2025 MOBILE Fiyat Tahmini: Gelecek Akıllı Telefon Maliyetlerini Belirleyen Piyasa Trendleri ve Teknolojik Unsurların Analizi

Giriş: MOBILE'ın Piyasa Konumu ve Yatırım Potansiyeli

Helium Mobile (MOBILE), merkeziyetsiz kablosuz altyapı sağlayıcısı olarak kurulduğu günden bu yana hücresel hizmetlerde giderek daha belirleyici bir rol üstleniyor. 2025 yılı itibarıyla MOBILE'ın piyasa değeri $21.652.741 seviyesine ulaşmış, dolaşımdaki arz yaklaşık 62.544.025.971 tokena yükselmiş ve token fiyatı $0,0003462 civarında seyretmiştir. "Merkeziyetsiz hücresel ağ tokeni" kimliğiyle, kablosuz altyapının dönüşümünde MOBILE'ın önemi hızla artmaktadır.

Bu makalede, 2025-2030 döneminde MOBILE'ın fiyat hareketleri; tarihsel eğilimler, arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortam ile bütünleşik olarak ele alınacak, yatırımcılara profesyonel fiyat öngörüleri ve uygulamaya dönük yatırım stratejileri sunulacaktır.

I. MOBILE Fiyat Geçmişi ve Mevcut Piyasa Durumu

MOBILE Tarihsel Fiyat Süreci

- 2024: 16 Mart'ta piyasaya sürüldü, fiyatı $0,006944 ile tüm zamanların en yüksek seviyesine ulaştı

- 2025: Piyasa geriledi, 26 Haziran'da fiyatı $0,0002574 ile en düşük seviyeye indi

MOBILE Güncel Piyasa Görünümü

05 Ekim 2025 tarihinde MOBILE, $0,0003462 fiyatından işlem görüyor; 24 saatlik işlem hacmi $23.586 olarak kaydedildi. Son 24 saatte token %1,53 düşüş gösterdi. MOBILE'ın piyasa değeri $21.652.741 olup, kripto para piyasasında 1.056'ncı sıradadır.

Token, farklı zaman aralıklarında karmaşık bir performans sergiledi. Geçtiğimiz hafta %14,76 yükseliş, son 30 günde %11,15 artış ve son bir yıl içinde %66,34 oranında ciddi bir düşüş yaşandı.

MOBILE'ın güncel fiyatı, 16 Mart 2024'teki $0,006944'lik tüm zamanların zirve değerinin %95,01 altında; 26 Haziran 2025'teki $0,0002574'lik en düşük seviyeye göre ise %34,5 üzerinde bulunuyor. Dolaşımdaki arz 62.544.025.971 MOBILE, toplam arzın (230.000.000.000 MOBILE) %27,19'una karşılık geliyor.

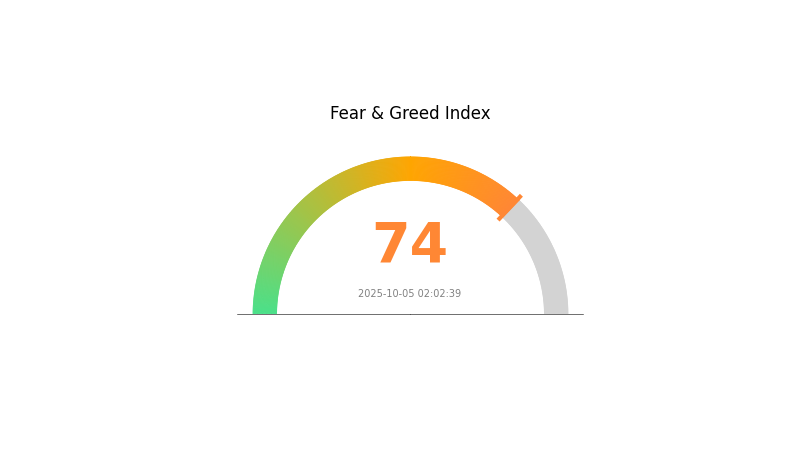

Kripto piyasasında mevcut duyarlılık açgözlülük yönünde; VIX endeksi 74 seviyesinde ve bu, piyasa coşkusunun yüksek olduğuna işaret etmektedir.

Güncel MOBILE piyasa fiyatını görüntüleyin

MOBILE Piyasa Duyarlılık Endeksi

2025-10-05 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Kripto piyasasında açgözlülük sinyalleri güçlü; Korku ve Açgözlülük Endeksi 74 seviyesine ulaşarak yatırımcı iyimserliğinin ve varlıkların aşırı değerlenmiş olabileceğinin göstergesi olmuştur. Piyasada heyecan yüksek olsa da, temkinli hareket etmek gereklidir. Tecrübeli yatırımcılar kâr almayı veya hedge etmeyi düşünebilir; yeni katılımcılar ise piyasa döngüleri ve risk yönetimi hakkında bilgi edinme fırsatı yakalayabilir. Unutmayın, piyasalar hızla değişebilir; Gate.com'da güncel kalın ve bilinçli işlem yapın.

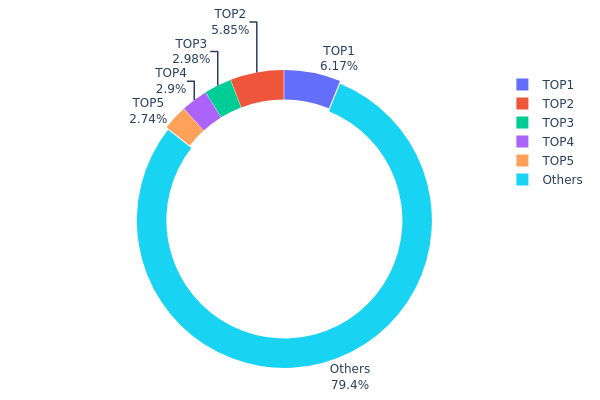

MOBILE Varlık Dağılımı

MOBILE'ın adres bazlı varlık dağılımı, görece merkeziyetsiz bir yapıyı yansıtıyor. İlk 5 adres toplam arzın %20,6'sını elinde tutarken, en büyük adres tek başına %6,16 MOBILE'a sahip. Bu dağılım, kripto piyasalarında sık rastlanan orta düzeyde bir yoğunlaşmaya karşılık geliyor.

Mevcut dağılım, MOBILE için dengeli bir piyasa yapısı gösteriyor. Üst sıralardaki adreslerde belirli bir yoğunlaşma olsa da aşırıya kaçmıyor. Tokenların %79,4'ünün ilk 5 dışında tutulması, küçük yatırımcılar arasında geniş bir dağılım olduğunu gösteriyor. Bu durum, fiyat istikrarına destek sağlayıp tek bir büyük yatırımcının piyasayı manipüle etme riskini azaltıyor.

Genel olarak MOBILE token dağılımı, zincir üstü sağlıklı bir yapı sunuyor. Merkeziyetsizlik düzeyi, projenin uzun vadeli sürdürülebilirliği ve merkezi kontrole karşı direnci açısından olumlu bir gösterge. Ancak, adres yoğunlaşmalarının izlenmesi, piyasa dinamiklerindeki potansiyel değişimleri değerlendirmek için önem taşıyor.

| Üst Sıra | Adres | Varlık (Adet) | Varlık (%) |

|---|---|---|---|

| 1 | 22Wnk8...h7zkBa | 3.787.263,69K | 6,16% |

| 2 | 8dzcoH...G5Ry4J | 3.590.186,88K | 5,84% |

| 3 | V8MgBK...3C5cDF | 1.831.758,14K | 2,98% |

| 4 | 8Ndq7B...xJZw49 | 1.780.401,69K | 2,89% |

| 5 | 47T8Gb...o3pKy8 | 1.681.707,30K | 2,73% |

| - | Diğerleri | 48.747.375,00K | 79,4% |

II. Gelecekteki MOBILE Fiyatlarını Etkileyecek Temel Unsurlar

Tedarik Zinciri ve Üretim

- Çip Maliyetleri: Çip ve donanım bileşenlerinin fiyatları, doğrudan cep telefonu maliyetlerini belirler.

- Tedarik Zinciri Yönetimi: Tedarik zincirinde verimli maliyet kontrolü, toplam fiyatlandırmayı etkiler.

Piyasa Dinamikleri

- Piyasa Rekabeti: Akıllı telefon pazarındaki rekabet düzeyi, fiyat politikalarını şekillendirir.

- Arz ve Talep: Piyasa dengesi, cep telefonu fiyatlarını doğrudan etkiler.

Makroekonomik Ortam

- Küresel Ekonomik Trendler: Genel ekonomik koşullar, tüketicilerin alım gücünü ve cihaz fiyatlarını etkiler.

Teknolojik Gelişmeler ve Ekosistem

- 5G Altyapısı: 5G altyapı geliştirme ölçeği, gelecekteki cep telefonu adaptasyonu ve fiyatlandırma için kritik önemdedir.

- Kullanıcı Tabanının Büyümesi: Yeni mobil teknolojilere katılımın artması, fiyatlandırma stratejilerini etkiler.

- Üst Düzey Donanım: Gelişmiş işlemci, kamera ve depolama sunan cihazlar genel piyasa fiyatlarını yukarı çeker.

- Teknolojik İlerlemeler: Sürekli gelişen mobil teknoloji, cihaz özelliklerini ve fiyatları yeniden şekillendirir.

Regülasyon Ortamı

- Politika Değişiklikleri: Tarife, teşvik ve diğer düzenlemelerdeki değişiklikler, ithalat ve nihai satış fiyatlarını etkileyebilir.

III. 2025-2030 MOBILE Fiyat Öngörüsü

2025 Tahmini

- Temkinli tahmin: $0,00027 - $0,00035

- Orta tahmin: $0,00035 - $0,00040

- İyimser tahmin: $0,00040 - $0,00046 (yüksek piyasa adaptasyonu gerektirir)

2026-2027 Tahmini

- Piyasa evresi: Kademeli büyüme ve konsolidasyon

- Fiyat aralığı:

- 2026: $0,00033 - $0,00043

- 2027: $0,00037 - $0,00044

- Ana etkenler: Kullanım artışı, olası iş ortaklıkları ve genel kripto piyasasının toparlanması

2028-2030 Uzun Vadeli Öngörü

- Temel senaryo: $0,00043 - $0,00047 (istikrarlı piyasa büyümesi halinde)

- İyimser senaryo: $0,00047 - $0,00053 (hızlı adaptasyon ve elverişli piyasa koşulları ile)

- Transformasyon senaryosu: $0,00053 - $0,00057 (çığır açan teknoloji ve kitlesel adaptasyon ile)

- 2030-12-31: MOBILE $0,00057 (iyimser tahminlere göre zirve)

| Yıl | En Yüksek Tahmini Fiyat | Ortalama Tahmini Fiyat | En Düşük Tahmini Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00046 | 0,00035 | 0,00027 | 0 |

| 2026 | 0,00043 | 0,0004 | 0,00033 | 16 |

| 2027 | 0,00044 | 0,00042 | 0,00037 | 19 |

| 2028 | 0,00046 | 0,00043 | 0,00027 | 22 |

| 2029 | 0,0005 | 0,00044 | 0,00031 | 27 |

| 2030 | 0,00057 | 0,00047 | 0,00038 | 36 |

IV. MOBILE Profesyonel Yatırım Stratejisi ve Risk Yönetimi

MOBILE Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Hedef kitle: Merkeziyetsiz kablosuz altyapıya inanan uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde MOBILE biriktirin

- Ağ yönetimine katılarak ek gelir elde edin

- Tokenlarınızı saklama hizmeti sunmayan bir cüzdanda güvenle saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli eğilimleri inceleyin

- RSI (Göreli Güç Endeksi): Aşırı alım/satım seviyelerini belirleyin

- Dalgalı alım-satımda kritik noktalar:

- Teknik göstergelere göre net giriş-çıkış stratejisi oluşturun

- Helium Mobile ağındaki büyüme ve adaptasyon oranlarını takip edin

MOBILE Risk Yönetimi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: %5-10'u

- Profesyoneller: Portföyün %15'ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı kripto varlıklara dağıtın

- Zarar durdur emirleri: Riskleri sınırlayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli için donanım cüzdanı

- Güvenlik: İki faktörlü doğrulama, güçlü şifreler ve güncel yazılım kullanımı

V. MOBILE Potansiyel Riskler ve Zorluklar

MOBILE Piyasa Riskleri

- Yüksek volatilite: MOBILE fiyatı ciddi dalgalanmalara açık olabilir

- Rekabet: Yeni merkeziyetsiz kablosuz projelerin ortaya çıkma olasılığı

- Kullanıcı adaptasyonu: Yavaş benimseme token değerini olumsuz etkileyebilir

MOBILE Regülasyon Riskleri

- Belirsiz regülasyon ortamı: Kriptoya yönelik düzenlemelerde değişiklik ihtimali

- Uyum sorunları: Telekom regülasyonlarına adaptasyon zorlukları

- Vergi etkileri: Kripto varlıkların vergilendirilmesinin değişmesi

MOBILE Teknik Riskler

- Ağ güvenliği: Helium Mobile altyapısında oluşabilecek açıklar

- Ölçeklenebilirlik: Artan kullanıcı ve trafik yönetiminde sorunlar

- Akıllı sözleşme: Token'a ait akıllı sözleşmede hata veya açık riski

VI. Sonuç ve Eylem Önerileri

MOBILE Yatırım Potansiyeli Değerlendirmesi

MOBILE, merkeziyetsiz kablosuz teknolojide uzun vadeli büyüme potansiyeliyle benzersiz bir fırsat sunar. Ancak yatırımcılar, kısa vadeli oynaklık ve regülasyon belirsizliklerine karşı hazırlıklı olmalıdır.

MOBILE Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Projeyi anlamak için düşük tutarlı ve düzenli yatırımlar yapın ✅ Tecrübeli yatırımcılar: Tutma ve alım-satım stratejilerini dengeleyin ✅ Kurumsal yatırımcılar: Detaylı inceleme ile risk toleransınıza uygun büyük pozisyonları değerlendirin

MOBILE Katılım Yolları

- Al ve tut: Uzun vadeli birikim için token satın alın

- Aktif alım-satım: Kısa vadede teknik analiz ile hareket edin

- Ağa katılım: Helium Mobile ağına katkı sağlayarak ödül kazanın

Kripto para yatırımları oldukça yüksek risk taşır; bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar kendi risk toleranslarına göre karar vermeli ve profesyonel danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

2025 için MOBILE fiyat tahmini nedir?

Teknik analizlere göre, MOBILE'ın fiyatı 2025'te en az $0,000379 seviyesine ulaşabilir; en yüksek fiyatın ise bu rakamın üzerinde olması beklenmektedir.

Helium Mobile 1 dolara ulaşabilir mi?

Mevcut piyasa öngörülerine göre Helium Mobile'ın $1 seviyesine çıkması beklenmemektedir. Tahmin edilen zirve fiyat, kısa vadede $1'in oldukça altında kalacaktır.

Helium Mobile büyüyor mu?

Evet, Helium Mobile hızlı büyüyor. 2025 ikinci çeyrekte 150.876 yeni ön ödemeli aboneyle liderlikte ve güçlü bir piyasa ivmesi gösteriyor.

MOBILE kripto para ne kadar değerli?

Ekim 2025'te MOBILE'ın değeri $0,000669'dur. Fiyat dalgalanmakta olup son düşük seviye $0,000343 olarak kaydedilmiştir.

2025 POKT Fiyat Tahmini: Pocket Network’in Yerel Token’ı İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 XL1 Fiyat Tahmini: Yeni Nesil Elektrikli Araç İçin Piyasa Trendleri ve Potansiyel Büyümenin Analizi

2025 NKN Fiyat Tahmini: Yeni Tür Ağ Tokeni'nin Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 BZZ Fiyat Tahmini: Web3 Depolama Ekosisteminde Swarm'ın Yerel Token Potansiyelini Analiz Etmek

2025 FIL Fiyat Tahmini: Filecoin'in Gelecekteki Değeri İçin Piyasa Trendleri ve Uzman Tahminlerinin Analizi

2025 MSN Fiyat Tahmini: Dijital Ekonomide Merkeziyetsiz Depolamanın Geleceğinde Yol Almak

Xenea Günlük Quiz Yanıtı 13 Aralık 2025

Polygon Ağına Varlık Transferi Kılavuzu

Polygon Ağını Kripto Cüzdanınıza Entegre Etme Kılavuzu

BEP2 ile Dijital Varlıkların Güvenli Saklanmasına Yönelik Yeni Başlayanlar İçin Rehber

Polygon PoS Ağı’na Varlık Aktarma Kılavuzu