Defioasis

Aucun contenu pour l'instant

Defioasis

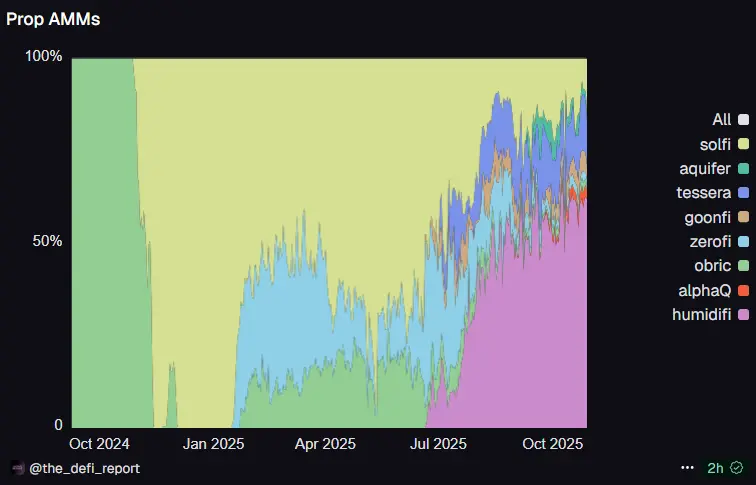

Cette année, le développement des dark pools Prop AMM sur Solana a été extrêmement rapide, avec plusieurs des principaux Prop AMM ayant déjà accumulé un volume de transactions de plus de 270 milliards de dollars.

Le plus impressionnant est HumidiFi, qui, depuis sa création fin juin, est devenu en seulement 5 mois le plus grand DEX Prop AMM sur Solana, et aussi le premier Prop AMM à dépasser un volume de transactions cumulé de 100 milliards de dollars.

J'ai réalisé un GIF récapitulatif de la bataille des volumes de transactions des Prop AMM sur Solana, afin de ressentir la vitesse fulgurante de

Voir l'originalLe plus impressionnant est HumidiFi, qui, depuis sa création fin juin, est devenu en seulement 5 mois le plus grand DEX Prop AMM sur Solana, et aussi le premier Prop AMM à dépasser un volume de transactions cumulé de 100 milliards de dollars.

J'ai réalisé un GIF récapitulatif de la bataille des volumes de transactions des Prop AMM sur Solana, afin de ressentir la vitesse fulgurante de

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

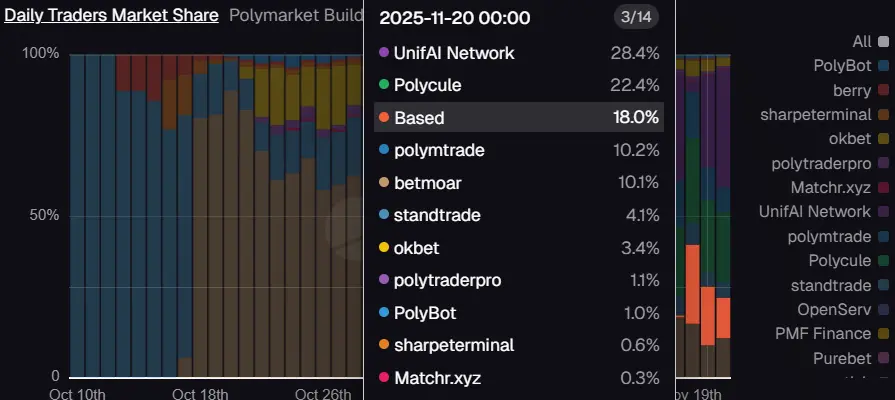

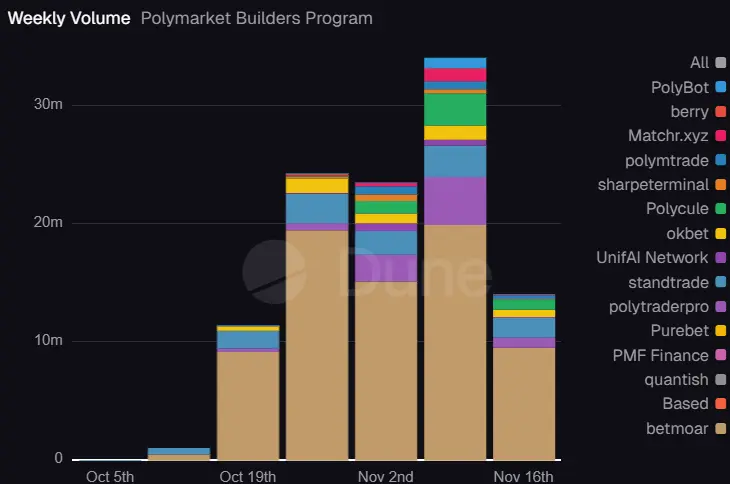

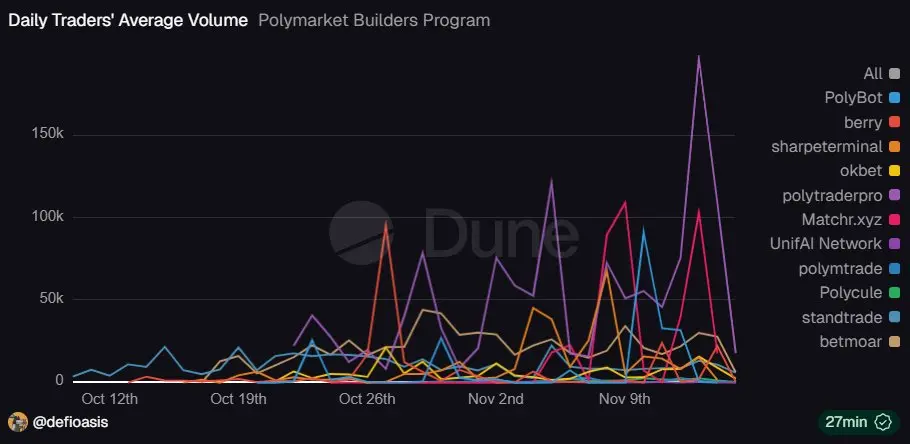

Considéré comme la première équipe officielle à entrer sur le marché, Polymarket Builder. Voyons si, dans les semaines à venir, BasedApp deviendra le plus grand canal de distribution de Polymarket.

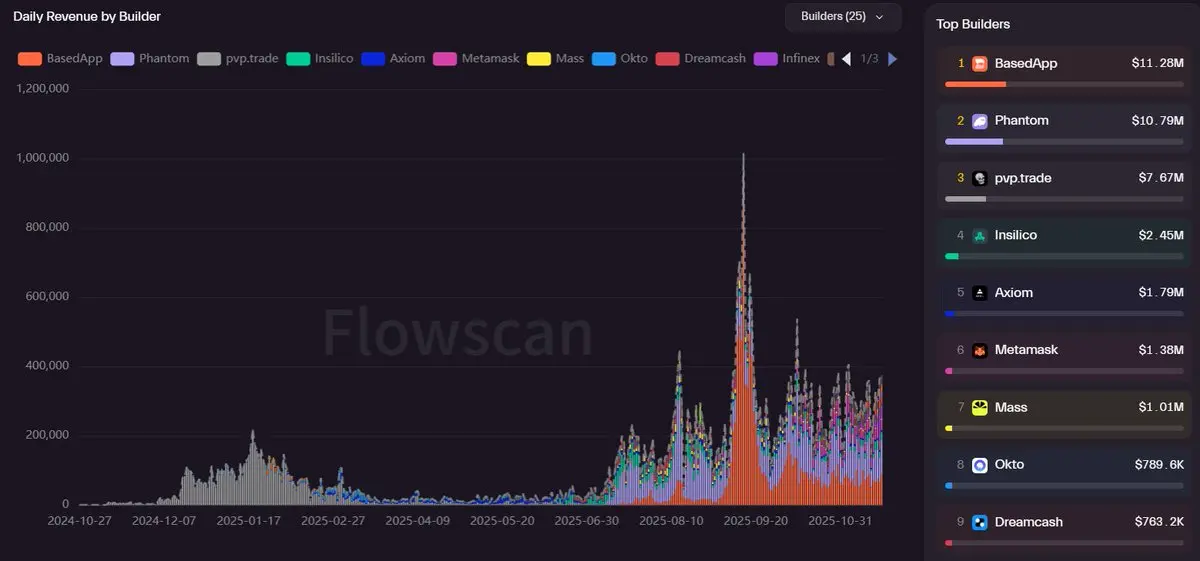

Lancée début juillet, BasedApp n’a mis qu’environ deux mois pour devenir le Builder générant le plus de revenus quotidiens sur Hyperliquid. Actuellement, BasedApp et Phantom sont les deux seuls Hyperliquid Builders dont les revenus cumulés dépassent 10 millions de dollars.

