The Evolution of LatAm’s Stablecoin Market: From Survival to Growth

Latin America is experiencing a financial infrastructure revolution, triggered by the failure of local currencies. This report provides a comprehensive analysis of the region’s stablecoin market, drawing on macroeconomic data, on-chain activity, and regulatory policy from 2024 to 2025. The findings reveal that Latin America has moved past the initial phase of passive dollarization and is now rapidly transforming into a Web3-driven financial ecosystem.

At the macro level, Argentina’s 178% inflation rate and Brazil’s $300 billion in crypto trading volume have made stablecoins essential tools for both survival and efficiency. On the micro level, the market is giving rise to a new breed of financial institution—Crypto Neobank. Unlike traditional fintech giants such as Nubank, Crypto Neobanks leverage zero-fee networks like Tether-backed Plasma and DeFi yields to fill the gap between legacy banking and pure crypto speculation. This report identifies the next alpha opportunity in Latin America’s crypto sector: how Web3 infrastructure can harness $1.5 trillion in transaction volume to replicate—and potentially surpass—the explosive growth seen in traditional fintech.

1. Reconstructing the Macro Narrative

To truly understand Latin America’s market dynamics, it’s essential to look beyond North American or European perspectives focused on technological innovation. In Latin America, the rise of stablecoins is a direct consequence of macroeconomic structural imbalance. The region’s primary drivers are survival and efficiency, and the adoption of Web3 technology is converting passive survival needs into proactive financial advancement.

1.1 Currency Failure and Loss of Store-of-Value

Inflation is the strongest catalyst for crypto dollarization in Latin America, with Argentina and Venezuela as prime examples.

Despite the Milei administration’s aggressive economic reforms, Argentina’s annual inflation rate remains at 178% for 2024–2025, and the peso has lost 51.6% of its value against the US dollar in just 12 months. In this environment, stablecoins have shifted from investment vehicles to the de facto unit of account. On-chain data shows stablecoin transactions comprise 61.8% of Argentina’s volume—far above the global average. Demand for stablecoins is highly responsive to price movements: whenever the exchange rate breaks a key psychological barrier, monthly stablecoin purchases on exchanges surge past $10 million.

In Venezuela, as the bolivar continues to lose value, Tether has become ubiquitous in daily economic activities, from supermarket shopping to real estate transactions. Data reveals a strong negative correlation between the fiat exchange rate and crypto inflows, with stablecoins providing a parallel financial system independent of government monetary policy.

1.2 Banking Exclusion and the Financial Void for 122 Million Adults

Beyond inflation, financial exclusion remains a critical challenge. Latin America has 122 million adults—26% of its population—without access to bank accounts. This massive demographic is excluded from traditional banking due to minimum balance requirements, complex compliance paperwork, and geographic isolation.

](https://s3.ap-northeast-1.amazonaws.com/gimg.gateimg.com/learn/f2c4935e906e2b8c29b205af3e0fffed49ad2d5e.jpg)

This environment has fueled the rise of new banking models. Nubank’s success demonstrates the power of a branchless, low-fee mobile banking approach—capturing 122 million users in just a decade, reaching a $70 billion market cap, and covering 60% of Brazil’s adult population.

Now, Crypto Neobanks are redefining the model. While Nubank addressed accessibility, its accounts are still denominated in local fiat currencies, and savings yields typically lag inflation. In contrast, Web3 neobanks offer USD stablecoin accounts without banking licenses, and through DeFi integration, deliver 8–10% annualized yields in US dollars—a compelling proposition for users in inflationary economies.

1.3 Remittance Economy: Reducing Costs and Boosting Efficiency

Latin America is one of the world’s largest recipients of remittances, with annual inflows exceeding $160 billion. Traditional cross-border remittances often incur fees of 5–6% and take days to settle—resulting in nearly $10 billion lost to fees every year.

In the US–Mexico corridor—the world’s largest single remittance channel—Bitso has processed over $6.5 billion, accounting for 10% of the total. Blockchain-powered transfers can cut costs to $1 or mere cents, and reduce settlement times from days to seconds. This dramatic leap in efficiency is a game-changer for the region’s financial landscape.

2. Market Depth and On-Chain Activity

2024–2025 data shows Latin America has developed a distinctive crypto adoption pattern: high-frequency, large-scale, and highly institutionalized transactions.

2.1 Trading Volume and Growth Resilience

Aggregated data indicates that from July 2022 to June 2025, Latin America recorded nearly $1.5 trillion in crypto trading volume, with annual growth of 42.5%. Even during global market turbulence, Latin America’s growth remains robust. In December 2024, monthly trading volume hit a record $87.7 billion—demonstrating that growth is driven by intrinsic demand, not merely global bull market cycles.

2.2 Brazil’s Institutional Dominance vs. Argentina’s Retail Surge

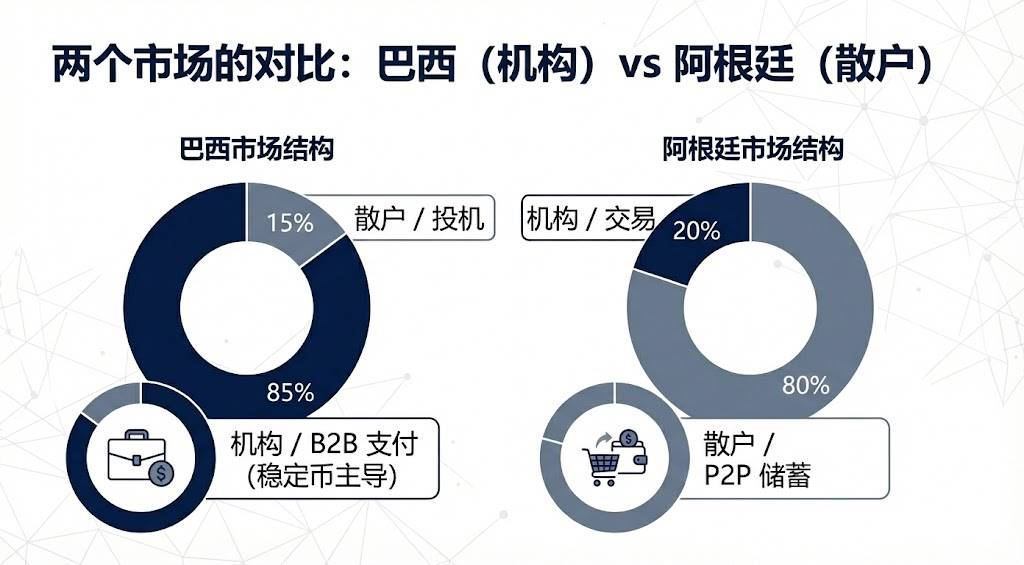

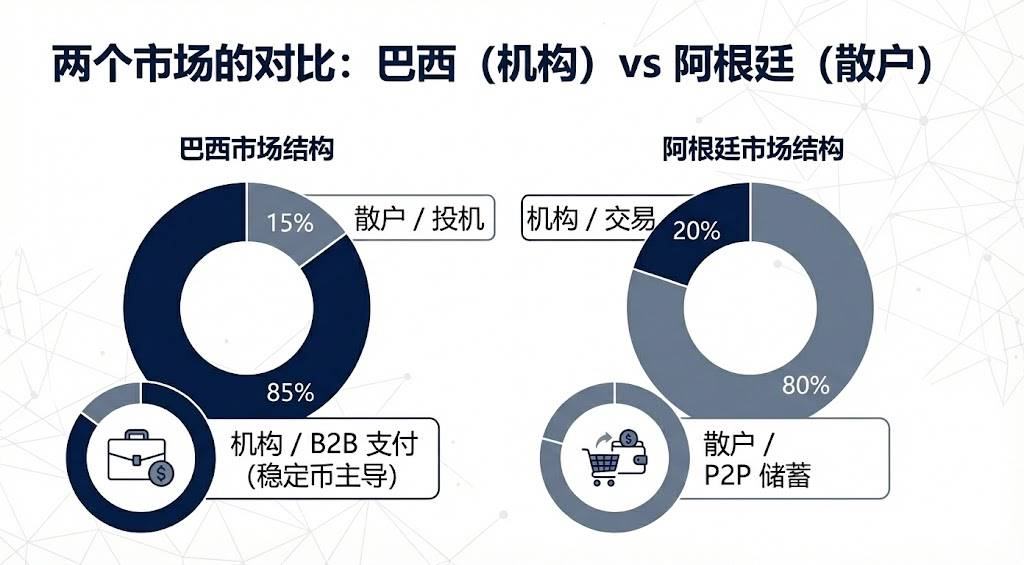

Market structures vary sharply across countries:

Brazil leads the region, receiving about $318.8 billion in crypto assets—nearly a third of the total. Central bank data shows roughly 90% of crypto flows are stablecoin-based, highlighting Brazil’s institutional market: stablecoins are used mainly for enterprise payments, cross-border settlements, and liquidity management, not retail speculation.

Argentina ranks second, with $91.1–93.9 billion in volume, driven primarily by retail users who rely on crypto dollarization as a daily inflation hedge.

2.3 Platform Preferences: Centralized Exchanges Dominate

Latin American users rely heavily on centralized exchanges, with 68.7% of trading occurring on these platforms—the second-highest rate globally.

This trend is strategically important for Web3 projects seeking entry. The optimal approach is to partner with local platforms like Mercado Bitcoin and Bitso, which offer compliant fiat channels and deep user trust. Crypto Neobanks should collaborate rather than compete directly for fiat on/off ramps, leveraging these exchanges’ large user bases.

3. Asset Evolution

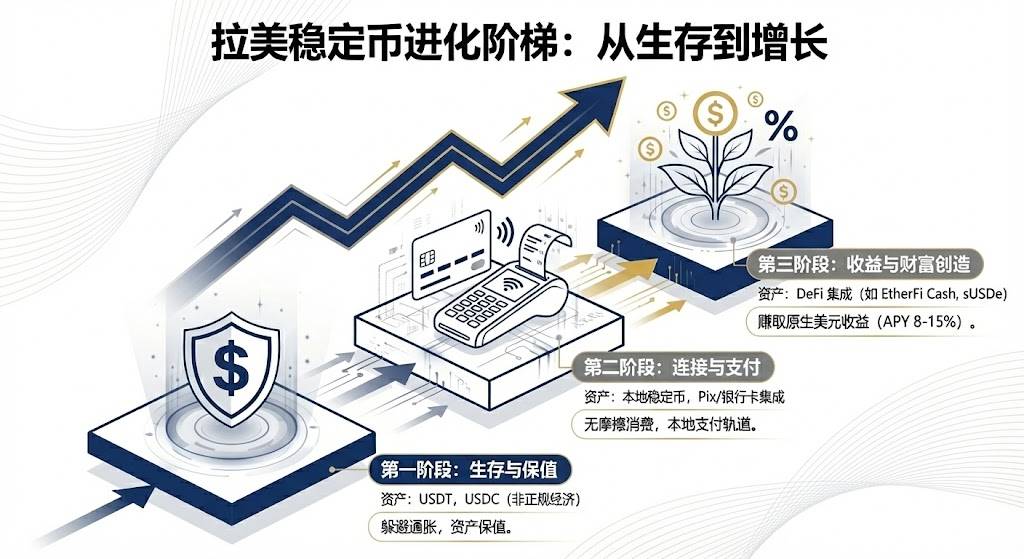

Latin America’s market features both global stablecoins and innovative local assets, and is shifting from asset preservation to asset growth.

3.1 Tether and USDC: Market Leaders

Tether maintains its dominance in peer-to-peer and informal markets thanks to its first-mover advantage and deep liquidity. In Venezuela and Argentina’s OTC markets, Tether is the primary pricing unit. Brazilian tax data shows Tether accounts for two-thirds of reported trading volumes, making it the preferred tool for bypassing capital controls due to its censorship resistance and ubiquity.

USDC is expanding rapidly through compliant channels. Circle’s partnerships with Mercado Pago and Bitso have made USDC the preferred asset for institutional settlements, with Bitso reporting that by the end of 2024, USDC became its top-purchased asset (24%), surpassing Bitcoin.

3.2 Local Fiat Stablecoins as Bridges

Stablecoins pegged to local Latin American currencies are gaining traction in 2024–2025, addressing friction between local payment systems and blockchain networks.

Mercado Libre’s launch of Meli Dólar in Brazil is a milestone, embedding stablecoins into daily shopping for tens of millions of users via Mercado Pago, and serving as a vehicle for credit card cashback—lowering barriers to entry. Num Finance’s peso and real stablecoins support cross-exchange arbitrage and enterprise-grade DeFi, helping local businesses manage liquidity on-chain without currency risk.

3.3 Yield-Bearing Assets and DeFi Integration: A New Trend

This is Latin America’s next alpha opportunity. Traditional banks offer low USD deposit rates, while Web3 neobanks, integrated with DeFi protocols, are redefining savings.

EtherFi, for example, uses its multi-billion-dollar TVL to launch credit card products. Users can stake crypto assets to earn yield and spend with the card, enabling borrowing and spending without selling assets—preserving upside while solving liquidity needs.

In high-inflation countries, synthetic dollar stablecoins like USDe offer native yields of 10–15%, making them highly attractive. Compared to Nubank’s real-denominated deposits, a 10% USD annualized yield is a game-changer for traditional savings products.

4. Divergent National Paths

Political and economic differences across Latin American countries have led to distinctly different stablecoin development trajectories.

4.1 Brazil: Compliance Meets Innovation

Brazil stands out as Latin America’s most mature and compliant market. In 2025, the central bank’s Drex CBDC project shifted focus to wholesale, opening up retail opportunities for private stablecoins.

That year, Brazil introduced a unified crypto tax rate and clarified stablecoins’ foreign exchange status, increasing costs but providing industry legitimacy. Local innovator Neobankless, built on Solana, abstracts blockchain complexity on the frontend and integrates directly with Brazil’s PIX payment system. Users deposit reals, which are automatically converted to yield-bearing USDC—delivering a Web2 experience powered by Web3 infrastructure and directly challenging traditional fintech habits.

4.2 Argentina: Liberal Testbed

The Milei administration’s virtual asset service provider registry raises compliance hurdles but tacitly allows USD stablecoins to compete as currency. Asset regularization programs have legitimized vast amounts of previously gray-market stablecoins.

Lemon Cash addresses last-mile payment issues with crypto debit cards, allowing users to earn yield on USDC and only convert to pesos at the point of sale. This model is highly attractive in high-inflation environments, minimizing exposure to local fiat.

4.3 Mexico and Venezuela: A Tale of Two Extremes

Mexico’s Fintech Law and central bank restrictions have created a divide between banks and crypto companies. Bitso and others have pivoted to B2B, using stablecoins as bridges for US–Mexico cross-border transfers, bypassing inefficient traditional banking.

In Venezuela, amid renewed sanctions, Tether is used even for oil export settlements. On the retail side, Binance’s peer-to-peer platform remains the main source of foreign exchange, with the market overwhelmingly favoring private USD stablecoins over the failed official petro.

5. From Traditional Finance to Crypto Neobank

Latin America is at a crucial inflection point, evolving from legacy fintech to Crypto Neobank—a leap not just in technology, but in business models.

5.1 Valuation Gap and Alpha Opportunities

Nubank’s $70 billion and Revolut’s $75 billion valuations validate digital banking’s commercial viability in Latin America. By contrast, the entire Web3 neobank sector is valued at less than $5 billion—just 7% of Nubank’s market cap.

This represents a significant value gap. If Crypto Neobanks capture even 10% of Nubank’s user base and leverage superior unit economics, valuations could rise 10–30 times.

5.2 Next-Generation Infrastructure: The Zero-Fee Revolution

Gas fees have long hindered crypto payment adoption. Plasma and its flagship product, Plasma One, backed by Tether, have eliminated gas fees for Tether transfers—removing the biggest psychological and financial barriers to crypto payments.

Within just 20 days of launch, Plasma’s total value locked surpassed $5 billion, proving that banking-grade infrastructure can drive rapid capital inflows. This vertically integrated “infrastructure + neobank” model may become the industry standard.

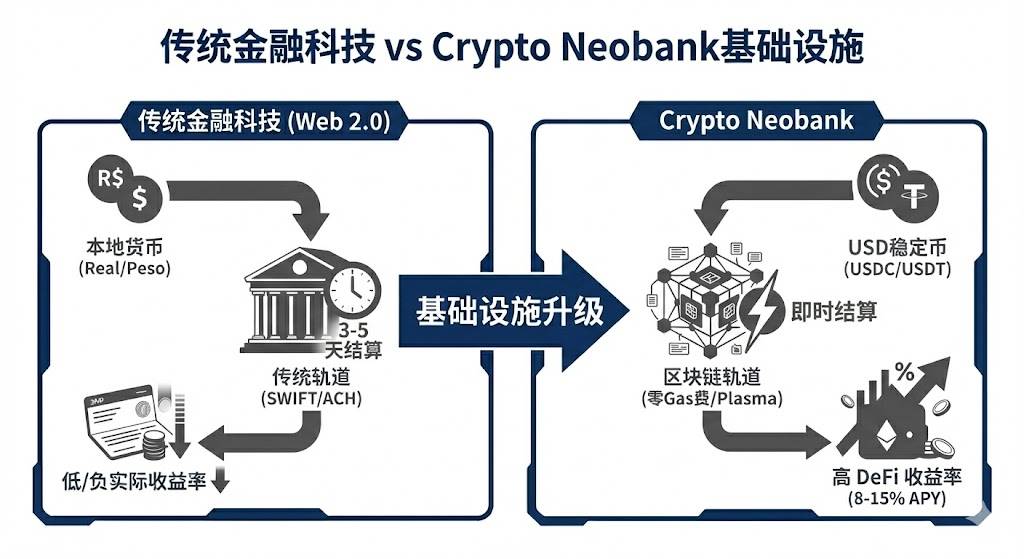

5.3 Business Model Disruption

Crypto Neobanks offer three distinct advantages over traditional banks:

- Settlement speed: From SWIFT’s 3–5 days to blockchain’s near-instant transactions.

- Account currency: From depreciating local fiat to inflation-resistant USD stablecoins.

- Yield source: From net interest margin to sharing native DeFi protocol yields with users.

For Latin American users, this is not just a better experience—it’s a vital solution for asset preservation.

6. Challenges, Strategic Playbooks, and Endgame Outlook

6.1 Challenges and Breakthrough Strategies

Despite strong prospects, bank account closures for crypto businesses due to compliance concerns persist in Mexico and Colombia. Regulatory fragmentation is pronounced, and cross-border compliance costs remain high.

Web3 projects targeting Latin America should adopt a focused strategy:

- Prioritize Brazil: With 31% of Latin America’s crypto volume and a robust payment infrastructure, Brazil is the key market.

- Start niche: Don’t try to serve everyone at once. Win a specific community first, then expand.

- Viral marketing: Nubank’s growth was 90% word-of-mouth. Crypto Neobanks should use on-chain incentives to drive viral growth on social platforms like WhatsApp.

6.2 Market Outlook

Based on this analysis, here are short- and medium-term stablecoin market forecasts:

- Private stablecoins will replace central bank digital currencies: With Brazil’s Drex retreating from retail, compliant private stablecoins will effectively serve as digital fiat.

- Yield-bearing assets will become mainstream: Stablecoins without yield will face competition from tokenized US Treasuries and other yield-generating assets. Latin American users will increasingly prefer assets that both hedge inflation and generate returns.

- Market stratification: The market will split into two camps—a highly compliant, bank-integrated whitelist market, and a shrinking but persistent gray peer-to-peer market.

Conclusion

Latin America’s stablecoin market is the world’s leading fintech proving ground. Here, stablecoins are not a luxury—they are a lifeline. From digital safety nets for Argentinians to cross-border settlement tools for Brazilian financial giants, stablecoins are reshaping the region’s financial arteries.

With new regulatory frameworks in 2025 and the rise of Crypto Neobanks, Latin America is poised to become the world’s first region to achieve large-scale commercial adoption of stablecoins. For investors, the opportunity window is just 12–18 months. Whoever can replicate Nubank’s user experience on Web3 rails before 2026 will become the next $100 billion giant. The race is on—Latin America is the untapped gold mine.

Statement:

- This article is republished from [TechFlow]. Copyright belongs to the original author [@ BlazingKevin_, Researcher at Movemaker]. If you have any objections to this republication, please contact the Gate Learn team for prompt resolution.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is referenced, translated articles may not be copied, distributed, or plagiarized.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.