2025 XNY Fiyat Tahmini: Piyasa Trendleri, Teknik Göstergeler ve Kripto Para Yatırımcıları İçin Gelecek Perspektifinin Analizi

Giriş: XNY'nin Piyasa Konumu ve Yatırım Potansiyeli

Codatta (XNY), merkeziyetsiz protokol ve veri altyapısı olarak, kuruluşundan bu yana kullanıcıların bilgilerini dijital varlıklara dönüştürmelerini mümkün kılıyor. 2025 yılı itibarıyla Codatta'nın piyasa değeri 19.395.000 $'a ulaşırken, yaklaşık 2.500.000.000 dolaşımdaki token ve 0,007758 $ civarında işlem gören bir fiyat ile öne çıkıyor. "Yapay zekâ tabanlı telif hakkı sağlayıcı" olarak bilinen bu varlık, bilgi gelirleştirme ve yapay zekâ tabanlı içerik üretimi alanında giderek daha kritik bir rol üstleniyor.

Bu makalede, Codatta'nın 2025-2030 yılları arasındaki fiyat eğilimleri detaylı şekilde incelenecek; tarihsel desenler, piyasa arz-talep dengesi, ekosistem büyümesi ve makroekonomik faktörler değerlendirilerek yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacak.

I. XNY Fiyat Geçmişi ve Güncel Piyasa Durumu

XNY Tarihsel Fiyat Gelişimi

- 2025 (Temmuz): İlk çıkış, fiyat 0,01 $ ile başladı

- 2025 (31 Temmuz): Tüm zamanların en düşük seviyesi 0,002231 $

- 2025 (16 Ağustos): Tüm zamanların en yüksek seviyesi 0,030677 $

XNY Güncel Piyasa Durumu

5 Ekim 2025 itibarıyla XNY tokeni 0,007758 $ seviyesinde işlem görüyor. Son 24 saatte %1,84 değer kaybeden tokenin işlem hacmi 230.743,25 $ olarak gerçekleşti. XNY'nin piyasa değeri 19.395.000 $ olup, kripto para piyasasında 1.120'nci sırada yer alıyor.

Tokenin farklı zaman dilimlerinde performansı şu şekilde:

- 1 saatlik değişim: +%0,4

- 7 günlük değişim: +%9,64

- 30 günlük değişim: +%3,40

- 1 yıllık değişim: +%28,83

XNY'nin dolaşımdaki arzı 2.500.000.000 token ile toplam arzın %25'ini oluşturuyor (toplam arz: 10.000.000.000). Tam seyreltilmiş piyasa değeri ise 77.580.000 $'dır.

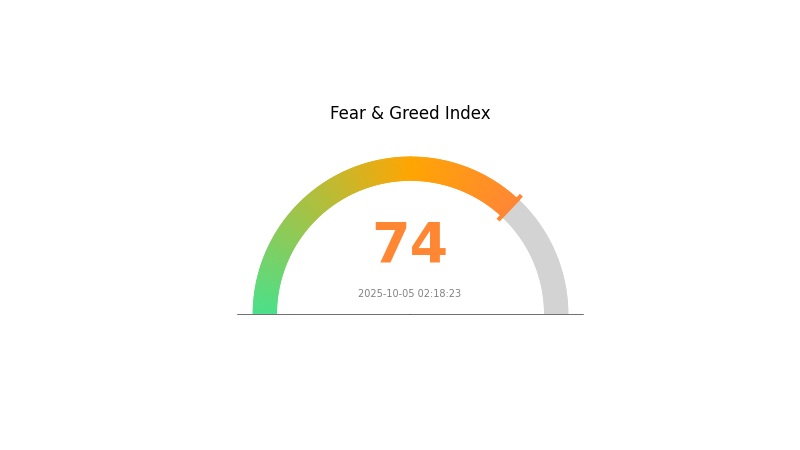

Piyasa duyarlılığı "Açgözlülük" olarak tanımlanıyor ve VIX endeksi 74 seviyesinde. Bu, piyasanın aşırı ısınmış olabileceğine işaret ediyor.