Voir l'originalLancée début juillet, BasedApp n’a mis qu’environ deux mois pour devenir le Builder générant le plus de revenus quotidiens sur Hyperliquid. Actuellement, BasedApp et Phantom sont les deux seuls Hyperliquid Builders dont les revenus cumulés dépassent 10 millions de dollars.

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

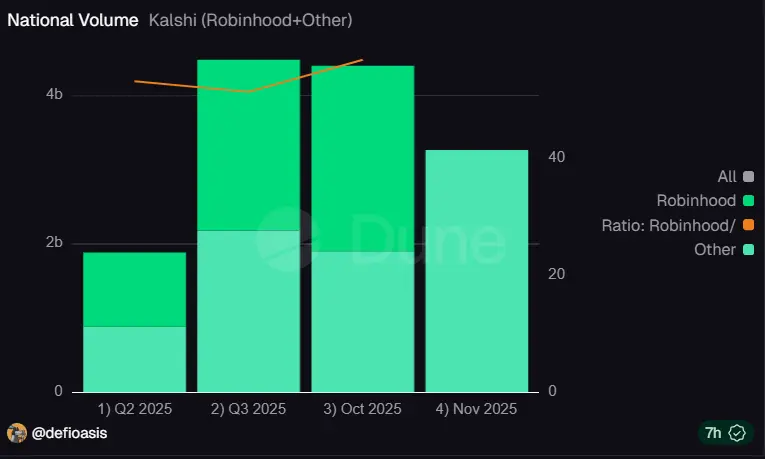

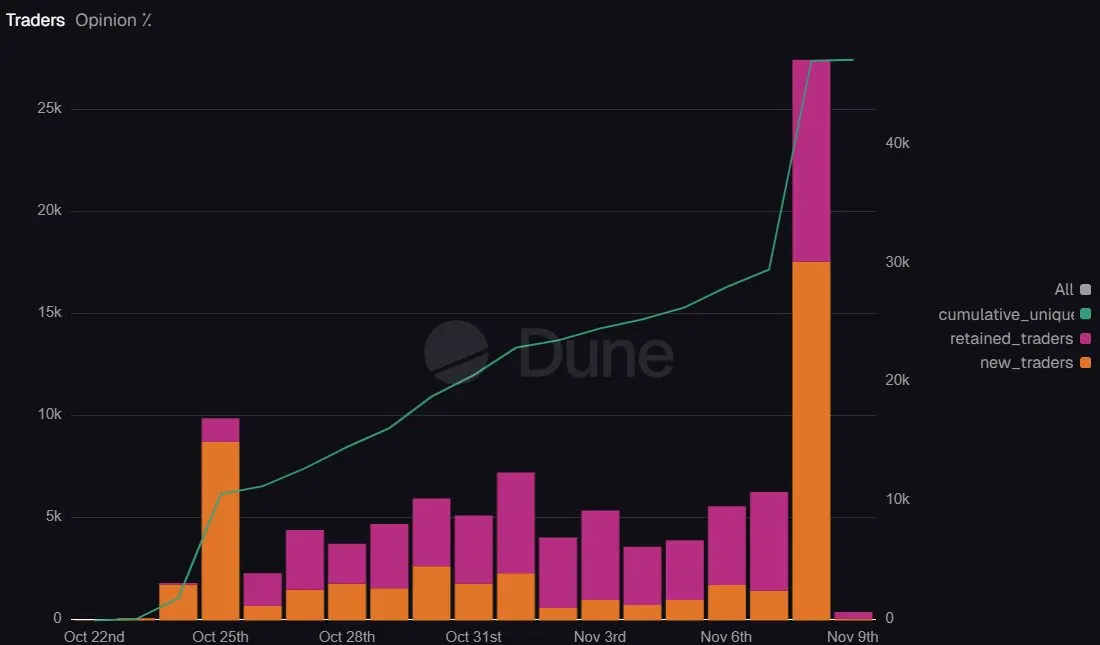

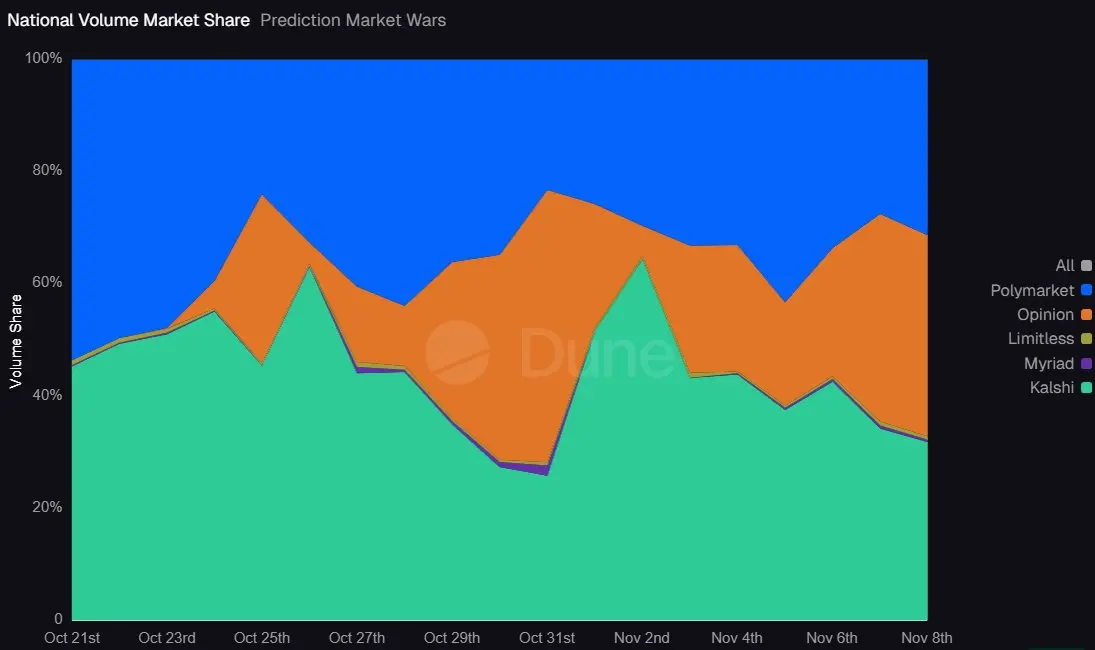

Polymarket et Kalshi adoptent deux modèles radicalement différents.

Polymarket met en place des Builder Codes, l'écosystème et la communauté suivent une approche ascendante, adaptée à tous les types de développeurs Crypto Native ; Kalshi collabore avec Robinhood et Coinbase, s'appuyant sur des courtiers en ligne et des échanges centralisés pour la distribution de flux, adoptant une approche de synergies.

En termes d'efficacité, l'écosystème Polymarket est plus riche, tandis que Kalshi se développe plus rapidement sur une plateforme unique. Polymarket a intégré plus de 170 types

Voir l'originalPolymarket met en place des Builder Codes, l'écosystème et la communauté suivent une approche ascendante, adaptée à tous les types de développeurs Crypto Native ; Kalshi collabore avec Robinhood et Coinbase, s'appuyant sur des courtiers en ligne et des échanges centralisés pour la distribution de flux, adoptant une approche de synergies.

