capital Support

Falcon Finance’s capital base is also distinctive.

Falcon is directly backed by DWF Labs. In April, DWF Labs invested $25 million at an average price of $0.10 in World Liberty Financial (WLFI)—a crypto project tied to the Trump family—and committed to supporting the liquidity of its stablecoin, USD1. (The market also widely expects DWF Labs to serve as WLFI’s token market maker.)

On July 30, 2025, Falcon Finance announced a $10 million investment from WLFI—their first investment in a stablecoin protocol. WLFI issues its own dollar stablecoin, USD1, backed by real-world assets such as U.S. Treasuries and cash. Both parties stated that this funding will accelerate Falcon’s cross-chain compatibility and facilitate technical integrations between USDf and USD1.

Falcon has confirmed that USD1 has already joined Falcon’s list of accepted collateral assets, and the team will launch a USDf/USD1 cross-chain swap tool, creating a complementary relationship between the two currencies.

WLFI tokens are already live on Binance’s pre-market futures, with a fully diluted valuation exceeding $20 billion. Related coins like DOLO have performed well recently as well. This “WLFI concept” capital backing is poised to be a strong benefit for Falcon.

A Different Operating Model

Falcon’s operating model—including its revenue streams and minting mechanism—sets it apart from the rest.

The market has seen other stablecoins earning yields from hedged trading profits—such as Ethena Protocol’s USDe/sUSDe. Whereas traditional stablecoins are fully fiat-backed, Ethena’s USDe is a synthetic dollar using BTC, ETH, SOL, and other crypto collateral paired with perpetual contract positions for delta-hedging, plus holdings in mainstream stablecoins for added stability.

Falcon’s revenue sources, combined with price arbitrage and other market-making specializations, create an even more diverse and complex yield structure.