Güncel XNY piyasa fiyatını görüntüleyin

XNY Piyasa Duyarlılık Göstergesi

2025-10-05 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi'ni inceleyin

XNY piyasasında açgözlülük öne çıkıyor ve Korku ve Açgözlülük Endeksi 74'e ulaşmış durumda. Bu gösterge, yatırımcıların aşırı iyimserliğe kapılıp aşırı alım koşullarına neden olabileceğini işaret ediyor. Yatırımcıların temkinli davranması ve kâr almayı veya pozisyonu korumayı değerlendirmesi önerilir. Piyasa aşırılıkları genellikle geri dönüşlerden önce görülür. Dalgalı ortamda riskinizi yönetmek için güncel kalın. Gate.com bu piyasa koşullarında işlem stratejilerinize yön vermeniz için çeşitli araçlar sunar.

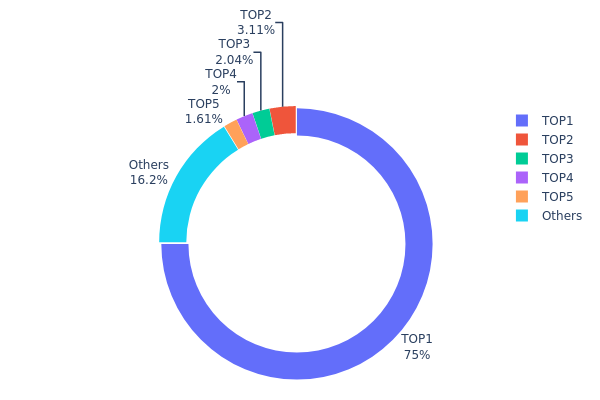

XNY Varlık Dağılımı

Adres varlık dağılımı verileri, XNY'de son derece yoğunlaşmış bir sahiplik yapısını gösteriyor. En büyük adres toplam arzın %75'ini elinde bulundururken, sonraki dört adresin toplam payı %8,74; geri kalan %16,26 ise diğer adresler arasında dağılmış durumda.

Yoğunlaşan sahiplik yapısı piyasa manipülasyonu ve fiyat oynaklığı riskini artırır. Arzın üçte ikisinden fazlasını kontrol eden tek bir adres, satış veya transfer kararıyla piyasada büyük dalgalanmalara yol açabilir. Merkezileşmiş dağılım, projenin dayanıklılığı ve yönetimi açısından da risk oluşturuyor.

Aynı zamanda, bu yapı yeni yatırımcıların birkaç büyük sahibin baskın rolünden dolayı piyasaya girişini engelleyebilir. XNY projesi, daha dengeli bir token dağılımı sağlayarak piyasa istikrarını artırmalı ve ekosisteme daha geniş katılımı teşvik etmelidir.

Güncel XNY Varlık Dağılımı'nı inceleyin

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x6e0b...bed395 | 7.500.000,00K | 75,00% |

| 2 | 0xb60e...00ad9e | 311.137,04K | 3,11% |

| 3 | 0xf819...c873aa | 203.943,08K | 2,03% |

| 4 | 0x93de...85d976 | 200.000,00K | 2,00% |

| 5 | 0x73d8...4946db | 160.692,05K | 1,60% |

| - | Diğerleri | 1.624.227,82K | 16,26% |

II. XNY'nin Gelecekteki Fiyatını Belirleyen Temel Faktörler

Makroekonomik Ortam

-

Para Politikası Etkisi: Küresel merkez bankalarının kararları XNY fiyatında belirleyici olacak. ABD Merkez Bankası'nın faiz adımları ve Çin Merkez Bankası'nın para politikası kritik faktörlerdir.

