2025 AVAAI Fiyat Tahmini: Genişleyen Yapay Zeka Sektöründe AVAAI'nin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Giriş: AVAAI'nin Pazar Konumu ve Yatırım Potansiyeli

AVA (AVAAI), Holoworld AI tarafından piyasaya sürülen ilk amiral gemisi yapay zeka ajanı olarak kuruluşundan bu yana kayda değer ilerlemeler gösterdi. 2025 itibarıyla AVA'nın piyasa değeri 18.955.163 dolar seviyesine ulaşırken, dolaşımdaki arz yaklaşık 999.217.903 token ve fiyatı 0,01897 dolar civarında seyrediyor. “Görsel yapay zeka öncüsü” olarak bilinen bu varlık, görsel-işitsel yapay zeka ajanları ve NFT tabanlı dijital avatarlar alanında giderek daha önemli bir rol üstleniyor.

Bu makalede, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunmak amacıyla, 2025-2030 yılları arasında AVA'nın fiyat trendleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler doğrultusunda kapsamlı biçimde analiz edilecektir.

I. AVAAI Fiyat Geçmişi ve Mevcut Piyasa Durumu

AVAAI Tarihsel Fiyat Gelişimi

- 2025: Proje lansmanı ile 15 Ocak tarihinde fiyat tüm zamanların en yüksek seviyesi olan 0,338 dolara ulaştı

- 2025: Piyasa düzeltmesiyle fiyat, 2 Ocak'ta tüm zamanların en düşük seviyesi olan 0,01035 dolara geriledi

- 2025: Kademeli toparlanma sonrası, güncel fiyat 0,01897 dolar civarında dengelendi

AVAAI Güncel Piyasa Durumu

5 Ekim 2025 tarihinde AVAAI tokenı 0,01897 dolardan işlem görüyor. Son 24 saatte %0,99 oranında değer kaybeden tokenın işlem hacmi 557.545,99 dolara ulaştı. AVAAI'nin piyasa değeri 18.955.163,63 dolar olup, genel kripto para piyasasında 1.127'nci sırada yer alıyor. Dolaşımdaki arz 999.217.903,34463 AVAAI ile toplam arzın %99,92'sine tekabül ediyor (toplam arz: 999.943.930,924107 token). Son 24 saatteki düşüşe karşın, AVAAI son bir haftada %2,6 oranında artış göstererek kısa vadede yükseliş eğiliminde. Ancak, son 30 günde %18,95 ve son bir yılda %63,035 oranında değer kaybetmesi, uzun vadede düşüş eğilimi olduğunu gösteriyor.

Güncel AVAAI piyasa fiyatını görmek için tıklayın

AVAAI Piyasa Duyarlılığı Endeksi

2025-10-05 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda açgözlülük hakim; Korku ve Açgözlülük Endeksi 74 seviyesine ulaşmış durumda. Bu, yatırımcıların iyimserliğinin yüksek olduğunu ve fiyatları yukarı çekebileceğini gösteriyor. Ancak, aşırı açgözlülük piyasada düzeltmelere yol açabilir. Yatırımcılar, kâr almayı veya pozisyonlarını hedge etmeyi değerlendirmeli, temel direnç seviyelerini ve piyasa gelişmelerini takip etmelidir. Sürdürülebilir büyüme, kısa vadeli coşkudan daha önemlidir. Gate.com’da bilinçli ve sorumlu işlem yapmaya özen gösterin.

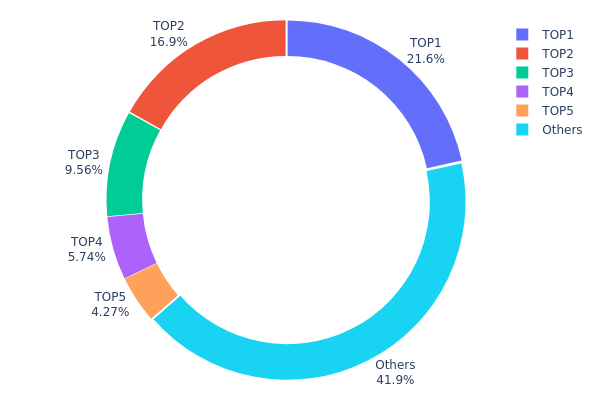

AVAAI Varlık Dağılımı

AVAAI’nin adres bazlı varlık dağılımı, oldukça yoğunlaşmış bir sahiplik yapısına işaret ediyor. En büyük 5 adres, toplam arzın %58,04’ünü elinde bulundururken, en büyük sahip %21,57 paya sahip. Bu yapı, az sayıda adresin piyasada önemli etki yaratma potansiyelini gösteriyor.