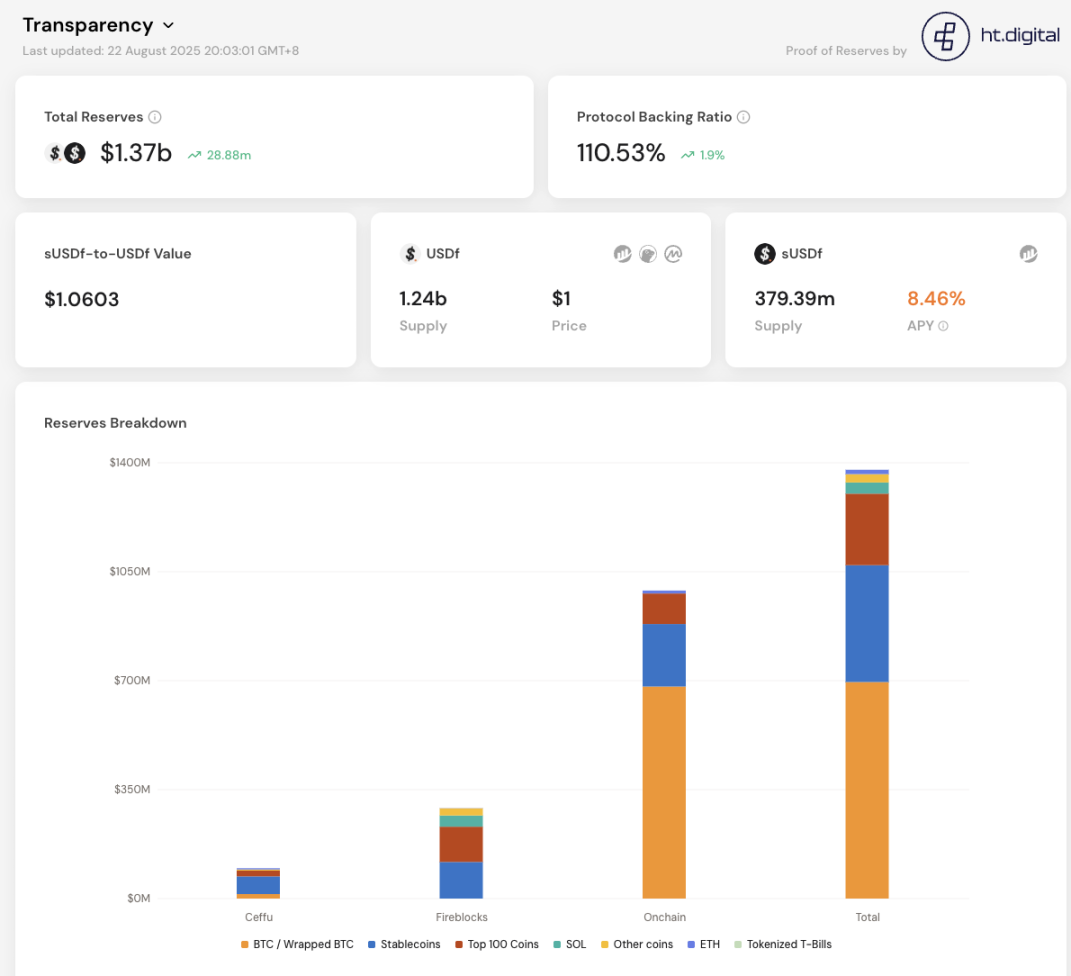

Unlike most stablecoins, USDf isn’t backed by a single asset. Instead, it uses multi-asset overcollateralization and hedging strategies: Every USDf in circulation must be secured by collateral worth more than one dollar, with collateralization ratios currently ranging between 110% and 116%.

Falcon’s design lets users mint USDf from a wide range of assets. Supported collateral includes leading stablecoins (USDT, USDC, DAI), major cryptocurrencies (BTC, ETH, SOL), and a selection of altcoins. According to Falcon, more asset types—including tokenized real-world assets (RWAs)—will be supported in the future.

There are two ways to acquire USDf: First, users can mint USDf on Falcon’s official app (subject to KYC review and minimum mint thresholds), choosing between a “traditional” or “innovative” (options-based) collateralization model. Second, users can purchase USDf directly on decentralized exchanges (like Uniswap and Curve) without KYC or minimums. Either method earns Falcon Miles—the platform’s loyalty points—but minting using non-stablecoin collateral carries a higher points multiplier.

Once they hold USDf, users can earn yield through multiple channels:

- Holding Rewards — Simply holding USDf earns users 6x daily points;

- Staking — Stake USDf into sUSDf to earn interest, with both flexible (base APY) and fixed-term (higher APY) options;

- Liquidity Mining — Provide liquidity using USDf on leading DEXs (Uniswap, Curve, PancakeSwap) or aggregators (Convex, StakeDAO) to earn trading fees and up to 40x points;

- Borrowing and Leverage — Falcon is integrated with lending protocols like Morpho, Euler, and Silo, supporting USDf or sUSDf as collateral for lending and recursive yield farming;

- Yield Tokenization — Protocols such as Pendle let users deploy USDf to tokenize future yield streams (“SY/YT” tokens), enabling either speculation or fixed-yield strategies. For further reading, see: Pendle Is Complicated—But Ignoring It Is a Missed Opportunity

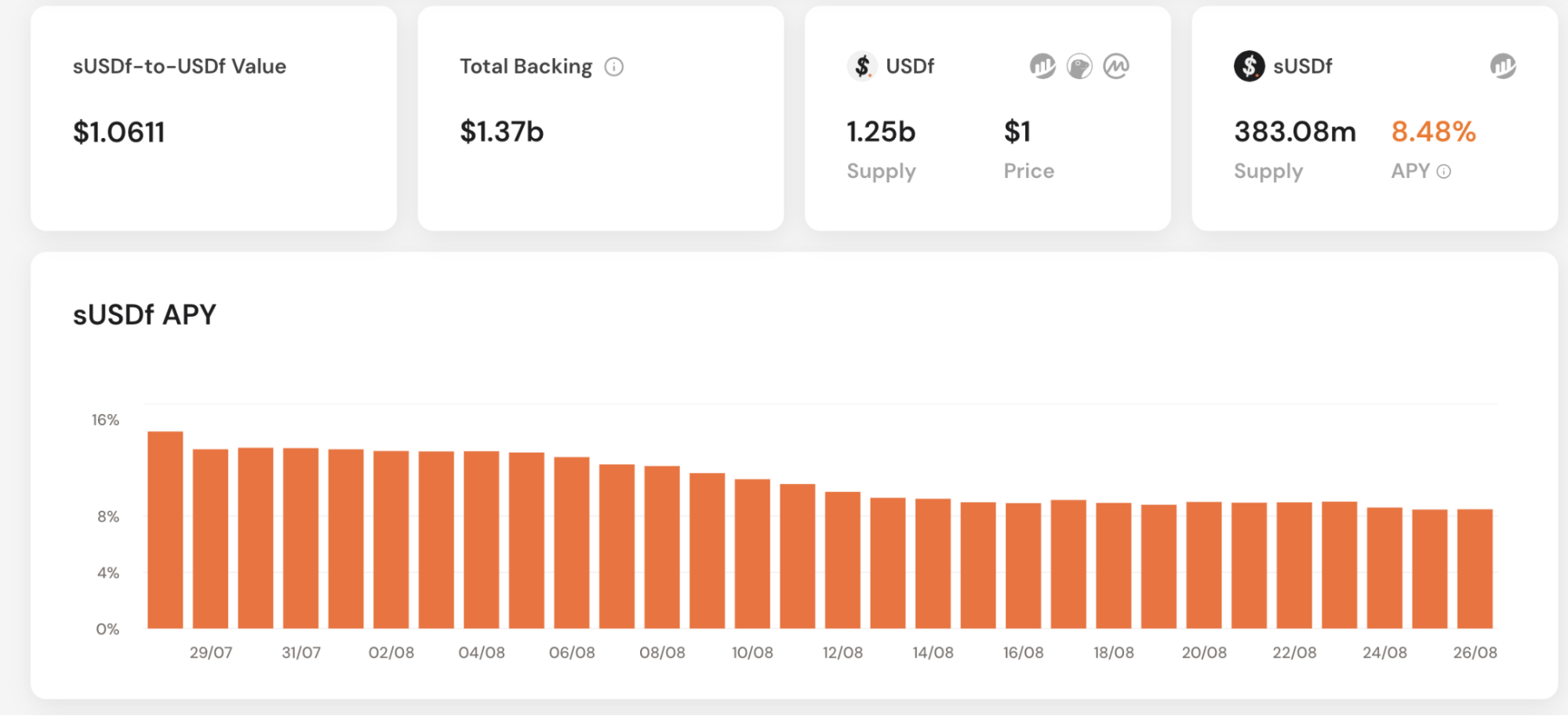

As of today (August 26), USDf’s circulating supply stands at $1.25 billion, placing it among the top 10 stablecoins for an emerging protocol. sUSDf, the yield-bearing token, has a supply of 383 million tokens and offers an annualized yield of 8.48%.

Vision: Redefining the Stablecoin Landscape

As discussed above, Falcon’s vision goes far beyond the typical “stablecoin” model.

Falcon Finance positions itself as a “universal collateral infrastructure,” seeking to transform all types of custodied assets—including crypto tokens, fiat-pegged tokens, and tokenized real-world assets—into on-chain, dollar-pegged synthetic liquidity.

Rather than simply launching another stablecoin, Falcon’s goal is to become a financial connectivity layer for diverse assets and markets—enabling users to enter the protocol with any asset, earn yield, and exit with any asset, to any location.

Co-founder Andrei Grachev has repeatedly stressed that USDf’s purpose is to bring traditional financial assets, like U.S. Treasuries and equities, onto the blockchain—unlocking liquidity and returns.

Falcon achieves this by tightly integrating real-world assets with DeFi use cases (trading, lending, market making) using transparent and compliant protocol logic. The team has built trust through rigorous risk controls, audits, and a public transparency dashboard—verifying that USDf is always over 110% collateralized via independent, third-party audits. Falcon’s product team will also roll out more detailed proof-of-reserves and audit reports on a regular basis. This will meet institutional users’ expectations for security and compliance.

A Roadmap Diverging From the Norm

All these differences are reflected in Falcon’s strategic roadmap.

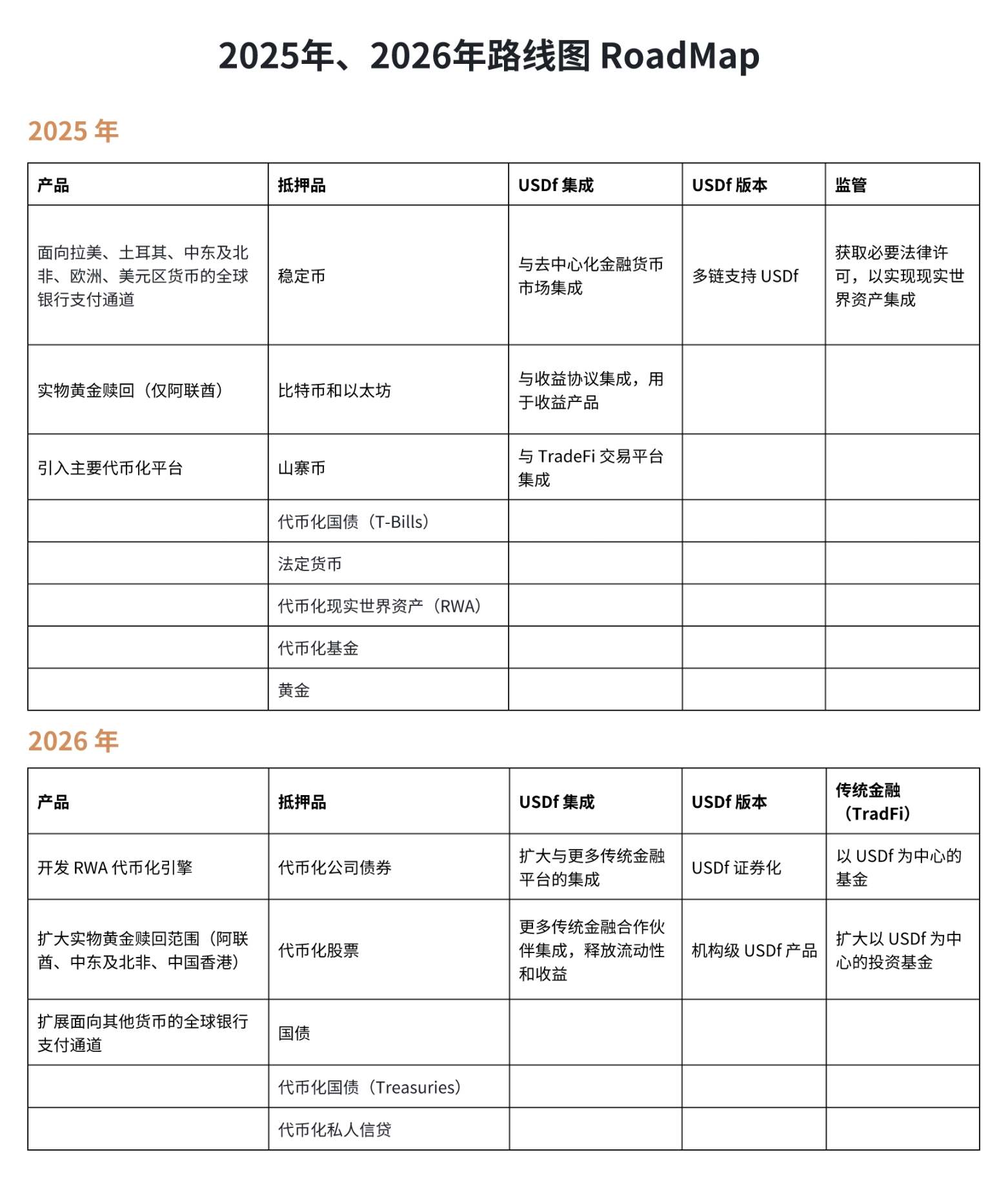

According to official plans, by the end of 2025, Falcon will prioritize building out USD fiat “onramps” and multi-chain deployment. This includes opening regulated fiat channels in Latin America, Turkey, and the Eurozone, enabling 24/7 real-time settlements, and deploying USDf across Ethereum L2 and other leading Layer 1/Layer 2 chains to maximize cross-chain capital efficiency.

The team is also pursuing partnerships with regulated custodians and payment institutions to deliver bank-grade USDf products, such as overnight cash sweep management and money market fund access, while considering on-chain gold redemption services in global financial centers (such as the Middle East and Hong Kong). By 2026, Falcon will build a “real-world asset engine” capable of tokenizing corporate bonds, private debt, and other instruments—and will launch USDf investment products and structured securities to meet the needs of institutional investors at scale.

Getting Involved

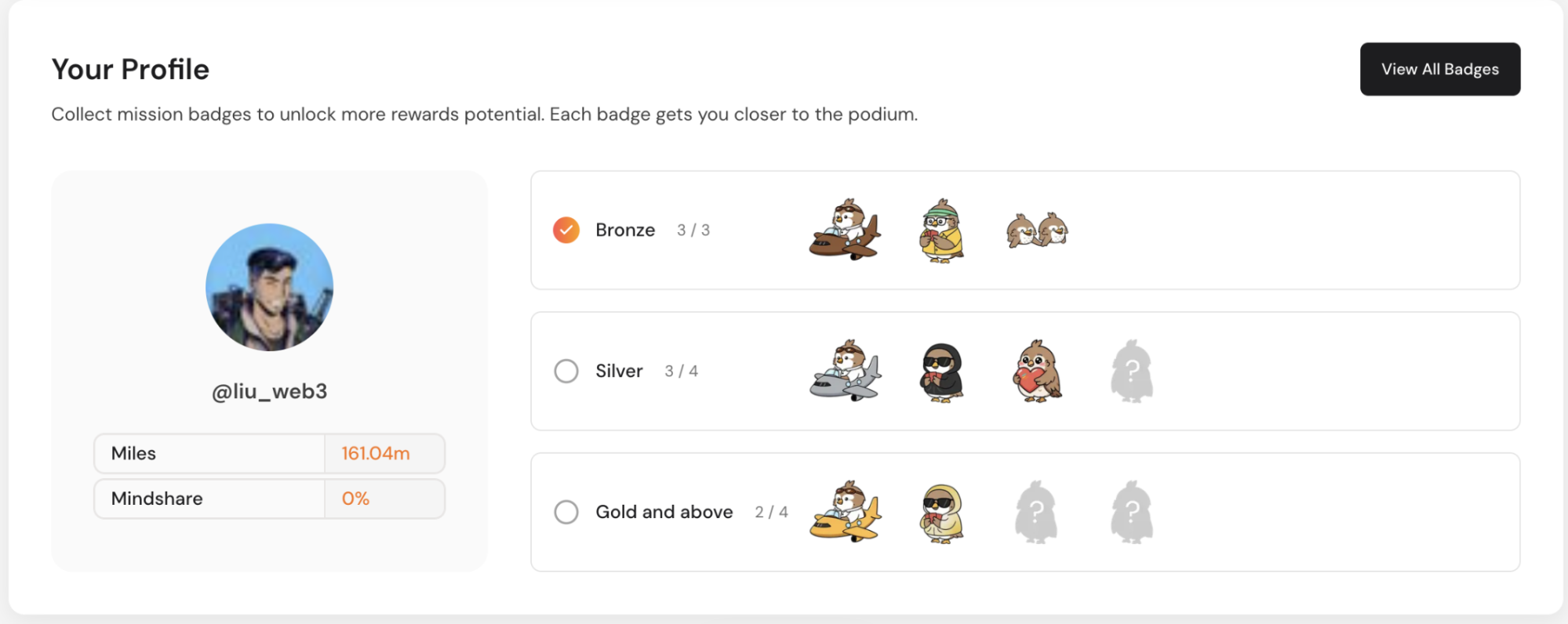

Falcon is also ramping up a variety of community incentives to drive engagement, including Falcon Miles and the Yap2Fly social leaderboard.

Falcon Miles is the protocol’s points system—directly tied to potential future airdrops—and eligibility and earning methods have been outlined above.

Yap2Fly is a collaborative program with Kaito that combines Falcon Miles with “Mindshare” earned through social media activities (“Yaps”). Each month, the top 50 ranked users share approximately $50,000 in USDf rewards. The badge system not only unlocks increased rewards but may provide additional bonuses.

In summary, Falcon Finance has amassed over $1 billion in USDf circulating supply and total value locked, positioning itself as a market leader among synthetic dollar protocols.

What truly distinguishes Falcon is its use of large-scale collateral to create on-chain liquidity. These assets continue to generate yield. The team’s focus on robust risk management, compliance, and diverse asset onboarding is designed to attract institutional capital—not just traditional DeFi users.

In the future, Falcon Finance aims to further bridge the gap between DeFi and traditional finance. It will do so by expanding asset diversity and scaling across multiple chains.

Disclaimer:

- This article is republished from [Foresight News], and copyright belongs to the original author [Alex Liu, Foresight News]. For reprint concerns, please contact the Gate Learn team, who will respond in accordance with relevant procedures.

- Disclaimer: The opinions and views expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize this translation unless Gate is clearly referenced.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

What Is USDT0