-

Enflasyona Karşı Koruma: XNY'nin enflasyonist dönemlerdeki performansı dikkatle izlenecek. Enflasyona karşı koruma işlevi talep ve fiyat üzerinde doğrudan etki yaratabilir.

-

Jeopolitik Etkenler: Özellikle Çin-ABD ilişkileri, ticaret müzakereleri ve siyasi gerilimler XNY'nin fiyatında ciddi dalgalanmalara neden olabilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

-

Uluslararasılaşma: XNY'nin küresel ticaret ve para takasında artan kullanımı, uzun vadeli istikrarı desteklemektedir.

-

Ekosistem projeleri: XNY tabanlı DApp'ler ve ekosistem projeleri tokenin işlevini artırarak talebi yükseltebilir.

III. 2025-2030 XNY Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00733 $ - 0,00780 $

- Nötr tahmin: 0,00780 $ - 0,00843 $

- İyimser tahmin: 0,00843 $ - 0,00905 $ (olumlu piyasa duyarlılığı gerektirir)

2027 Orta Vadeli Görünüm

- Piyasa fazı: Oynaklığın arttığı potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,00632 $ - 0,00885 $

- 2027: 0,00458 $ - 0,01028 $

- Başlıca katalizörler: Genel kripto piyasa toparlanması, projeye özgü gelişmeler

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,01259 $ - 0,01383 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,01383 $ - 0,01633 $ (güçlü benimseme ve olumlu regülasyonlarla)

- Dönüştürücü senaryo: 0,01633 $+ (son derece olumlu piyasa koşullarında)

- 2030-12-31: XNY 0,01633 $ (%78 artış, 2025'e kıyasla)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00905 | 0,0078 | 0,00733 | 0 |

| 2026 | 0,00885 | 0,00843 | 0,00632 | 8 |

| 2027 | 0,01028 | 0,00864 | 0,00458 | 11 |

| 2028 | 0,01277 | 0,00946 | 0,00596 | 21 |

| 2029 | 0,01656 | 0,01111 | 0,01022 | 43 |

| 2030 | 0,01633 | 0,01383 | 0,01259 | 78 |

IV. XNY Profesyonel Yatırım Stratejileri ve Risk Yönetimi

XNY Yatırım Yöntemi

(1) Uzun Vadeli Elde Tutma Stratejisi

- Uygun olanlar: Yüksek risk toleransına sahip, yapay zekâ teknolojisine inanan yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde XNY token biriktirin

- En az 1-2 yıl tutarak potansiyel büyümeyi hedefleyin

- Tokenleri güvenli donanım cüzdanlarında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar (MA): 50 ve 200 günlük ortalamalarla trend takibi

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım durumlarını gözlemleyin

- Dalgalı işlemde dikkat edilmesi gerekenler:

- Zarar durdur emirleriyle olası kayıpları sınırlandırın

- Belirlenmiş fiyat hedeflerinde kâr alın

XNY Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %1-3'ü

- Agresif yatırımcılar: Portföyün %5-10'u

- Profesyonel yatırımcılar: Portföyün %15'ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Birden fazla kripto varlığına yatırım yapın

- Zarar durdur emirleri: Kaybı sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı (ör. Gate Web3 cüzdanı) önerisi

- Soğuk saklama: Özel anahtarları çevrimdışı saklayın

- Güvenlik önlemleri: İki aşamalı doğrulama kullanın, özel anahtarlarınızı paylaşmayın

V. XNY için Potansiyel Riskler ve Zorluklar

XNY Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasalarında sert fiyat hareketleri görülebilir

- Rekabet: AI odaklı yeni blockchain projeleri ortaya çıkabilir

- Piyasa duyarlılığı: Genel kripto trendleri XNY fiyatını etkileyebilir

XNY Regülasyon Riskleri

- Belirsiz regülasyonlar: Hükümetler daha sıkı kurallar getirebilir

- Vergisel etkiler: Değişen vergi mevzuatı XNY yatırımlarını etkileyebilir

- Sınır ötesi kısıtlamalar: Uluslararası regülasyonlar benimsemeyi sınırlayabilir

XNY Teknik Riskler

- Akıllı kontrat açıkları: Protokoldeki hatalar kötüye kullanılabilir

- Ölçeklenebilirlik sorunları: Kullanım arttıkça ağda sorun çıkabilir

- Teknolojik eskime: AI alanındaki hızlı gelişmeler Codatta'nın ilerlemesinin önüne geçebilir

VI. Sonuç ve Eylem Önerileri

XNY Yatırım Değeri Değerlendirmesi

Codatta (XNY), AI ve blockchain kesişiminde uzun vadeli büyüme potansiyeli sunuyor. Ancak, kısa vadeli oynaklık ve regülasyon belirsizlikleri ciddi riskler barındırıyor.

XNY Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasayı tanımak için küçük ve deneme amaçlı yatırımlar yapın

✅ Deneyimli yatırımcılar: Yüksek riskli portföyün bir kısmını XNY'ye ayırın, maliyet ortalamasıyla alım yapın

✅ Kurumsal yatırımcılar: Detaylı inceleme gerçekleştirin, XNY'yi çeşitlendirilmiş kripto portföyü içinde değerlendirin

XNY İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com'da XNY token alıp tutabilirsiniz

- Stake etme: Varsa Staking ile pasif gelir elde edin

- DeFi entegrasyonu: XNY token ile ilgili merkeziyetsiz finans fırsatlarını değerlendirin

Kripto para yatırımları çok yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk toleranslarına göre dikkatle almalı ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

XNY kripto nedir?

XNY, Solana blokzinciri üzerinde çalışan, hızlı ve düşük maliyetli işlem imkânı sunan bir kripto para birimidir. Web3 ekosisteminin parçasıdır ve şu anda kullanılabilirdir.

XRP için 2030 fiyat tahmini nedir?

Analistlere göre, XRP 2030'da benimsenme, regülasyonlar ve piyasa koşullarına bağlı olarak 4,67 $ ile 26,97 $ arasında işlem görebilir.

Hangi coin 1 rupiye ulaşacak?

Shiba Inu'nun 2030'a kadar 1 rupiye ulaşabileceği öngörülüyor. Ancak bu tahmin spekülatiftir ve piyasa koşullarına bağlıdır.

Xen Crypto için 2025 fiyat tahmini nedir?

Piyasa analizlerine göre Xen Crypto'nun 2025'te 0,000002 $ ile 0,000008 $ arasında işlem göreceği tahmin edilmektedir.

2025 HOLO Fiyat Tahmini: Halving Sonrası Kripto Piyasasında Trendler ve Büyüme Potansiyeli Analizi

2025 COOKIE Fiyat Tahmini: Dijital Cookie Ekonomisi için Piyasa Analizi ve Gelecek Perspektifi

2025 SIREN Fiyat Tahmini: Gelecek Perspektifi, Piyasa Analizi ve Bu Gelişen Kripto Varlığı Şekillendiren Temel Dinamikler

2025 AVAAI Fiyat Tahmini: Genişleyen Yapay Zeka Sektöründe AVAAI'nin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 ACT Fiyat Tahmini: Gelişen kripto ekosisteminde ACT tokenlarının piyasa trendlerini ve gelecekteki değerlemesini analiz ediyoruz

2025 CLORE Fiyat Tahmini: Kripto Paranın Piyasa Eğilimleri ve Gelecek Beklentilerinin Analizi

SEI Airdrop Rehberi: Ödüllerinizi Almak İçin Yapmanız Gerekenler

Kripto para piyasalarında Breakout işlemleri için etkili stratejiler

Kendi Kriptoparanızı Nasıl Oluşturursunuz: Adım Adım Kılavuz

Bored Ape Yacht Club'un ikonik NFT koleksiyonunu keşfetmek için rehber

Polygon PoS Ağı’na Varlık Aktarma Kılavuzu