Böyle bir dağılım, piyasa istikrarı ve fiyat manipülasyonu riskleri açısından endişelere yol açabilir. Özellikle ilk iki büyük adresin toplamda %38’in üzerinde paya sahip olması, büyük alım-satım işlemleriyle piyasada ciddi baskı oluşturabilir. Bu konsantrasyon, AVAAI piyasasında oynaklığı ve likidite eksikliğini artırabilir.

Diğer yandan, arzın %41,96’sı farklı adresler arasında dağılmış durumda. Bu, daha geniş bir piyasa katılımı sağlasa da, genel yapı AVAAI’nin zincir üstü istikrarının ve manipülasyona karşı direncinin mevcut dağılım nedeniyle sınırlı olduğunu gösteriyor.

Güncel AVAAI Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 2iwfzt...VLtRhr | 215.554,61K | 21,57% |

| 2 | u6PJ8D...ynXq2w | 169.091,69K | 16,92% |

| 3 | 44P5Ct...J4Dyra | 95.515,87K | 9,55% |

| 4 | 5Q544f...pge4j1 | 57.356,04K | 5,74% |

| 5 | A77HEr...oZ4RiR | 42.620,81K | 4,26% |

| - | Diğerleri | 419.079,11K | 41,96% |

II. AVAAI’nin Gelecek Fiyatını Belirleyen Temel Faktörler

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankası politikalarının, AVAAI ve genel kripto piyasası üzerinde belirleyici etkisi olması bekleniyor.

- Jeopolitik Faktörler: Ticaret savaşları gibi küresel gelişmeler, AVAAI fiyat hareketlerini önemli ölçüde etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşturma

- Ekosistem Uygulamaları: AVAAI ağı üzerinde geliştirilecek DApp ve ekosistem projeleri, token’ın gelecekteki değerinde belirleyici rol oynayacak.

III. AVAAI 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,01439 - 0,01893 dolar

- Tarafsız tahmin: 0,01893 - 0,02035 dolar

- İyimser tahmin: 0,02035 - 0,02177 dolar (olumlu piyasa duyarlılığı gerektirir)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Büyüme potansiyeli dönemi

- Fiyat aralığı tahmini:

- 2027: 0,01529 - 0,02946 dolar

- 2028: 0,02052 - 0,03169 dolar

- Temel katalizörler: Artan benimseme ve teknolojik ilerleme

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,02883 - 0,03013 dolar (istikrarlı piyasa büyümesi varsayımı)

- İyimser senaryo: 0,03013 - 0,04398 dolar (güçlü piyasa performansı varsayımı)

- Dönüştürücü senaryo: 0,04398+ dolar (sıra dışı piyasa şartları ve yaygın benimseme halinde)

- 2030-12-31: AVAAI 0,04398 dolar (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,02177 | 0,01893 | 0,01439 | 0 |

| 2026 | 0,02462 | 0,02035 | 0,01323 | 7 |

| 2027 | 0,02946 | 0,02249 | 0,01529 | 18 |

| 2028 | 0,03169 | 0,02597 | 0,02052 | 36 |

| 2029 | 0,03142 | 0,02883 | 0,01816 | 51 |

| 2030 | 0,04398 | 0,03013 | 0,01687 | 58 |

IV. AVAAI Profesyonel Yatırım Stratejileri ve Risk Yönetimi

AVAAI Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Hedef kitle: Yüksek risk toleranslı uzun vadeli yatırımcılar

- Uygulama önerileri:

- Piyasa geri çekilmelerinde AVAAI token biriktirin

- Fiyat hedefleri belirleyip portföyünüzü düzenli olarak dengeleyin

- Tokenlarınızı güvenli Gate Web3 cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası giriş/çıkış noktalarını belirlemek için kullanılır

- RSI: Aşırı alım/aşırı satım durumlarını ölçmek için kullanılır

- Salınım işlemleri için önemli noktalar:

- AI sektörü haberlerini ve Holoworld AI gelişmelerini takip edin

- Riskleri sınırlamak için zararı durdur emirleri kullanın

AVAAI Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: En fazla %15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı birden fazla yapay zeka ve blockchain projesine dağıtın

- Zararı durdur emirleri: Olası kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 cüzdan

