Morph: Porque tem a oportunidade de se tornar uma Super Entrada?

Repost o título original “Morph: A Dar o Primeiro Tiro nas Cadeias Públicas de Grau de Consumidor, Porque Tem a Oportunidade de se Tornar um Super Gateway?”

Primeiro, do ponto de vista do ciclo da indústria, por que é que a cadeia pública de nível de consumo é indispensável neste ciclo?

Nas últimas rodadas do ciclo cripto, do DeFi Summer ao frenesi do NFT, e depois ao grande salto em frente na infraestrutura e à explosão da narrativa MEME, a indústria tem inovado constantemente. Mas agora, a infraestrutura cada vez mais rica contrasta fortemente com a redução da liquidez e a desaceleração do crescimento de usuários, tornando essa contradição estrutural o maior dilema da indústria atual. Especialmente na corrida da cadeia pública, a lógica narrativa dominante costumava ser: "TPS mais rápido + taxas de gás mais baixas + mais aplicações DeFi". No entanto, à medida que o fosso tecnológico diminui e a inovação converge, o modelo de confiar exclusivamente na «especulação sobre novas cadeias públicas» está a acelerar a sua ineficácia, com o dinamismo especulativo a diminuir e a procura real a mudar. Em termos mais simples, as pessoas já não querem "casinos mais rápidos", mas sim "cadeias que sejam acessíveis de usar". Neste contexto, cadeias públicas de nova geração, como a Morph, com cenários de consumo no seu cerne, estão a tornar-se os produtos inevitáveis da evolução do ciclo da indústria. Há duas lógicas profundas aqui: mudanças macroestruturais, onde a Web3 como a infraestrutura de internet da próxima geração deve fazer a transição de atributos puramente financeiros para acomodar demandas mais amplas, como consumo real, social e conteúdo. Em uma micro tendência evolutiva, a lógica de tráfego da indústria deve ser reconstruída, e o motor de crescimento futuro deve ser o tráfego natural orientado pela experiência, ou seja, cenários diários de alta frequência onde os usuários estão dispostos a permanecer e consumir. Para apoiar essa transformação, as cadeias públicas tradicionais orientadas para o financiamento (como as excessivamente focadas em DeFi) são naturalmente inadequadas, e as cadeias públicas de nível de consumidor se tornarão novos pontos de entrada de tráfego e bases de experiência. Morph pode ser posicionado no local certo deste ponto de viragem no ciclo.

Dois, Morph: A Disrupção Tecnológica e Estratégica das Cadeias Públicas de Qualidade do Consumidor

1. Vantagens técnicas principais: Equilibrar desempenho e segurança

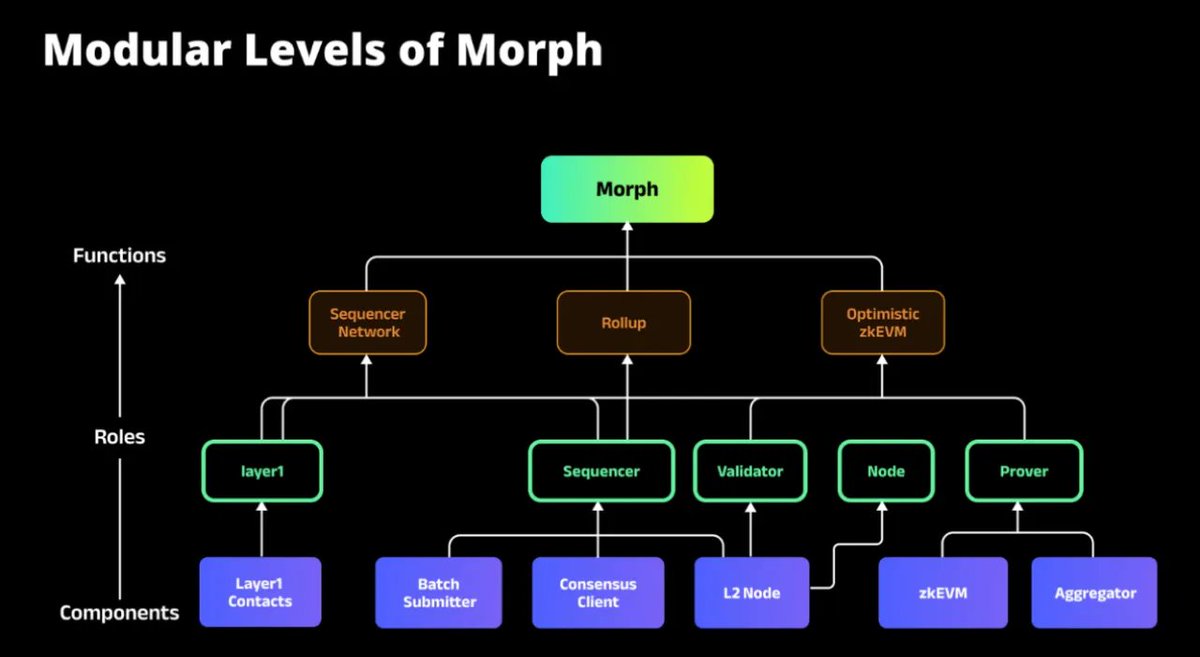

No geral, na arquitetura, não há muita descrição redundante, em suma, semelhante a outras cadeias públicas, principalmente usada para o consenso e execução do sequenciador para mecanismo de validação de estado e disponibilidade de dados. Além disso, o projeto possui algumas de suas próprias inovações e otimizações.

Inovação Mixed Rollup (Optimistic + ZK), a Morph pioneirizou o mecanismo do Optimistic zkEVM + Prova de Validade Responsiva (RVP), combinando o baixo custo do Optimistic Rollup com a alta segurança do ZK Rollup, reduzindo significativamente a janela de desafio, melhorando a velocidade de retirada e reduzindo os custos gerais.

Ordem descentralizada, no depende mais de um único centro de classificação, aliviando completamente os maiores pontos problemáticos da camada 2 tradicional, o monopólio de MEV e a censura de transações, garantindo a equidade e alta disponibilidade do processamento de transações.

Arquitetura modular: suporta a atualização e evolução independentes de diferentes módulos, e pode adaptar-se flexivelmente a mais novos requisitos de extensão no futuro, como EIP-4844, SP1 zkVM, garantindo a capacidade de evolução técnica a longo prazo do Morph.

Do ponto de vista técnico, a lógica de construção geral da Gate não é uma única inovação, mas sim uma integração sistemática inovadora, garantindo os três aspectos de desempenho, segurança e experiência.

2. Vantagem de posicionamento estratégico: Extensão do comércio para a vida

Com os 'cenários de consumo' como núcleo, o Morph não é simplesmente uma cadeia que fala sobre 'TPS' ou 'DeFi', mas está claramente posicionado como a infraestrutura para 'aplicações de consumo on-chain' (entretenimento, social, estilo de vida). As direções nas quais o Morph se concentra - conteúdo on-chain, social on-chain, entretenimento on-chain, pagamentos on-chain, etc., são todos cenários que podem realmente ativar as necessidades diárias de centenas de milhões de usuários, não apenas ciclos de especulação financeira.

Combinando recursos fortes e tráfego com plataformas como Bitget para formar sinergias potenciais, compartilhando usuários, marcas e canais, acelerando a introdução de usuários reais e o início a frio do ecossistema. Na verdade, para tais projetos, nos estágios iniciais, as barreiras de tráfego são extremamente importantes, e as cadeias públicas com entrada de tráfego estável e eficiente serão capazes de construir mais facilmente um momento ecológico inicial.

Mais do que apenas cartão U, construindo o Alipay do Web3, a força do produto + marca continua a aumentar

Com o forte endosso da Bitget e do emissor de cartões de primeira linha de Cingapura DCS, o cartão preto Morph rapidamente detonou discussões acaloradas na indústria assim que foi lançado, desencadeando extensas discussões dentro da Web3 e quebrando com sucesso o círculo com o sistema financeiro de consumo Web2. Embora ainda haja alguma controvérsia ao nível dos detalhes operacionais, há quase um consenso sobre um ponto: o Morph black card, como um produto ao nível do consumidor de "integração on-chain + off-chain", verificou preliminarmente que existe uma ampla procura real de ligações de alta frequência entre os serviços financeiros on-chain e a vida real. Por trás disso está o pensamento aprofundado e o layout de conformidade da Morph para a estratégia de longo prazo. Embora seja semelhante ao tradicional "cartão U" na superfície, em essência, ele foi além dos atributos de uma ferramenta e é mais como uma infraestrutura de nível de entrada Web3 conectando o sistema de conta financeira on-chain, direitos do consumidor off-chain e rede de compensação compatível. O Morph Black Card é emitido pelo DCS, um banco licenciado local em Cingapura, e concluiu todo o processo de integração da rede de cartões, revisão da estrutura do produto, KYC, certificação AML e auditoria de controle de risco sob a supervisão da MAS (Autoridade Monetária de Cingapura). Além disso, Morph não posiciona o cartão preto apenas como uma "ferramenta de passar o cartão", mas introduz um sistema completo de direitos e interesses que só podem ser desfrutados por cartões de crédito high-end no mundo Web2, o que não só torna o cartão preto em si escasso, mas também reflete o pensamento profundo de Morph sobre a "entrada de nível de consumidor": Deixe que a identidade on-chain se torne um certificado para desfrutar de uma experiência distinta no mundo real e faça com que os criptoativos realmente se tornem um "ativo de crédito" que pode ser usado diariamente. A adoção meticulosa dessa estratégia pela Morph reflete que o principal apelo do projeto como um todo para o desenvolvimento de longo prazo não é aproveitar o vento quente para ganhar dinheiro, mas mais considerar a construção de um sistema compatível, seguro, conveniente e globalmente disponível a partir de toda a estratégia subjacente.

4. O sistema de contas subjacente suporta o ciclo fechado ecológico. Emitir cartões não é o fim, mas o início.

O cartão preto Morph não é um produto financeiro isolado, mas mais profundamente, faz parte de todo o sistema de contas Morph. Este sistema de contas não só suporta a emissão de cartões e funções de pagamento, mas também se tornará a infraestrutura central para a construção de finanças Web3, identidade, pontos e sistemas de associação no futuro: não só suporta a ligação de contas on-chain com identidades off-chain, mas também suporta funções como armazenamento de ativos criptografados, troca e finanças, semelhante a uma versão Web3 do 'Alipay'; além disso, também pode incorporar mais aplicações Web3 e ferramentas financeiras de terceiros, realizando um ecossistema financeiro aberto. Com base nisso, a Morph está a construir um sistema onde 'contas são portais financeiros': cada cartão, cada conta, não é apenas uma ferramenta de pagamento, mas também o centro de identidade principal que liga vários serviços Web3 (consumo, transações, finanças, interações sociais).

Três, desafios potenciais e valor a longo prazo do Morph

Embora o consumo e as aplicações sejam reconhecidos como a próxima curva de crescimento na indústria, a dificuldade de início a frio e os requisitos operacionais ultrapassam em muito protocolos como o Defi. Em primeiro lugar, do ponto de vista do risco, existem desafios futuros em termos de ciclo de aterragem, competição na indústria, etc., que precisam ser continuamente superados.

Desafio 1: A aterragem de cenários de consumo requer uma operação contínua e sólida. A controvérsia anterior sobre os benefícios do Cartão Preto Morph e do Cartão Platinum é na verdade um microcosmo dos desafios operacionais. Não apenas testa a compreensão do projeto do 'cartão' em si, mas também o design eficaz da experiência do usuário. A essência do produto ainda pertence à categoria de 'serviços financeiros para consumidores'. Os usuários não apenas se concentram nos benefícios e na experiência do usuário, mas também fazem escolhas de médio a longo prazo com base em fatores como continuidade do serviço, segurança e conformidade. Embora o Cartão Preto tenha aberto algum espaço, o projeto ainda precisa realmente fazer com que os usuários estejam dispostos a usá-lo naturalmente em experiências diárias e continuar a educação do usuário.

Desafio 2: A intensificação da concorrência requer uma construção de marca mais rápida e eficaz e uma construção de ecossistema. Com a Gate a liderar a janela narrativa das “blockchains públicas de nível de consumidor”, é previsível que mais L2, e até mesmo alguns novos tipos de L1, sigam rapidamente o exemplo, estabelecendo o mercado de consumidores da cadeia. Algumas blockchains públicas de alto TPS já começaram a focar na disposição do “ecossistema de conteúdo”, e a série Rollup da Ethereum também poderá juntar-se à competição pelas narrativas dos consumidores no futuro. Neste contexto, como estabelecer a marca e o ecossistema inicial antes da narrativa estar totalmente implementada irá determinar diretamente a posição da Gate na competição da indústria. Isto não só requer clareza sobre “o que é”, mas também fazer com que os utilizadores “gostem de o usar”. Embora o ciclo de arranque a frio das blockchains públicas de nível de consumidor seja longo e os requisitos operacionais sejam muito elevados, a partir da arquitetura tecnológica atual da Gate, do layout estratégico às capacidades de coordenação de recursos, tem múltiplos potenciais para passar pelos primeiros obstáculos e avançar para a próxima curva de crescimento:

Valor 1: A monetização on-chain de aplicações de consumidor é uma tendência de longo prazo, e a posição da Morph tem um alto grau de escassez.

No contexto da indústria que gradualmente se desloca para a competição de ações, é extremamente raro conectar verdadeiramente as aplicações on-chain com as cenas de consumo diário dos utilizadores. Do lado da procura, os utilizadores Web3 já não estão satisfeitos com a especulação DeFi, mas esperam que a cadeia transporte experiências de vida reais, contínuas e de alta frequência, tais como pagamento, social e consumo de conteúdo de entretenimento. Do lado da oferta, a maioria dos L1 e L2 ainda estão focados em aplicações financeiras nativas (DEX, empréstimos) e narrativas de curto prazo (como MEME). Os projetos que realmente se concentram na experiência de consumo on-chain e têm a capacidade de se concretizar são muito poucos. Como pioneiro em cadeias públicas de consumo, espera-se que o Morph conquiste a mente dos utilizadores nos próximos 2-3 anos e estabeleça uma posição escassa de "entrada diária de consumo on-chain".

Valor 2: A tecnologia Morph tem uma escalabilidade extremamente forte e pode adaptar-se a mais mudanças narrativas no futuro

Graças ao seu design modular e arquitetura híbrida Rollup, o Morph pode adaptar-se de forma muito flexível à evolução da indústria no futuro. Por exemplo, com o avanço da tecnologia de shard, o Morph pode rapidamente reduzir os custos de disponibilidade de dados. Ao promover a descentralização através do Sequencer, pode construir uma infraestrutura de nível inferior com maior segurança e resistência à censura. No futuro, também pode ser compatível com mais aplicações de consumidor on-chain, como publicidade on-chain, serviços de subscrição on-chain e outros novos campos. Em geral, o Morph não é uma cadeia pública limitada por um único enquadramento técnico, mas sim uma plataforma aberta que pode evoluir dinamicamente e de forma síncrona com a indústria, com uma longa vitalidade técnica.

Valor 3: As vantagens dos recursos e do capital são óbvias, com potencial de sinergia de recursos a longo prazo.

Deixando de lado todas as influências recentes da opinião pública, a longo prazo, Morph possui o fluxo, canais e recursos de marca de plataformas fortes como a Bitget, que podem continuar a injetar utilizadores e fundos no ecossistema de consumo on-chain; no futuro, espera-se que conecte o loop de consumo on-chain e off-chain, formando uma barreira única para os utilizadores; a nível de capital, Morph recebeu investimentos estratégicos de múltiplos fundos de primeira linha, proporcionando garantias de recursos sólidos para o apoio e incubação ecológicos subsequentes.

Valor 4: O sistema de contas é a base da super entrada, e o fosso do sistema é forte.

O núcleo do Morph não está relacionado com “quantos cartões são emitidos”, mas sim com a construção de uma super entrada através do sistema de conta por trás do cartão, que pode incluir gestão de ativos, vinculação de identidade, pagamento on-chain, pontos e até mesmo social Web3. No futuro, todos os comportamentos on-chain dos utilizadores podem expandir-se para cenários diversos, como finanças, empréstimos, pagamentos e adesão no sistema de conta. Esta será a base fundamental para o crescimento de todas as aplicações ao nível do consumidor. Por isso, o cartão preto do Morph não é um produto isolado, mas sim uma parte importante da sua construção de “contas como hubs financeiros”. A longo prazo, este sistema é a vala subjacente que verdadeiramente o distingue de outros projetos de Layer2.

4. Resumo: Morph, esperado para se tornar a super entrada da infraestrutura de vida on-chain

A partir das tendências atuais da indústria, precisamos reconhecer que a Web3 está passando por uma mudança profunda na lógica subjacente, transicionando a indústria da especulação de ativos para o consumo real; da alavancagem financeira para a evolução da experiência de vida; da simples sobreposição on-chain para a transformação de integração on-chain + off-chain. Nesta tendência, o Morph forneceu uma resposta sistemática completa em termos de tecnologia, estratégia e sinergia de recursos. Apesar da recente opinião pública desfavorável, olhando a longo prazo, se conseguir promover steadymente a aplicação prática, completar rapidamente o início a frio e expandir gradualmente a escala de usuários reais, então o valor a longo prazo do Morph não será apenas uma cadeia pública, mas também a infraestrutura de vida on-chain da próxima geração e pode até se tornar o Alipay, WeChat, ou até mesmo a super entrada do mundo Web3.

No geral, como uma cadeia pública de qualidade do consumidor com uma posição clara, tecnologia sólida e perspicácia estratégica, o Morph realmente atingiu um ponto importante na transformação narrativa da indústria. A chave para o Morph realmente realizar esse potencial no futuro depende de suas capacidades operacionais, sua capacidade de ocupar a mente dos usuários e sua construção contínua de um fosso no ecossistema. Do ponto de vista da pesquisa de investimento, se a palavra-chave do ciclo anterior foi 'profundidade do protocolo', então a palavra-chave do próximo ciclo é 'amplitude de experiência'. E o que o Morph está tentando conectar é o caminho completo do ciclo de vida do usuário de 'ativos-identidade-consumo-crédito'. Precisamos reconhecer que em uma nova era de despedida do crescimento extensivo e virando para operações refinadas, o Morph está tentando fornecer uma resposta mais próxima da imagem real do futuro, não apenas especulação na cadeia. E talvez este caminho seja a rota necessária para a Web3 realmente avançar para o mainstream e realmente mudar o mundo. Se você acredita que o futuro da Web3 é sobre a vida e a adoção generalizada, então o Morph merece atenção contínua.

Declaração:

- Este artigo é reproduzido a partir de [Gate@Ice_Frog666666O título original é ‘Morph: A dar o primeiro passo na cadeia pública de nível do consumidor, por que tem a oportunidade de se tornar o super portal?’, os direitos de autor pertencem ao autor original [ @Ice_Frog666666], se tiver alguma objeção à reimpressão, por favor entre em contatoEquipa Gate Learn),a equipa irá processá-la o mais rapidamente possível de acordo com o processo relevante.

- Aviso Legal: As opiniões expressas neste artigo são exclusivamente do autor e não constituem qualquer conselho de investimento.

- As outras versões do artigo em outros idiomas são traduzidas pela equipe Gate Learn, quando não mencionadoGate.ioNo caso de ) não é permitido copiar, divulgar ou plagiar os artigos traduzidos.

Artigos relacionados

Utilização de Bitcoin (BTC) em El Salvador - Análise do Estado Atual

O que é o Gate Pay?

O que é o BNB?

O que é o USDC?

O que é Coti? Tudo o que precisa saber sobre a COTI