En termes d'efficacité, l'écosystème Polymarket est plus riche, tandis que Kalshi se développe plus rapidement sur une plateforme unique. Polymarket a intégré plus de 170 types

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

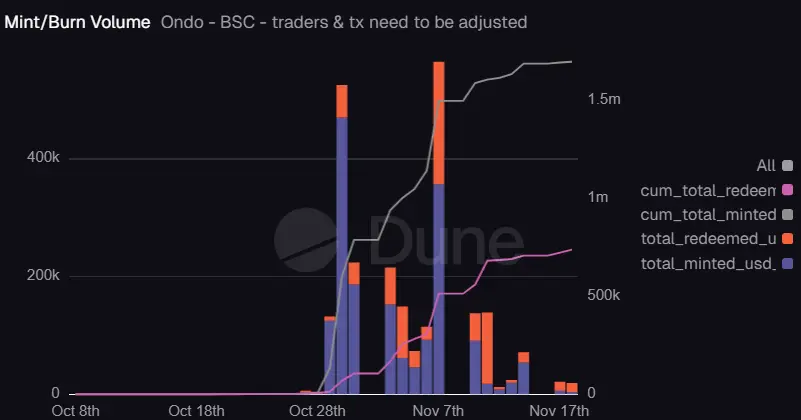

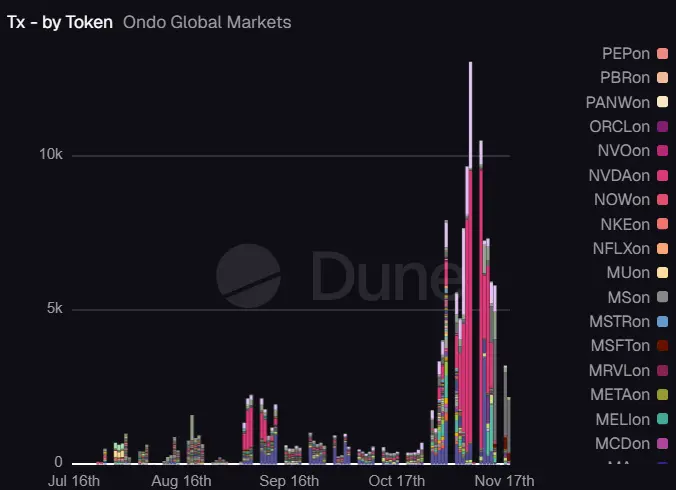

Il y a quelque temps, Ondo Global Markets a effectué une émission de jetons d'actions tokenisées sur BNB Chain, trois semaines plus tard, la situation de développement est inférieure aux attentes.

Ondo a déployé 103 jetons d'actions sur la chaîne BNB dès le début du mois d'octobre, mais jusqu'à aujourd'hui, il n'y a pas eu d'autres nouveaux déploiements. Ces 103 jetons d'actions Ondo ont actuellement un AUM d'environ 820 000 dollars sur la chaîne BNB, dont plus de la moitié de la quantité émise provient des deux premiers jours après leur lancement. Au cours

Voir l'originalOndo a déployé 103 jetons d'actions sur la chaîne BNB dès le début du mois d'octobre, mais jusqu'à aujourd'hui, il n'y a pas eu d'autres nouveaux déploiements. Ces 103 jetons d'actions Ondo ont actuellement un AUM d'environ 820 000 dollars sur la chaîne BNB, dont plus de la moitié de la quantité émise provient des deux premiers jours après leur lancement. Au cours

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

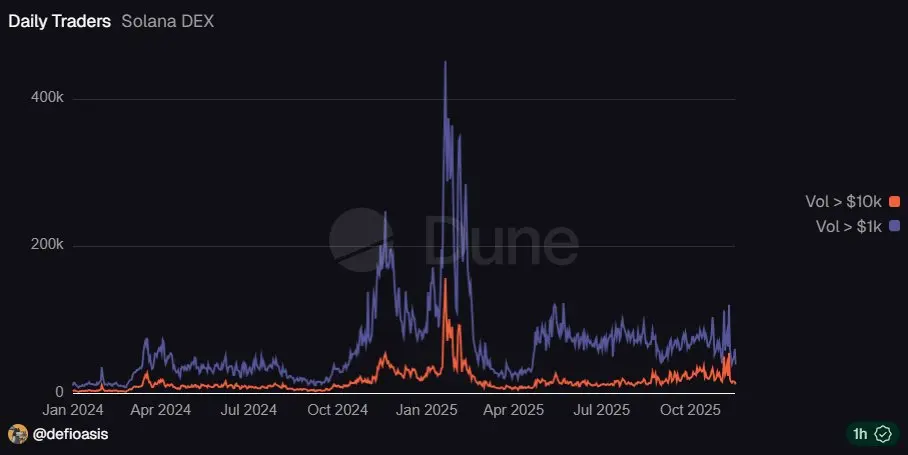

Le nombre d'adresses des utilisateurs de DEX Solana ayant un volume de transactions quotidien supérieur à 1 000 dollars se situe autour de 50 000 à 70 000. Ce groupe de joueurs devrait constituer le noyau le plus essentiel de Solana, et depuis la fin avril, il maintient une relative stabilité dans cette fourchette, sans augmentation significative ni perte évidente.

Dans cette perspective, Solana devrait avoir dépassé la phase de liquidité la plus faible après TRUMP. Au cours des trois mois suivant l'émission de TRUMP, le nombre d'adresses de trading avec un volume quotidien supérie

Dans cette perspective, Solana devrait avoir dépassé la phase de liquidité la plus faible après TRUMP. Au cours des trois mois suivant l'émission de TRUMP, le nombre d'adresses de trading avec un volume quotidien supérie

TRUMP-1.14%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

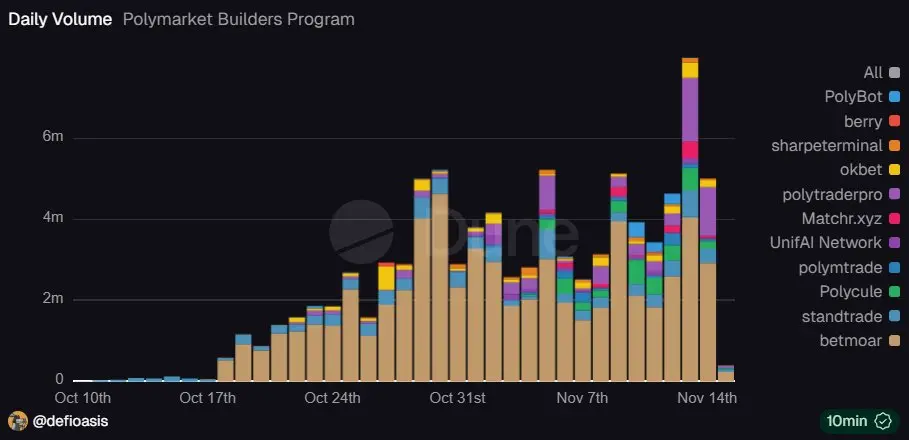

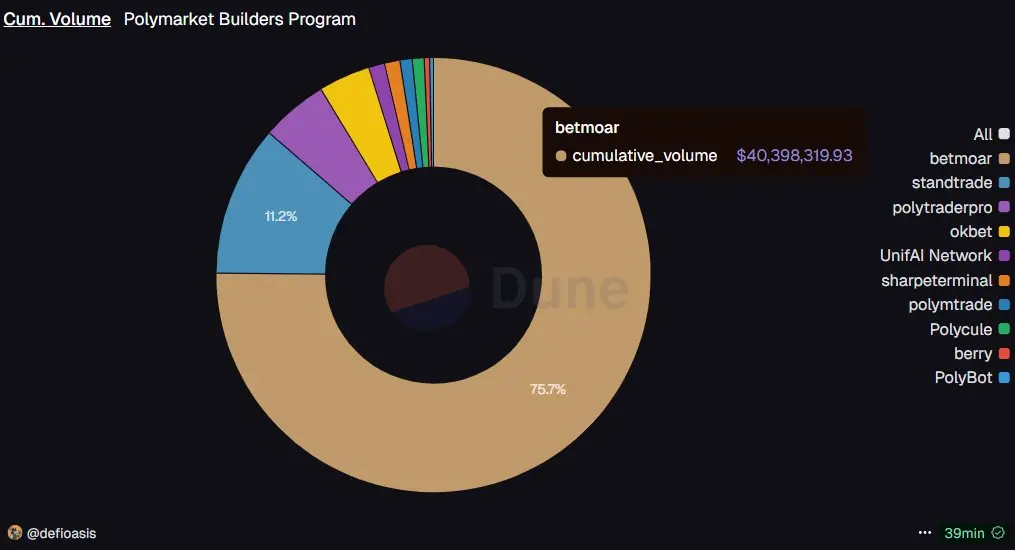

Récemment, les Builders de Polymarket sont assez actifs, avec un volume de transactions quotidien atteignant un nouveau sommet de près de 8 millions de dollars, la part des Builders dans le volume de transactions quotidien de Polymarket dépassant pour la première fois 5 %.