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve özel anahtar yedeklemesi

V. AVAAI İçin Potansiyel Riskler ve Zorluklar

AVAAI Piyasa Riskleri

- Oynaklık: Kripto piyasalarında yüksek fiyat dalgalanmaları yaygındır

- Rekabet: Yeni AI projeleri AVAAI'nin pazar payını etkileyebilir

- Likidite: Sınırlı işlem hacmi fiyat istikrarını olumsuz etkileyebilir

AVAAI Düzenleyici Riskler

- Belirsiz düzenlemeler: Gelişen kripto ve yapay zeka mevzuatı operasyonları etkileyebilir

- Uyum zorlukları: Küresel düzenleyici standartlara uyumda güçlük yaşanabilir

- Hukuki statü: Bazı ülkelerde menkul kıymet olarak sınıflandırılma riski

AVAAI Teknik Riskler

- Akıllı sözleşme açıkları: Kodda açık veya hata olasılığı

- Ölçeklenebilirlik sorunları: Ağ talebindeki artışa yanıt vermede zorluklar

- Entegrasyon problemleri: Yeni AI teknolojilerinin uyumunda yaşanabilecek aksaklıklar

VI. Sonuç ve Eylem Önerileri

AVAAI Yatırım Potansiyeli Değerlendirmesi

AVAAI, gelişen dijital ekosistemde uzun vadeli potansiyele sahip yenilikçi bir AI projesi olarak öne çıkıyor. Ancak yatırımcıların, kripto ve AI alanındaki kısa vadeli oynaklık ve mevzuat belirsizlikleri konusunda temkinli olmaları gerekmektedir.

AVAAI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük ve kademeli yatırımlarla piyasaya adım atabilir ✅ Deneyimli yatırımcılar: Belirli fiyat hedefleriyle düzenli alım stratejisi uygulayabilir ✅ Kurumsal yatırımcılar: Detaylı inceleme yapmalı ve büyük işlemler için OTC piyasasını değerlendirmeli

AVAAI İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden AVAAI token alıp satabilirsiniz

- Staking: Mevcut ise staking programlarına katılabilirsiniz

- DeFi entegrasyonu: Uygun olduğunda merkeziyetsiz finans seçeneklerini değerlendirin

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk toleranslarına göre hareket etmeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

Sıkça Sorulan Sorular

Ava AI iyi bir yatırım mı?

Evet, Ava AI 2025 için güçlü bir potansiyele sahip. Yükseliş beklentisi, bunun cazip bir yatırım fırsatı olabileceğini gösteriyor.

AVAAI token için 2030 fiyat öngörüsü nedir?

Son fiyat analizi verilerine göre, AVAAI token’ın 2030 yılında 180,05 dolara ulaşacağı tahmin edilmektedir.

Hangi kripto para 1000x potansiyeli taşıyor?

Bitcoin Hyper, Maxi Doge ve PEPENODE; sırasıyla Bitcoin L2 ölçeklenmesi, meme kültürü ve oyunlaştırılmış madencilik ile 1000x potansiyele sahip görünüyor.

2025’te hangi AI kripto projesi öne çıkacak?

Bittensor, merkeziyetsiz AI alanındaki rolüyle 2025’te öne çıkacak. NEAR da AI kripto sektöründe kayda değer büyüme potansiyeli taşıyor.

2025 HOLO Fiyat Tahmini: Halving Sonrası Kripto Piyasasında Trendler ve Büyüme Potansiyeli Analizi

2025 COOKIE Fiyat Tahmini: Dijital Cookie Ekonomisi için Piyasa Analizi ve Gelecek Perspektifi

2025 SIREN Fiyat Tahmini: Gelecek Perspektifi, Piyasa Analizi ve Bu Gelişen Kripto Varlığı Şekillendiren Temel Dinamikler

2025 XNY Fiyat Tahmini: Piyasa Trendleri, Teknik Göstergeler ve Kripto Para Yatırımcıları İçin Gelecek Perspektifinin Analizi

2025 ACT Fiyat Tahmini: Gelişen kripto ekosisteminde ACT tokenlarının piyasa trendlerini ve gelecekteki değerlemesini analiz ediyoruz

2025 CLORE Fiyat Tahmini: Kripto Paranın Piyasa Eğilimleri ve Gelecek Beklentilerinin Analizi

DeFi ekosisteminde teminatsız kredi sağlamanın temelini oluşturan Flash Kredileri anlamak

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler