LAB (LABtrade) Coming Soon? Must-Read Pre-Launch Guide for Beginners

LAB (LABtrade) Project Introduction

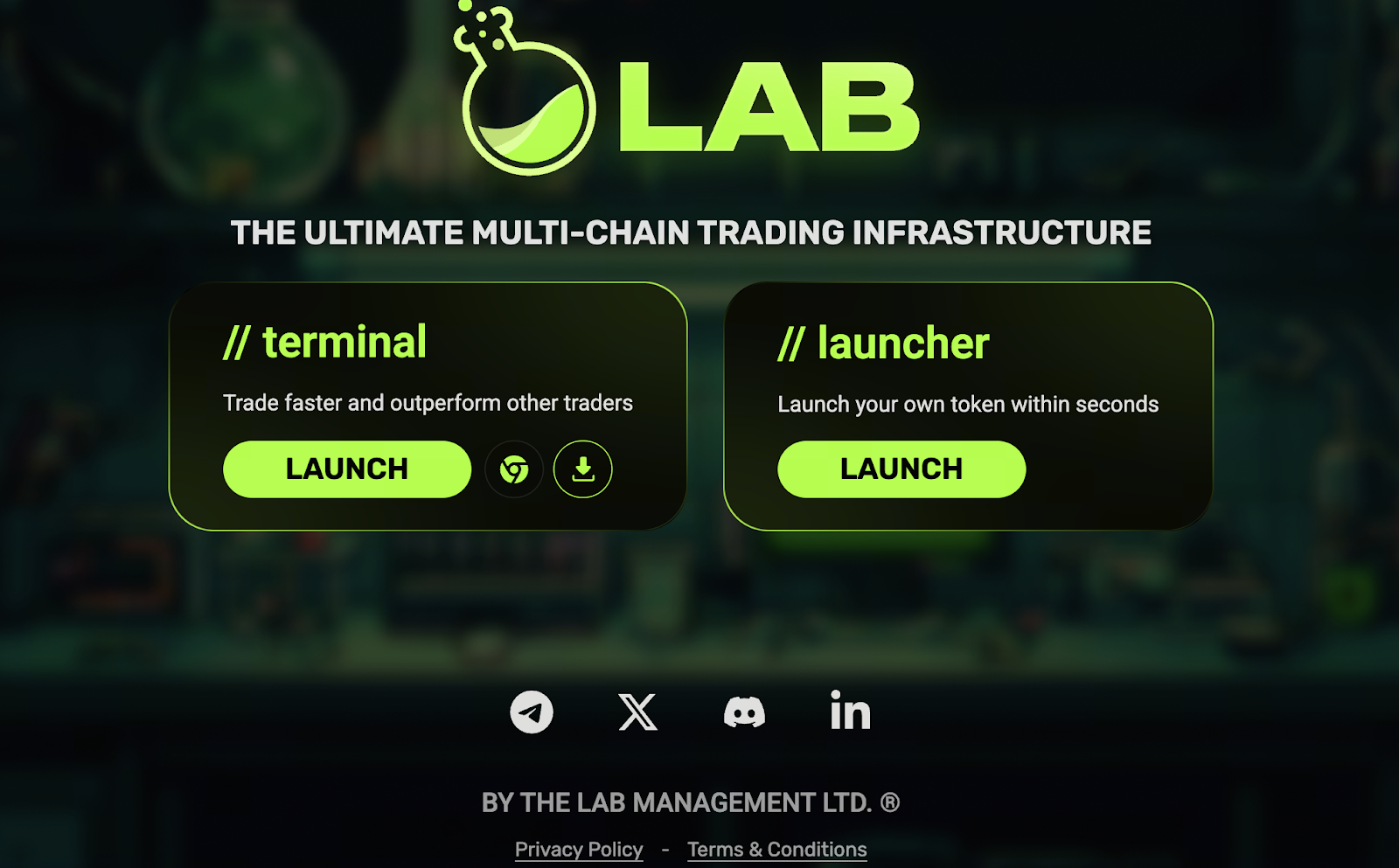

Image: https://about.lab.pro/

LAB, also known as LABtrade, is a groundbreaking token project dedicated to trading infrastructure and multi-chain interoperability. Its primary goal is to connect trading channels across disparate blockchains, leveraging an AI-powered trading engine to execute strategies. The team states the platform will support spot trading, limit orders, perpetual contracts, and more, while enhancing cross-chain compatibility to drive greater trading efficiency and user flexibility.

Publicly available information indicates LAB is still in its pre-launch phase, not yet listed on major exchanges, and without an accessible market price. As a result, current participants rely on resources such as the whitepaper, community announcements, and social media updates for information.

Current Status: Why Isn’t It Live Yet?

Several factors may be delaying LAB’s official launch:

- Compliance and review: Before listing on centralized exchanges (CEXs), tokens must undergo rigorous review by the project team, the exchange, legal counsel, and auditors.

- Incomplete technical development: The trading engine, cross-chain modules, and smart contract security features may still be undergoing internal testing or refinement.

- Community and liquidity preparation: Teams typically plan liquidity pools, community incentives, and early holder distribution in advance to prevent a post-launch collapse.

- Ongoing fundraising or subscription: Reports suggest LAB has completed a community funding round and intends to offer token allocations through a subscription or IDO.

- Timing strategy: The team may be waiting for more favorable market conditions, strategic partnerships, or ecosystem maturity before going live.

Latest Community and Fundraising Updates

Despite not being live, LAB has seen notable community activity and exposure:

- Rumors indicate LAB raised approximately $1.5 million in its community round, reaching its hard cap.

- Social media reports suggest LAB’s Token Generation Event (TGE) is imminent.

- Some sources claim LAB may launch or hold its TGE on the Binance Alpha platform, with the subscription window scheduled for a specific period.

- Community members and supporters are steadily increasing, fueling strong anticipation for the project.

While these developments do not guarantee future outcomes, they provide valuable indicators for potential investors assessing project momentum and market sentiment.

Launch Potential and Likely Scenarios

For projects yet to launch, successful listings typically follow several paths:

- IDO / IEO / community subscription: The team allows community members or early supporters to purchase tokens before listing on exchanges.

- Initial decentralized exchange (DEX) listing: Tokens are first traded via liquidity pools on a DEX to enable early price discovery.

- Direct exchange partnership: The project coordinates with selected exchanges, preparing marketing campaigns and liquidity ahead of launch.

- Phased rollout: Initial listings on smaller or regional exchanges for testing, then expanding to major platforms.

If LAB can build a strong community foundation, generate high subscription interest, and maintain transparency and security before launch, it stands a strong chance of achieving favorable initial pricing and market trust.

Key Risks for Investors to Watch

Unlisted token projects carry elevated risks, requiring heightened vigilance. Major risk factors include:

- Project legitimacy and team background: Verify the team’s credentials, contract addresses, and security audit history to prevent losses from anonymous or fraudulent projects.

- Liquidity and fund management: Insufficient post-launch liquidity can result in extreme volatility or price manipulation.

- Subscription scams and airdrop traps: Beware of “subscription/airdrop/whitelist” offers demanding upfront payment or private key submission, as these are often fraudulent.

- Token unlock/release mechanisms: Large-scale token unlocks after launch can trigger heavy selling pressure and price declines.

- Market conditions: Broad crypto market corrections and regulatory changes may abruptly impact new listings and trading performance.

- Transparency of information: Limited disclosures from the project team hinder community oversight, increasing risk exposure.

Future Outlook: Potential Post-Launch Trends

If LAB launches successfully, several market scenarios may play out:

- Rapid short-term growth: Strong initial subscription demand and community enthusiasm could drive a sharp price surge.

- Mid-term consolidation and correction: After initial gains, a period of market adjustment and consolidation is likely—a healthy phase for sustainable growth.

- Steady upward momentum: Continued delivery of new features, partnerships, and ecosystem developments may support LAB’s long-term value appreciation.

- Decline or abandonment: Failure to meet milestones, community disengagement, or broken partnerships could lead to market neglect and price depreciation.

For newcomers, closely following official announcements, community updates, partnership integrations, and token subscription arrangements is crucial. Even before launch, reviewing the whitepaper, engaging with the community, and understanding project mechanisms can help investors prepare effectively.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article