Actuellement, les Builders avec un volume de transactions au niveau de millions de dollars par jour sont Betmoar et PolyTraderPro, parmi lesquels Betmoar est le premier à avoir dépassé un volume de transactions cumulatif de 10 millions de dollars après l'intégration de Builder, et a maintenant accumulé plus de 60 million

Actuellement, les Builders avec un volume de transactions au niveau de millions de dollars par jour sont Betmoar et PolyTraderPro, parmi lesquels Betmoar est le premier à avoir dépassé un volume de transactions cumulatif de 10 millions de dollars après l'intégration de Builder, et a maintenant accumulé plus de 60 million

UAI-4.55%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

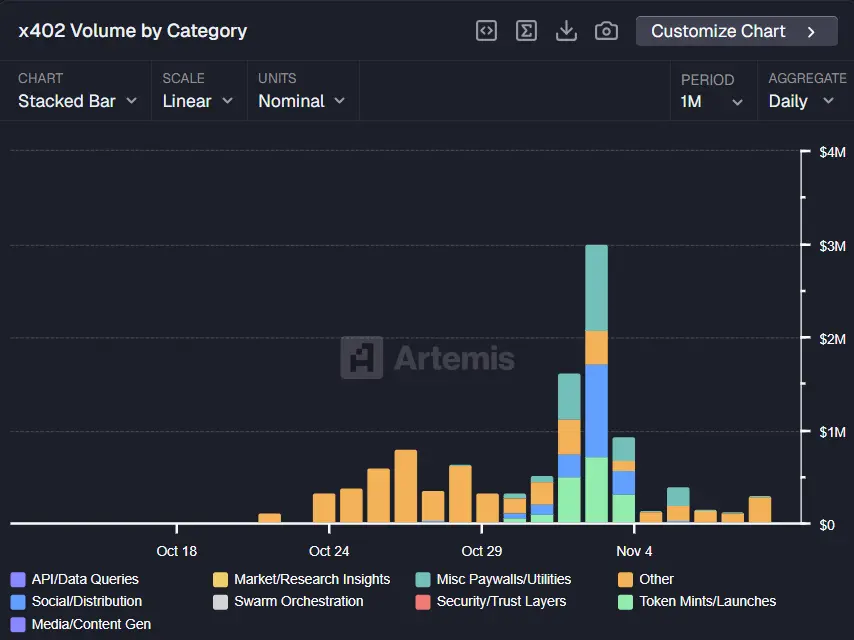

La naissance de nouveaux modes de paiement nécessite de trouver de nouveaux scénarios d'adaptation. Où se trouve le scénario de paiement de x402 ?

Les étiquettes de données créées par Artemis semblent bonnes. Actuellement, les scénarios de paiement x402 peuvent être classés en 8 catégories : API / requêtes de données, marché / insights de recherche, outils de mur payant, social / distribution (comme la publication automatique et l'évaluation de la réputation), orchestration de clusters, couche de sécurité / confiance, création / lancement de jetons (y compris NFT et Memecoins), médias

Voir l'originalLes étiquettes de données créées par Artemis semblent bonnes. Actuellement, les scénarios de paiement x402 peuvent être classés en 8 catégories : API / requêtes de données, marché / insights de recherche, outils de mur payant, social / distribution (comme la publication automatique et l'évaluation de la réputation), orchestration de clusters, couche de sécurité / confiance, création / lancement de jetons (y compris NFT et Memecoins), médias

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

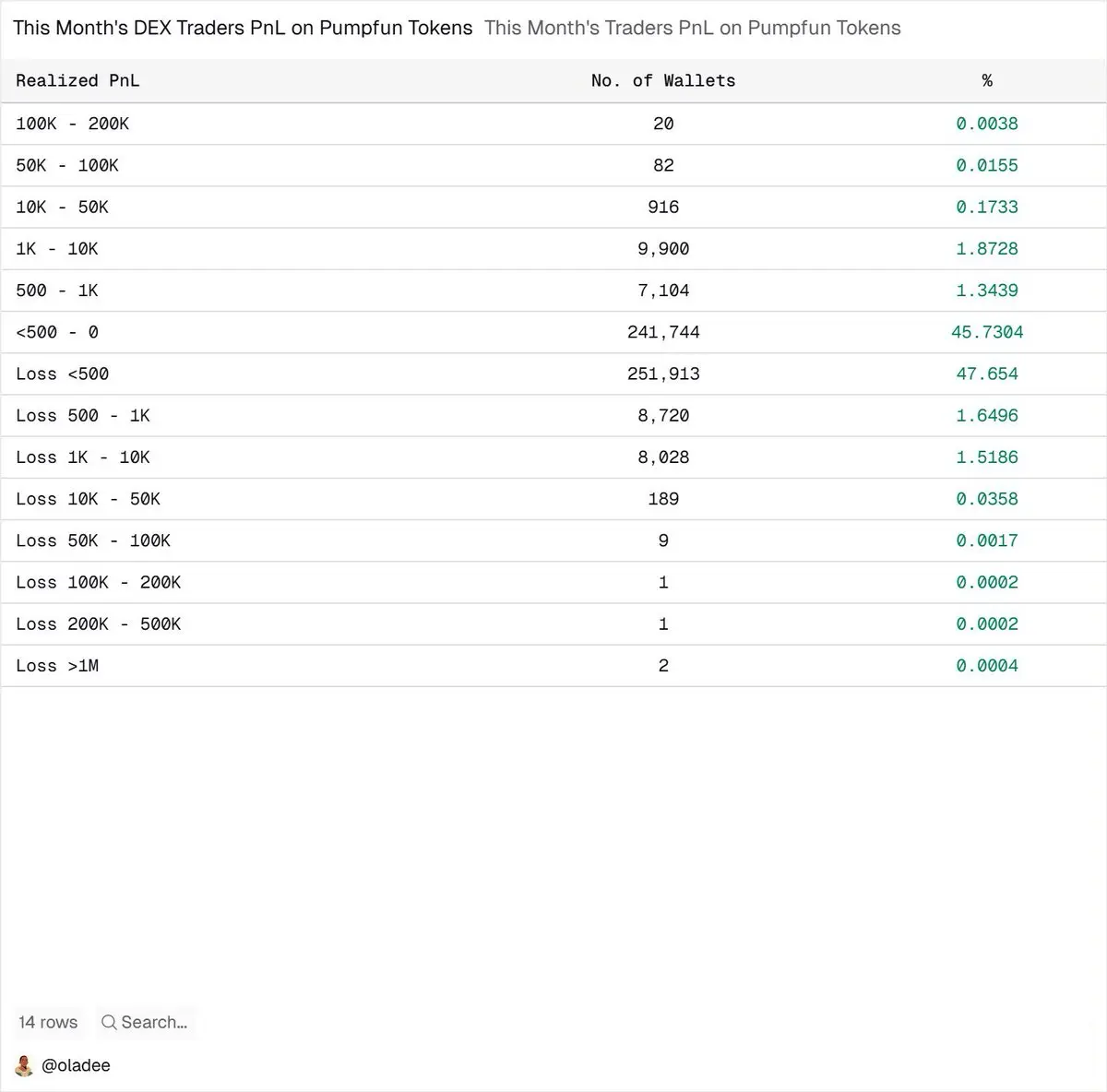

Cela fait un moment que je n'ai pas examiné les données de Solana, et aujourd'hui, je viens de voir les données mensuelles de Pump Fun publiées par @oladeeayo, le professeur Isaac :

- Un bénéfice mensuel supérieur à 500 $ représente déjà le Top 3,4 %.

- Moins de ~100 adresses génèrent un bénéfice mensuel de plus de 50 000 dollars ?? …

- La bonne nouvelle est que les bénéfices mensuels de 0 à 500 dollars sont plutôt nombreux, avec plus de 240 000 adresses.

- Il n'est pas facile de perdre trop, au pire on ne joue pas ou on joue moins, mais il y a encore 13 malheureux qui ont perdu pl

Voir l'original- Un bénéfice mensuel supérieur à 500 $ représente déjà le Top 3,4 %.

- Moins de ~100 adresses génèrent un bénéfice mensuel de plus de 50 000 dollars ?? …

- La bonne nouvelle est que les bénéfices mensuels de 0 à 500 dollars sont plutôt nombreux, avec plus de 240 000 adresses.

