2025 NKN Fiyat Tahmini: Yeni Tür Ağ Tokeni'nin Piyasa Trendleri ve Büyüme Potansiyeli Analizi

Giriş: NKN'nin Piyasa Konumu ve Yatırım Değeri

NKN (NKN), merkeziyetsiz ve topluluk odaklı bir ağ altyapısı olarak, 2018’deki kuruluşundan bu yana blokzincir tabanlı ağ iletimi alanında önemli ilerlemeler kaydetti. 2025 yılı itibarıyla, NKN’nin piyasa değeri 20.632.478 $’a ulaştı; yaklaşık 792.946.920 adet dolaşımdaki tokenı bulunuyor ve fiyatı 0,02602 $ civarında seyrediyor. “New Kind of Network” olarak bilinen bu varlık, ağ kaynaklarının dağıtımı ve veri iletiminin verimliliğinde dönüşüm yaratmada giderek daha kritik bir rol üstleniyor.

Bu makale, 2025-2030 yılları arasında NKN’nin fiyat eğilimlerini; geçmiş örüntüler, arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı biçimde analiz edecek; yatırımcılara profesyonel fiyat tahminleri ve uygulamaya dönük stratejiler sunacaktır.

I. NKN Fiyat Geçmişi ve Mevcut Piyasa Durumu

NKN Tarihsel Fiyat Gelişim Seyri

- 2020: Piyasa dip seviyesi, 13 Mart’ta fiyat 0,00667819 $’a indi

- 2021: Boğa piyasası zirvesi, fiyat 10 Nisan’da tüm zamanların en yüksek seviyesi olan 1,44 $’a ulaştı

- 2024-2025: Uzatılmış ayı sezonu, fiyat son bir yılda %62,84 oranında geriledi

NKN Güncel Piyasa Durumu

5 Ekim 2025 itibarıyla NKN, 0,02602 $ seviyesinden işlem görüyor. Token, farklı zaman dilimlerinde karmaşık performanslar sergiledi:

- 1 saatlik değişim: +%0,58

- 24 saatlik değişim: -%3,12

- 7 günlük değişim: +%12,21

- 30 günlük değişim: +%1,25

- 1 yıllık değişim: -%62,84

NKN’nin piyasa değeri şu anda 20.632.478 $ ve genel kripto para piyasasında 1.082. sırada. Tokenın 24 saatlik işlem hacmi 28.841 $; bu, orta düzeyde likiditeyi gösteriyor. Dolaşımdaki 792.946.920 NKN tokenı, toplam arzın %79,29’unu oluşturuyor ve projede yüksek bir dolaşım oranı mevcut.

Mevcut fiyatın tüm zamanların zirvesinin oldukça altında olması, piyasa koşulları iyileşirse büyüme potansiyeline işaret ediyor. Son 7 günlük pozitif performans ise kısa vadede yükseliş eğilimini gösteriyor.

Güncel NKN piyasa fiyatını incelemek için tıklayın

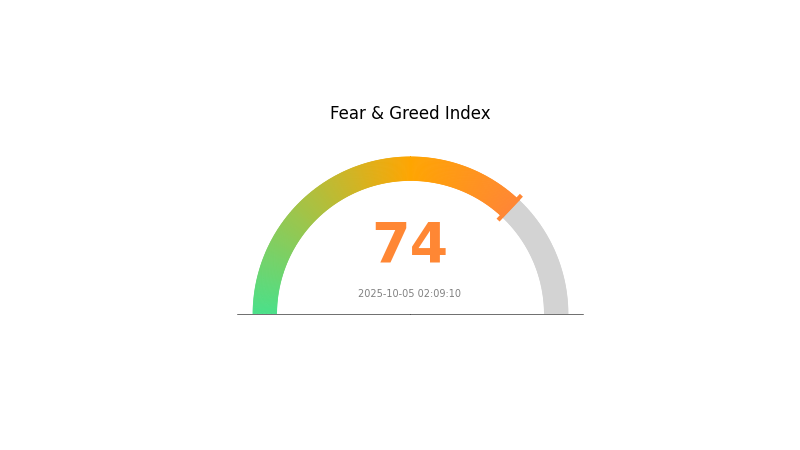

NKN Piyasa Duyarlılık Göstergesi

05 Ekim 2025 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında açgözlülük göstergeleri kuvvetli; Korku ve Açgözlülük Endeksi 74’e yükseldi. Bu seviye, yatırımcıların iyimserliğinin yükseldiğini ve fiyatları yukarı çekebileceğini gösteriyor. Ancak, aşırı açgözlülük genellikle piyasa düzeltmesinden önce gelir. Yatırımcılar kâr realizasyonu yapmalı veya risk yönetim stratejileri oluşturmalı. Piyasa trendlerini dikkatle takip ederek olası oynaklığa karşı hazırlıklı olunmalı. Her zaman olduğu gibi, çeşitlendirme ve detaylı araştırma bu dinamik koşullarda başarı için kritik önemdedir.

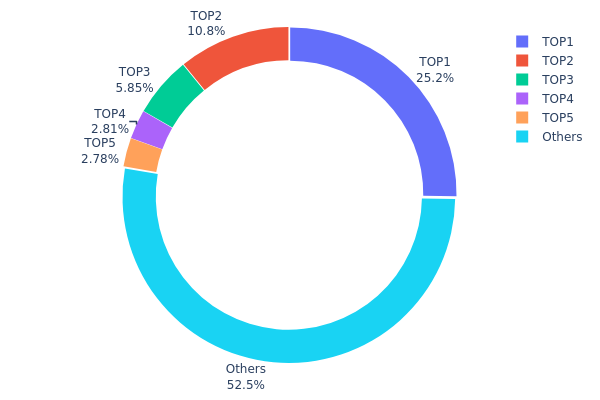

NKN Varlık Dağılımı

NKN’de adres bazlı varlık dağılımı verileri, tokenların büyük bölümünün az sayıda adreste yoğunlaştığını gösteriyor. En büyük sahip toplam arzın %25,23’ünü elinde tutarken, ilk 5 adres toplam NKN’nin %47,5’ini kontrol ediyor. Bu yoğunluk, piyasada ve token yönetiminde merkeziyetçi bir dağılıma işaret ediyor.

Böyle bir dağılım, NKN fiyatında volatilitenin yükselmesine yol açabilir. Büyük sahipler, yüksek miktarda işlemle piyasayı ciddi şekilde etkileyebilir. Ayrıca, bu durum ağdaki merkeziyetsizlik konusunda soru işaretleri doğurabilir; az sayıda varlık sahibi projeye önemli ölçüde yön verebilir.

Yine de tokenların %52,5’i diğer adreslere dağılmış durumda; bu, daha geniş bir dağılıma ve nispi istikrara katkı sağlayabilir.

Güncel NKN Varlık Dağılımı için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 176.642,95K | 25,23% |

| 2 | 0xb1c6...f9c15d | 75.901,99K | 10,84% |

| 3 | 0x9b0c...ba8d46 | 40.928,39K | 5,84% |

| 4 | 0xc402...561858 | 19.676,68K | 2,81% |

| 5 | 0x7e9a...295d32 | 19.468,61K | 2,78% |

| - | Diğerleri | 367.381,38K | 52,5% |

II. NKN’nin Gelecekteki Fiyatını Belirleyen Temel Faktörler

Teknik Gelişim ve Ekosistem İnşası

-

Çekirdek Protokol Güncellemeleri: NKN’nin çekirdek protokolüne yönelik iyileştirmeler uzun vadede değerini destekler. Bu güncellemeler, ağın performansını ve fonksiyonelliğini artırarak daha fazla kullanıcı ve geliştirici çekebilir.

-

Ağ Performansı İyileştirmeleri: NKN ağının hız, ölçeklenebilirlik ve verimliliğinde yapılan sürekli geliştirmeler, projenin değer önerisini ve benimsenme oranını yükseltir.

Makroekonomik Ortam

-

Kripto Para Piyasası Trendleri: NKN’nin fiyatı, kripto ekosisteminin genel duyarlılığı ve piyasa trendlerinden etkilenir.

-

Küresel Ekonomik Faktörler: Enflasyon, para politikaları ve ekonomik büyüme gibi küresel koşullar, NKN gibi kripto varlıklara olan yatırımcı ilgisini şekillendirir.

III. 2025-2030 NKN Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,02519 $ - 0,02597 $

- Tarafsız tahmin: 0,02597 $ - 0,03000 $

- İyimser tahmin: 0,03000 $ - 0,03428 $ (olumlu piyasa duyarlılığı ve proje bazlı gelişmeler gerektirir)

2027-2028 Görünümü

- Piyasa aşaması: Artan benimsenmeyle büyüme evresi

- Fiyat aralığı tahmini:

- 2027: 0,02668 $ - 0,0453 $

- 2028: 0,03091 $ - 0,05267 $

- Temel katalizörler: Teknolojik ilerleme, ağın yaygınlaşması ve olumlu piyasa koşulları

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,04542 $ - 0,05132 $ (istikrarlı piyasa büyümesi ve sürekli proje geliştirmesi)

- İyimser senaryo: 0,05132 $ - 0,06056 $ (güçlü piyasa performansı ve NKN ekosisteminde belirgin büyüme)

- Dönüştürücü senaryo: 0,06056 $ - 0,07000 $ (çığır açan inovasyonlar ve NKN teknolojisinin yaygın benimsenmesi)

- 31 Aralık 2030: NKN 0,05132 $ (2025 seviyesine göre %97 artış)

| Yıl | En Yüksek Tahmin | Ortalama Tahmin | En Düşük Tahmin | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,03428 | 0,02597 | 0,02519 | 0 |

| 2026 | 0,03193 | 0,03013 | 0,01567 | 15 |

| 2027 | 0,0453 | 0,03103 | 0,02668 | 19 |

| 2028 | 0,05267 | 0,03817 | 0,03091 | 46 |

| 2029 | 0,05723 | 0,04542 | 0,02362 | 74 |

| 2030 | 0,06056 | 0,05132 | 0,03592 | 97 |

IV. NKN için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

NKN Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Merkeziyetsiz ağ altyapısının uzun vadeli savunucuları

- Öneriler:

- Piyasa düşüşlerinde NKN tokenı biriktirin

- Düğüm işleterek ek ödüller kazanın

- Tokenları donanım cüzdanında veya güvenilir saklama çözümlerinde tutun

(2) Aktif Alım Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük ortalamalarla trend analizi

- RSI: Aşırı alım/aşırı satım bölgelerini takip edin

- Dalgalı işlemlerde dikkat edilmesi gerekenler:

- Düşüş riskini yönetmek için stop-loss limitleri belirleyin

- Kârı önceden belirlenmiş direnç seviyelerinde alın

NKN Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün en fazla %15’i

(2) Riskten Korunma Planları

- Çeşitlendirme: Farklı blokzincir projelerine yatırım yapın

- Opsiyon stratejileri: Düşüşten korunmak için put opsiyonlarını değerlendirin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk saklama: Uzun vadeli alımlar için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki faktörlü doğrulamayı etkinleştirin, güçlü parolalar kullanın

V. NKN için Potansiyel Riskler ve Zorluklar

NKN Piyasa Riskleri

- Yüksek volatilite: NKN fiyatı ciddi dalgalanmalara açık

- Sınırlı benimsenme: NKN teknolojisinin yavaş yayılması token değerini etkileyebilir

- Rekabet: Diğer blokzincir ağ projeleri NKN’den üstün performans gösterebilir

NKN Düzenleyici Riskler

- Belirsiz düzenlemeler: Kripto düzenlemelerindeki değişiklikler NKN’nin faaliyetlerini etkileyebilir

- Sınır ötesi uyumluluk: Uluslararası farklı kanunlar NKN’nin küresel erişimini sınırlayabilir

- Token sınıflandırması: NKN’nin bazı ülkelerde menkul kıymet olarak değerlendirilme riski

NKN Teknik Riskler

- Ağ ölçeklenebilirliği: Artan trafikle başa çıkmada zorluklar

- Güvenlik açıkları: Akıllı sözleşme veya ağ seviyesinde zaaflar oluşabilir

- Teknolojik eskime: Yeni teknolojiler NKN’yi daha az geçerli kılabilir

VI. Sonuç ve Eylem Önerileri

NKN Yatırım Değeri Değerlendirmesi

NKN, merkeziyetsiz ağ altyapısında uzun vadede potansiyel sunarken, kısa vadede piyasa oynaklığı ve düşük benimsenmeden kaynaklı riskler taşıyor.

NKN Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Çeşitlendirilmiş portföyde küçük, uzun vadeli pozisyonlar önerilir ✅ Deneyimli yatırımcılar: Ortalama maliyetle alım ve düğüm operasyonunu değerlendirin ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın ve stratejik iş birliklerini göz önünde bulundurun

NKN Alım Satım Yöntemleri

- Spot alım satım: Güvenilir borsalardan NKN alın ve saklayın

- Staking: Düğüm işleterek NKN ağına katılın ve ödül kazanın

- DeFi entegrasyonu: NKN ile likidite sağlama ve getiri elde etme fırsatlarını keşfedin

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk toleransınıza göre verin ve profesyonel finansal danışmanlara başvurun. Asla kaybetmeyi göze alamayacağınız miktarda yatırım yapmayın.

SSS

NKN’nin en yüksek fiyatı nedir?

NKN’nin ulaştığı en yüksek fiyat 1,54 $’tır; bu, piyasaya çıktığı günden bu yana kaydedilen zirve seviyesidir.

Hangi kripto varlığın fiyat tahmini en yüksektir?

Bitcoin’in fiyat tahmini en yüksek (120.286 $), sonrasında Chainlink (62,60 $) geliyor.

NKN kripto nedir?

NKN, ağ bağlantısı ve veri iletimini tokenlaştırmak için blokzincir kullanan eşler arası açık kaynak protokolüdür. Amaç; merkeziyetsiz bir kaynak paylaşım ağı oluşturmak.

2030’da XRP fiyat tahmini nedir?

XRP, 2030 yılında benimseme, düzenleme ve piyasa koşullarına göre 4,67 $ - 26,97 $ aralığında olabilir.

2025 POKT Fiyat Tahmini: Pocket Network’in Yerel Token’ı İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 XL1 Fiyat Tahmini: Yeni Nesil Elektrikli Araç İçin Piyasa Trendleri ve Potansiyel Büyümenin Analizi

2025 MOBILE Fiyat Tahmini: Gelecek Akıllı Telefon Maliyetlerini Belirleyen Piyasa Trendleri ve Teknolojik Unsurların Analizi

2025 BZZ Fiyat Tahmini: Web3 Depolama Ekosisteminde Swarm'ın Yerel Token Potansiyelini Analiz Etmek

2025 FIL Fiyat Tahmini: Filecoin'in Gelecekteki Değeri İçin Piyasa Trendleri ve Uzman Tahminlerinin Analizi

2025 MSN Fiyat Tahmini: Dijital Ekonomide Merkeziyetsiz Depolamanın Geleceğinde Yol Almak

Dogecoin Madenciliği İçin Kapsamlı Rehber: Yeni Başlayanlar İçin Başarı Yol Haritası

MetaMask’i Polygon ağına hızlı ve verimli şekilde nasıl entegre edebilirsiniz

EIP 4337’yi Anlamak: Hesap Soyutlamasının Kolaylaştırılmış Bir Özeti

Solana'nın merkeziyetsiz türev alım satım protokollerini yakından incelemek

Polygon PoS Ağına Bağlanma Kılavuzu