- Il n'est pas facile de perdre trop, au pire on ne joue pas ou on joue moins, mais il y a encore 13 malheureux qui ont perdu pl

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

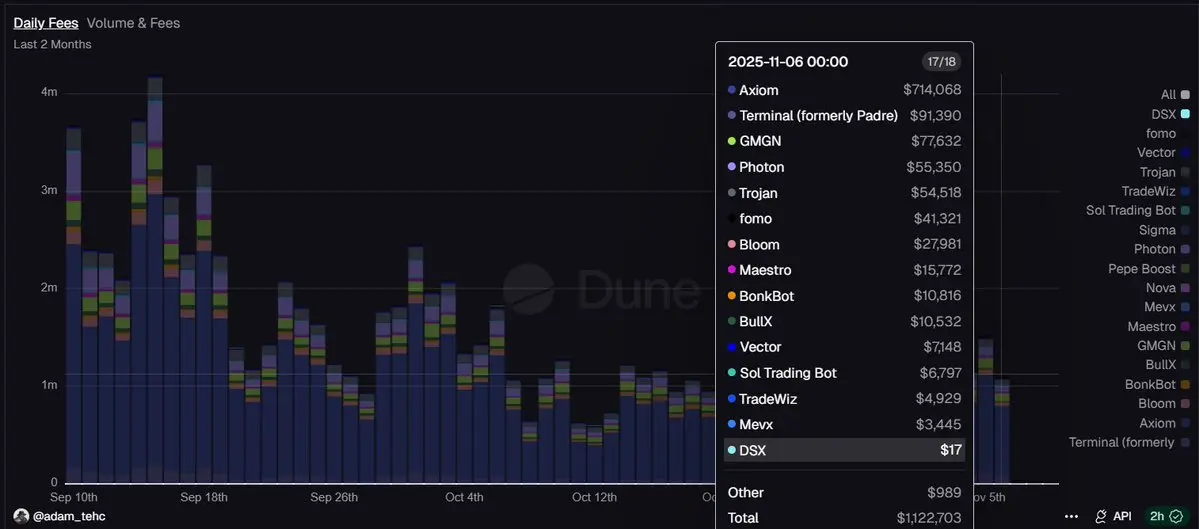

Mis à part Axiom, les autres terminaux de trading de meme Solana ont des frais quotidiens inférieurs à 100 000 dollars, ce qui équivaut à un volume de transactions quotidien inférieur à 10 millions de dollars.

Il faut dire qu'Axiom est vraiment fort, peu importe comment le marché évolue, il maintient toujours une part de marché de plus de 60% sans baisse, avec des revenus quotidiens de 700 000 à 1 000 000 dollars.

Depuis son acquisition par Pump Fun, Padre est devenu le deuxième plus grand terminal de trading de Meme, mais le volume de transactions quotidien n'a en réalité presque pas

Il faut dire qu'Axiom est vraiment fort, peu importe comment le marché évolue, il maintient toujours une part de marché de plus de 60% sans baisse, avec des revenus quotidiens de 700 000 à 1 000 000 dollars.

Depuis son acquisition par Pump Fun, Padre est devenu le deuxième plus grand terminal de trading de Meme, mais le volume de transactions quotidien n'a en réalité presque pas

SOL1.23%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

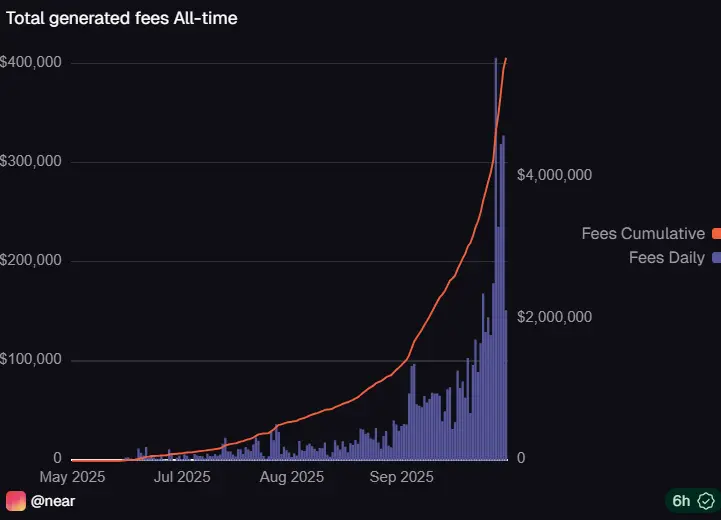

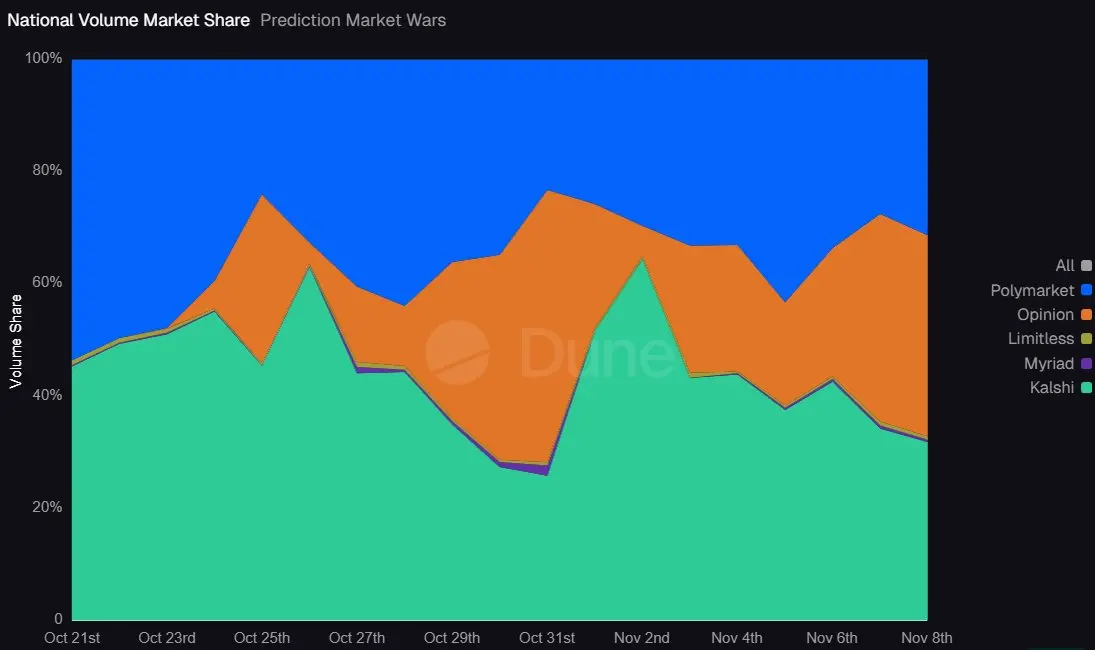

Honnêtement, cela fait longtemps que je n'ai pas regardé Near, mais récemment, il y a eu pas mal de discussions sur Near Intents. J'ai jeté un coup d'œil, et logiquement, c'est un protocole de transaction multichaîne, impliquant des concepts tels que les intentions et les agents AI. Contrairement aux plateformes d'agents AI qui exécutent des transactions avec des primitives ou à un DEX simple, Near Intents sera plus une infrastructure de base, déjà intégrée avec SwapKit, Zashi et Kyberswap, etc.

Depuis novembre, le volume quotidien des transactions de Near Intents est resté

Depuis novembre, le volume quotidien des transactions de Near Intents est resté

Voir l'original

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

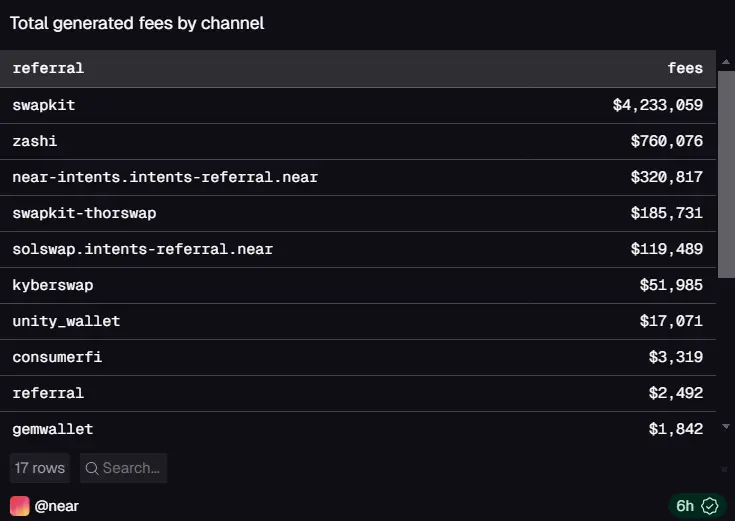

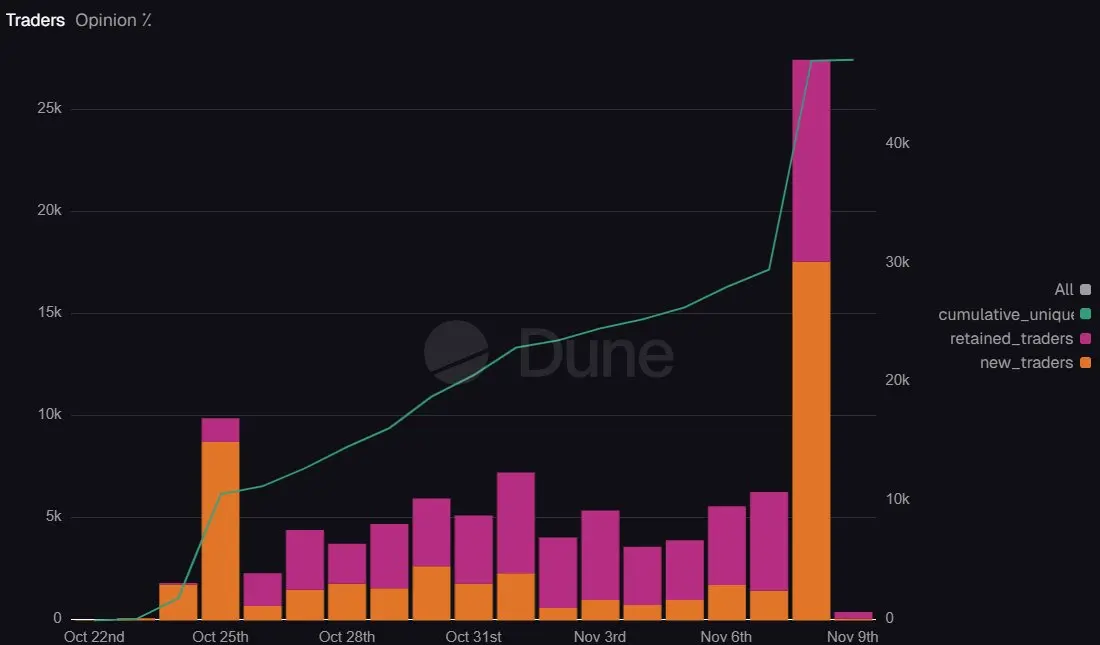

Hier après-midi, il a été annoncé que les utilisateurs de cette semaine >$200 Vol pourront partager 10 000 points de fidélité.

Opinion : Le nombre de nouveaux utilisateurs de trading a considérablement augmenté, avec plus de 17 000 nouvelles adresses de trading qui ont afflué hier, portant le nombre total d'adresses de trading à plus de 27 000, atteignant ainsi un nouveau record historique.

Actuellement, Opinion a récupéré plus de 20%-30% de part de marché en volume de transactions et plus de 8% de part de marché en volume de positions de Polymarket et Kalshi.

Voir l'originalOpinion : Le nombre de nouveaux utilisateurs de trading a considérablement augmenté, avec plus de 17 000 nouvelles adresses de trading qui ont afflué hier, portant le nombre total d'adresses de trading à plus de 27 000, atteignant ainsi un nouveau record historique.

Actuellement, Opinion a récupéré plus de 20%-30% de part de marché en volume de transactions et plus de 8% de part de marché en volume de positions de Polymarket et Kalshi.

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Hier après-midi, il a été annoncé que les utilisateurs de cette semaine >$200 Vol pourront partager 10 000 points de fidélité.

Opinion : Le nombre de nouveaux utilisateurs de trading a considérablement augmenté, avec plus de 17 000 nouvelles adresses de trading arrivant hier, ce qui a porté le nombre total d'adresses de trading à plus de 27 000, établissant un nouveau record historique.

Actuellement, Opinion a réussi à obtenir plus de 20%-30% de part de marché en volume de transactions et plus de 8% de part de marché en positions auprès de Polymarket et Kalshi.

Voir l'originalOpinion : Le nombre de nouveaux utilisateurs de trading a considérablement augmenté, avec plus de 17 000 nouvelles adresses de trading arrivant hier, ce qui a porté le nombre total d'adresses de trading à plus de 27 000, établissant un nouveau record historique.

Actuellement, Opinion a réussi à obtenir plus de 20%-30% de part de marché en volume de transactions et plus de 8% de part de marché en positions auprès de Polymarket et Kalshi.

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

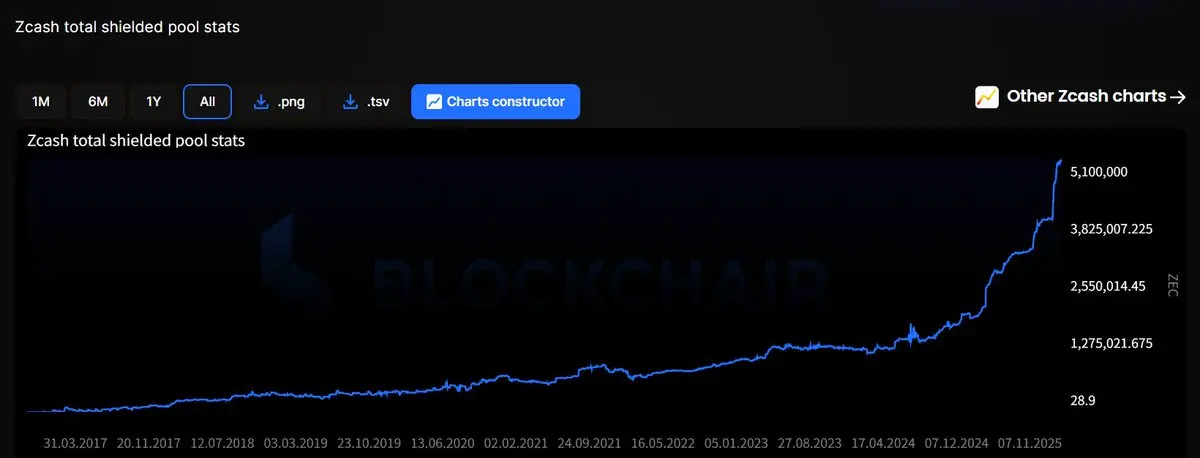

Il y a des affirmations selon lesquelles la hausse de ZEC serait liée aux géants de l'industrie qui blanchissent de l'argent via Zcash. Bien qu'il soit impossible de le prouver directement, les données de la chaîne Zcash montrent qu'il y a effectivement une demande croissante pour la confidentialité.

Les données les plus cruciales montrent que le Shielded Pool de Zcash contient plus de 5 millions de ZEC, représentant plus de 30 % de l'offre totale. La croissance du Shielded Pool s'est fortement accélérée depuis le second semestre de 2024, avec même une période de croiss

Les données les plus cruciales montrent que le Shielded Pool de Zcash contient plus de 5 millions de ZEC, représentant plus de 30 % de l'offre totale. La croissance du Shielded Pool s'est fortement accélérée depuis le second semestre de 2024, avec même une période de croiss

Voir l'original

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Bien qu'ils soient tous deux appelés Builder Codes, Polymarket et Hyperliquid présentent tout de même des différences notables.

Pour Hyperliquid, les codes Builder sont intégrés sous forme de paramètres dans les données de commande, liés à une adresse de builder spécifique, permettant de distinguer et de tracer la source de trafic sur la chaîne. Le Builder de Polymarket s'intègre principalement via des clés API et un client Relayer, qui sont hors chaîne, et il semble qu'il n'y ait pas de moyen de distinguer directement les transactions natives et celles des Builders à partir de

Voir l'originalPour Hyperliquid, les codes Builder sont intégrés sous forme de paramètres dans les données de commande, liés à une adresse de builder spécifique, permettant de distinguer et de tracer la source de trafic sur la chaîne. Le Builder de Polymarket s'intègre principalement via des clés API et un client Relayer, qui sont hors chaîne, et il semble qu'il n'y ait pas de moyen de distinguer directement les transactions natives et celles des Builders à partir de

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

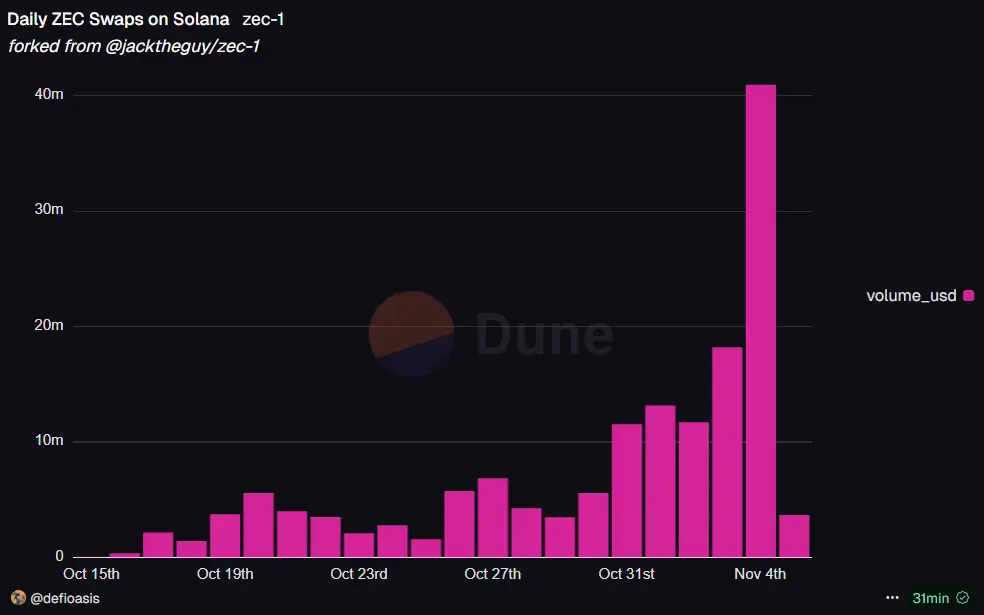

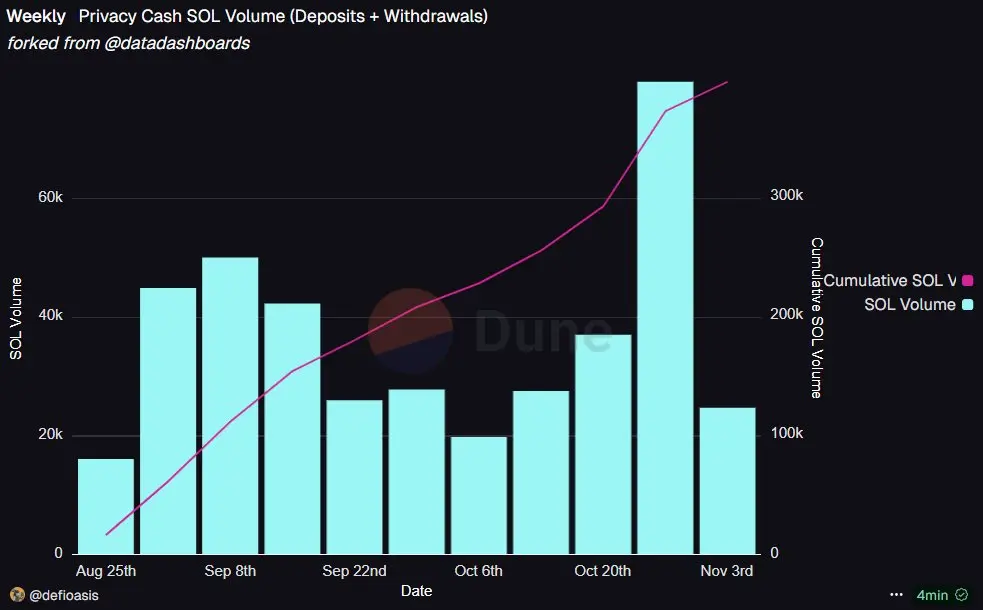

Le vent de la confidentialité de Solana

Précédemment, ZEC a été transféré vers Solana, et la plateforme de trading anonyme HumidiFi a lancé ZEC. En seulement deux semaines, le volume quotidien de transactions de ZEC sur le DEX de Solana a dépassé 40 millions de dollars, contribuant à plus de 2 % du volume total de transactions sur le réseau.

D'autre part, le protocole de confidentialité Solana Privacy Cash a traité un nombre record d'environ 80 000 SOL de transferts anonymes en une semaine.

Vie privée Vie privée ou vie privée🧐

Précédemment, ZEC a été transféré vers Solana, et la plateforme de trading anonyme HumidiFi a lancé ZEC. En seulement deux semaines, le volume quotidien de transactions de ZEC sur le DEX de Solana a dépassé 40 millions de dollars, contribuant à plus de 2 % du volume total de transactions sur le réseau.

D'autre part, le protocole de confidentialité Solana Privacy Cash a traité un nombre record d'environ 80 000 SOL de transferts anonymes en une semaine.

Vie privée Vie privée ou vie privée🧐

SOL1.23%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

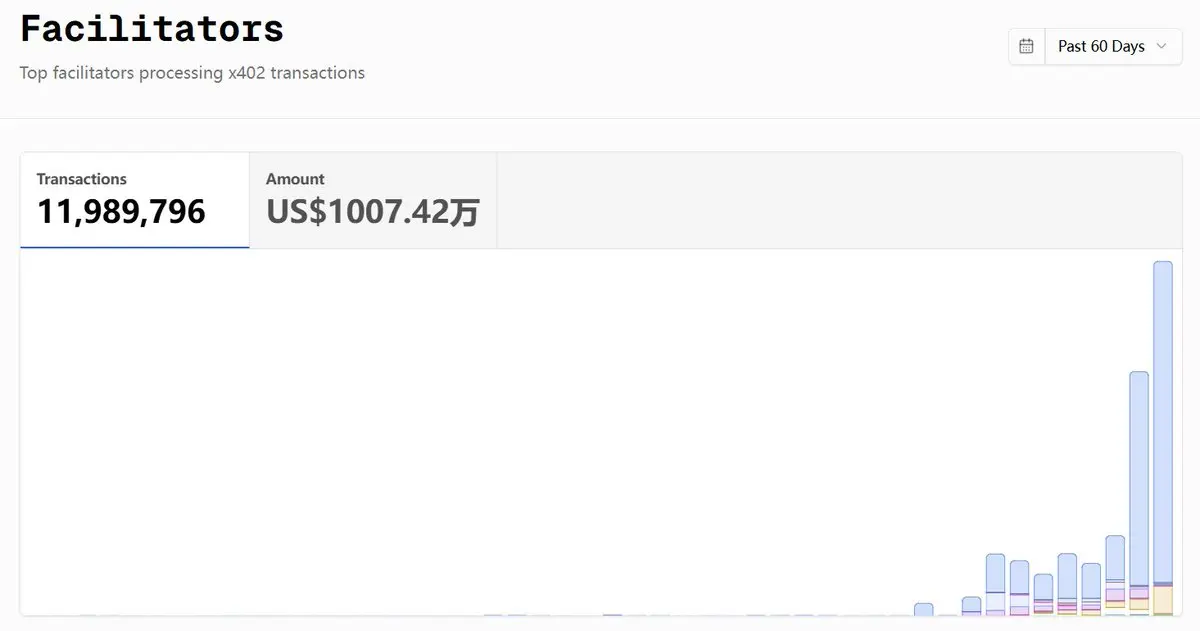

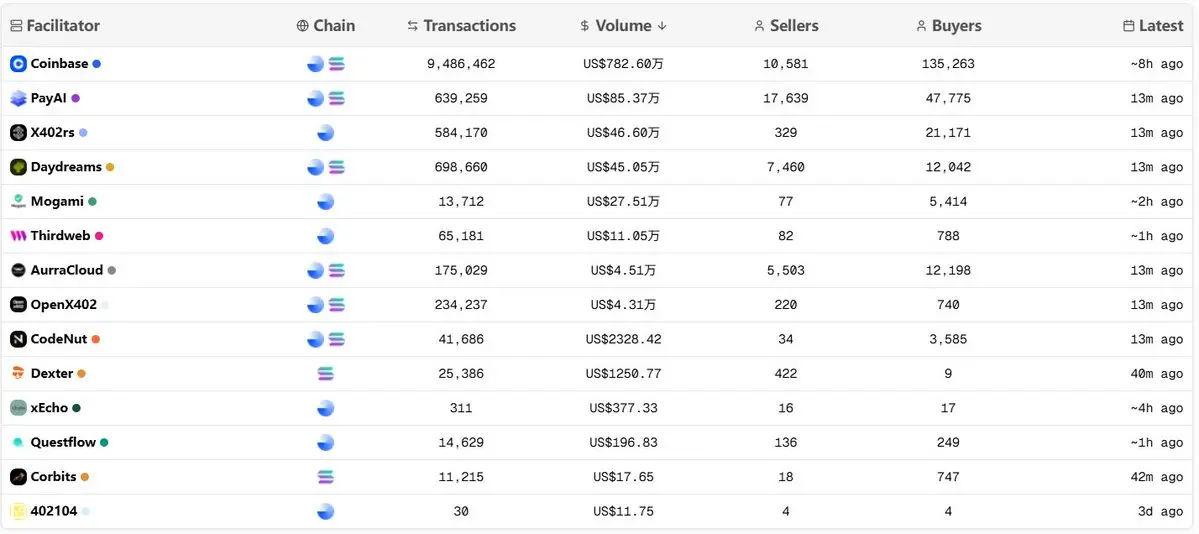

x402 Facilitators ont déjà traité plus de 10 millions de dollars de volume de paiements, mais en même temps, la concurrence devient de plus en plus forte, avec près de 15 entreprises s'engageant dans cette direction de l'enregistrement des transactions x402.

Il y a déjà 6 facilitateurs x402 traitant un volume de paiements supérieur à 100 000 dollars, avec des entreprises comme Daydreams et X402rs qui émergent rapidement, ayant déjà traité plus de 400 000 dollars de volume de paiements et plus de 500 000 transactions. La principale raison reste que le seuil technologique des facilitateu

Voir l'originalIl y a déjà 6 facilitateurs x402 traitant un volume de paiements supérieur à 100 000 dollars, avec des entreprises comme Daydreams et X402rs qui émergent rapidement, ayant déjà traité plus de 400 000 dollars de volume de paiements et plus de 500 000 transactions. La principale raison reste que le seuil technologique des facilitateu

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

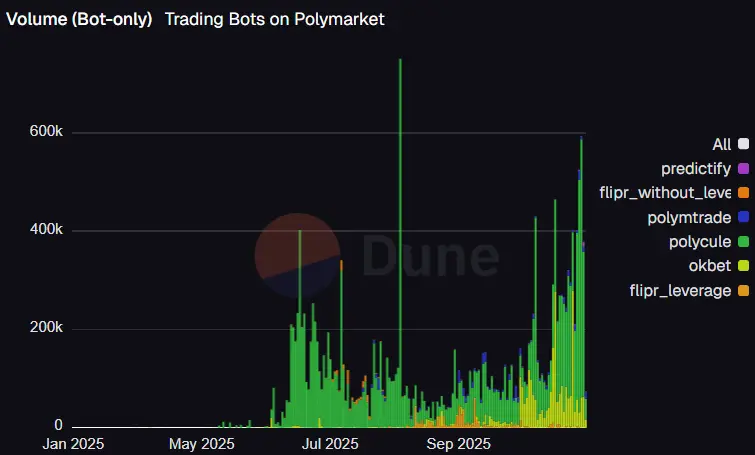

Tout comme Hyperliquid Builder, le programme Builder de Polymarket est également en ligne.

Selon les données officielles, il y a actuellement 7 Trading Bots (terminaux de trading / TG Bots) intégrés à Builder Codes pour construire des plateformes de distribution, avec un volume de transactions quotidien d'environ 3 à 5 millions de dollars, représentant moins de 5 % du volume de transactions de Polymarket. Parmi ces plateformes, plus de 90 % du volume de transactions est concentré sur l'ancien terminal Betmoar.

Cependant, actuellement une partie importante des Trading Bots ne prélève pa

Voir l'originalSelon les données officielles, il y a actuellement 7 Trading Bots (terminaux de trading / TG Bots) intégrés à Builder Codes pour construire des plateformes de distribution, avec un volume de transactions quotidien d'environ 3 à 5 millions de dollars, représentant moins de 5 % du volume de transactions de Polymarket. Parmi ces plateformes, plus de 90 % du volume de transactions est concentré sur l'ancien terminal Betmoar.

Cependant, actuellement une partie importante des Trading Bots ne prélève pa

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

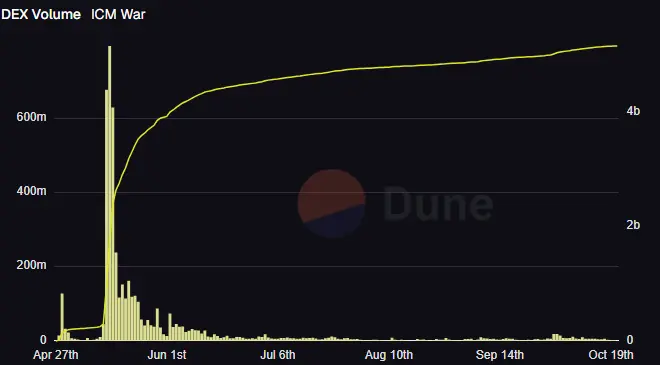

Peut-être que c'était autrefois trop éblouissant, comment la fin de Believe ne peut-elle pas être touchante ?

Mi-mai de cette année, Believe a lancé seul la vague de narration de l'ICM Launchpad, avec un volume de transactions quotidien des tokens écologiques atteignant 600 à 800 millions de dollars, offrant un nouvel espoir pour les mèmes. Malheureusement, ce ne fut qu'une étoile filante, et après six mois d'attente, Flywheel a décidé d'augmenter l'émission et a produit une vidéo abstraite..

Aujourd'hui, abandonné par tous, certains projets leaders ne sont plus dig

Voir l'originalMi-mai de cette année, Believe a lancé seul la vague de narration de l'ICM Launchpad, avec un volume de transactions quotidien des tokens écologiques atteignant 600 à 800 millions de dollars, offrant un nouvel espoir pour les mèmes. Malheureusement, ce ne fut qu'une étoile filante, et après six mois d'attente, Flywheel a décidé d'augmenter l'émission et a produit une vidéo abstraite..

Aujourd'hui, abandonné par tous, certains projets leaders ne sont plus dig

- Récompense

- 2

- Commentaire

- Reposter

- Partager

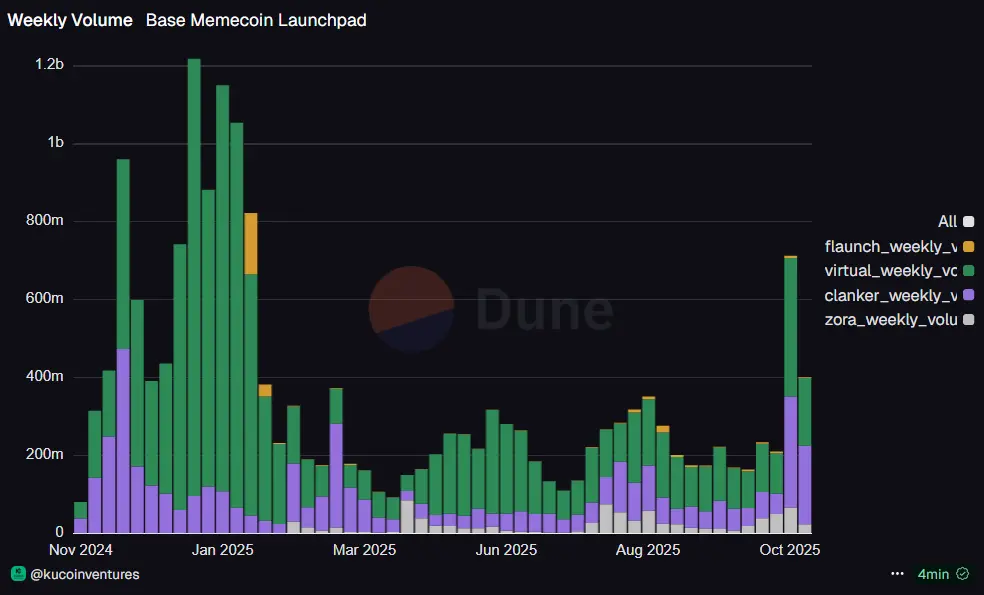

Après l'acquisition de Clanker et x402 par Farcaster, la tendance des Virtuals – AI Agents a été ravivée.

Le volume des échanges de jetons sur le Base Memecoin Launchpad, représenté par Clanker et Virtuals, a considérablement augmenté, atteignant un sommet depuis février de cette année, bien qu'il reste encore loin de l'engouement des AI Agents à la fin de l'année dernière.

La version de base de Clanker + Virtuals, la combinaison "Général + AI", a rivalisé à la fin de l'année dernière avec Pump Fun + ai16z de Solana. Malheureusement, le temps a passé et les choses ont chang

Le volume des échanges de jetons sur le Base Memecoin Launchpad, représenté par Clanker et Virtuals, a considérablement augmenté, atteignant un sommet depuis février de cette année, bien qu'il reste encore loin de l'engouement des AI Agents à la fin de l'année dernière.

La version de base de Clanker + Virtuals, la combinaison "Général + AI", a rivalisé à la fin de l'année dernière avec Pump Fun + ai16z de Solana. Malheureusement, le temps a passé et les choses ont chang

CLANKER3.15%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Voir que le plus grand Prop AMM dark pool HumidiFi va émettre un jeton, lancer un jeton au moment où l'activité est à son apogée pourrait également permettre d'obtenir une valorisation de marché et une prime plus élevées.

Prop AMM se développe très rapidement sur Solana cette année, occupant maintenant presque 35 % à 40 % du volume quotidien des échanges DEX de Solana, dont HumidiFi représente 60 % du volume des transactions de Prop AMM.

En réalité, HumidiFi a été lancé seulement à la mi-juin de cette année, et le volume des transactions quotidien est désormais supérieur à 1 milliard d

Voir l'originalProp AMM se développe très rapidement sur Solana cette année, occupant maintenant presque 35 % à 40 % du volume quotidien des échanges DEX de Solana, dont HumidiFi représente 60 % du volume des transactions de Prop AMM.

En réalité, HumidiFi a été lancé seulement à la mi-juin de cette année, et le volume des transactions quotidien est désormais supérieur à 1 milliard d

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager